Note from the Author: Next week’s analysis might have less detail or be a little late as I will be speaking at Bitcoin South conference in New Zealand.

Last Week’s Review

As usual we start with an overview of what last week’s conclusion stated:

“Now that prices have stabilized a bit, it looks like a decent place to test the waters for a Bull entry. This run up that took place has turned all of our charts Bullish, but it also did that in the middle of October right before the picture deteriorated. You do have a clear low at around US$375 so any entries to buy here have a very clear indication of when you can admit you have made a mistake. Another way to play this is to consider US$375-400 a neutral zone. Anything over $400 is an indication of higher prices and anything under $375 means the pullback probably has some more legs.

Two scenarios in order of higher probabilities

Bullish: the pullback low is most likely in at US$370-375, so we should be seeing more buyers coming in. look for the same resistance points to be broken as were mentioned the last few weeks. US$400, US$440-450 zone, then US$500. US$420 is no longer important since it was the previous high and has been cleared.

Bearish: In case there is more pain in store on this pull back, look for $340-350 as the next support if we close under the 50-day SMA currently at US$375. Under that there are plenty of support points at US$330 and US$315, but if that last one goes, look out bellow because it will get real ugly in a hurry.”

Once again Bitcoin price movements are proving to be extremely more difficult to forecast from both a technical and fundamental perspective. It should now be a fact that the great rally in early November was nothing more than traders moving the market. The evidence for that is now that things have settled the price is lower than it was prior to the start of the rally. This is not the type of pricing action that takes place during any kind of fundamental improvements. However, there is nothing wrong with traders controlling the price, it happens all the time in the stock market with companies way more liquid than Bitcoin is today.

As for last week’s action, our primary case that prices should remain elevated was not meant to be and once again we are forced to have the less likely scenarios play out in the price action. Yes, this can be very discouraging but that’s why it’s only recommended to trade with 10-20% of your Bitcoin wealth and leave this career to those who can actually watch it continuously or those with enough coins to move the market. Once the price action was not able to hold the level of the breakout at the 50-day SMA at US$375, it was over and the market fell an additional US$25+.

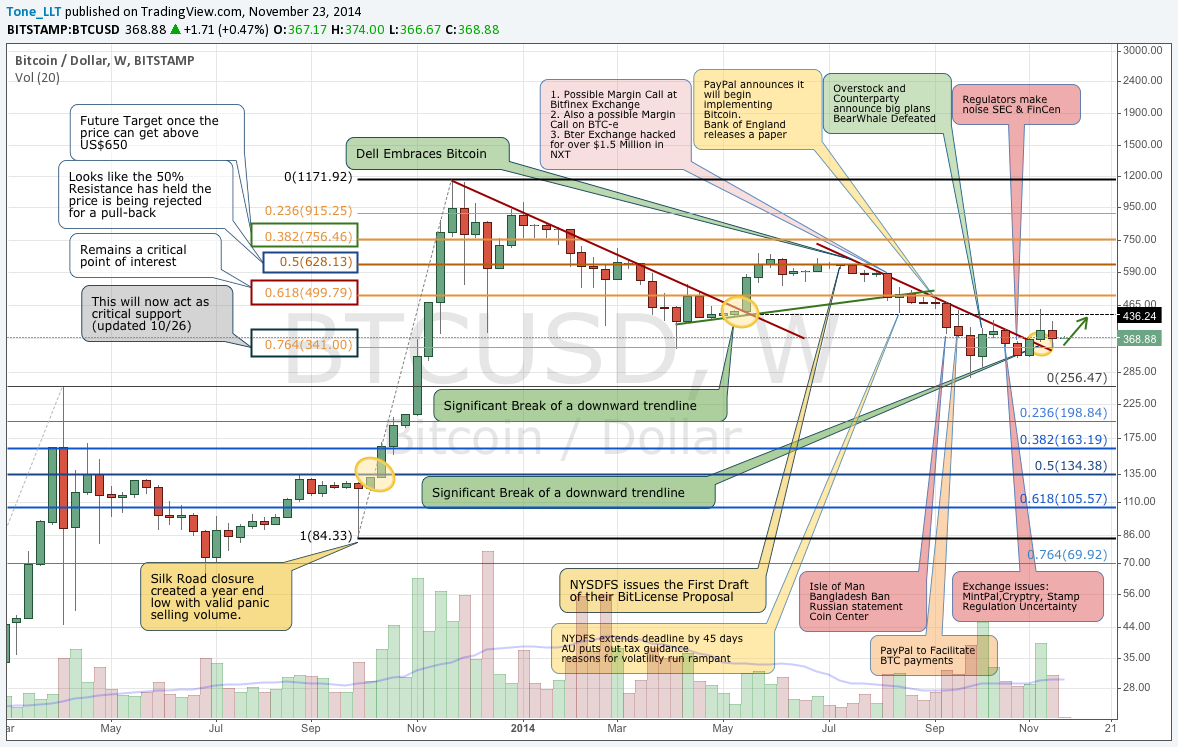

The long term chart is hanging on to its Bullish view by a thread and will stay that way as long as we remain above the broken descending trend line.

It should be very clear from the chart above that this breakout is very different from the one back in May and we will definitely need another week or two to determine whether it was a false breakout or the start of something going into year-end.

Education (A Review of Recent Topics)

The last few weeks have discussed some very important topics about possible price manipulation and arbitrage. There was also a separate article discussing the structure of Bitcoin future’s exchanges so that everyone has a better understanding.

Everyone needs to understand that this is an unregulated space and pretty much anything goes; there is nothing wrong with that but it does mean that there are more things to stay aware of. As mentioned last time, it is impossible to see everything at once unless you have a bot running and even if you don’t, it is possible to spot bots trading around you. Here is an example, which was also tweeted as it happened.

This was a snap shot from the Futures exchange 796 and there are a few things going on here, which need to be explained.

First, please notice a 6,000 bitcoin volume trade that took place after about 17 minutes of no activity. This was a very strange event because this volume was not sitting on the order book prior to execution unlike the large volume trades highlighted last week. This trade came out of nowhere and appeared to have been filled instantly right in the middle of the Bit/Asked spread which is also strange.

We will assume this was either a bot or a person who instantly filled this trade, since thid is not an investigation into the possibility of fake trades. This trade was definitely large enough for someone to profit handsomely by moving the price of Bitcoin on the more traditional exchanges. If this trade was entered with only 5% down (300 bitcoins) then all it takes is about a US$19 move at these prices to make the position go bust and have a margin call. About 12 hours later, there was a US$21 move in the price of Bitcoin. Again, this may all be a coincidence and who knows how many other large trades took place on the futures exchange that could make this one meaningless, but watching this market is definitely interesting.

Another thing that is going on in the picture above is that the “Bit(1) position to buy 2.25 bitcoins at US$380.32 per bitcoin is an automated ‘bot’ entry. How does this analyst know that? The answer is simple, the Bid(2) labeled ‘Human’ is my entry. During a time of low volume (outside of the 6,000 BTC trade that started some action right after), an experiment was being run to see why there is always a higher bid by about 1 penny. So every time a trade was entered to buy some bitcoins, another order would instantly appear for just under half the size and exactly one cent higher. The moment the trade is removed, the other one disappears as well. Once again, there is nothing malicious about this practice, it is simply smart trading on the part of those who built the bot, but for the readers of this series - this is a good opportunity to see exactly what you are up against if you decide to take on this challenge.

Fundamentals & News

Here are the usual Roundups for those that do not keep up with the news on a regular basis:

Cointelegraph Weekly Roundup by Armand Tanzarian

Bitcoin News Roundup by Bitsmith on TheCoinsman

Weekly News Roundup by Brave New Coin

Let’s start of with the latest incompetent United States regulatory agency that will be looking to get its slice of revenue and justify their existence through fines in this industry. We present the Commodity and Futures Trading Commission (CFTC) when their commissioner stating he belies Bitcoin should be classified as a commodity.

It is only a matter of time before they put out their official statements in order to protect us all from the things mentioned in the section above, but what everyone needs to understand about the agencies like CFTC, SEC and FinCEN is that they are not actually there to protect the consumer. Maybe back when they were created there may have been some ideas to this effect that got implemented, but today their role has been completely reversed. Their existence is to protect the current system and to protect institutions that are allowed to manipulate markets.

Occasionally, there will be a fine in order to keep their budgets in tact and when there is outrage from the consumer, though more so by other institutional heavyweights, they would consider putting someone in jail. That was pretty much the difference between Bernie Madoff and John Corzine, as one stole from a prominent high net worth individual while the other stole from small to medium retail clients.

During the panels at the Bloomberg building where those statements were said, the question was being posed to these regulators whether they have actually used Bitcoin and the answer to the question to anyone reading should be completely obvious.

“It will be very interesting to see how CFTC or other US regulators plan to enforce their will on exchanges (especially Futures exchanges) none of which are located in the US’s jurisdiction.”

--Tone Vays

As always Government meddling in the free market is the wild card and while in reality it should all be bad, organized manipulation can do wonders for price as well. If all this regulation gets the big banks and hedge funds on board, they will be more than happy to blow the next bubble to US$10,000 before selling to those on the street.

Another big piece of news this week is the upcoming sale of more than 50,000 bitcoins by the US Marshals. This is a very unfortunate situation in that the fundamentals behind Bitcoin are to prevent Governments from robbing the people but when incompetent websites like Silk Road are not able to decentralize customer funds or create any kind of protection, this is the result.

Perhaps it’s a good thing they are no longer around, no reason to enrich more undeserving agencies for Millions of Dollars. There is definitely a lesson here and the lesson is that better tools are needed to protect the store of bitcoins in such a way that they cannot be hacked into and, more importantly, confiscated by the authorities. This recent drop in price is good for those about to bid on the coins.

In other news, we have both a Wall Street firm getting involved in Bitcoin trading via a platform called Buttercoin and a Spanish bank deciding to invest in a Bitcoin exchange. Both are positive signs and should help with mass adoption, but what that Spanish Bank should be more focused on is what will happen in the near future when the customers in Spain will not be able to get any cash on demand. That is the biggest catalyst that will drive Bitcoin to the next level.

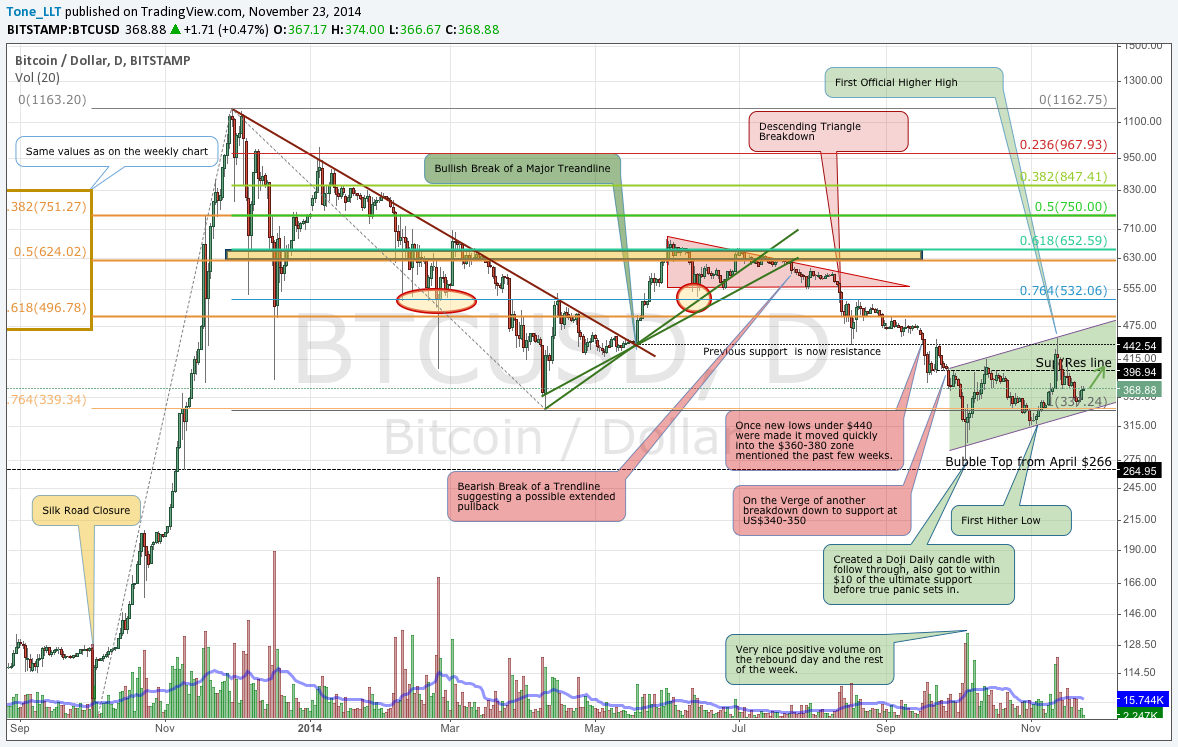

Daily Overview

Here is our standard 1-year Daily look back.

The high level daily chart is still looking ok. If the most recent low around US$340 can hold, we might be looking at a parallel channel drawn into the graph. If that’s the case then we should be headed up from here and there is room to add over 100 points before running at the next major resistance level at US$500. We are still in the zone of Higher Highs and Higher lows so until this pattern is broken, the Intermediate Time Frame is Bullish.

The Short-Term time frame is not as clear. You can see the addition of a Descending Triangle, which has been added to the graph. The two previous triangles that are on this chart hit their targets fairly easy and even went a little further, but if this one holds true to form, that means the target lies just under US$300.

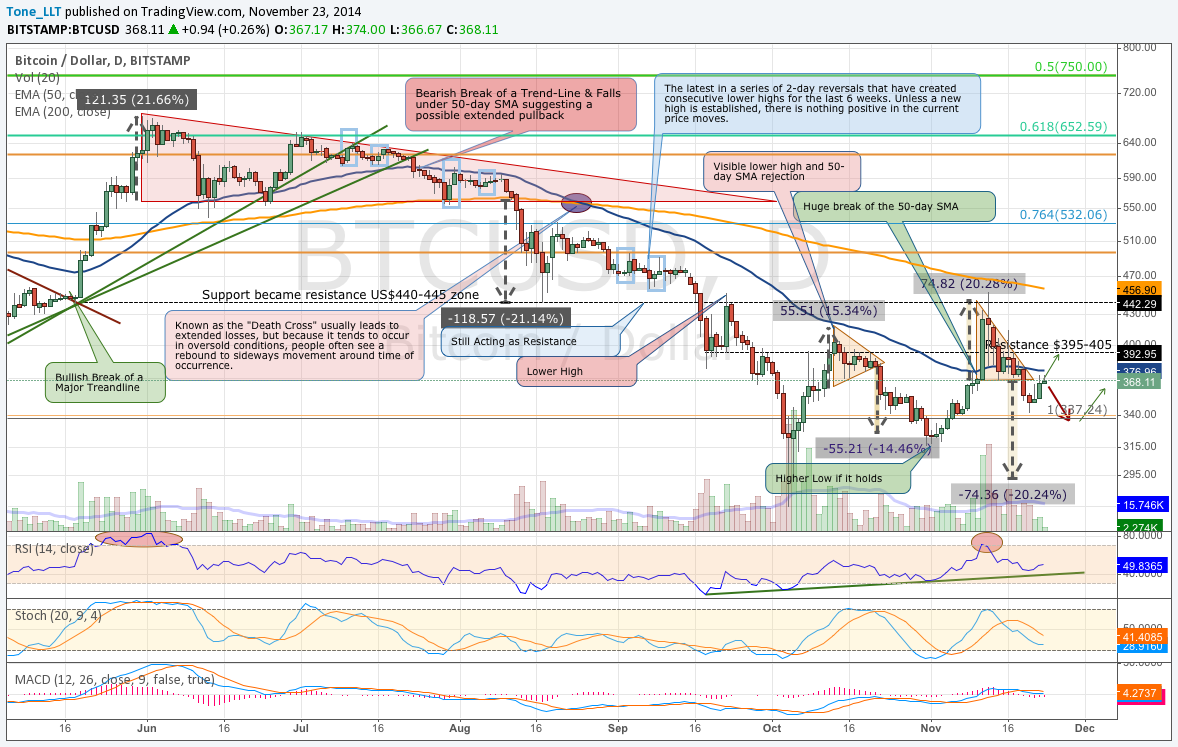

The RSI is looking good and looks like it’s turning around just above the trend line, but the Stochastic has not yet started to Reverse. We also see a ‘hammer’ candle with follow through that had touched the bottom end of our support zone at US$340. However, we are now coming back up into resistance at the $370-375 zone and the presence of the 50-day SMA resistance.

Conclusion

Now that the pullback from the US$450 top has played its course, we can consider the low from a few days ago at US$340 as a temporary low; if it holds and we can get back over the 50-day SMA, which is now beginning to turn down once again, whihc would be a great sign.

For the moment we remain tentatively Bullish Long-Term, Bullish Intermediate Term, but Neutral Short-Term. We have fallen lower than ideal so resistance we thought was cleared is now back in play. This includes US$375 and US$400. Don’t expect miracles and most likely there will not be a year end rally to the moon and the most likely outcome for the near future is some consolidation while a larger trend is established.

Two scenarios in order of higher probabilities:

Bullish: One more time we will attempt to say that the pullback low is in place, but this time at US$340, so if we can break the US$375 in the next few days, US$400 is now nearby. If the ultimate target of this rally is US$500, it would be nice to see this target reached by Christmas so don’t expect miracles this week.

Bearish: The Descending Triangle that has formed is not to be ignored - it might be the only real Bearish thing we have on the charts, but it is there and they are right about 70% of the time. If the price reverses at any moment and starts to get near that US$340 level, US$300 might come in the blink of an eye.

Reference Point: Sunday Nov 23 11:30 pm ET, Bitstamp Price US$370

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences world wide. He also runs his own personal blog called LibertyLifeTrail.

Disclaimer: Articles regarding the potential movement in crypto-currency prices are not to be treated as trading advice. Neither Cointelegraph nor the Author assumes responsibility for any trade losses as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money.

Did you enjoy this article? You may also be interested in reading these ones: