1. NCR Silver to Process Bitcoin Payments For SMEs

NCR, a global leader in transaction processing hardware whose machines process nearly 500 million transactions every day, announced Monday its cloud-based POS NCR Silver would begin processing Bitcoin transactions.

“Bitcoin needs to be accepted by small to medium sized businesses if it is ever to become a mainstay mode of payment,” Carlo Caraluzzo wrote Wednesday.

“This is a problem that NCR Silver, a cloud-based point-of-sale (PoS) system especially designed for these smaller organizations, like cafes, gift shops, food trucks and even street artists and vendors, is trying to resolve.”

2. Counterparty Using Ethereum’s Programming Language for Smart Contracts

On Wednesday, Ian DeMartino reported how Counterparty was taking Ethereum’s program language and applying it to smart contracts on the Bitcoin blockchain.

“‘By introducing the same smart contract functionality on the Bitcoin blockchain, we’re demonstrating that Counterparty's native currency, XCP, can do everything that Ethereum’s coin can do, and more,’ Counterparty co-founder Robby Dermody said.

“‘With Counterparty, Bitcoin will be able to do anything that Ethereum ever could. The porting effort was focused around maximizing compatibility and security. Indeed, our own code passes 100% of pyethereum’s contract execution software tests.’”

3. Ukrainian Government Says Cryptocurrencies Are Illegal Forms of Payment

The National Bank of Ukraine has identified cryptocurrencies such as Bitcoin as “money substitutes” and said they cannot be used for legal payments, Allen Scott reported Tuesday.

“‘This is a simple runaround,’ Michael Chobanian of the Ukrainian Bitcoin embassy said. ‘Based on the contents, it’s clear that the NBU does not understanding the situation.’”

4. BitLicense Creator Lawsky to Step Down in Early 2015

On Monday, William Suberg reported that New York Superintendent of Financial Services Benjamin Lawsky would be leaving his post at the beginning of the year for the private sector.

“Sources told the New York Daily News the departure is expected as part of a reshuffle of several key positions, with Governor Cuomo’s chief aide Larry Schwartz and others also tipped to leave next year.”

5. Banks Investigating the Disruptiveness of Cryptocurrencies

On Thursday, Diana Ngo reported that one of the world’s largest banks, BNP Paribas, had released its thoughts on how Bitcoin could shake up the financial services industry.

“In a report published in late October by BNP Paribas's magazine Quintessence, research analyst Johann Palychata describes the 5 potential disruptive impacts of cryptocurrencies on the banking industry, and advises financial institutions to spend time and energy on understanding the technology to ‘make best use of them before other players step in to make that decision for them.’”

Elsewhere

-

Ethereum released a video Wednesday previewing Mist, its decentralized app browser (24 minutes).

-

CNBC’s Brian Kelly calls Bitcoin “The Most Important Innovation in the History of Money.”

-

Melanie Swan at the Institute for Ethics & Emerging Technologies argues that the Counterparty/Ethereum cooperation is building a strong foundation for Bitcoin 2.0, and she suggest (though she doesn’t explicitly back up the claim) that this cooperation drove the Bitcoin price upward this week.

Market activity

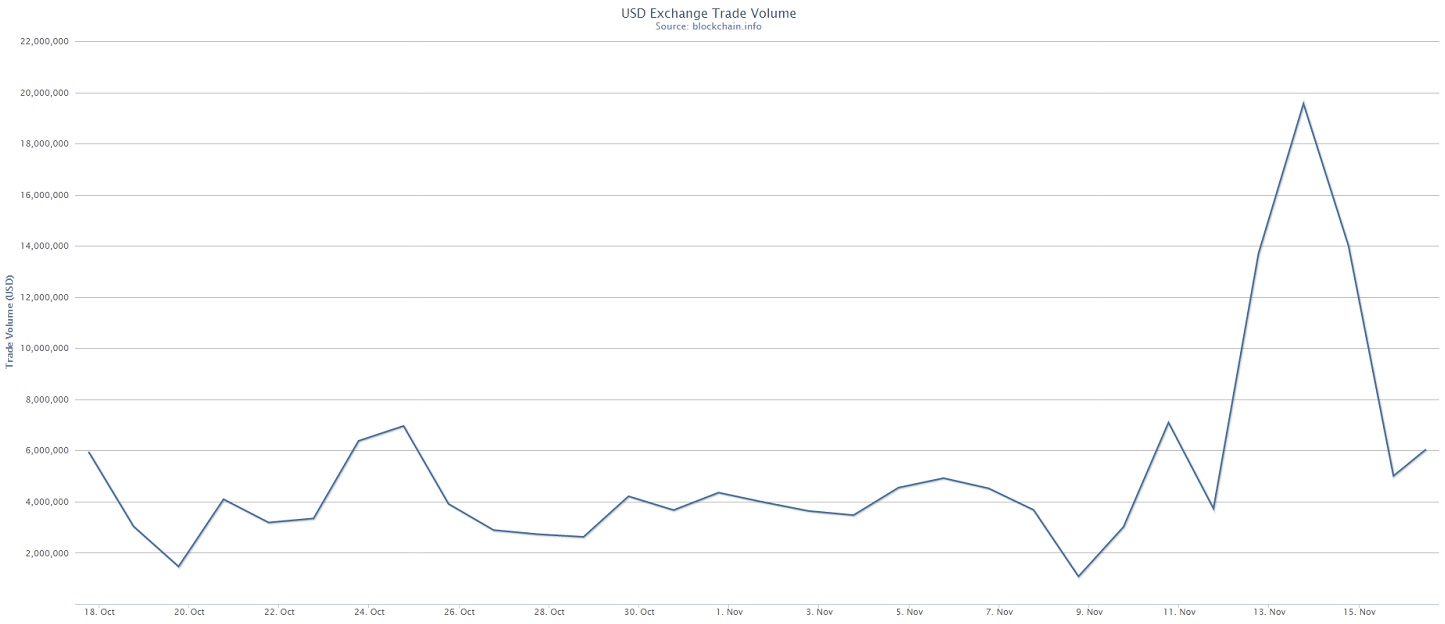

The big market news this week was the big spike in the BTC/USD price on Wednesday and Thursday.

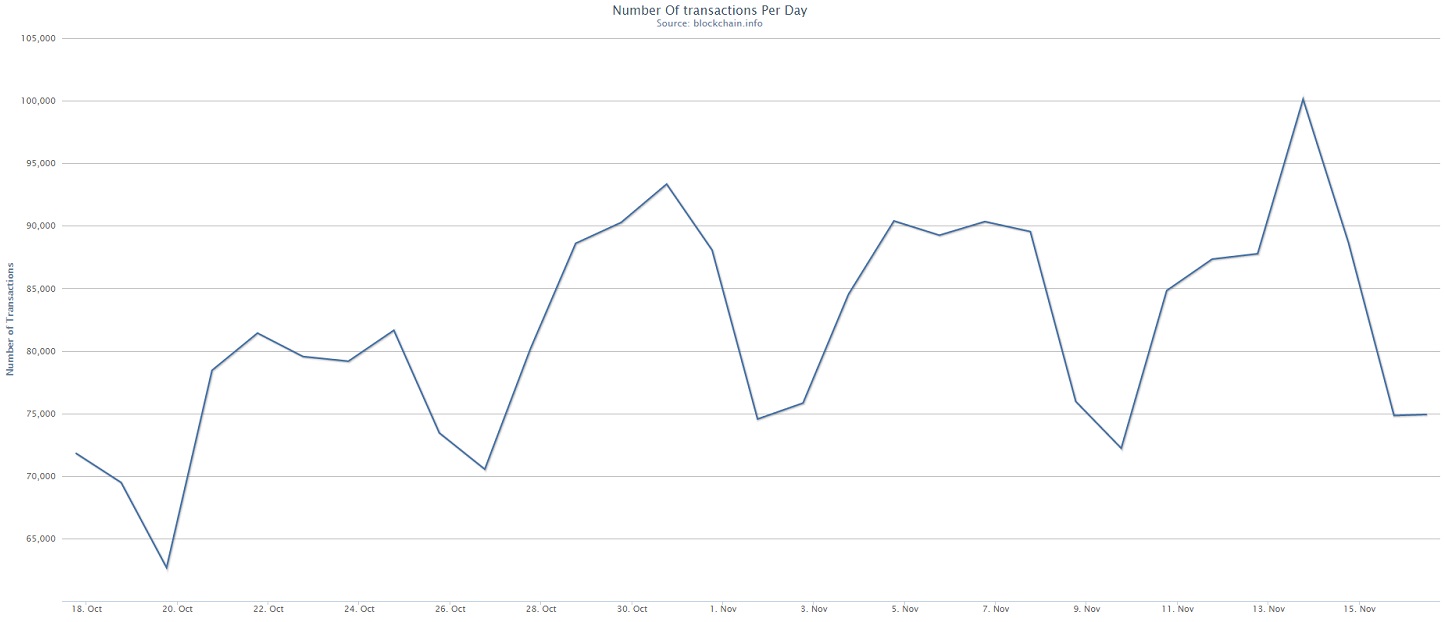

Look at Nov. 13 on each of the above graphs:

-

That’s the highest exchange volume in USD since October 6;

-

That’s only the second time we’ve ever seen 100,000 on-blockchain transactions in a single day;

-

And that’s the first time we’ve broken through US$400 since mid-October.

I think Tone nailed it in his mid-week analysis piece: “In my opinion, this entire move was trader initiated and is not a result of any big news or fundamentals.”

That means whatever seasonal events that could have been driving the Bitcoin bubble this time last year is probably not affecting the price in the same way this year, at least not yet.

Singles’ Day in China on November 11 might have accounted from some of Monday’s transactions and trade volume, but it didn’t pour rocket fuel on the network or anything. Last week’s DarkNet busts didn’t send the price moonward, either (I need a Silk Road 3.0 bust in November 2015 to officially dub that a seasonal event).

“However,” Tone wrote on Thursday, “once the price begins to take off to the moon or crash, panic sets in and the crowd gets on board. This can last for quite a while, but if all this was trader driven as suspected, it can go down as fast as it went up, so keep your eyes open and never risk wealth you are not willing to lose.”

Did you enjoy this article? You may also be interested in reading these ones:

- Weekend Roundup: Dark Markets Go Down, Bitcoin Tips Go Viral, and a 100-BTC Bounty is Put on a Hacker

- Weekend Roundup: Reports, Rumors Surround a Possible SEC Crackdown; Jon Matonis Leaves Bitcoin Foundation

- Weekend Roundup: Trouble at Bitnation and Dropbox, Promising Projects in Pakistan and the Philippines