“We accept Bitcoin here” signs remain few and far between, even online. A handful of studies suggest merchants would be happy to accept digital currencies due to the lower transaction fees involved. But volatility is a major concern, and judging by another wild week in crypto it will continue to be so.

Commerce is fiat-denominated and will likely remain that way for the foreseeable future.

So it’s no surprise that crypto media outlets herald the news when major merchants add Bitcoin to their list of accepted currencies. In July, for instance, Travala brought Expedia under the “We accept Bitcoin here” umbrella — another sign that crypto payments are, business-by-business, slowly becoming more widely accepted.

The mainstream adoption narrative as legitimacy

The mainstream adoption of cryptocurrency, in particular Bitcoin, has long been touted as proof of legitimacy for the cryptocurrency movement. Easily buying a cup of coffee with Bitcoin is widely regarded as a measure of success for the blockchain-based, non-government issued currency experiment that began with Satoshi’s whitepaper.

Of course, for long-term holders, that goal has been accompanied by the belief that if crypto is widely used by consumers and equally widely accepted by merchants, the growing demand coupled with its fixed supply would force its price up. There is a certain level of prestige associated with seeing a trend before it becomes popularized (not to mention the obvious financial rewards for cashing in on it).

A shift to a currency not issued by a national government is not a fairy tale. The Euro was introduced to the European Union in 2002, and is now the official currency of 19 of its 27 member states, replacing the storied German Mark and French Franc within three months.

And the period of westward migration in the United States saw the rise of the Free Banking Era, in which private banks, municipalities, and even railroad companies and stores could issue currencies.

Even countries who suffer from hyperinflation can revert to dollarization, as Zimbabwe did in 2008.

But cryptocurrency is different for a number of reasons than any of those moves away from nationally printed fiat money. The Euro was imposed by Eurozone member states, giving citizens no option but to accept it. A dollarization program has the intention of stabilizing economies susceptible to free fall.

The American Frontier of the late 19th century was characterized by isolated communities for whom privately issued money made intuitive sense — until forcibly ended by the National Banking Acts.

Cryptocurrency is global in reach, being native to the Internet. As Jack Dorsey told Quartz:

“If you consider the internet to be the equivalent to a nation state, it will have a currency native to itself.”

Crypto was designed for the digital world in which we live, and mainstream adoption is a naturally aligned goal. But crypto purism has the potential to make a perfect enemy of the common good. So maybe it’s time for fiat and crypto to put aside some differences… and just get along?

In a fiat world, off-ramps remain key for crypto

Just as Bitcoin could not exist without the Internet, its currency (if you’ll excuse the pun) is particularly ingrained in digital nativism. Glaring generational divides show that cryptocurrency is very much a “demographic mega-trend”.

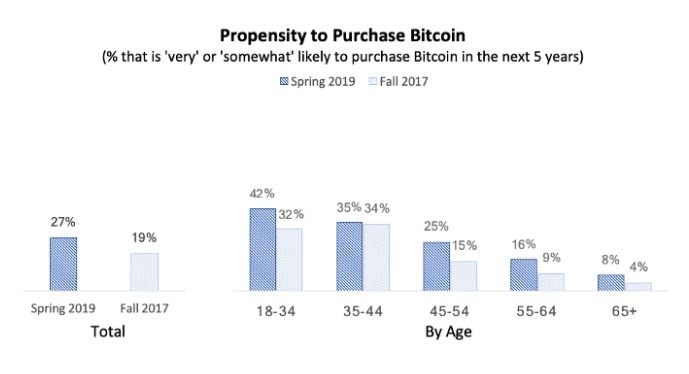

The Harris Poll, on behalf of Blockchain Capital, conducted a survey in April last year and found that less than 10% of older Americans were likely to buy Bitcoin. While that figure was double the findings of 2017, it pales into insignificance against the 42% figure for 18-34 year-olds and 35% among 35-44 year-olds.

Courtesy Blockchain Capital Blog, Propensity to purchase Bitcoin by age group

Courtesy Blockchain Capital Blog, Propensity to purchase Bitcoin by age group

Less than 1% of over 65 year-olds owned Bitcoin, according to the same study.

It is against this backdrop of sluggish consumer adoption and merchant acceptance that a number of crypto entities have chosen paths of least resistance to bring crypto into use. These bridging services between the crypto and fiat worlds may be anathema to crypto purists, but are essential steps to getting crypto into the hands of a wider set of users.

Crypto-native and digital asset-friendly neobanking companies have played a substantial role in building those bridges.

For example, Nexo and Mastercard have partnered to allow crypto holders to spend crypto at Mastercard-accepting merchants. Crypto.com has partnered with Visa. Revolut has joined forces with Mastercard, as well as both Apple Pay and Google Pay.

As Zac Prince, founder and CEO of BlockFi argued:

“Crypto is making strides in mainstream adoption, but if it’s truly going to work for everyday people, it needs to fit into the customary channels they already know and understand. These are things like credit and debit cards, personal finance and banking apps — even gift cards. People want to use things that feel familiar to them, and that’s especially true when it’s something as sensitive as personal finance. We just recently launched our mobile app and we’re working on new products like a premium consumer credit card with crypto rewards.”

Of course, the involvement of the major payment processors undoes many of the advantages crypto has to offer in terms of low fees for both buyers and sellers. But it offers a bridge that remains important when significant segments of the population are accustomed to buying with existing payment methods, and when merchants have difficulties off-ramping from crypto.

For users eager to spend crypto with merchants reluctant and/or unable to accept them, the off-ramp bridging service is critical. Crypto, in this case, isn’t replacing the existing fiat-based infrastructure, but being woven into it.

Payment processors may be considered layer two solutions on top of the legacy banking infrastructure. There is no reason not to adopt them as layer two solutions complementing blockchain networks, too.

The regulatory moat that the banking industry has dug around itself means supplanting it with an entirely independent crypto-based financial services sector would likely take decades of overcoming regulatory hurdles — never mind the difficulty changing consumer attitudes.

On the retail level, it’s fairly obvious that crypto and mainstream finance will eventually meet. The means-of-payment narrative demands it. But what about institutional players and the notion of Bitcoin as digital gold, a store-of-value?

Institutions are equally invested in bridging the gap

Institutional interest in digital assets as investment vehicles also demands easy fiat on and off-ramps. As Michael Shaulov, CEO of Fireblocks, the institutional asset transfer network, points out:

“Our platform has begun integrating traditional banks like Signature into the Fireblocks Network to provide financial institutions with on and off-ramps for blockchain-based assets. Traditional banking and digital asset systems need interoperability for mainstream crypto adoption to occur — even if that system evolves over time. Even though our platform has moved over $50 billion in digital assets this year, our customers are insistent in having access to fiat on and off-ramps. Industry leaders acknowledge that crypto alone may be profitable, but institutions will always long for fiat as an exit strategy.”

Banking can be disrupted… but if crypto is to be the ultimate disrupter there needs to be a bridging mechanism between fiat and digital currencies. As Hugo Renaudin, CEO & co-founder of Europe’s largest institutional grade spot trading exchange, LGO, points out, mainstream adoption will come with “silent revolutions” in which the end user is not necessarily aware they are dealing with cryptocurrencies:

“(Adoption) will only come if the UX is similar or better than current non-blockchain UX. Today it is still difficult to interact with/understand the blockchain and digital assets. Sending BTC has to be as easy as doing a contactless payment with a credit card for mainstream adoption to become a reality.”

The promise of financial inclusion

Whether it’s a true objective or simply virtue signaling, one of the crypto industry’s primary advocacy positions is its promise to bank the unbanked and open financial services up to everyone, regardless of socio-economic status. If crypto is to fulfill that vital promise, the sector needs to accept the reality that many of those that are unbanked are in emerging economies, where cash is king.

Even there, fintech is growing rapidly. The relatively low-tech M-Pesa has demonstrated how to extend financial services to the unbanked with little friction, and now 83% of Kenyan adults use it to send and receive money. But many neobanking and mobile banking solutions continue to rely on kiosks to enable users to cash out.

Consumer adoption of digital money is outpacing merchant adoption in the developing world. A 2016 report by the World Bank found that, despite the tremendous advantages to the poor of digital money solutions, merchant recalcitrance remains a sizable barrier.

Micro, small, and medium retailers (MSMRs) made and accepted roughly 44% of their payments electronically in 2015. Tellingly, however, the gulf between digital money penetration in the developed and developing worlds is stark. 71% of transactions made by MSMRs in the developed world were digital. That figure falls to 25% in Sub-Saharan Africa, 30% in the Middle East and North Africa, 31% in East Asia and the Pacific, and only 20% in South Asia.

The major impediments to small merchant adoption, particularly acute in the developing world, were:

“(i) an inadequate value proposition for merchants, including product design that does not adequately encourage them to migrate from cash to electronic payments; (ii) weak product and stakeholder economics in traditional card models; (iii) insufficient aggregate customer demand, needed to reach the “tipping point” that drives demand and supply towards an electronic payments ecosystem; (iv) inconsistent technological infrastructure and regulatory environment in developing markets to support electronic payments; (v) ineffective distribution models to serve hard-to-reach merchants in areas with limited economic capillarity; and (vi) difficulty in formalizing enterprises and reluctance of merchants to pay full taxes on sales.”

There are around 1.7 billion people in the world who are unbanked and a further 4 billion are underbanked. A 2016 report from the McKinsey Global Institute estimated that were the unbanked to switch from cash to mobile banking, the benefits would be staggering, adding “$3.7 trillion to the GDP of emerging economies within a decade.”

Mobile and non-traditional banking may be growing, but their ubiquity is outpacing merchant adoption. Cashing out of digital ecosystems to physical ones continues to be necessary in the developing world. As Ray Youssef of Paxful points out:

“Cryptocurrencies have the potential to transform the financial system as we know it, but this transformation is dependent on several factors. Currently, for crypto to find its solidified place in the world’s financial system, it needs to provide solutions to problems that others are unable to solve.”

45% of Paxful’s wallets are held in Africa. Youssef sees a great deal of promise in emerging markets, largely due to failed legacy systems:

“A major point where cryptocurrency has begun to reign king is solving such problems in emerging markets. It’s amazing to see the wealth generation that crypto can create and the wide adoption of bitcoin in the face of volatile currencies. Cryptocurrency needs to continue down this path and for it to win big it needs to be inclusive, and provide a monetary system that works for everyone.”

Ironically, and perhaps offering a glimmer of hope, emerging economies typically have young populations, which should lower the barriers to the more widespread use of cryptocurrencies. Oslo-based Arcane Research’s 2020 report, The State of Crypto, argued that Africa, in particular, is ripe for crypto use.

“Economic problems, from high inflation rates and volatile currencies to financial issues such as capital controls and a lack of banking infrastructure, create a fertile ground for an alternative to germinate… Cryptocurrencies are positioned to become the ideal antidote to these challenges. Bitcoin and some other crypto assets are unique in that they combine the wealth preservation properties of hard assets such as gold with the portability of digital currencies, combined with an unparalleled degree of censorship resistance.”

And while merchant adoption is lagging, Arcane Research’s Bendik Norheim Schei expects crypto to make enormous strides on the continent over the next five years.

“The use of smartphones is expected to grow massively over the next five years. The global average is 59% in terms of smartphone usage, while Sub-Saharan Africa is lagging behind (only 39%), making adoption more difficult. However, this is expected to grow to 66% in 2025 and will probably be an important factor for cryptocurrency adoption and merchant acceptance.”

Renaudin takes that a step further, arguing that digital assets offer “a better payment system for individuals and businesses in countries with a poor financial infrastructure.”

Taking cues from gaming and tokenization?

Crypto-as-payment can follow the lead of non-fungible tokens (NFTs) and other tokenized assets that are finding use-cases in gaming, collectibles, art sales and fractional ownership to expand economic value. As Jason Kelley, General Manager of Blockchain Services at IBM’s Global Business Services at argues, “By bringing ease-of-transaction to cumbersome, unwieldy assets like homes, commodities, heirlooms, and more, we could potentially help investors unlock trillions of dollars from the economy… This work is already underway, thanks to tokenization… (which represents) ownership rights for physical assets digitally on a distributed ledger or blockchain.”

Tokenized real estate offerings allow investors to buy a fractional portion of a property. This expands the potential investor base, and opens up opportunities for individuals otherwise priced out of real estate to access it as an investment vehicle.

Non-fungible tokens representing in-game assets in the gaming industry promise to revolutionize secondary gaming markets, reducing the risk of fraud and enhancing transparency.

NFTs can confer property rights to the billions currently locked out of markets. Ownership of tokenized assets recorded on blockchain networks could democratize access to wealth and wealth-generating assets on a scale as yet unseen.

Jonathan Perkins, the co-founder of SuperRare, a digital art market space, calls blockchain and NFTs a “zero-to-one moment for digital art.”

“The open and connected nature of crypto enables these assets to be purchased and traded in highly liquid global marketplaces such as SuperRare, a reality far beyond the constraints of the traditional art market. In this way, blockchain technology is unlocking new consumer behaviors on the internet, and enabling a new, natively digital generation to massively expand the definition of art collecting.”

It is interesting to note that in Perkins’ experience “many artists and collectors in this market were not users of cryptocurrencies or wallets beforehand — they simply identified the power of this new paradigm and embraced crypto as the technology that allowed them to create and collect art on the internet.”

No currency is an island

Crypto-as-a-payment-method currently runs parallel to existing fiat-based payment tracks and is defined by its nativism — to the Internet and to its own ecosystem and proponents. Nativism will almost surely result in failure, just as isolationism always has.

Crypto can be both not-quite-real money and an enhanced, superior form of money at the same time. Understanding and responding to facts on the ground, even if you don’t entirely like them, isn’t defeat. It’s progress.

Reuben Yap, Project Steward for Zcoin, suggests the “mainstream adoption” narrative is inappropriately targeted toward direct crypto payments. He argues that “Bitcoin has been around for a while now, so I think the number of people who have not heard about it is quite low. Yet despite all this awareness, we aren’t seeing Bitcoin or cryptocurrencies being used in the “mainstream” as traditionally thought. We too often think of mainstream adoption as being used as payments in the real world or integrated into existing businesses, but perhaps we need to revisit what we think “mainstream” adoption is and think about the opportunities that cryptocurrencies are opening that were not possible otherwise.”

Even if it’s no longer the only game in town — even if the narrative has changed — the ability to actually spend Bitcoin is still a desirable result, and Mati Greenspan, founder of analysis firm Quantum Economics, certainly foresees it:

“In the long term I think we’re likely to see more and more businesses accepting Bitcoin, especially in travel hubs, tourist destinations and online.”

And as Prince points out, “It’s important to look at this market through a historical lens. Although traditional currency feels so permanent, as a society we’ve always evolved and grown to adopt new assets as soon as they benefited us. We went from using seashells to paper money because it was easier to measure and trade, and as the world becomes increasingly digital, digital currency will begin to look more and more like the obvious next step.”