NFTs can also command serious cash, with some selling for hundreds of thousands of dollars.

But what are they? What can they be used for, how do they work, and what are some of the best-known projects in the industry today?

Buckle up for your ultimate guide on all things NFT.

- The Interview: Talking Tokens with William Shatner

- Why Animism Gives Japan a Cultural Headstart in the NFT World

- Why NFTs are a Perfect Match for the Digital Natives of Generation Z

- Reinventing Gaming with Blockchain Economies

- Beyond In-Game Assets: How Blockchain is Really Changing Video Games

- Dissecting the Investment Case for Blockchain Gaming

- Big Brands, Big Audiences: Why NFTs Could Lead the Way to Mass Adoption

Fungible vs. non‑fungible

It’s Easy When You Know!

'Fungibility' sounds complicated — but it’s really a very simple concept that relates to the things we own and use everyday. It applies to real-world assets as well as digital ones.

The dollar in your pocket — or the Bitcoin in your crypto wallet — is a prime example of a fungible asset. Both are easily replaced by something that is (for all intents and purposes) identical.

If Bob lends Kate $10, he wouldn’t need to receive exactly the same banknote back, because they’re equally as valuable.

Why Am I In Seattle?

All of this changes with a non‑fungible asset. Let’s imagine Bob lends Kate his rare baseball card. If she gave him back a common card, he’d probably be extremely annoyed. The two cards may look identical in shape, size, texture, and so on... but the details printed on them make them unique.

A plane ticket is also an example of something non‑fungible: one could send you to Sydney first class, but another may offer a trip to Seattle in economy.

Here are three things that make them different from your typical cryptocurrency:

Unique

Deep inside a non‑fungible token, metadata describes what makes this asset different from all the rest. This is a permanent, unalterable record that describes what this NFT represents — almost like the certificate of authenticity that you’d get with a rare painting.

Rare

Scarcity is an important ingredient in the recipe that makes NFTs so attractive. While developers have the freedom to generate an infinite supply of certain assets, they also have the power to limit the number of rare, desirable items in existence.

Indivisible

For the most part, NFTs cannot be split into smaller denominations — they can only be bought, sold and held whole. Remember the rules of non‑fungibility: you can’t purchase 10% of a plane ticket, or collect 50% of a baseball card.

Why are NFTs exciting?

Ownership

Your Twitter handle can be taken away from you in a heartbeat. NFTs cannot. Blockchain technology helps enshrine your ownership rights — and make digital assets a heck of a lot easier to move around.Transferable

This brings us neatly onto our next point. Twitter bans you from selling your handle to others, but NFTs can be freely traded on specialist markets. NFTs also solve the annoying problem about ”walled gardens” in games — meaning coveted assets within a popular game could be used in a totally different title... or exchanged for items in a different game, even with a completely different publisher.Authentic

Fraud’s a big problem — affecting everything from art to tickets and collectibles. The blockchains powering NFTs clamp down on counterfeiting — and give buyers confidence that they’ll get what they pay for.

Now it’s worth remembering that rare NFTs can equal big bucks — like when a one-of-a-kind diamond is auctioned off.

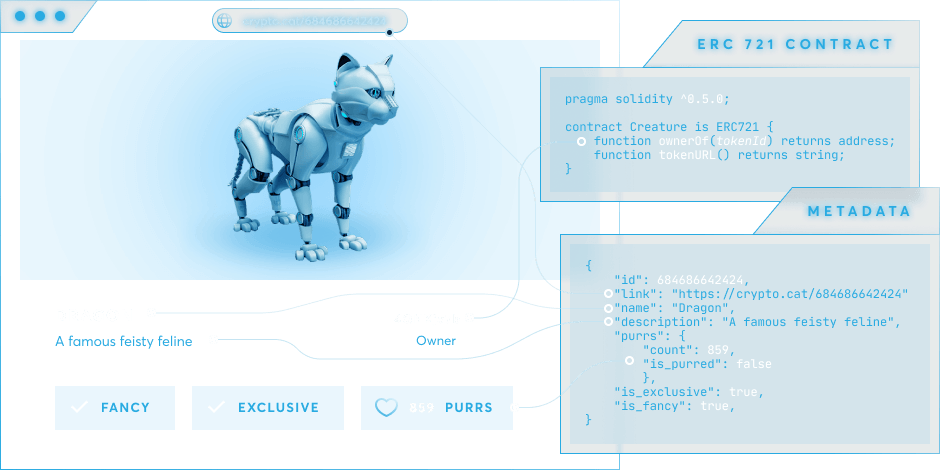

To see what we mean take a look at CryptoKitties, where players can collect and breed digital cats. Back in 2018, a feisty feline called Dragon broke records when she was sold. Have a guess... how much was she worth?!

NFT use cases

So... let’s delve into some of the ways that non‑fungible tokens can be used:

Art

Digital artists can have a nightmare protecting their copyright — and it can be difficult for talented creators to make a living. Through NFTs, someone can buy a creation and proudly showcase it in a virtual space, with blockchain offering proof of ownership. Artists can get a bigger cut of the payment, too... and even portion out a residual profit from future sales, to create a recurring revenue stream.

Collectibles

As we’ve seen with CryptoKitties, NFTs are being used to create entirely new types of collectibles — it’s even possible to buy tokenized versions of your favorite celebrities or sports stars. These tokens are also dragging traditional collectors’ items into the 21st century, such as baseball cards, coins, and stamps.

Gaming

Selling rare weapons and skins is currently prohibited by many popular titles such as Fortnite. It can also be near impossible to use these assets in other games, too. With NFTs, coveted items can be easily transferable — solving one of the biggest annoyances that avid gamers face.

Virtual assets

The Ethereum Name Service — which offers .ETH domains — has turned each of these domain names into non‑fungible tokens so they can be bought and sold, while Unstoppable Domains has done the same for .crypto addresses. Other platforms such as Decentraland and Cryptovoxels allow you to buy plots of virtual land.

Real-world assets

Work in this space is at an early stage, but it’s possible to tokenize real-world assets like property, with NFTs being used to prove that someone owns a piece of land.

Identity

We all have attributes about ourselves that are completely unique — ranging from our appearance to our education qualifications and medical histories. NFTs could digitize all of this, and give us greater control over our data.

What are the best-known projects?

My Crypto Heroes

My Crypto Heroes is a Japanese battle game that’s built on the Ethereum blockchain. It offers non‑fungible tokens including heroes that take part in quests and tournaments, and extensions that enhance their performance.

Gods Unchained

Another is Gods Unchained. This is a competitive card game where the cards are non‑fungible tokens that can be bought and sold freely.

CryptoKitties

We mentioned CryptoKitties a little earlier. This platform took NFTs mainstream, with each token having distinctive ”cattributes” that made each feline special. These digital cats can breed and produce offspring, and some of them will be rarer than others.

Decentraland

Games are exceedingly popular. Decentraland allows players to buy parcels of virtual land, and some areas of its universe are more valuable than others. Owners can monetize their space with shops, advertising and art, and sell it on for a profit.

A blockchain game in action

Well, one upcoming title is Blockchain Heroes, which features digital trading cards of 50 superheroes inspired by top crypto influencers and inventors. These cards are non‑fungible tokens, and each has a special design.

Big brands getting into NFTs

- Formula 1

The major sport signed a licensing agreement with Animoca brands — and now, players can build a collection of NFTs including cars, parts and drivers in an Ethereum-powered game.

- Ubisoft

The gaming giant Ubisoft has expressed an interest in blockchain. Earlier this year, it released rare digital Rabbids Tokens that can be collected and potentially sold for a profit.

- Vodafone

One of the world’s biggest mobile phone networks launched an augmented reality game where players had to hunt down NFTs called Vatoms on the streets of central London.

- Nike

The sportswear titan hit headlines last year when it was awarded a patent for NFT-based footwear. Digital shoes could be bred and traded, and may be turned into real-world shoes.

- NFL & NBA

Cards featuring American football and basketball players can now be bought on blockchain thanks to a partnership with the long-standing collectibles company Panini.

- Samsung

The tech giant’s top-end smartphones now come pre-installed with a crypto wallet called Enjin where NFTs could be stored, in what could be a major milestone for adoption.

- Louis Vuitton

Counterfeiting is a problem for luxury brands, and consumers want to know the provenance of their handbags and clothes. Now, products are given NFTs so authenticity can be verified.

The pros and cons of NFTs

- They could unlock new revenue streams in gaming, sports, the arts, and technology.

- Building decentralized apps for non‑fungible tokens can be tricky and time consuming.

- NFTs could introduce millions of people to cryptocurrencies for the very first time.

- Much more simplification is needed so NFTs are easy to use for people who know nothing about blockchain.

- They can transform our attitudes toward ownership — and make it possible to own a real-world asset that’s thousands of miles away.

- NFT games can have a ”hot potato” effect. Players buy an asset in the hope of selling it on for a profit, but if the market collapses, they can make a nasty loss.

How are NFTs made?

Several different standards exist for non‑fungible tokens. The very first was ERC-721, a cousin to more common ERC-20 tokens. ERC-721 tokens are driven by smart contract code that embed the unique details that make them rare or desirable. This metadata can be stored on the blockchain, or off.

Other standards take the utility of NFTs further. ERC-1155 tokens can be used to develop fungible and non‑fungible tokens — the crucial difference between a shield every player uses and a rare sword only a few people own.

Tokens are also easier to transfer in bulk

NFT industry stats

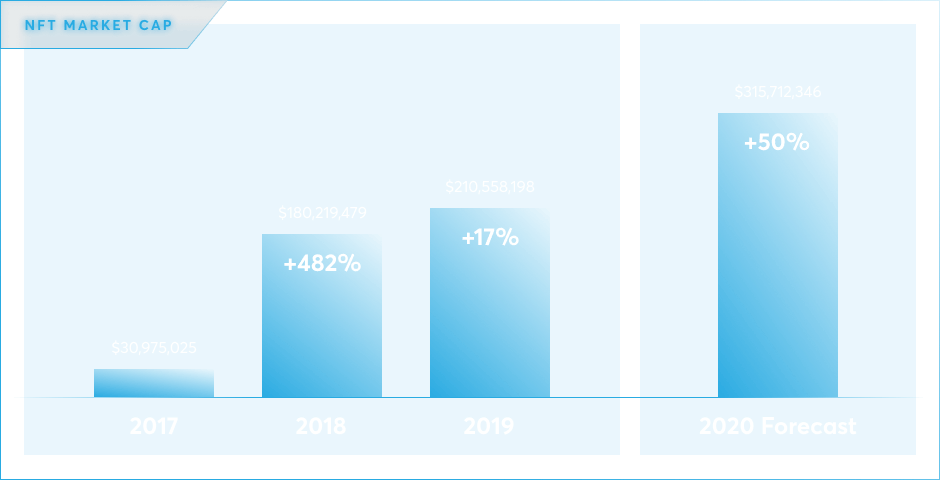

So... exactly how big is the NFT space. Well, in terms of market capitalization, the industry grew 17% in 2019 — and it’s forecast to grow 50% by the end of 2020.

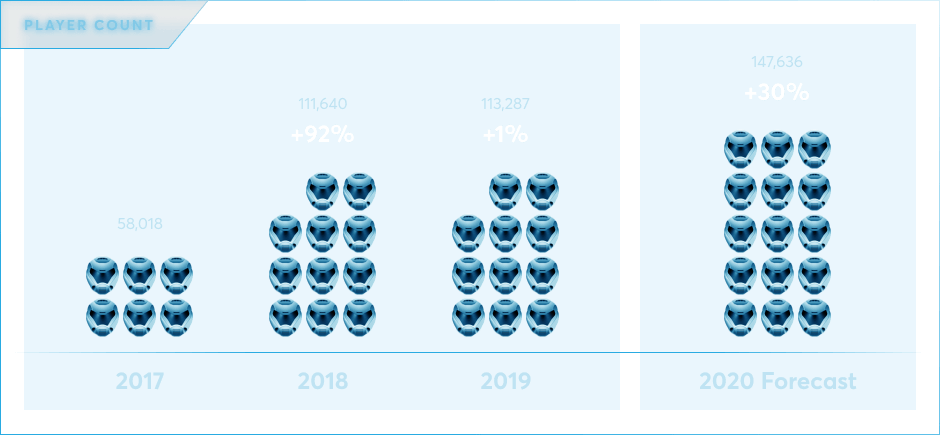

NFT games were exceedingly niche in 2017 — and the number of players was stagnant in 2018 and 2019. This year, it’s predicted that the industry’s user base will grow by 30%.

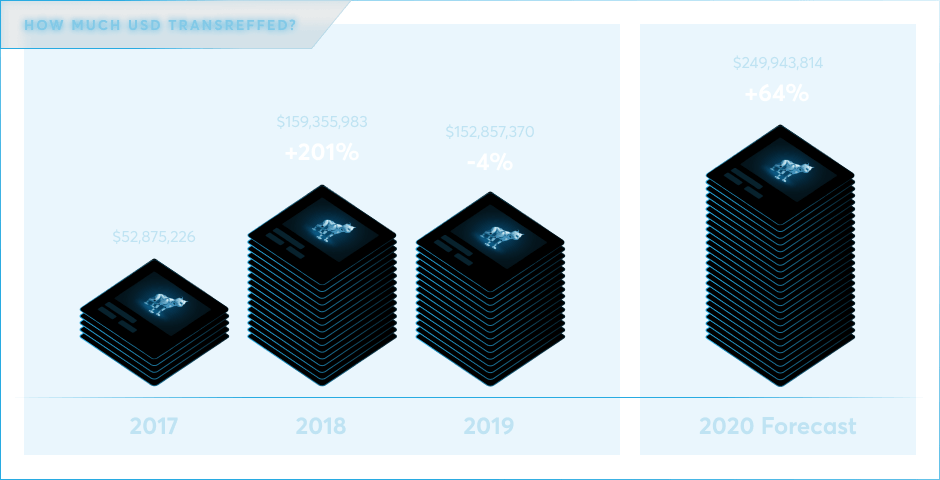

The dollar value of NFTs transferred trebled to reach highs of $159 million in 2018, falling to $152 million in 2019. Forecasts suggest there will be a year-on-year rise of 64% in 2020.

All these stats making promises of astronomical growth don’t tell the full story, though. The NFT space does have its challenges.

According to Nonfungible.com’s annual report, most projects have a poor retention rate — and in 2019, the vast majority were used for three months or less. As of February 2020, just 3.5% of these platforms were used for more than 10 months.

The liquidity of NFTs is also a crucial measure of how healthy a marketplace is, but in 2019, just 12% of newly created assets actually circulated between users.

Big NFT news in 2020 (so far)

New developments in the NFT space are emerging all the time.

Back in March, Tyler and Cameron Winklevoss revamped Nifty, a centralized exchange that allows people to sell their tokens and withdraw their profits in fiat. The company’s even planning to team up with celebrities to issue tokenized collectibles.

We’re seeing more and more top-tier sports clubs enter into partnerships to launch tokenized player cards with varying degrees of rarity. And interactive platforms are giving developers a chance to experiment with non‑fungible tokens, potentially paving the way for even more use cases.

CryptoKitties still have a tremendous amount of pulling power, too. In May, a surprise drop of 100 tokens depicting ”Catterina” drawn by the artist Momo Wang overwhelmed the Nifty exchange, and they were sold out in three minutes.

What’s next?

Expect to see more and more non-blockchain brands wade their way into the world of NFTs — especially in the gaming industry. In some cases, these companies will strike partnerships with specialist blockchain projects to make their visions a reality.

We’ll continue to see further improvements in the infrastructure that underpins NFTs, and a renewed effort to make these assets appealing to non-techy consumers. A straightforward user interface will be crucial for unlocking mainstream adoption.

And, as endless experimentation takes place, we’ll likely see several NFT projects crash and burn. Some will struggle to maintain the excitement and momentum they have immediately after launching.

As such, if you’re tempted to snap up a pricy token worth a few hundred bucks, make sure you’re not left holding a hot potato.