“The actual context and state of content [on the internet] is going to be so different to anything we can envisage at the moment, where the interplay between the user and the provider will be so in sympatico it’s going to crush our ideas of what mediums are all about.”

— David Bowie, BBC Newsnight 1999

Bowie was remarkably prescient on the impact the internet would have, not only within the creative industries but also on society at large. While the early days of the internet painted a future of borderless, peer-to-peer networks of unlimited creative possibility, we still have gatekeepers and intermediaries demanding their share of cultural equity.

Can the new era of Web3 technologies, such as blockchain and crypto assets, revitalize culture-making and blur the lines between creators and patrons in such a way that perhaps the Starman himself would approve?

The nature of creative scenes

Ambient music pioneer (and Bowie collaborator) Brian Eno described the spontaneous eruption of creative scenes and subcultures as a display of scenius: “The intelligence and the intuition of a whole cultural scene […] the communal form of the concept of the genius.”

While stars or other influential figures may be the vanguard for a new scene or subculture, bottom-up community engagement is paramount for any modern cultural movement to gain traction — whether it be surrealism, punk rock, hip-hop, cyberpunk or crypto.

Wired founder and futurist Kevin Kelly breaks down scenius into four core factors:

“Mutual appreciation — Risky moves are applauded by the group, subtlety is appreciated, and friendly competition goads the shy. Scenius can be thought of as the best of peer pressure.

Rapid exchange of tools and techniques — As soon as something is invented, it is flaunted and then shared. Ideas flow quickly because they are flowing inside a common language and sensibility.

Network effects of success — When a record is broken, a hit happens, or breakthrough erupts, the success is claimed by the entire scene. This empowers the scene to further success.

Local tolerance for the novelties — The local ‘outside’ does not push back too hard against the transgressions of the scene. The renegades and mavericks are protected by this buffer zone.”

Scenius can occur anywhere minds meet: a town, a company, a region or a virtual space.

Scenius tends to have a subversive quality to it. Some of the most lasting and influential cultural movements have happened without permission or broad market appeal. Often, subversion of the status quo is the core driver of their success.

Despite this subversive quality, scenius is often the process, by which new ideas, concepts, sounds, images and so on are injected into the mainstream consciousness, a sort of cultural lab that experiments with the new long before acceptance (or even integration) with the established order.

The framework of scenius presented by Kelly implies a democratic, community-driven structure; yet, if we look at past cultural currents through that lens, a clear pattern emerges of powerful and opportunistic interests seeking to stake their claim on these movements.

The concept of patronage — the ongoing financial and social support of a creator by an individual or community — provides an illuminating fulcrum for analyzing the changing anatomy of cultural markets.

The evolution of creative patronage

The history of patronage in the arts reveals that technological and social evolution over hundreds of years results in shifting power relationships between artists and their patrons.

As far back as ancient Rome, it was the status and power of elites that shaped creative scenes. Gaius Maecenas, a prototypical patron of the arts and close associate of Roman Emperor Augustus, almost single-handedly shaped the “Golden Age” of Roman literature and poetry through his support of luminaries like Virgil, Horace, Propertius and Ovid.

Centuries later, in Renaissance Italy, the powerful Medici family elevated figures like Galileo and Leonardo da Vinci from mediocrity to legend.

In recent times, it’s not hard to find examples, such as the Saatchi brothers, who have been credited with driving early awareness of Damian Hirst, Tracey Emin and other young British artists.

In short, for over two millennia, the rich and powerful have bankrolled cultural production and reaped the benefits, and in many cases, artists were placed in a precarious position — subject to the whims and sensitivities of their patrons. Galileo, the father of modern astronomy, was abandoned and betrayed by the Medicis when faced by charges of heresy for his discoveries by the church and later died under house arrest.

This was the dominant form of patronage until the rise of the joint-stock corporation and the growth of private enterprise in the 19th century. From here, creative endeavors were commodified to feed the market rather than appease the few. The advent of the music “industry” in the 20th century is testament to this phenomenon, as aristocratic patrons were replaced by corporate executives feasting on the creative genius of others until only scraps were left for the creators themselves.

In retrospect, it is easy to criticize the patrons of creative industries, but the reality is that these economic spaces were formed within the context of the dominant technologies and social structures of the time. As Conway’s Law states: “Organizations which design systems … are constrained to produce designs which are copies of the communication structures of these organizations.”

These industry gatekeepers played a vital role for artists in a less connected and integrated world — and in fact, broadened the scope of cultural production and consumption — but it was not until the arrival of the internet and the World Wide Web that a viable alternative could present itself — one that could potentially reify the magic of scenius in the digital age.

Cultural markets in the digital age

Web 1.0 and the internet of ideas

The rise of the internet was met with unbridled enthusiasm by those at the edge of culture and with ambivalence by the mainstream. While the concept may not have been explicitly stated by many beyond Bowie, at least in the early days, the internet was seen as the perfect medium for cultivating scenius beyond the constraints of time and space.

People joined mailing lists and bulletin board systems to discuss niche topics from counterculture, scientific research and music to upending the global financial order (and of course, Bitcoin (BTC) itself was born of these early online communities).

We can describe this as the internet of ideas: a global medium for knowledge sharing, propelled by ideas of its own potential.

This era also witnessed a groundbreaking evolution in patronage that could only occur in the connected environment that would become the norm many years later.

In 1997, the British rock band Marillion found themselves adrift with no record label. Since tours were largely bankrolled by labels, they were unable to produce the estimated $60,000 cost of an upcoming United States tour. The inability to perform shows could have resulted in a death spiral, given the band’s dwindling resources.

When the band turned to its mailing list to update fans on its predicament, many fans offered to help fund the tour. (For those who enjoy a good pun and an obscure ‘90s music reference, this was before the days of Fish-ing scams.)

After setting up an escrow account managed by a third party, the band successfully funded its next tour with the aid of its fans. After the tour, Marillion fired its manager and funded the recording of its next album with pre-orders. Marillion’s story is often cited as the first instance of crowdfunding in the creative arts and predated the platforms and e-commerce systems that rule the landscape today.

The experience and transmission of culture also changed radically during this period, particularly in the domain of music.

When Napster entered the scene in 1999 and provided users a platform on which to share MP3 files freely with one another, many in the music industry were incensed. Infinitely replicable content was incompatible with the current business models. While the new global distribution mechanism did not go unnoticed, established artists such as Metallica railed against Napster for its facilitation of rampant piracy, which resulted in substantial loss of revenue.

What happened when the powers-that-be embraced this new domain?

Web 2.0 and the internet of commerce

The dot-com boom of the late ‘90s occurred when entrepreneurs made the connection between the web page and the shopping catalog. After all, people seemed to be spending a lot of time “browsing” through this medium — so, why not capitalize on their attention? Enter the internet of commerce.

Using music as an example once more, Apple released the iPod in 2001, the digital evolution of the Walkman. The first subscription-based music provider, Rhapsody, launched that same year. In 2004, following the success of the iPod, Apple launched iTunes, a platform for purchasing and downloading individual songs.

This model dominated the industry for years until the launch of streaming services. Spotify launched in 2008 across several countries and quickly gained traction with millions of subscribers. Apple, quick to notice a profitable trend when they see one, launched its own competing streaming service, Apple Music, months later. Other platforms, such as Bandcamp, gave independent creatives and labels more room to breathe with lower fees and flexible pay-what-you-want options.

These internet companies became the new gatekeepers, securing a cartel-like hold on the cultural market.

The advent of crowdfunding platforms that provided two-sided marketplaces for creators and patrons was a boon to culture. Yet, the business models at play were mere attempts to gain market share of a new era of distributed patronage and creative economy, presaged by Marillion’s efforts over a decade beforehand with its humble mailing list.

Eventually, crowdfunding platforms emerged with different business models, such as the subscription-based services of Patreon and the project campaigns of Kickstarter and Indiegogo, but the 30%-plus marketplace commission fee that has become standard in the Web 2.0 era of e-commerce has turned sustainable creative endeavors into a sheer numbers game.

This era is also characterized by the rise of social media platforms. In this setting, the connection between artists, brands and their fans/customers was cemented in a more open setting than the forums and mailing lists of the previous generation. While these social media platforms have allowed greater exposure to creators, this transition has resulted in a saturated (and deeply problematic) market for people’s attention, the true currency in an online world. Social media simply became a new way for companies to sell things.

In short, Web 2.0 has been defined by semi-monopolistic platforms built on open protocols selling products to people, oftentimes manufacturing demand and imposing on individual privacy in the process. Marketplaces are gated with a toll. Communities are ephemeral, only showing up for exclusivity and discounts. The economic and social incentives appear to be broken in a game set not by creators or their patrons but by companies looking to gain a dominant market share of culture itself.

The rise of the Web3 brand

A new technological and social movement dubbed Web 3.0 hopes to give internet users a greater share of personal sovereignty and agency through more decentralized and privacy-preserving protocols for the sharing and distribution of content and value, in which people are not the product.

In a corner of this fringe space, the maverick experimentation of Web3-enabled brands may provide a glimpse of how “the interplay between the user and the provider” can be fully realized in the future. Stranger yet, if we look closely at the technologies and communities that make this experimentation possible, we’ll find that it really is scenius all the way down: from protocol, to platform, to product, to people.

Brands are a powerful manifestation of scenius. They not only encompass the aesthetic qualities of a certain scene — shared language, styles, techniques — but also form the narrative that gives the scene momentum.

While branding has often been the domain of singular individuals or institutions as they attempt to convey an emotional response within potential fans, followers or customers, the rise of open-source software development, and particularly the cryptocurrency movement, has completely inverted the concept with the notion of what Toby Shorin, Laura Lotti and Sam Hart refer to as headless brands.

These brands are highly distinctive from centrally-managed brand initiatives since the visual assets, messaging and core narratives take on a life of their own through an open community of builders and advocates rather than the cathedrals of corporate development. While Satoshi Nakamoto and Vitalik Buterin certainly set the initial course for Bitcoin and Ethereum, respectively, these systems are now fully (or at least, primarily) driven by the scenius of these communities.

The evolution of the open-source software movement and the building of Web3 is a powerful display of scenius across time and space. Let’s return to Kelly’s four pillars of scenius in this context:

Mutual Appreciation: The ultimate goal of open-source and cryptocurrency is to build a better future through open access to technology. Developers, like musicians, complement (and compliment) each other’s works. Cred goes a long way with positive, peer-to-peer pressure.

Rapid exchange of tools and techniques: Software is publicly available and auditable, and in many cases, devs are encouraged to exchange ideas, remix code and participate in open discourse, all of which advances the state of the art.

Network effects of success: Cryptocurrency protocols are an interesting phenomenon of software protocols with their own internal economy. All stakeholders and contributors share in the growth and maturation of the network.

Local tolerance of the novelties: While the novelty bandwidth of outsiders may be surpassed by a simple glance at crypto, for the most part, if no harm is done, experimentation is permitted within the scene.

But these are protocols; what about products?

While traditional business-to-business and business-to-customer software application development has often been about identifying problems and building solutions as a basis of product development, decentralized Web3 environments have introduced a new phenomenon that Shorin et al. term “market-product fit”:

“Cryptoeconomic protocols are market frameworks looking for potential product applications.”

The Ethereum space, for example, has produced a wide array of experimental building blocks, or “primitives” in software parlance, which builders can use to compose applications that would be impossible within a traditional software stack.

This composability and inversion of product development may seem strange, but it allows the fundamental values that inform the underlying protocols to be reflected in what is built on those foundations, a process that ultimately resolves in the user experience.

Democratizing cultural production for fun and profit

“She turned the problem upside down, as usual,

And blockchained from the user to the source,

Made information a utility

Fair-valued by the user’s use of it,

Paying surprised creators their reward.”

— Frederick Turner, Apocalypse: An Epic Poem

Many theorists subscribe to the idea that the market is all-knowing and efficient, providing the perfect paradigm to determine where resources (money, attention, etc.) ought to be allocated. In practice, there is no fundamental basis for this model. The market is a game, and some enterprising individuals and institutions bend the rules in their favor.

The markets of cultural production (for example, fashion) are severely inhibited by rampant speculation, price gouging, fraud and even violence (modern-day slavery in the supply chain). The reason for these deep flaws is that the allure of potential gain incentivizes atrocious behaviors that benefit few at the expense of many. These markets are not just untrustworthy and inefficient; they can actually bring out the worst in us.

Three Web3 brand ventures, MetaFactory, Zora, and Foundation, have been experimenting with tokenization, community governance and market design to create a more open and participatory brand experience, in which speculation is leveraged to advance the brands themselves, and the upside of their markets are shared by creators and patrons alike.

Before we discuss these, however, let’s look at how an odd experiment inspired this new model of creative patronage.

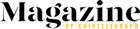

Unisocks Exchange

One of the most popular projects in the Ethereum blockchain community is Uniswap, a decentralized exchange protocol that allows for accessible token liquidity without centralized trust. Basically, it allows teams to bootstrap markets for digital assets without relying on trusted third parties.

The team behind Uniswap has experimented with buying and selling a digital token redeemable for a physical good on a dynamic pricing model called a bonding curve. The item in question: a pair of socks.

Uniswap / Twitter

While variations of bonding curves exist, the core idea is that the price of an asset fluctuates based on supply and demand within a pre-programmed set of rules, allowing builders to launch markets that incentivize certain user behaviors (a practice also known as mechanism design).

Five hundred $SOCKS tokens were created, each redeemable for a physical pair of Unisocks. At the time of writing, one pair is trading at $128.36 with 162 SOCKS unclaimed.

While that price tag for a simple pair of socks is of course ludicrous, the Unisocks proof-of-concept broke ground by pairing crypto-economics to physical goods.

Now, what happens when Web3 builders expand this idea beyond speculative socks to any creative artifact?

MetaFactory: Brand factories for the metaverse

The MetaFactory is a platform that builds on the Unisocks model by allowing the creation of brand factories, decentralized organizations that oversee the collective management of a brand by a community of stakeholders.

Within this model, a new brand factory is launched through a Genesis Auction — a crowdsale for Brand Factory Memberships through the brand’s Genesis Product. For MetaFactory itself, the Genesis Product is the MF Bomber Reversible Jacket.

metafactory.ai

Memberships are non-transferable voting rights that entitle the holder to participate in the brand’s ongoing governance, as well as profit-sharing.

Like Unisocks, products are represented as scarce, non-fungible tokens, which the community can use for speculation on the open market or to redeem for the product itself.

In MetaFactory, a product NFT is tied to a digital wearable for avatars in virtual environments. MetaFactory’s core goal is to create an economy for “digi-physical” goods that exist simultaneously in the virtual and physical world. As MetaFactory co-founder Drew Harding notes in Fitzner Blockchain Consulting’s primer, Democratizing Fashion:

“Physical apparel is the anchor and likely to be the initial attraction for most, but I believe it will be the digital side and its future applications that will propel MetaFactory forward. We decided to combine these two trends and leverage them to cultivate culture and build community through the introduction of digi-physical apparel.”

Zora: The cultural marketplace

Similar to MetaFactory, Zora is a marketplace that builds on the Unisocks model to accommodate a wider range of limited-edition goods beyond apparel. The team behind Zora also worked on St. Fame DAO, a decentralized brand organization that sold $FAME tokens tied to a limited-edition shirt created by well-known crypto designer Matthew Vernon (commissioned through his personal token $BOI).

ourzora.com

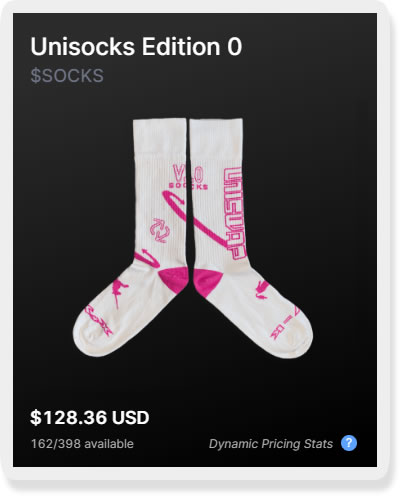

On May 11, 2020, Zora launched its first collaboration with Grammy Award-winning songwriter/producer and experienced Web3 artist RAC to crowdsale a limited-edition cassette tape version of his new album, BOY.

ourzora.com

The $TAPE has sold 28.32 out of 100 tokens at an initial price of $20. The current market value for a limited-edition cassette facilitated by its bonding curve is $265.02 (after reaching an all-time high of $929.77). RAC receives a cut of the speculation.

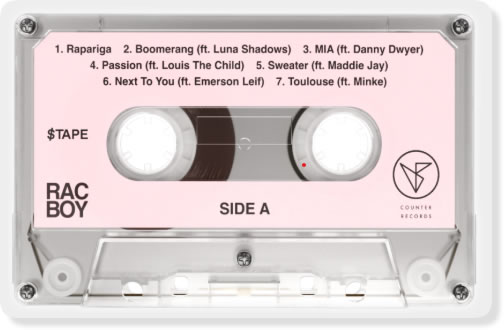

Foundation: Culture’s Stock Exchange

Similar to Zora, Foundation is a Web3 marketplace that allows brands, artists, and designers to create dynamic markets for limited-edition goods, using a combination of bonding curves and NFTs for speculation and redemption of scarce cultural artifacts.

Foundation’s initial drop is a series of shirts designed by their Founder and Head of Design, Matthew Vernon, who also designed the aforementioned St. Fame DAO shirt, for his own brand, Neuegoods.

(Neuegoods.com)

Drops slated for release on the near horizon will feature musicians, designers, artists, and photographers to showcase how different creators can use the platform.

Describing themselves as “culture’s stock exchange,”the team is clearly hacking the language of corporate finance largely inaccessible to the layperson for independent creatives. As Founder/CEO Kayvon Tehranian puts it:

“The web’s radical, permissionless architecture reshaped our world for the better. And blockchains carry a similar messianic promise for foundational change. What is there to be democratized this time? Markets, currency, capital formation. With Foundation, our aim is to empower everyone to create their own markets and their own currency with which to accumulate capital — in exchange for whatever it is of value they have to offer.”

MetaFactory and Zora have been using similar crypto-economic building blocks — decentralized autonomous organizations, NFTs, dynamic pricing via bonded curves — to create democratized cultural markets that creators can configure to their own needs and specifications, all without permission from industry gatekeepers.

What advantages do they bring now, and what challenges await them in the future?

Advantages of Web3 models

Efficient markets

There is an element of curation that Web3 markets empower and that traditional markets or crowdfunding platforms simply cannot beat. An auction for a limited good allows a creator not only to gauge market interest in a future product release but also to calculate exactly the number of units that need to be manufactured in advance. This reduces waste in excess manufacturing and storage.

Also, the ability to effectively tie a physical good to a digital counterpart via a blockchain allows for a cryptographically secure and verifiable authentication system, making forgery or tampering incredibly easy to counter through track and trace of the supply chain.

Price discovery

As we see in many markets for scarce assets, the price distortions from scalpers and other opportunists can keep many from participating. Bonding curves provide a dynamic pricing model that rises and falls according to market interest. In Web3 markets, many different crowdsale options and auction models exist, some more fitting for certain contexts.

Engaged patrons

Most of the crowdfunding platforms that emerged from the Web 2.0 era are basically no more participatory than patrons putting money in a bucket for some exclusive access or reward in an extremely high-latency discounted presale.

Subscription models like Patreon provide more continuous engagement, but the patrons (especially the earlier ones) are unable to share in the creator’s success as the value of their work grows. Within these platforms, communities are ephemeral at best. There’s no sense of stake. Web3 platforms, however, cultivate this engagement through an innovative market design that emulates “equity” in these creative endeavors.

Put bluntly, the creator can build royalties from future sales directly into their smart contract, ensuring that the artifact’s value accrual over time delivers returns to the creator and the patron, not just the platform.

Challenges for Web3 models

Regulatory compliance

Builders in the Web3 space tend to envision new financial instruments as unique constructs from the legacy system. However, regulatory authorities do not care about the novel technologies or even the intentions behind these value-accruing systems. (If it quacks like a duck, it’s a duck.)

It is possible that by emulating equity in these new contexts, various “abbreviated agencies” will step in and either demand “the real thing” with proper registration and paperwork… or shut them down entirely. Ultimately, this is an ongoing dilemma and the subject of much discourse in the blockchain industry.

Legal liability

Web3 platforms introduce a new framework for product marketplaces that are radically driven by their support base, but in some cases, the legal liabilities (which exist in any commercial setting regardless of context) are hazy.

How are risk and responsibility allocated within decentralized autonomous organizations and token economies? Who owns the intellectual property?

Answering these questions not only clears up regulatory considerations but also introduces an opportunity for experiments and innovations in law and software to improve creative commerce at a fundamental level.

User experience

Much to its detriment, crypto is not graced with excellence in user experience. This is unfortunate since the UX is the product in the eyes of the layperson. Between managing cryptographic key pairs and making sense of the bonding curve, Web3 brand ventures have been faced with the considerable task of abstracting this complexity in such a way that people are secure in what they are doing as they interact with these applications.

Web3 and the decentralized renaissance

We’ve examined the evolution of cultural markets from the perspective of patronage with the conclusion that creators and patrons are limited to the technological constraints and social conventions of their time.

In recent times, the market has become the dominant medium of culture, facilitating the allocation of capital and attention that influences what people see, hear or do. But attempts by corporations and internet platforms to monopolize culture itself have extracted unfathomable value from creators and their patrons.

Early visions of the internet painted it as a new autonomous zone for cultivating scenius, that co-creative magic beyond time or space, but this potential was hijacked by those who decided that creators and users, from music to online publishing, were particularly lucrative products in themselves. In many ways, this is a tragedy.

The Web3 technological and social movement may produce the necessary tools and infrastructure to facilitate next-generation, peer-to-peer creative economies that remove the rent-seeking, the gatekeeping and the industry-wide 30% marketplace commission that has defined the business model of the Web until now.

These new platforms may allow creatives to thrive on the support of a hundred devoted patrons rather than thousands, revitalizing culture beyond what’s trending or viral at a given moment. It might be considered the current apex of “agency through community.”

Can markets, oddly enough, therefore, become the saving medium of cultural change that allows us to reclaim and realize our cultural equity?

Go build something, and find out.