Ten years after Satoshi Nakamoto posited a peer-to-peer electronic cash system, it seems safe to say that Bitcoin has finally caught on. But not as the creator of the cryptocurrency envisioned.

While investors and speculators have rallied behind Bitcoin, its use among retail buyers and sellers remains sluggish.

Crypto forensics firm Chainalysis suggests that $4 billion was transacted in Bitcoin payments in 2019; but Nilson reports that card payment companies processed almost $1,800 in the U.S. alone for every dollar spent with BTC worldwide — even though a recent study by The Economist noted that 34% of survey respondents believe the future for digital currencies will primarily be for online payments.

Significantly, the Economist Intelligence Unit survey was conducted among people in both advanced and emerging economies. Over half of those surveyed saw Bitcoin as a short-term speculative investment tool or a long-term growth asset. With almost three times as many people in developing countries claiming to have used crypto, it is fair to assume that in the West, Bitcoin is largely seen as an investment vehicle.

Analysts and pundits have pointed to varying reasons for the massive discrepancy. Reluctance to embrace new technology, awkward user interfaces, private key security concerns, and a dark history of use for illicit purposes have all been suggested as barriers to the adoption of Bitcoin as money.

Yet there is one, more fundamental, issue Bitcoin presents to potential new users.

It doesn’t look like money.

Bitcoin is in serious need of a denomination schema that resembles something we, mere humans, can comprehend.

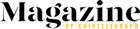

The two most common denominations used to describe the cryptocurrency are Bitcoins and Satoshis (or sats). Unlike dollars and cents, which are two orders of magnitude apart, a Bitcoin is eight orders of magnitude greater than a Satoshi.

In other words: while a Bitcoin hovers around $7,000 in value, the community wants “normals” to pay for a $5.00 cup of coffee with either 0.00071428571 Bitcoins or 71,420 Satoshis.

And regular folks just don’t seem to get along with that concept.

Whole Number Bias Theory

According to Whole Number Bias Theory, “humans have great difficulty comparing quotients including fractions, proportions, and probabilities and often erroneously isolate the whole numbers of the numerators and denominators to compare them.” Whole number bias has been found to be intrinsic to the way humans solve number comparisons, rather than merely a compensatory strategy.

The problem is observed among young learners and extends into adulthood. In one study, subjects were asked to choose the larger of 27/42 and 43/77. Most wrongly chose the latter, focusing on the numerator.

The bias toward whole numbers extends to a preference for dealing with natural, or whole and positive, numbers. The numbers that appear after a decimal point are called the mantissa. Bitcoin has eight figures after the decimal point. It is divisible into one hundred million Satoshis.

That can be extended if that becomes necessary in the future. For everyday purchases using Bitcoin, only its mantissa will be used given its post-2017 prices. People have great difficulty assigning value to long post-decimal place numbers. It is easy to understand the price of a cup of coffee when it costs $5.00. That becomes far more problematic when it costs 0.00071428571 BTC.

The problem worsens when making price comparisons. It is a relatively simple exercise to see that the $15.00 lox bagel in Manhattan is more expensive than the $7.50 lox bagel in Oklahoma City. In $7,000 Bitcoin terms, those bagels are worth 0.0021428 and 0.0010714 BTC, respectively. A closer look indicates one is something like double the price of the other. But a closer look is too much work for the average shopper.

As Albrecht et al. argue, Bitcoin’s “mantissa, or the part of the logarithm that follows the decimal point is, in its current form, too large for day-to-day and micro transactions.”

The Satoshi Workaround

There is, of course, an alternative method of representing smaller figures in Bitcoin measurement units. Pricing in Satoshis has been presented as a way to more meaningfully represent prices in Bitcoin terms. One Satoshi is 0.00000001 BTC: the smallest fraction is one hundred millionth of a Bitcoin.

The problems with this workaround are twofold. Firstly, many thousands of Satoshis are no more meaningful in an instant than an eight-decimal place fraction of a whole number. Secondly, we are not conditioned to deal in such figures unless we are making large purchases.

In the event of a large purchase, Satoshis work even less effectively. A million dollar house costs over 14 billion Satoshis. Were Bitcoin to ever be worth many multiples of what it is now, Satoshis may become more helpful. But Bitcoin is unlikely to fall in line with a particular price range that makes assigning value to it as intuitive as we have become accustomed to.

Previous Attempts To Make Bitcoin Human Readable

Efforts have been made to apply a monetary unit system to which we are more accustomed. In many ways, they are comparable to the Ethereum Name Service, designed to improve the user experience by eliminating the need for people to use long addresses.

One grisly attempt includes an excessively complex labeling system that runs from the Satoshi (Satoshi), through the Microbit (uBTC(BTC)), Milibit (mBTC), Bitcent (cBTC), uBT(BTC) (microBitcoin), mBTC (milliBitcoin), dBTC (deciBitcoin), daBTC (decaBitcoin), hBTC (hectoBitcoin), kBTC (kiloBitcoin), MBTC (megaBitcoin), cBTC (centiBitcoin), nBTC (nanoBitcoin), pBTC (picoBitcoin), fBTC (femtoBitcoin), aBTC (attoBitcoin), GBTC (gigaBitcoin), TBTC (teraBitcoin), PBTC (petaBitcoin), and all the way to the absurd EBTC (exaBitcoin), which is worth more Bitcoin than will ever be created: 1,000,000,000,000,000,000 BTC.

The uBTC, mBTC, cBTC schema is the most commonly referred to alternative value representation system. One uBTC (you-bit or microbitcoin) is 100 Satoshis, or 0.000001 BTC.

One mBTC (em-bit or millibitcoin) is equal to 100,000 Satoshis, or 0.001 BTC.

And one cBTC (bitcent), represents a million Satoshis, or 0.01 BTC.

Oddly, even the most comprehensive descriptors of Bitcoin units have no name for the 10,000 Satoshi denomination, despite its proximity to dollar-equivalence.

Courtesy Steemit, Measuring Bitcoin by Satoshis

Assuming a Bitcoin price of $7,000, the $5.00 cup of coffee is worth:

71,420 Satoshis

7142.1 uBTC

7.142 (not denominated)

0.7142 mBTC

0.07142 cBTC

0.0007142 BTC

The human aversion to extremely large numbers means nobody will want to spend over 70,000 anythings on a cup of coffee. Satoshis fail to help. And our Whole Number Bias renders BTC and cBTC equally unhelpful.

What we can see is that for a cup of coffee, if Bitcoin is assumed to be worth $7,000, uBTC and mBTC are both possible comprehensible measures.

The former is going to become awkward once we start calculating the price of big-ticket items like cars and houses, so it appears that the mBTC is the most helpful metric to use. In that case, the $50,000 car in your garage costs just over 7,000 mBTC and your million dollar house will sit at around 142,000 mBTC.

But even if we posit a metric that’s more similar to the dollar (at the current value of one Bitcoin), something that represents 10,000 Satoshis, there’s still a problem.

On the Question of Volatility

Volatility as a barrier to adoption is moot if merchants can instantly settle into fiat, as point-of-sale technology matures. But where it will count is if a schema is developed around Bitcoin at a certain price range and that price range is massively breached, up or down, thereby detracting from any meaning the schema had created.

In that case, volatility makes any denomination structure moot too. And settling instantly into fiat similarly makes any proposed Bitcoin denomination structure pointless because goods and services will not be advertised in a Bitcoin-based denomination.

Put simply, a denomination of 10,000 Satoshis makes some sense to U.S. users while Bitcoin is at $10,000 because it would be equal to one dollar. But at $1,000 or $100,000 per Bitcoin, we’re back into issues with whole number bias and large number aversion again.

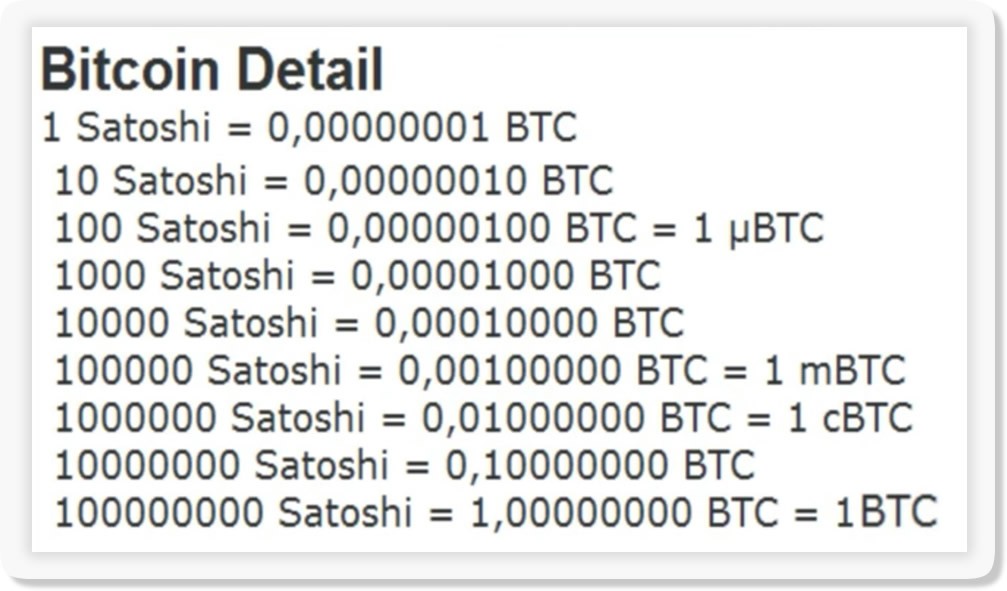

Bitcoin is historically volatile, having grown from being practically worthless to commanding almost $20,000 in its decade-long lifespan.

Courtesy Buy Bitcoin Worldwide, BTC historical volatility

Any unit of measurement that makes sense at one point in time for both big- and small-ticket items is likely to become unworkable until price discovery is more extensive, and volatility is far lower.

So, the denomination problem will remain a significant sticking point for Bitcoin’s use case as money. The current system is unworkable because humans have a form of cognitive dissonance when it comes to extremely large numbers or too many numbers following decimal points.

The denomination problem is both a prohibitor of its use, and yet moot so long as Bitcoin is volatile. The currency needs a measurement protocol to suit what we’re used to, and that will also withstand any future volatility and still make sense.

Bitcoin needs to be human-readable, as it were.

And for that to happen, Bitcoin terminology needs to change. Because humans may not.