As interest in crypto has stirred anew, some long-term investors have chosen to invest in digital assets through an instrument that provides tax advantages — a self-directed Individual Retirement Account (IRA).

Interviews by Cointelegraph with people who have opened crypto IRAs suggest they have attracted both sophisticated veterans who have made millions in cryptocurrency, as well as those who may not have profited greatly so far — but who still have faith in the future. The IRAs have also attracted newcomers who are willing to dip a cautious toe in the digital asset pond.

The self-directed IRA, while administered by custodians or trustees, allows investors to purchase, hold and sell alternative assets including precious metals and real estate. Depending on the provider, self-directed IRAs may also have investment choices that include stocks, mutual funds and ETFs (exchanged-traded funds). There are both traditional and Roth versions of the self-directed IRA.

Investors in our survey who have set up crypto IRAs find it a compelling proposition. “I do believe in the space and find it intriguing enough to set aside a small portion of my retirement funds to invest into crypto,” says Derek Price, 39, who lives in central Pennsylvania near Harrisburg and opened a self-directed traditional crypto IRA account several months ago.

“Certainly it’s a speculative investment. I realize it’s not a slam dunk,” Price says. “I’m fully aware the coins being offered today may not be around tomorrow,” he explains. “I still have 401(k)s and other retirement savings accounts invested in traditional assets, so I will continue to be diversified,” he adds.

Price originally invested in crypto in 2017 just before “the market went bananas,” garnering him significant gains. At the same time, however, he was concerned that he was not tech savvy and was worried about investing on exchanges where his holdings might not be secure. So, he got out of the market ahead of crypto winter.

Price heard about the crypto IRA from a friend and decided to give it a try after learning that assets are held by a custodian and investors can check, verify and track their digital holdings. This time he would hold his crypto assets for the long term. “I have a longer runway. My approach might be different if I was closer to retirement. If I was in my 50’s I might look at it differently than now in my late 30’s. If it doesn’t work out, I have many solid years left to save. It won’t be ruining my retirement.”

His crypto IRA is sponsored by iTrust Capital of Encino, California. Like many other firms that currently offer crypto IRAs to consumers, iTrustCapital is a platform. It is not a custodian, digital wallet or an exchange. The company’s crypto IRAs are administered by its custodian, SunWest Trust of Albuquerque, New Mexico, while assets are stored with Curv, an institutional wallet service based in New York City, according to Blake Skadron, chief operating officer at iTrustCapital. The company was started in 2018 and had “a soft launch” in July 2019, he said. It has not been offering crypto IRAs long enough to be rated by the Better Business Bureau.

“Funds move over to a platform we manage. Customers can log into their account and they can self-trade 24 hours a day seven days a week,” says Skadron. “We don’t employ salesmen and we don’t give investment advice.” He faults some other crypto and gold IRA providers for hiring a sales force to market their accounts and make claims about the value of the investment even though they are not financial advisers.

Trading Inside A Crypto IRA

Some investors have turned to crypto IRAs, in part for trading, and, in part, to hold it for the long term. An IRA shelters trades from capital gains taxes. In the end, however, investors must hold assets in the IRA until age 59½ to avoid tax penalties. After that age, account holders can withdraw funds from a traditional crypto IRA and pay income tax on the amount of the withdrawal. For crypto Roth IRAs, the original contributions into the account are taxed but the gains and payouts from the account, if made after age 59½, are not taxed.

Austin Evans, 28, who left his job as an engineer in north Alabama two years ago, earns a living trading crypto. He rolled over his 401(k) balances from prior jobs into a traditional IRA sponsored by Interactive Brokers. The only crypto investment available to him though his brokerage account at the time was the Grayscale Bitcoin Trust Fund, which trades under the ticker symbol GBTC. Last summer he decided to rollover all the funds in his existing IRA into a crypto IRA offered by iTrustCapital.

With a crypto IRA, Evans has been able to invest directly in crypto assets offered by iTrustCapital. While he cannot trade futures in an IRA, which would allow him to short assets, he can “swing trade” trending coins. This strategy allows traders to capitalize on moves in the market that may take several days to develop.

Evans began to invest in crypto in early 2017 and was a buy-and-hold investor. However, when the bear market began in 2018, he developed the skills he needed to be an active day trader. “It’s a volatile space, so it’s got a lot of opportunities for trading. I was just getting in and out, taking profits and making enough to withdraw weekly.” As a trader he has been able to earn an income equivalent to what he earned as an engineer. He will continue to day trade outside his IRA on crypto exchanges where he can choose from a wider array of assets, as well as buy and sell futures, allowing him to trade long or short according to market conditions..

Evans, who most recently got into Bitcoin at $7,200, expects that the price should start to move up ahead of May 2020’s “halvening event” when the rewards earned by Bitcoin miners are slashed by fifty percent. Miners that expect to be unprofitable after that event are likely selling their Bitcoin inventories now, he said in December 2019 before the current upswing. As that selling momentum comes to end, Evan expects the price of Bitcoin to rise.

Crypto IRA Pioneers

Some of the companies that offer crypto IRAs have affiliates that were previously involved in offering other alternative investments through a self-directed IRA. The founders of BitcoinIRA of Sherman Oaks, California, for example, first offered a self-directed IRA in 2012 for investments such as real estate, limited liability partnerships, and later for precious metals including gold, according to CEO Chris Kline.

In late 2014 the company set out to explore how they could begin to offer a self-directed crypto IRA. “So we got to work putting together the critical components. We needed to have a custody solution because it was an IRA. We needed to have a solid wallet solution because you’re dealing with retirement money. And we needed a liquidity mechanism that allowed us to be able to do functions for transactions for clients,” Kline says. They chose BitGo of San Jose, California as the wallet provider and custodian and chose Genesis Global Trading of New York to provide liquidity. (Several other crypto IRA providers also report they rely on Genesis for liquidity). BitcoinIRA has a B rating from the Better Business Bureau.

“In June 2016 we introduced the first Bitcoin IRA,” Kline says. “Ironically, Edmund Moy, former director of the United States Mint, was our first client and he had the first Bitcoin IRA.”

When asked about the account, Moy said, “Yes, I was BitcoinIRA’s first customer.”

Moy, 62, who lives in the Washington, D.C. area, explained how he became the first pioneer in the world of crypto IRAs. “When we started thinking about starting the first-ever Bitcoin IRA, I was helping a sister company Fortress Gold Group with their gold IRA program,” he recalls. Moy, who was then the chief strategist at Fortress, helped the company explore the idea of a crypto IRA. “Then when it became reality, I wanted to be their first customer,” he says.

Fortress Gold Group no longer accepts new clients and has a C rating from the Better Business Bureau. Moy also shared some of his insights into investing in crypto through an IRA. “In a way, this was taking the HODL idea and mainstreaming it in a way that can make sense for the average retirement investor,” he says.

The word “HODL” caught on as a humorous way of saying HOLD, as in holding the currency for the longer term instead of trading it. (The term originated as an apparent typo on a Bitcoin Forum in December 2013 by someone posting under the title “I AM HODLING,” according to Wikipedia, although later wits have suggested that in cryptocurrency it is an appropriate acronym for Hold On for Dear Life.)

“Using an IRA investment vehicle makes sense for those who believe in cryptocurrencies’ long term potential but who don’t want the roller coaster of near-term price volatility,” Moy says. Of course, they should understand crypto is speculative and understand the risk, he adds.

Right Place, Right Time

Jose Rubio, 54, of Los Angeles, is looking forward to a secure retirement. He worked as a public school teacher teaching English and history in the state of California school system for 22 years, enough time to be able to vest at age 55 in a pension that pays out an annual annuity. The defined benefit plan, as his type of pension is known, has become less and less common over the last three decades as employers switched over to defined contribution plans, such as the 401(k).

“It’s called a defined benefit because you get a defined payout, the exact same amount every month, for life,” says Rubio. With that monthly income, combined with rental income from properties he owns outright without mortgages, “I should be able to get by.” Rubio resigned from his teaching job last summer and has been taking a year off ahead of the time he begins to collect his monthly pension in May 2020.

With a secure base of retirement income, Rubio felt he could “just place a bet” with funds he had accumulated through a 401(k) and other retirement savings plans. He took those funds and rolled them over into a crypto IRA in September 2019 and invested it mostly in Bitcoin. “I’m very bullish on Bitcoin,” he says.

Rubio chose to rollover his retirement savings into an account from BitIRA, a company based in Burbank, California, that is registered as a Money Services Business with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN).

BitIRA, launched in 2017, claims it offers “the most secure digital currency IRA in the world” and backs up the claim with insurance to cover digital assets held in its customer’s accounts.

Providing insurance has not been a simple matter for BitIRA. “There is no such thing as an ‘end to end policy’ that covers our services, so in order to provide the closest thing, we’ve worked with our partner custodian, Preferred Trust Company [of Las Vegas, Nevada], to assemble seven different policies to cover the process across three entities,” says Andy Klein, director of strategic planning at BitIRA. The three covered entities are BitIRA, the cold storage wallet, and Preferred Trust. The seven insurance policies, each worth $1 million or more, cover losses from hacks, fraud, employee theft, mistakes, or social engineering, according to the company. BitIRA has earned an “A” rating and is accredited by the Better Business Bureau.

Rubio’s decision to devote a chunk of his retirement to crypto is not his first venture into digital assets. He first began investing in cryptocurrency in 2013. He was invested in Bitcoin with funds held at Mt. Gox, the notorious exchange based in Tokyo that collapsed in early 2014. He lost only $300 or $400 then because he was only investing modest amounts.

He also reports losing money from coins he bought on BTC-e, a troubled exchange based in Bulgaria but operating through a company registered in London. “I got into gambling mode,” he says. In 2013 he invested in altcoins Cryptsy and MintPal, among others, and “lost a ton of money, to be sure.” He then moved his crypto investing activity to Poloniex and Bittrex away from BTC-e long before its domain was seized and shut down by the U.S. Department of Justice in July 2017.

Rubio continued to play the crypto coin market from 2014 to the end of 2017 and over time his gains far outweighed his losses. Thus, it is no surprise he has a very positive view of his experience. “It’s probably been the best thing that’s ever happened to me in my life.”

He eventually stopped trading in crypto in 2018 and sold all his holdings. “I took the conservative route. I said, I’ve made enough money. That’s it. I’m going to pay my taxes like a good little boy and I’m going to take what I made and just pay off my investments, pay off my cars, pay off everything and call it a day.”

While Rubio has closely followed developments in the world of crypto since then, he did not return to investing in crypto until after he opened his account with BitIRA in September when he promptly made an investment in Bitcoin. He is mulling additional investments in a few of the top 10 coins.

The crypto IRA could offer some important advantages in the future, he contends, such as allowing him to cash out his Bitcoin should it soar to stratospheric levels, like half a million or a million dollars a coin. If the price exploded like that, he could sell, avoid capital gains tax and then reinvest in other alternative investments inside his self-directed IRA, such as real estate and gold… and maybe get back into Bitcoin after the price falls back from a future peak.

BBB Ratings For Crypto IRAs

A number of other firms have jumped into the crypto IRA space, including several affiliated with gold IRA providers. Investors may want to look carefully at all expenses related to accounts and do a careful comparison. They should also check out the Better Business Bureau’s rating of potential providers. Most, but not all, are rated A or A+ but not all are accredited.

Here are few of the bureau’s ratings of crypto IRA providers.

- CoinIRA of Woodland Hills, California, is rated A and accredited by BBB.

- BlockMint of Los Angeles is not rated; affiliate Lear Capital is rated A but is not accredited by BBB.

- IRA Bitcoin of Calabasas, California is rated A and accredited by BBB.

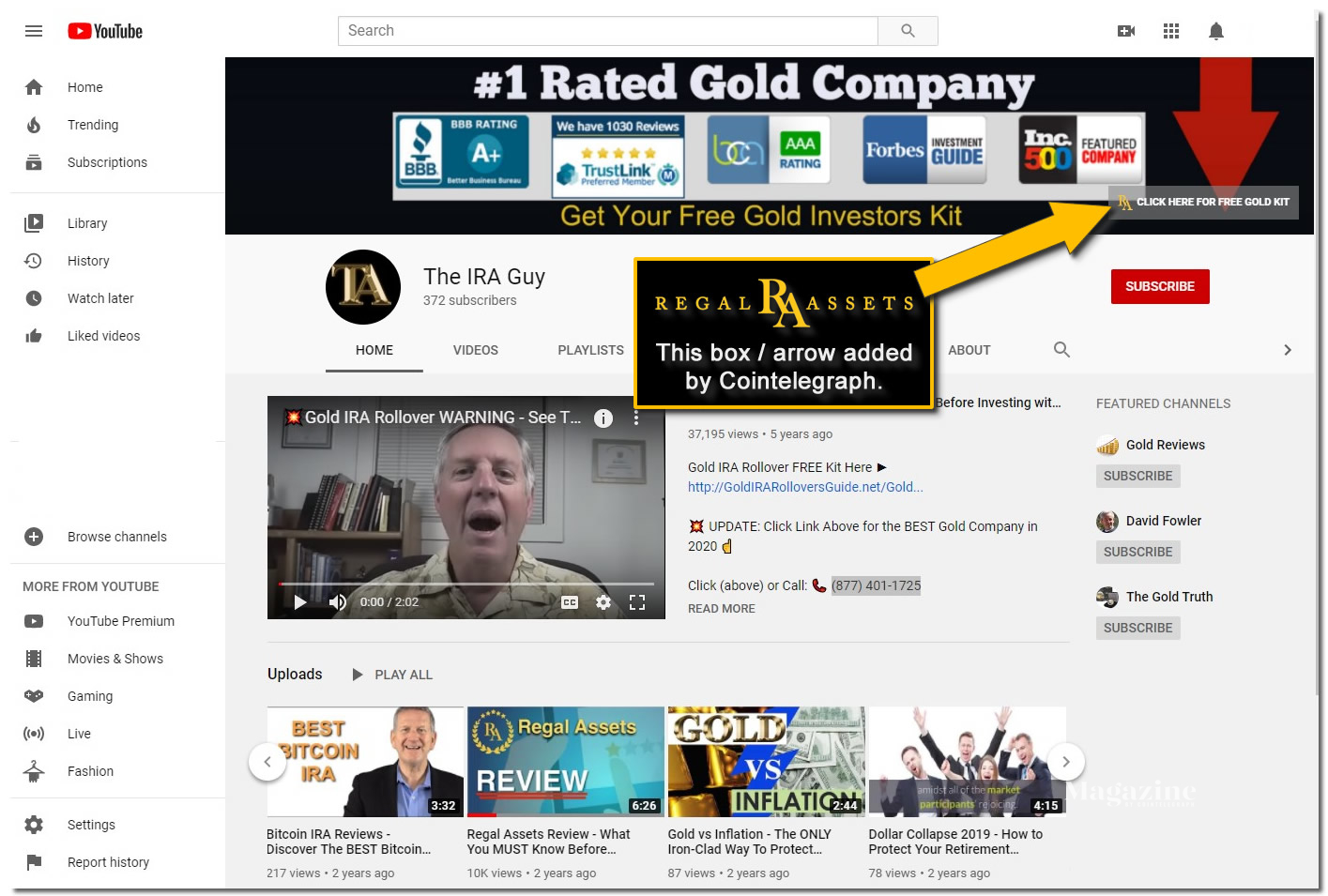

One provider however, Regal Assets of Beverly Hills, California, has earned an “F” rating from the bureau for what BBB contends is false advertising about its gold IRA and its crypto IRA, and a false claim that the firm has earned an A+ rating from BBB.

The Better Business Bureau has reported on its website that it contacted Regal Assets in July 2019 to ask them to cease using the rating bureau’s name and logo in its advertising. BBB has stated that despite an official disclaimer on Regal Associates’ own website, Regal or its affiliates continue to make claims the company is rated A+ by BBB. The bureau has also stated that Regal continues to make statements “that may mislead consumers into believing an investment in precious metals and cryptocurrency does not carry risk, and that past performance can possibly predict future performance.”

For example, in one YouTube video, a narrator asks the viewer what makes Regal stand out from competitors. His immediate answer: the fact that a Regal IRA is rated A+ by the Better Business Bureau. None of this is true.

It is not clear from the video who owns the channel, or whether the video was an independent review; however the phone number and website listed on the channel link to a promotional page for Regal Assets, and the company’s logo is included in the channel’s header page – complete with a link to Regal Assets’ website. The channel owner, ‘The IRA Guy’ stopped posting videos two years ago before starting up again last week.

By contrast, no such claims about BBB appear on Regal’s website. Instead, at the bottom of every page on the website there is a standard disclaimer warning that investors should carefully evaluate and research the risks and rewards of investing in cryptocurrency and precious metals before investing. There is also a warning that past performance is no guarantee of future results, and that Regal account executives are not financial advisers.

Anthony Bertolino, who heads crypto IRA business development at Regal, claims that their fee structure is competitive or better than its rivals. “We do not charge a rebalancing fee,” he says, while other self-directed IRA providers charge fees as high as 3% to 5%, he claims. “That’s going to eat up your capital very quickly,” he declares.

Bertolino also points to evidence that competitive pressures have begun to drive down fees charged by crypto IRA custodians, including fees charged by Regal’s own custodian, Kingdom Trust Financial Services of Murray, Kentucky. Bertolino expects competition will further reduce custodial fees in the future. Kingdom Trust has an A+ rating and is accredited by BBB.

Bertolino thinks that the advent of the self-directed IRA is a good thing for investors because it shifts the focus away from “tickeritis,” which he defines as focusing strictly on shifts in prices, and more toward fundamentals. “It’s changing the mindset to more of a longer term investment.” By contrast, he adds, someone who wants to get into crypto to “make a quick buck turnaround is more likely to be ravaged by the volatility.”

The Suitability Question

The risks associated with this asset class raise the question of whether or not an IRA can be an appropriate way to invest in crypto. As with all investments, buyers should educate themselves about the risks and do due diligence before either investing in crypto or choosing an IRA sponsor. Given that caveat, some independent observers say “yes” it can be appropriate under the right circumstances.

Despite the fact crypto is highly speculative and “there’s not a lot of commercial applications you can point to for crypto,” it might make sense for some investors who have faith in its future, according to Gil Luria, director of research at financial services firm D.A. Davidson & Company, an investment banking firm based in Great Falls, Montana.

“Some people see it as a hedge in a world where crypto assets could take over, even if that is a small likelihood,” Luria says. “If it’s something you just want to buy and put in a coffee can and put away until some point in the distant future, then retirement accounts can do that.”

Then again, just like the stock market, there’s no guarantee one’s faith in crypto is well-placed and that it will, in the end, be rewarded.