For the past several years, a hot debate has been taking place in the comment sections of alternative financial media sites. The debate is between those who have embraced cryptocurrency and its ability to protect its owners in tumultuous economic times and those who believe that only precious metals can properly fill this role.

However, a well-rounded crisis portfolio should contain both cryptocurrency and precious metals, and they actually complement each other quite well.

Bitcoin price and financial crises

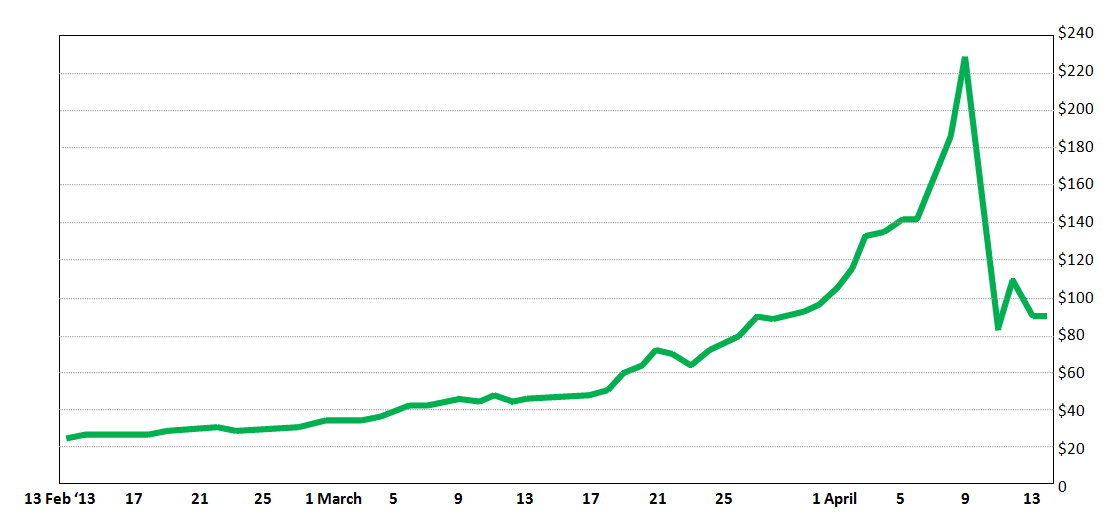

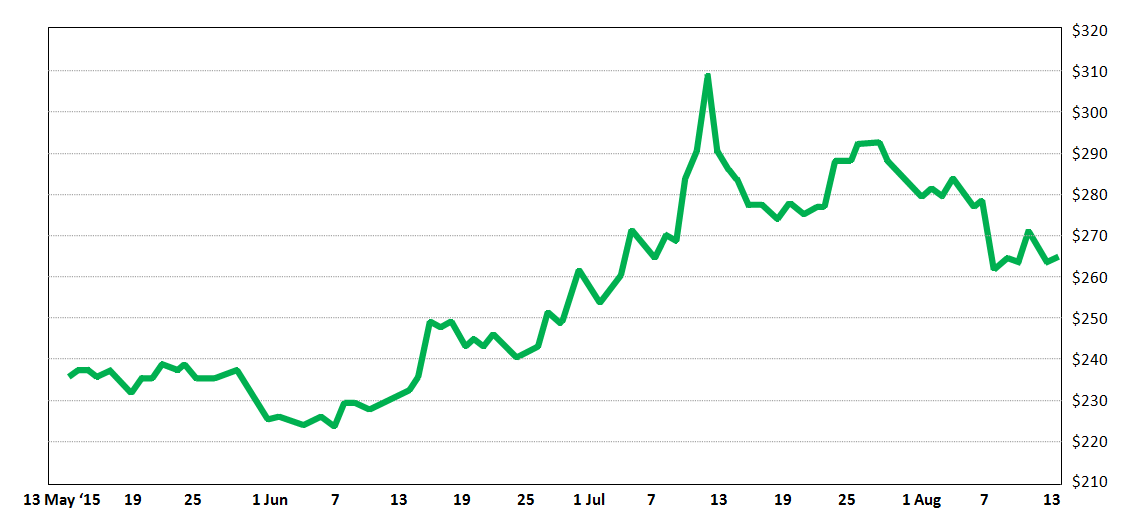

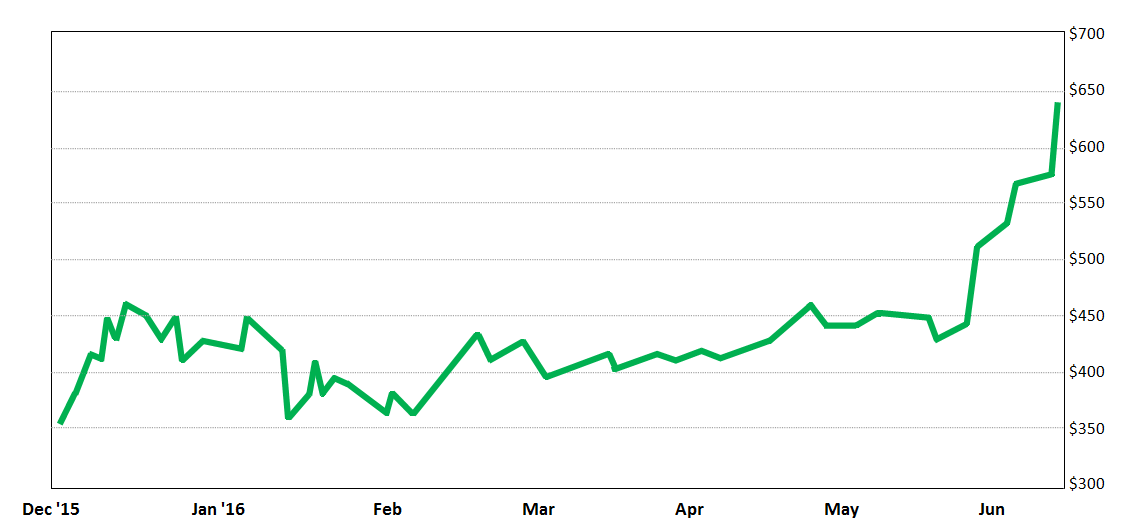

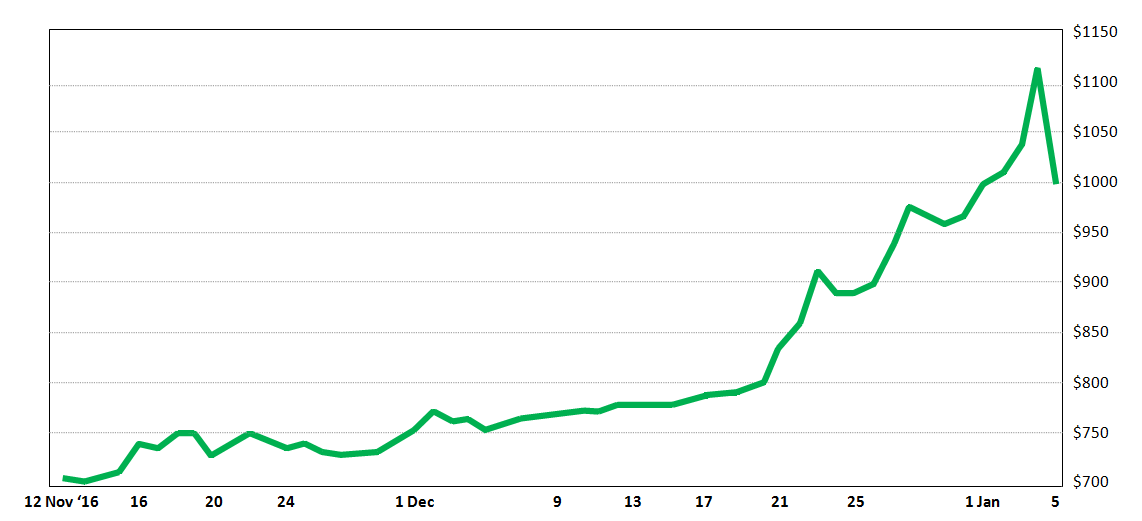

Gold and silver have thousands of years of history as a safe haven that no other asset class can match but Bitcoin is certainly building up an impressive track record for itself. Bitcoin price went up during the 2013 Cyprus Bail-in, the Russian Ruble Crisis of 2014, the 2015 Greek Crisis and the early 2016 imposition of Chinese capital controls.

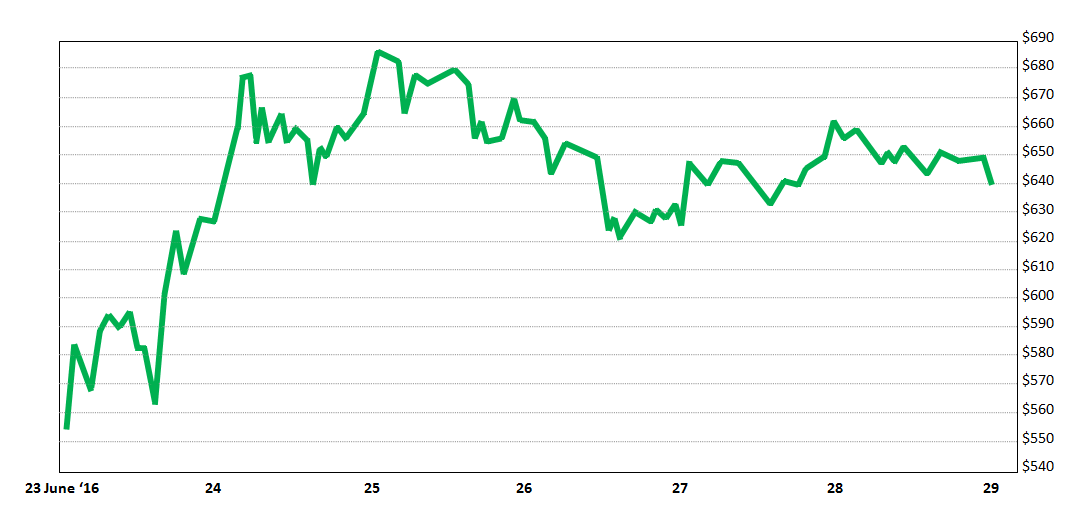

In the summer of 2016, Bitcoin had a similar reaction to Brexit and had an even more pronounced reaction to the Indian bank note demonetization and its resulting chaos.

Bitcoin’s latest crisis-driven run-up was assisted by continued Chinese capital controls and general political uncertainty. This short but consistent performance may not make Bitcoin a bona fide safe haven but it does demonstrate capital flight into crypto during times of economic shock will probably continue.

Chart data obtained from bitcoincharts.com

- Cyprus Bail-in

- Russian Ruble Crisis

- Greek Crisis

- Chinese Capital Controls

- Brexit

- Indian Demonetization

The total cryptocurrency market cap, according to coinmarketcap.com at the time of this publication, is about 34 bln dollars, which is less than one percent of the value of above-ground precious metals. In turn, the value of above ground precious metals is only about two percent of the size of the total world debt market. This is to say that the cryptocurrency market is very small and thus still has plenty of potential for growth.

How about precious metals?

Over the past several years, the owners of gold and silver have seen losses or very little returns from their assets, whereas the owners of cryptocurrency have enjoyed significant gains. Currently, Bitcoin and other cryptocurrencies lack a futures market, which is a favorite tool for manipulation of the precious metals market.

This doesn’t mean that precious metals don’t have their place. There is a lot to be said for an asset with no counterparty risk that you can retain in your possession.

The owners of precious metals who denounce cryptocurrency fear a government crackdown, technical problems or unknown flaws. For these reasons, they refuse to invest in cryptocurrency. There is also likely some stubbornness and/or sour grapes mixed in with their claims.

However, what precious metal owners should realize is that they are at a significant advantage when investing in cryptocurrency, compared to those who don’t own gold and silver. If the value of cryptocurrency is significantly impacted or somehow wiped out by an unforeseen event, that safe-haven demand will flow somewhere.

If the thesis of cryptocurrency being a safe haven was to be called into question, precious metals would likely be the beneficiary. Considering this, precious metals are a natural hedge for many of the concerns and risks pertaining to cryptocurrency.

The impact of regulations

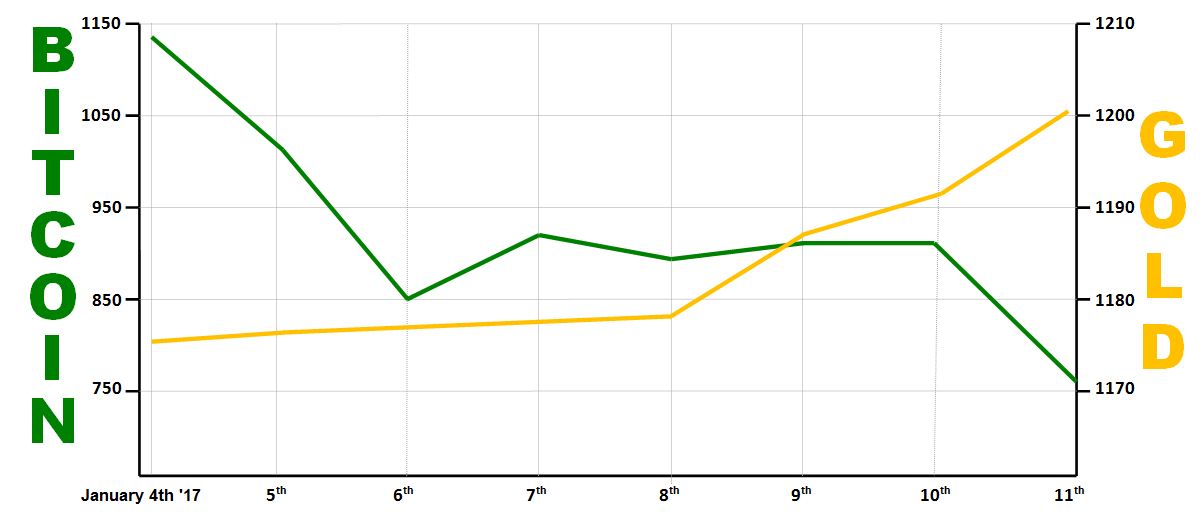

The most recent government reaction that impacted the cryptocurrency market occurred in China when regulators imposed new regulations on cryptocurrency exchanges that resulted in Bitcoin accounts being frozen. As you can see in the chart below, there was a clear negative reaction to Bitcoin price in response to this intervention but also note that the value of gold moved in the opposite direction.

Both precious metals and cryptocurrency will likely benefit from the inherent flaws in our debt-based monetary system, but owning one type of asset shouldn’t deter anyone from investing in the other. Precious metals and cryptocurrencies should be partners in a crisis portfolio: cryptocurrency for its potential for significant gains, and gold and silver, as always, as insurance against unforeseen outcomes.

By The Reset

Disclaimer: The author of this story is not a financial adviser and it should not be considered financial advice. The story is the opinion of the author only, to make investment decisions based only on this information, or any single source on the internet is NOT recommended. The author is long silver, Bitcoin, and Ether.