Ethereum has maintained its upward trend and momentum over the past seven days, recording a staggering $3.7 bln increase in market cap, from $5.7 bln to $9 bln. On May 5, Ethereum price established its new all-time high at $101 as the demand from both traders and institutional investors surged.

There are three major factors that have supported the increase in Ethereum price: widespread adoption in South Korea, satisfactory performance from the Enterprise Ethereum Alliance (EEA) and the emergence of innovative decentralized applications based on the Ethereum network.

South Korea - the largest Ethereum exchange market, major Ripple driver

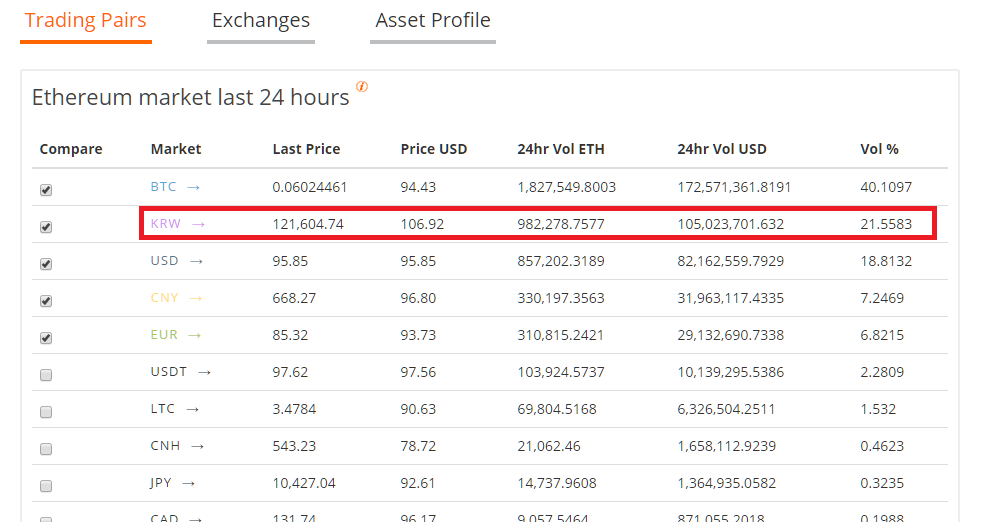

Surpassing the US and China, South Korea officially became the largest Ethereum exchange market with a market share of 21 percent of the global Ethereum exchange market. The South Korean exchange market processes 978,000 Ethers on a daily basis, a volume that is equivalent to $104 mln.

Some of South Korea’s major Bitcoin exchanges including Bithumb, Coinone and Korbit have experienced a massive spike in Ethereum trading volume, due to the Bitcoin scalability problems and exchange hacking attacks within the region.

While it may appear absurd to the global Bitcoin community, many Korbit users told Cointelegraph that users have migrated from Bitcoin to Ethereum due to Bitcoin’s scalability issues and Blockchain congestion. Many users have become impatient with the high transaction fees of Bitcoin, which according to 21 Inc’s Bitcoin Fees average at $0.71.

Also, one of South Korea’s most widely utilized Bitcoin exchange was hacked this past week. Many users that had insignificant knowledge in Bitcoin assumed that Bitcoin’s security measures led to the hack, rather than the Bitcoin exchange’s weak infrastructure and security systems.

Yapizon, the exchange which lost over $5 mln worth of Bitcoins in a security breach, told its users that the stolen funds will be recovered by the issuance of tokens. The Yapizon team wrote:

“Yapizon entered the cryptocurrency industry four years ago and it is expanding services and operations rapidly across the region. From January to March of this year, Yapizon generated over $325,000 in profit and the company projects a total profit of $1.8 mln by the end of 2017. If customers trust in Yapizon and its practices, the company believes it can make up for the losses of all customers relatively soon,” said the Yapizon team.

Growing fees

Bitcoin’s growing fee market, security breaches of major Bitcoin exchanges and the active Ethereum development community and meetups have allowed Ethereum to reach widespread adoption within South Korea.

Speaking to Cointelegraph, local users also stated that Ripple has become a hot commodity in the region because it is currently being supported by South Korea’s largest Bitcoin exchange Korbit. One user told Cointelegraph:

“Many users, traders and investors have begun to invest in Ethereum and Ripple. The Yapizon Bitcoin exchange hack and Bitcoin’s growing fees have all contributed to the growing demand for Ethereum and Ripple in South Korea.”

Ripple recorded a 38 percent increase in price over the past 24 hours. Litecoin has also experienced a 22.9 percent surge in price due to the activation of Segregated Witness.