Analytics provided by BBA

While bitcoin treads water in the mid-$750’s following another bullish week, Ether has been getting some less flattering attention.

Early Friday morning the cryptocurrency based project known as the DAO (“Decentralized Autonomous Organization”) was exploited for about 3.5 million Ethers, equivalent to around $50 million USD via a quirk in the code related to child DAO’s.

The public perception surrounding the event was certainly not good for Ethereum, the DAO, and other smart contract-focused endeavors.

This is just the first big hurdle for this very new technology. There is no doubt that this will negatively affect price and market confidence over the next few months, although it could end up being a good thing over the long term.

Extended correction

Let’s look at the charts to see if they corroborate the theses above.

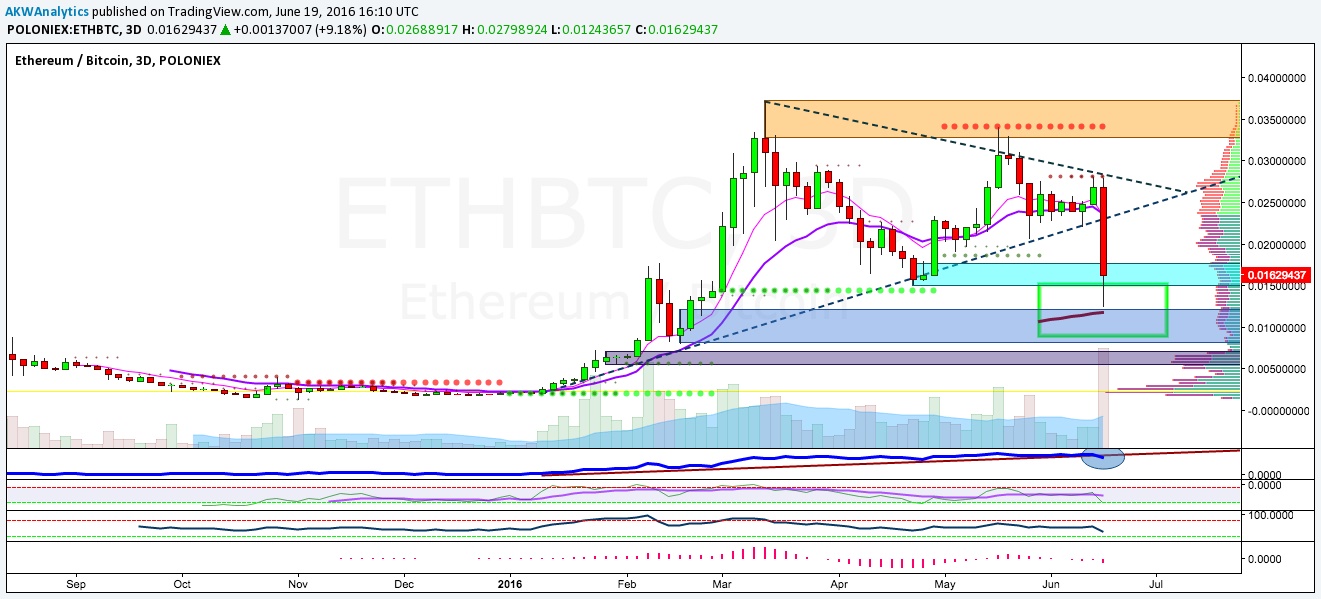

If we look at the 3-day chart, we can see that the prospects for a bull market continuation now look rather grim, at least over the short to medium term, due to the fact that we have a legitimate breakdown from the symmetrical triangle combined with what is now a confirmed double top.

Also notice the large spike in sell volume on the breakdown candle, along with the move below the A/D (Accumulation/Distribution) uptrend line for the first time in history. Both of these indications point to a more extended correction and consolidation.

Additionally, when we look at momentum we see that Willy has broken lower but still has plenty of room to run to the downside, RSI is now well below the centerline, and MACD is just starting to pick up some steam to the downside.

Price is testing pivot

Finally, volume profile remains almost nonexistent down to the ~0.007btc level which leaves a lot of price discovery left to be done. Conversely, it’s all not bad for the bulls seeing as though price has recovered from the local lows and is now testing an intermediate term pivot area.

Said lows were painted right in the middle of the 61.9% to 78.6% OTE (Optimal Trade Entry) buy zone and almost exactly at the 100-period SMA. There are some buyers in that area, but how many remains to be seen.

Despite the overwhelmingly bearish technical picture due to the recent damage to price, we can’t help but think that many Ether holders who wanted to sell on the DAO developments indeed have which means the market should be primed for a decent countertrend bounce. Over the near term we suspect that getting back over 0.025btc is asking for quite a bit, although the 19 – 20 range does not sound so unrealistic.

Generally speaking, the Ether market seems like it has been due for a more substantial pullback for a while and perhaps even a bear market, so now seems to be as good a time as any to get it over with. Be sure to see more forecasts, protrades, and our slack channel at www.bullbearanalytics.com!

BullBear Analytics

BullBear Analytics is the longest standing cryptocurrency forecasters in the market. They started in 2010, doing technical reports in bitcointalk.org, and have evolved into a buzzing community of traders. Adam is BBA’s chief analyst.

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at the BullBear Analytics Disclaimers & Policies page.