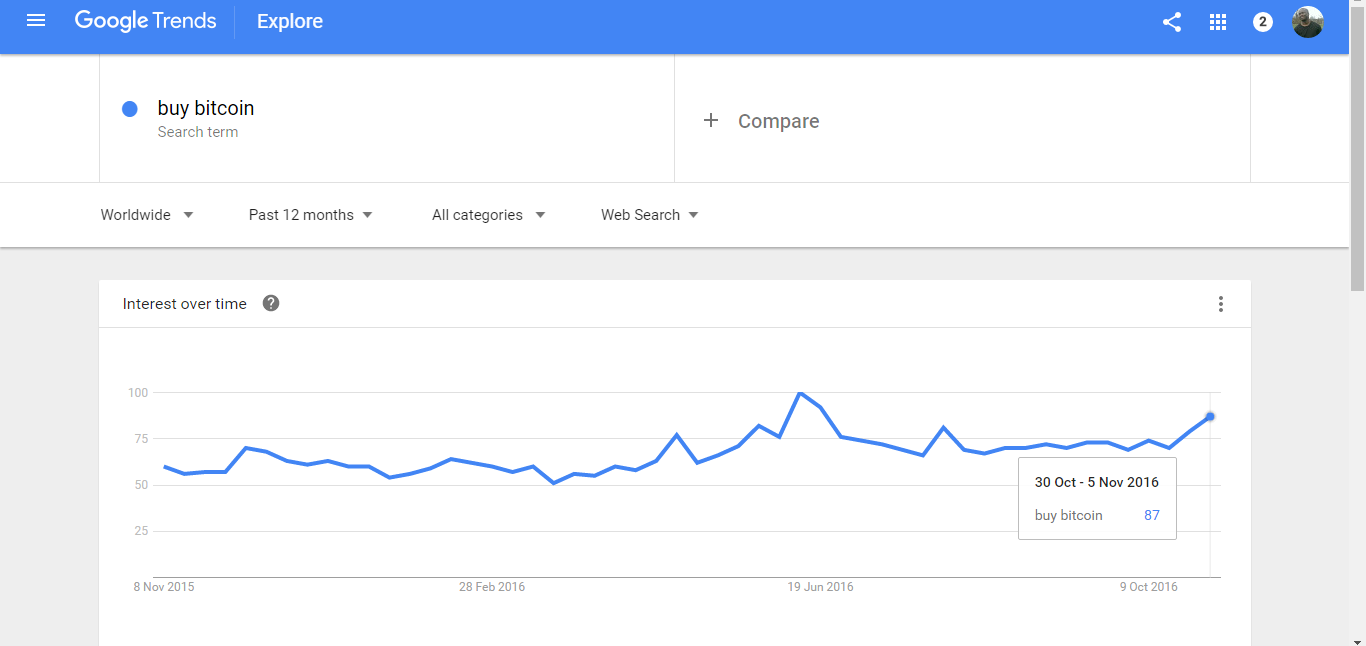

It may be the US election fever or it may be something else, but according to Google, the search for the “buy Bitcoin” term on the world's largest source of information platform is on an upward trend.

Though the particular factors that may be driving the rising interest has not yet been ascertained, Google analytics show that interest over time is currently at 87 - that’s tipping towards its highest point of 100 between June 12-18.

Bitcoin price has reached the $770 mark within the current period. Whether the current ascension, which according to Google kick started in Oct. 22, will continue at such a pace and return to the peak price reached earlier this year, will be determined by one or more of the following factors.

Trump, Clinton, Bitcoin

The outcome of today’s Nov. 8 elections could be a factor. A study by research and analysis firm Juniper in July, speculated that the price of Bitcoin will rise if Republican candidate, Donald Trump, wins as it will create turmoil on the global markets. Every time the polls indicated a rise in popularity for Trump, the market structure changes, however that was not the case for Democrat candidate, Hillary Clinton.

Investors believe a Clinton win is more likely, following the FBI clearance, and could push the S&P 500 index up by as much as 3 percent. In contrast, a Trump win would mean a sell-off of US equities, which analysts say would be more severe than the Brexit vote in June, of which made the S&P 500 dive 5.3 percent in two days.

Continuing Capital Flight in China

Fresh official data shows that China’s foreign reserves plunged $45.7 bln in October from the previous month, to fall to $3.12 trillion. Goldman Sachs says China may have lost as much as $78 bln in September.

The trend is likely to continue as the yuan has, since the end of September, weakened 1.6 percent against the dollar despite Chinese authorities’ tight control over the currency’s trading range.

Release of SegWit

The Executive Director of the Bitcoin Foundation, Llew Claasen, believes the outlook of the top digital currency is even better in the remaining 60 days of 2016, especially post-Nov. 15, after the miner signalling for SegWit innovative scaling technology is released. He touted the release of SegWit in Bitcoin Core 0.13.1 as the much awaited positive development despite continuing disagreement about on-chain scaling.

The Unpredictable

There also remains the unpredictable events that may occur over time. These are common phenomenon in any given market, of which some may be avoided.

For example, the price of Bitcoin reached $745 last week before it slowed to fall below $700 due to several factors, including rumors that China was planning to crack down on Bitcoin capital outflows.

LocalBitcoins CEO Nikolaus Kangas stated that more people should be expected to become interested in Bitcoins whenever there is a price increase. So if there should be a sudden spike in the price of the currency, several new users could join the bandwagon.