Last week was the first down week for bitcoin in awhile, although we can’t say it wasn’t expected considering the technicals had been telegraphing a correction since we broke up through $700. Now price is hovering around that $700 level on what we think are pre-election nerves.

Last week was quite interesting from a price action perspective given that we reached a high of $745 before breaking near term market structure thus allowing the bears to get active. Additionally, rumors swirled about China cracking down on bitcoin capital outflows, a still unconfirmed theory, which combined with a breakdown below support at $700 on volume caused some panic to roll through the market. This led to heavy selling down to a local low around the 670 $ level at which point buyers began to move in to take advantage of the swift and unsustainable drop. Now price is stuck just above $700 as the US is less than 48 hours away from electing one of two very unfavorable candidates. We expect the market to remain relatively stable over these first few days of the new week, however post-election we expect volatility to make a noticeable comeback.

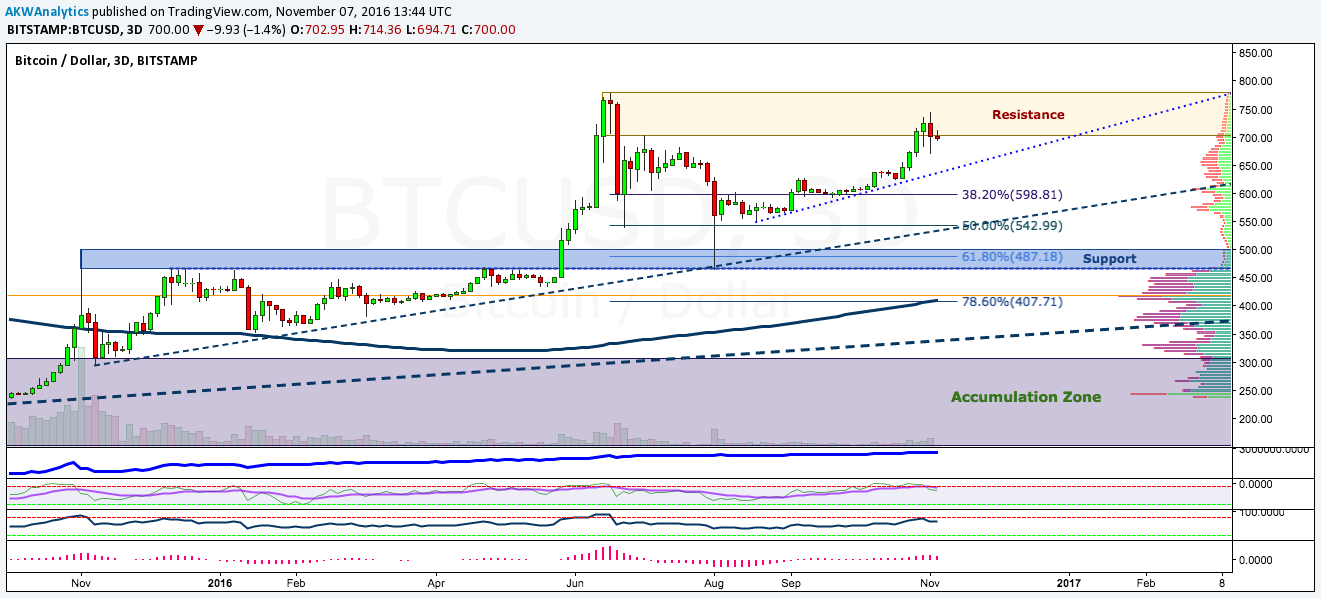

To get a better idea of what could be in store for bitcoin following the election results we turn to the 3-day chart for some context. First, we can see that China rumors weren’t the only trigger to a selloff given price was well within the medium term supply area off of the $780 regional highs from June of this year. Also notice that what we have so far in terms of a consolidation off of those highs appears to be the “Cup” portion of a Cup & Handle formation, typically a bullish continuation pattern. With that in mind, we still need to see a more substantial handle which implies slightly more downside from current levels than we have seen thus far, although given the fundamentals we think that downside is rather limited, relatively speaking.

Moving on, it’s no surprise that Willy and RSI are now slowly coming down out of overbought territory but remain elevated, MACD continues to paint a large bearish divergence, and price remains well above the volume profile value area, as well as the point of control (PoC). On the other hand, the 200-period SMA is now firmly trending higher, the A/D line is still moving steadily to the upside, and all relevant short, medium, and long-term trendlines remain intact. Given the technicals we would not be at all surprised to see another leg to the downside following the US election, perhaps down to test that upper trendline, however we would be buyers of that dip once market structure indicates that the selling has abated.

Generally speaking we are still fairly sanguine on the prospects for higher prices going into the new year, however we are not yet ready to call a breakout above the $780 regional highs imminent. We would love to see the market digest some of the recent rally as gains and losses are consolidated in a range trade over the next few weeks, and will be ready and waiting at the bottom of that range to pick up cheap coins when the time comes.

BullBear Analytics 20% Discount

BullBear Analytics is the longest standing cryptocurrency forecast service in existence. BBA began posting Bitcoin price reports and updates based on technical analysis via Bitcointalk.org back in late 2010 and has evolved into a buzzing community of savvy and professional cryptocurrency traders. Adam Wyatt (@AKWAnalytics) is BBA’s Chief Analyst & Editor.

We are offering a special discount to our Cointelegraph followers so enter ‘FALL2016’ at checkout for a 20 percent discount on all packages! Thanks, and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades Bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at the BullBear Analytics Legal.