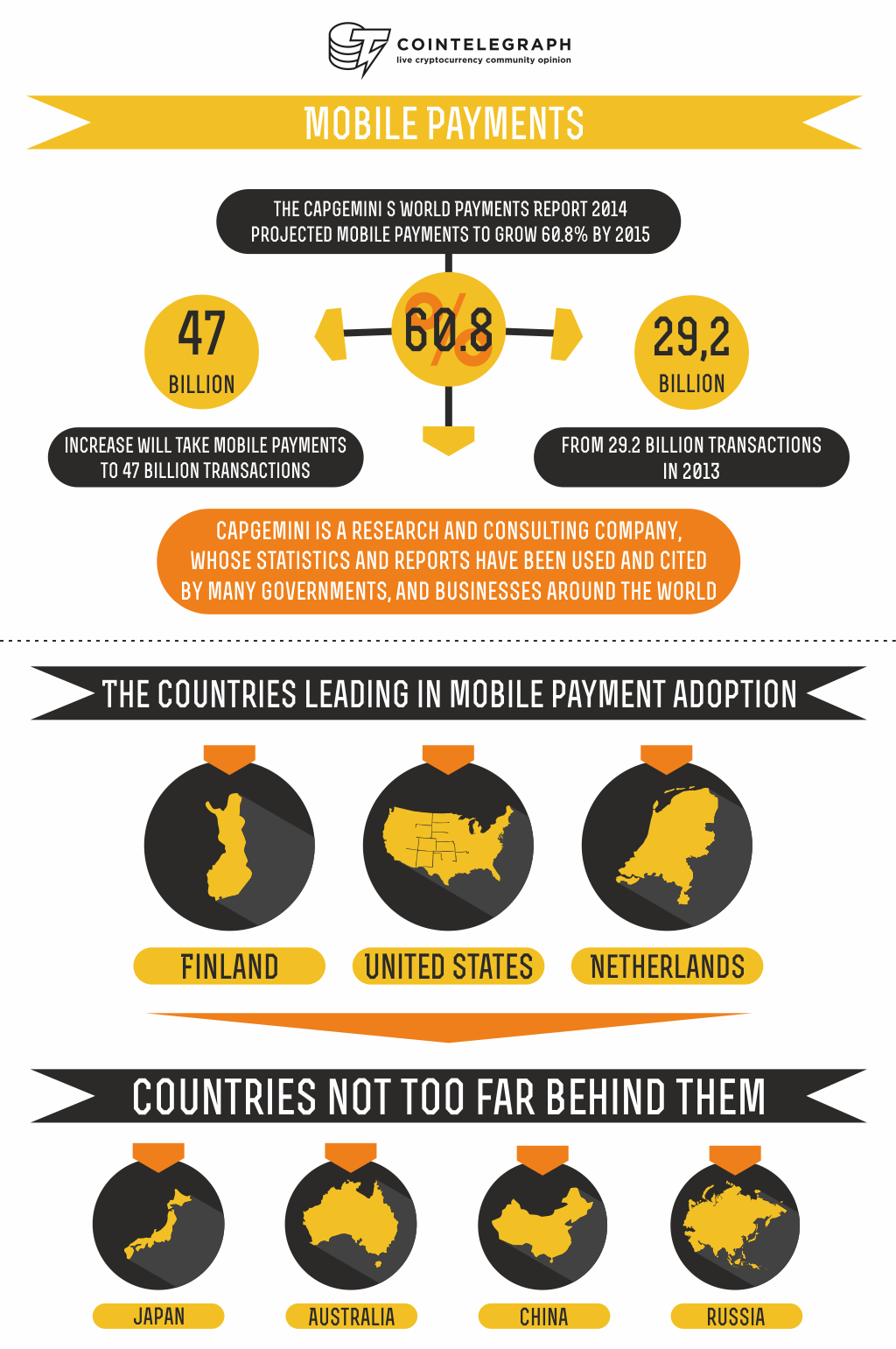

Recently, the Capgemini’s World Payments Report 2014 projected mobile payments to grow 60.8% by 2015.

That 60.8% increase will take mobile payments to 47 billion transactions, from 29.2 billion transactions in 2013. Capgemini is a research and consulting company, whose statistics and reports have been used and cited by many governments, and businesses around the world.

The countries leading in mobile payment adoption are Finland, United States, and the Netherlands. Countries not too far behind them include Japan, Australia, China, and Russia. Australia, for example, is growing at a rapid speed. Phil Gomm, from Capgemini Australia, told CIO Australia:

“We can confidently forecast that Australia will keep pace, or exceed the forecast 2013 growth rate in non-cash transactions of more than 12 per cent for the mature Asia Pac marketplace.”

Non-Banks Increasing Market Share

Non-banks are expected to take a bigger market share, as traditional banks’ market shares decline. This was highlighted in the report which said that bank’s share of non-cash transactions will decline by half by 2015. Nevertheless, the banks’ market share of non-transactions is still huge. Currently, banks processed 25.4 billion transactions in 2014, compared to 3.8 billion transactions by non-banks.

Payment processors like Paypal and BitPay are projected to grow. Paypal has been growing rapidly, processing more than US$27 billion in mobile payments in 2013, around 15 per cent of its total payment volumes.

Bitcoin is not slacking either. The daily transaction volume has nearly doubled over the last year. In 2013, there was an average of 35,000 bitcoin transactions per day, but now that number is growing to 60,000 transactions per day possibly reflecting the effect of merchant adoption.

The report also mentioned that countries, which have a fast growing mobile payments industry and who regulate the crypto-currency in a similar way to Brazil, will cause cryptocurrencies to grow even faster.

Africa’s Mobile Payments

The report also covered Africa’s rapidly growing number of mobile payment transactions. The report illustrates two important trends for cryptocurrencies. Smartphone penetration remains small, but low tech mobile phone penetration is high, and rapidly growing. Bitcoin will need to be accessible to lower tech “dumb phones,” or serviced through a third party if Bitcoin is to be adopted by Africans.

A second point was that Africa’s financial system is highly fragmented. Currencies, regulations, financials tools are all different in the continent's numerous countries. As a result, it is very hard for Africans to do business with each other. Bitcoin’s borderless nature could help Africans pay and get paid while doing business on the continent.

Rapidly Growing Cryptocurrency Payments

2014 has been a great year for the volume of crypto-currency transactions. As the report showed, the number of transactions has almost doubled. There are many reasons why this trend has emerged. Merchant adoption has been picking up the pace in the past year. It is also not just the number of merchants accepting cryptocurrencies that has grown, but huge companies have got on board as well. Dell, Expedia, Dish, and OverStock have all started to accept Bitcoin and have already reported impressive sales in Bitcoin.

Besides that, numerous companies are making it easier to use and accept Bitcoin. Paypal recently made big news by partnering with Coinbase, GoCoin, and Bitpay to integrate Bitcoin into their digital goods platform enabling a vast number of merchants to start accepting Bitcoin. While Paypal doesn’t even process the transactions, they do provide the infrastructure and reputation that fledgling digital currency startups cannot provide.

Paypal’s subsidiary, Braintree, teamed up with Coinbase before Paypal to integrate Bitcoin into their merchant platform. Braintree has opened up Bitcoin to over 35,000 merchants. These two integrations allows an enormous amount of merchants to accept Bitcoin, but more importantly, this is also a different demographic than your average Bitcoiner.

A number of Bitcoin companies are working on making payments and merchant adoption easier. CoinBlesk, a Bitcoin payment company, is looking to make payments more reliable and quicker. The CoinBlesk mobile app allows smartphone users to use two-way NFC. What this means is that only one of the people participating in the BTC transaction needs to have a reliable internet connection.

This allows for people to use Bitcoin in areas that have poor Wi-Fi connections. Making sure there is Wi-Fi is always the biggest pain and worry for Bitcoiners. The app also features an auto accept option, which enables the transaction to go through in under a second. This feature is very important for merchant adoption. The usual 7 minute confirmation time has been a big issue for merchants and now it seems that this problem will be fixed with such solutions.

The report outlines that instant confirmation was demanded by consumers. Though Bitcoin currently takes the longest among mobile payments, other mobile payments systems have been looking to increase their times as well.

Coinbase and Bitpay as well as numerous companies around the world are getting more and more merchants to start accepting Bitcoin. This is by far the most important factor for the future growth of Bitcoin’s transaction volume. People won’t spend Bitcoin if there isn’t anything they could buy with it. The number of merchants these companies have been signing up per month has been increasing, and this trend will likely continue through 2014 and into 2015.

With the aforementioned factors taken into account, the exponentially increasing trend in global mobile payments for 2015 could certainly create a perfect storm scenario as Bitcoin is in a prime position to capitalize and attract many new users to the world of cryptocurrencies. It will be interesting to see whether 2015 be the breakout year for Bitcoin.

Did you enjoy this article? You may also be interested in reading these ones: