When you mentally picture the average Bitcoin user, what image pops into your head? A tech nerd in his mid-20s? A wealthy, opportunistic investor in his 30s? (Probably not) an upper-middle-class college girl majoring in English literature?

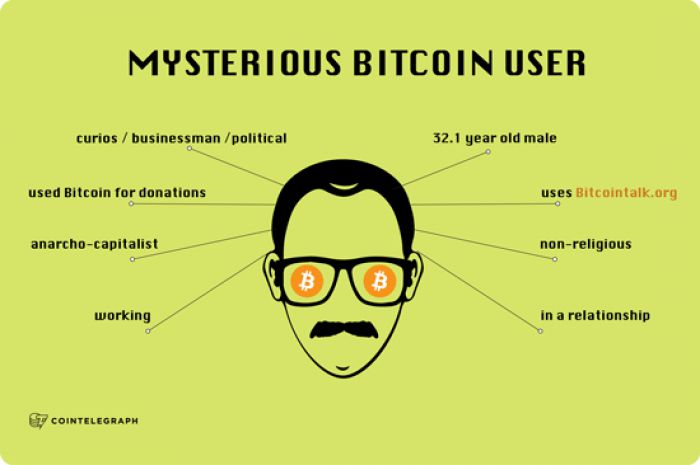

The average Bitcoin user used to be a non-religious male with libertarian/anarcho-capitalist leanings, 31.2 years of age, with a job and a full-time relationship, according to a self-selecting community survey done last year by tech/economics blog Simulacrum.

But that poll didn’t ask about an important – and surprisingly interesting – factor: ethnicity.

When framed this way, you may imagine whites/Caucasians dominating the market, or perhaps beaten out by Asians.

But you may be wrong. A new poll has found the most likely ethnic group to have heard about Bitcoin is (*drumroll*) Hispanic Americans.

When asked how much they had heard about Bitcoin, just 8 % of self-identifying white respondents to the survey by digital media company Morning Consult answered “a lot.” African-American respondents were similarly unfamiliar, with 7% saying they’d heard a lot about the cryptocurrency.

A staggering 21% of Hispanic-Americans , meanwhile, gave this answer, along with 22% of “other” respondents, many of whom are likely Asian.

Hispanic-Americans were by far the ethnic group most likely to say they would consider using Bitcoin themselves: 23% answered they were “very likely,” compared to 9% from African-Americans and “others” and just 5% from whites.

The differences between ethnic groups evened out about the issue of Bitcoin legality, with between 40 (whites) and 52 (Hispanics) percent of all respondents agreeing that the government should allow people to use Bitcoin.

Though it may be presumptuous to draw definitive conclusions from the survey, a clear inference about the results may be that Hispanic-Americans have begun to pick up on Bitcoin’s exciting implication for the remittance market: a low-cost method for diaspora members to send money back home.

Bitcoin-based remittance companies have been exploding especially in Africa, where it’s been estimated that people are losing US$1.8 billion annually to remittance fees.

In the United States (the country where the survey was performed and the largest sender of remittances in the world), however, the top two remittance recipients are Mexico and China.

Immigrants in the US sent US$22.8 billion back to Mexico and US$13.1 billion back to China in 2012, according to the Pew Research Center. Remittance prices average about 9% of the total value transferred (and over 12% of the total value in sub-Saharan Africa) according to the World Bank, making Bitcoin-based remittance services a godsend for immigrants sending money home to support their families.

What do the results imply for the future of Bitcoin use in the States?

People with incomes under US$20,000 a year and over US$100,000 a year are two to three times as likely to have heard a lot about Bitcoin than those with middling incomes, and those in the former group voted themselves the most likely of all income levels to use Bitcoin themselves.

Though the tech-savvy, middle-class white guys and Asians were the ones to get the Bitcoin ball rolling, the future of cryptocurrency expansion lies with the lower-income demographics all too eager (and rightfully so) to work around the fees, paperwork, and bureaucracy of traditional banking.

Did you enjoy this article? You may also be interested in reading these ones:

Do you want to read Cointelegraph from your mobile device? Then go to our Indiegogo campaign, contribute, collect your prize and enjoy the mobile app!