Founded in June 2011, BTC China, now BTCC, is the oldest and second largest chinese Bitcoin mining company. BTCC plays a leading role in every segment of the Bitcoin ecosystem, offering digital currency exchange, mining pool, payment processing, consumer wallets, and blockchain engraving. The diverse products and services BTCC offers allow its customers to engage in all aspects of the digital currency spectrum in one integrated platform.

Headquartered in Shanghai, BTCC serves a global customer base and has become an industry leader for security, risk mitigation, credibility, and technological innovation. BTCC’s mission is to provide the world with the most convenient and trustworthy digital currency services.

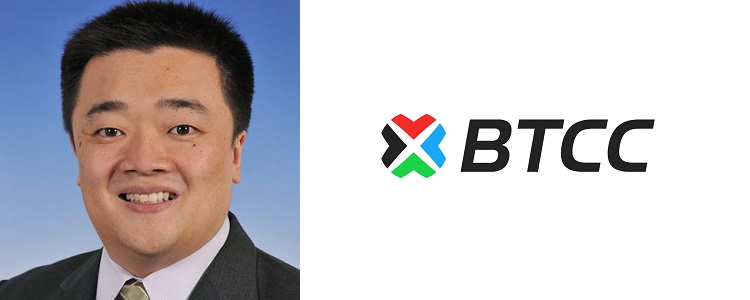

BTCC founder Bobby Lee and his brother, litecoin creator Charlie Lee, are, by all reckoning, among the writers of Bitcoin’s history. As such, they have extensive knowledge in the field of cryptocurrency.

Bobby and Charlie Lee, brothers were born in the Ivory Coast and grew up in the US to parents from Shanghai and were among the first Chinese people to go to Africa in the 1960s. After growing up in Africa, they went to the US for their studies, and after college, they both found jobs working for major IT companies: Charlie worked for Google and Bobby for Yahoo.

Bobby is co-founder and CEO of BTCC, and serves on the board of the Bitcoin Foundation, the most important non-profit organization that works to promote the adoption of bitcoin globally.

We talked with him about BTCC and the future of Bitcoin.

CT: So much water (money) flowed under the bridge since you founded BTC China in 2011. Back then trust in Bitcoin was incomparably lower than now. How much were you confident on the success of Bitcoin when you opened BTC China?

Bobby Lee: When I started BTCC, Bitcoin was practically unknown in China. Only a very small circle of enthusiasts actually knew about Bitcoin, early miners trading it with early adopters. Back in early 2013, in private gatherings with friends, as well as at public events I attend, I would always ask if anyone has heard of Bitcoin, and there would be a long silence, and it was clear no one has ever heard of this Bitcoin thing. Despite the lack of awareness, I was confident in it. I knew it was a matter of time for people to embrace Bitcoin, first by learning more about it, and then eventually believing in it and trusting it.

CT: Does BTCC own any mining hardware?

BL: BTCC does not run any mining rigs, so we are not a bitcoin mining operation. Instead, BTCC operates a mining pool, which is a loose collection of actual bitcoin miners (who own and run the hardware) getting together to pool their resources, and mine together, and share risk and reward. The miners forming BTCC Pool have their hardware distributed all over the world, but right now, the concentration is primarily in China.

CT: Do you plan to expand the mining capacity of the company, or hold for now?

BL: We are always encouraging more miners to come use our mining pool service, as we provide the most reliable mining pool platform, with the highest payouts in the industry, in a riskless fashion because we pay per share, regardless of luck. We differentiate ourselves from our competitors as we are extremely transparent about our hash rates and fees structure, ensuring that our customers will get the most bitcoins from their hashing power, regardless of how much or how little hashing power they have. Please come give BTCC Pool a try!

CT: What do you think will happen to Bitcoin price when the mining reward will be halved from 25 BTC to 12.5 BTC per block? And what will happen to miners? Do you think this will cut miners’ profits? Will we see a sudden drop in the number of nodes on the network?

BL: For me, it will be very exciting when the block reward halving happens next year. It marks another important milestone in Bitcoin’s early adoption by the world, as it will only be the second time the block reward halves. When that happens, and even leading up to it, many people think bitcoin price will shoot up, in anticipation of the slowing down of issuance of Bitcoin. I tend to agree with this, as this would even further remind people and reinforce the idea that Bitcoin supply is truly limited to 21 million. For miners, the lowering of rewards could potentially mean lower income if the price increase does not adequately compensate. This means that some miners would find it no longer profitable to run certain hardware, and will decide to turn off the machines. So overall network hashrate could see a temporary decrease, but it should not affect the number of full nodes on the bitcoin network.

CT: How quickly is mining hardware becoming old? What happens to the old mining hardware?

BL: This is hard to say. Old mining hardware becomes uneconomical to be kept running if the electricity costs exceeds the return in Bitcoins. Usually, the hardware gets scrapped, but many times, it gets sold in the marketplace, to someone else who can run it at locations with cheaper, or even free, electricity. With free electricity, mining hardware can be run indefinitely, so the resource bottleneck becomes real estate, operational overhead, and the amount of free electricity itself.

CT: Bitcoin’s biggest point is decentralization, but under a different point of view it’s also a weakness. In fact, exactly because it’s nobody’s property, nobody spends money to advertise it, and this is one of the reasons why so many people still don’t know about it. True, there’s word of mouth, but it doesn’t achieve as much as a well orchestrated professional marketing campaign, and true, some small company made some investment and pushed Bitcoin adoption with good results, but these are small, local things. It could be done on a much larger scale. But for a larger scale, a larger investment is required. Don’t you think that large companies working in the sector, like yours, should work together to create a marketing campaign? After all, you can be identified as the ones with the biggest interest in an increase of the Bitcoin value, at the moment.

BL: Bitcoin is public, in the sense that it belongs to the people; a gift from Satoshi Nakamoto. We all have an individual choice whether or not to use bitcoin. Bitcoin is great because it is decentralized, and not controlled or marketed by any single company. That is truly a breath of fresh air, just like how the Internet was. For the Internet, many individuals and companies found it valuable, and built businesses and new business models around it, and benefited from it. For Bitcoin, it’s the same. Bitcoin companies are already pushing and promoting it, encouraging users and merchants to adopt it, and I am sure more of this will happen from all Bitcoin companies. Bitcoin Foundation is also very involved in promoting and advocating for Bitcoin globally. In the end, I don’t think we will see much of any generic advertising campaigns for bitcoin. Here is why: the success and worldwide adoption of the Internet did not come from any “Please use the Internet” or “The Internet is great” advertising campaigns. The Internet became successful on its own merits, with a lot of Internet companies providing tremendous value to users.

The same will happen with Bitcoin.