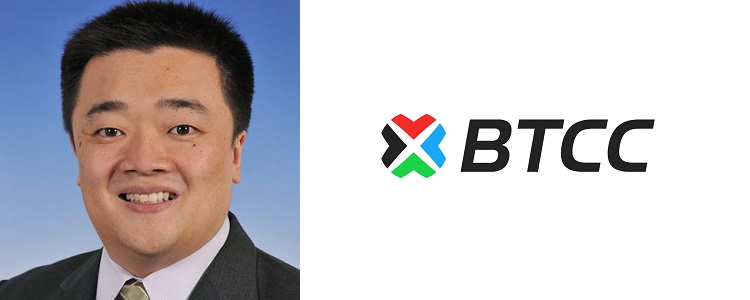

BTCC, one of the longest-running Bitcoin exchanges in China, celebrates its fifth anniversary. Cointelegraph spoke with the company’s CEO Bobby Lee about their current projects and his vision of the company’s future.

Leader in China Bitcoin Ecosystem

BTCC was originally founded in China in 2011. In a period of five years it has succeeded in occupying a leading role in every segment of the Bitcoin ecosystem. Let’s take a quick look at how the steel was tempered.

In 2013, two years after being established, the company raised $5 million in Series A funding from Lightspeed China Partners and Lightspeed Venture Partners, which made BTCC the first among Bitcoin Exchanges to acquire venture capital investment. In April 2014 BTCC introduced the first Bitcoin ATMs in China and a few months later it launched its own Bitcoin mining pool. In April 2016 BTCC announced that the mining pool was to be made available internationally.

Such a rapid expansion has allowed BTCC to become a Bitcoin company with the widest range of services to offer. The diversity of services and products provided by BTCC allows its customers from more than 100 countries to engage in all aspects of the digital currency spectrum in one integrated platform.

Bobby Lee said to Cointelegraph:

“We are proud to have come such a long way. But looking at it today, it seems such a short distance in the larger scale of things. We are also proud to have extended the property from offering exchange services to payment processing, wallet services, mining pool, and Blockchain engraving. We are the first Bitcoin exchange in China and will continue to expand globally, improving our services.”

Launch of Physical Bitcoins

To celebrate its fifth anniversary BTCC introduced a set of physical Bitcoins struck in pure titanium. The reverse side of each Five Bitcoin coin is inscribed with the words ‘FIVE’ in 21 major languages. The inscriptions are bound by a solid round line symbolizing the universality of Bitcoin.

Bobby Lee explained:

“We made the Five Bitcoin coin to honor the trust and support that our customers have shown us over the past five years. We are now the longest-running Bitcoin exchange, and our longevity reflects the unwavering confidence people worldwide place in Bitcoin and cryptocurrencies.”

BTCC’s COO, Samson Mow said:

“The BTCC brand is now synonymous with global excellence in the provision of Bitcoin services. The Five Bitcoin reflects BTCC’s position as the most trustworthy Bitcoin company.”

All Roads Lead to Asia

Discussing the company’s biggest achievements and challenges on the way to success, Cointelegraph was also interested in knowing more about the overall climate within the Bitcoin ecosystem in China. Apparently, the interest in Bitcoin is expanding and even though the acceptance of Bitcoin as a form of payment is still limited, there are numerous possibilities for it in terms of payments, investments and the exploration of other use-cases.

There is an opinion that Asia is by far the best place to set up a business within fintech, including the Bitcoin business. The relative simplicity of getting funding for a project and the friendliness of the regulatory framework certainly accelerates the establishment and development of businesses.

Bobby Lee shared his perspective with Cointelegraph:

“Asia provides a compelling logic point for Bitcoin companies. Obviously, the Bitcoin property is large in Asia, just as it is in the US and Europe. However, European and US regulation is much stricter. Countries like Japan and China have adopted regulation that is more appropriate for the development of Bitcoin businesses.”

Digital Currencies to Replace Cash

The potential for cryptocurrencies is recognized by the authorities. Recently, the governor of The People’s Bank of China, Zhou Xiaochuan, expressed his opinion that digital currencies will inevitably replace cash. But governments will regulate and control any digital currencies which are used as legal tender.

The PBOC has been researching Blockchain technology and digital currencies for quite some time. Besides the aforementioned, it has spent a lot of effort researching other technologies related to digital currencies, such as mobile payments, controllable cloud computing, cryptographic algorithms and secure chips. Through this research the PBOC seeks to optimize the technological framework for digital currency’s issuance and circulation, finding ways to predict and address the risks that may emerge during the circulation of the currency.

Zhou Xiaochuan shares his positive view on wider adoption of digital currencies:

“History shows that currencies evolve as technologies and economies develop. Cash, which is the current version of currency, is low-tech. It is therefore inevitable that cash will be replaced by new products and new technologies that have greater security and lower costs.”

Zhou Xiaochuan is certain that the rapid development of the internet and global payment systems make it necessary to issue and circulate digital currency, and he believes that it would improve financial infrastructure, economic quality and efficiency.

China has the world's largest population and an enormous economy. According to PBOC’s governor, it might take years of co-existing before digital currency will eventually replace cash in China. However, it seems that the country stepped into the future much earlier than a number of other states where the development of digital currencies is hindered. Shouldn’t they learn from China?