In light of users’ complaints over withdrawal delays on Australian Bitcoin exchange Igot, founder Rick Day, responds to clients concerns and sheds light on his exchange's verification process.

Igot, which is closely monitoring for suspicious activities occurring on its exchange, "has stopped over AUD$1.2M worth of frauds in the past 6 months alone by imposing 'manual verification' when an account is flagged," according to Day.

"We’re an exchange and we need to meet our AML and KYC obligations," he stated. These obligations are notably fulfilled by manual verifications of "high risk" profiles, which sometimes require video verification.

Such profile can correspond to a user living in country A, providing identification documents from country B, and requesting a deposit of money from country C, for instance.

In these particular cases, "the verification process cannot be done in a matter of minutes or hours," Day said. "That to us is high risk and we will need to take our time to thoroughly review their documentations and other information provided," he noted.

"Even if you are at Level 2 and the system flags you for whatever reason, we need to make sure we attend to that. We cannot fast track certain compliance requirements at all.

Bank frauds, BPAY frauds, and Bitcoin frauds are way too common for us, or any exchange to ignore. The risk is bigger than the reward. We’re not in this business for fraudulent people to move money anonymously. We require full disclosure from our users."

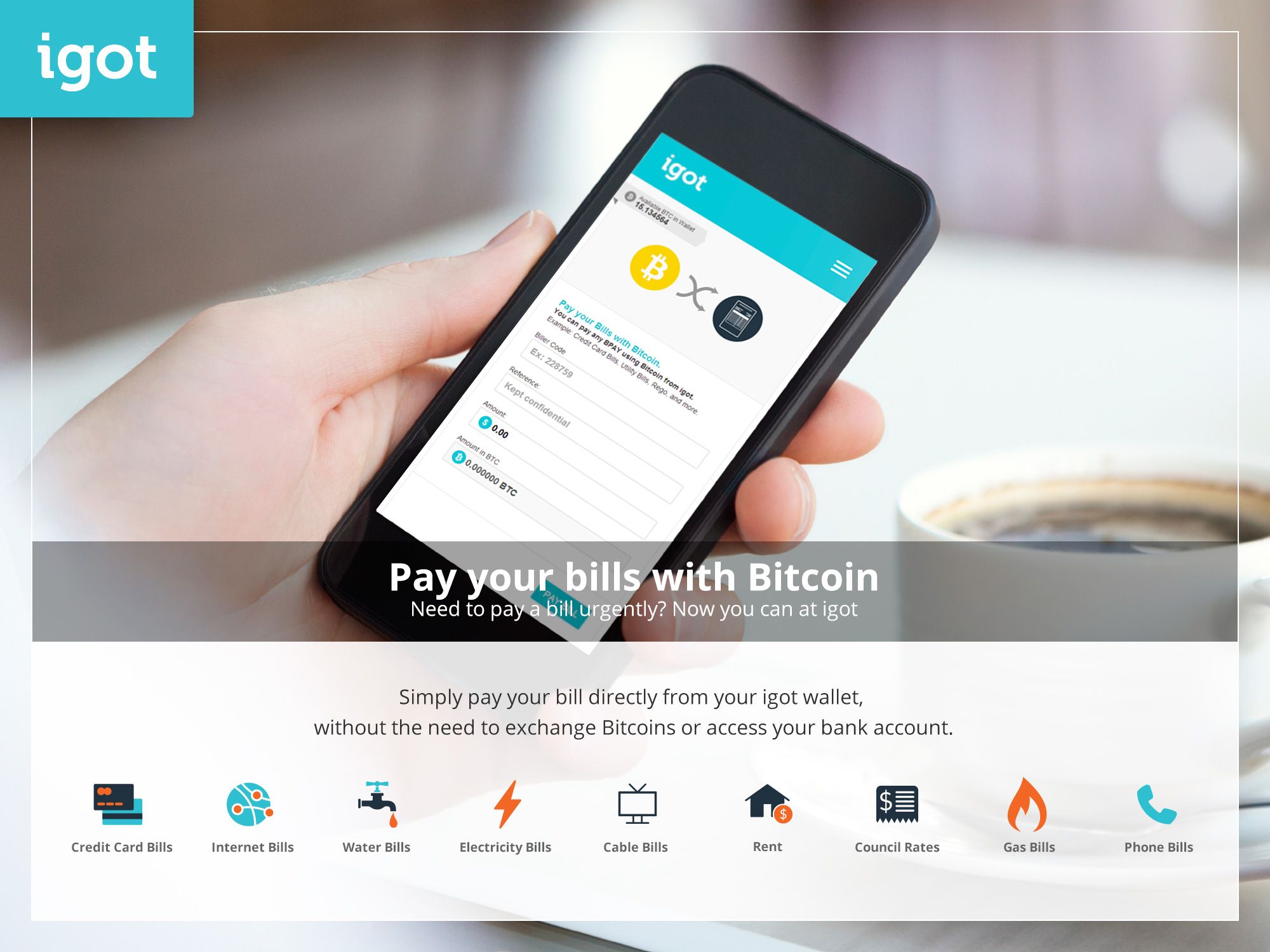

BPAY is Australia's leading electronic bill payment system, which processes approximately 30 million bills each month to the value of AUD$24 billion, as of January 2015.

Igot, which accepts BPAY payments in Australia, noted that the number of frauds using the popular electronic payment system is very high. Day explained:

"BPAY frauds are very high and when a customer is based overseas and sends us a BPAY from an Australian bank, the system automatically flags it for fraud. We conduct video verification (one off) and may require further verification from users.

Unfortunately, people get quite angry about this verification process. Compliance is a very important step and we ask our users not to get impatient."

While Bitcoin has great use case of remittance, Day remained that the digital currency can also be used by criminal activities, and firmly declared he does not want his exchange to be used for such activities. He concluded:

"Moving money should be easy, but only when you meet all the requirements. If we don't do our job at verifying users and country A, B and C, we're basically supporting money laundering. We're not interested in that."

Igot Acquires Kenya's TagPesa

Following its plan on taking over the international remittance market, Igot announced on February 25 that it had acquired Kenyan cryptocurrency exchange and remittance gateway TagPesa, allowing users to cash out directly via M-Pesa's popular mobile payment system.

Day commented on the news in a release:

"Over 2.5 million Kenyan emigrants around the world send money home to their families. Igot aims to make these transactions as easy, fast and convenient as possible.

In 2014, remittance inflows to Kenya increased by US$137 million or (11 percent) to US$1,428.5 billion. The average remittance transaction costs the emigrant sender between 5 percent and 9 percent. With a flat 1 percent transaction fee, we expect to get a lot more traction as Bitcoin becomes more ubiquitous."

With Kenya, Igot is now open for money transfers in 40 countries, including the United Arab Emirates, Egypt, Saudi Arabia, Hong Kong, India, New Zealand, Singapore and Germany.

Did you enjoy this article? You may also be interested in reading these ones: