Cointelegraph has assembled a research report on the regulatory environment for cryptocurrency across the globe. Already in 2015, we have seen many attempts at regulating new forms of digital currencies by various governments and jurisdictions, and we’d like to highlight the general trends and outlook for the readers.

Below is the second half of the report that focuses on business compliance, consumer protection and the general trends for the future.

- Summary

- A visual history of cryptocurrency regulation

- The status of cryptocurrency regulation around the world

- Regulatory compliance for business

- BitLicense: a test case for cryptocurrency regulation

- Cryptocurrency and consumer protection

- Conclusion: a note on regulation and the future

4. Regulatory compliance for business

A lot has been said regarding regulation of money service businesses (MSBs) across international jurisdictions. While often seen as a threat by cryptocurrency community, a substantial part of any legislation is nonetheless involved in security, particularly that of the consumer.

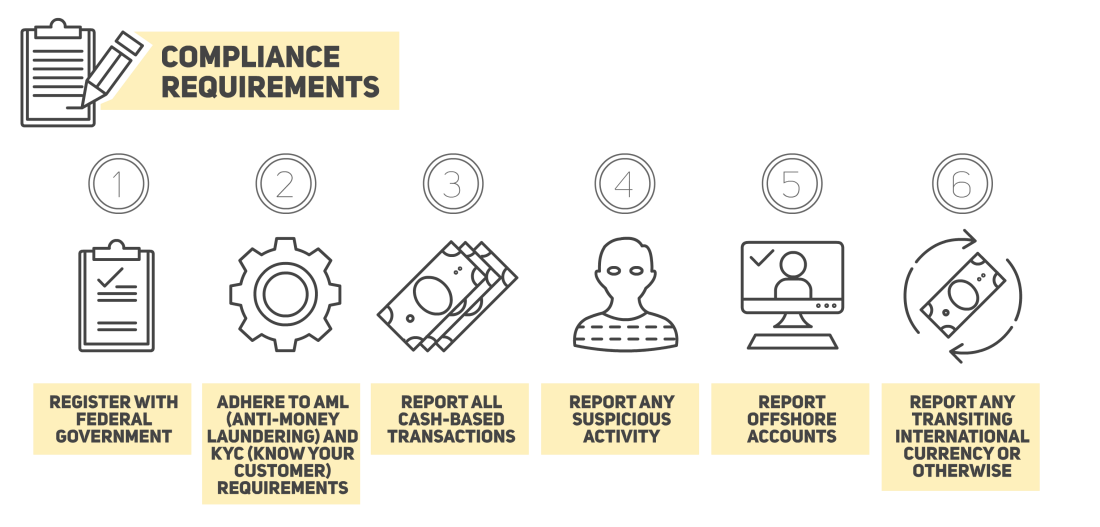

The adopted measures, which involve MSBs and therefore could implicate cryptocurrency, generally target areas such as fraud protection (from rogue companies and organizations), and prevention of criminal activity such as terrorism and money laundering from being financed. These broad practices are adhered to throughout major markets. As we’ve seen, however, the ways in which they affect cryptocurrency industry do vary between states.

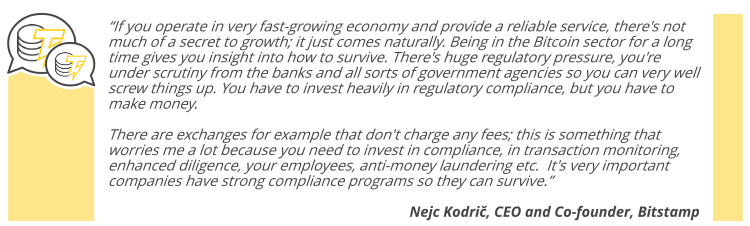

Companies operating in major markets such as exchanges and trading outfits as of 2015 strictly adhere to best practice measures. These either allow them to operate legally within their chosen jurisdictions, or act as ‘future-proofing,’ which will allow them to operate with cryptocurrency in the future if they do not already do so.

In the US, the steps described below have become mandatory for new and existing businesses with regard to regulatory compliance.

Despite divergences, it must be remembered that cryptocurrency-based operators impose new challenges for policy makers, and that teething problems (such as those witnessed through the creation of New York’s BitLicense scheme, for example) are to be seen as a natural stage on the path to suitable regulatory environment.

5. BitLicense: a test case for cryptocurrency regulation

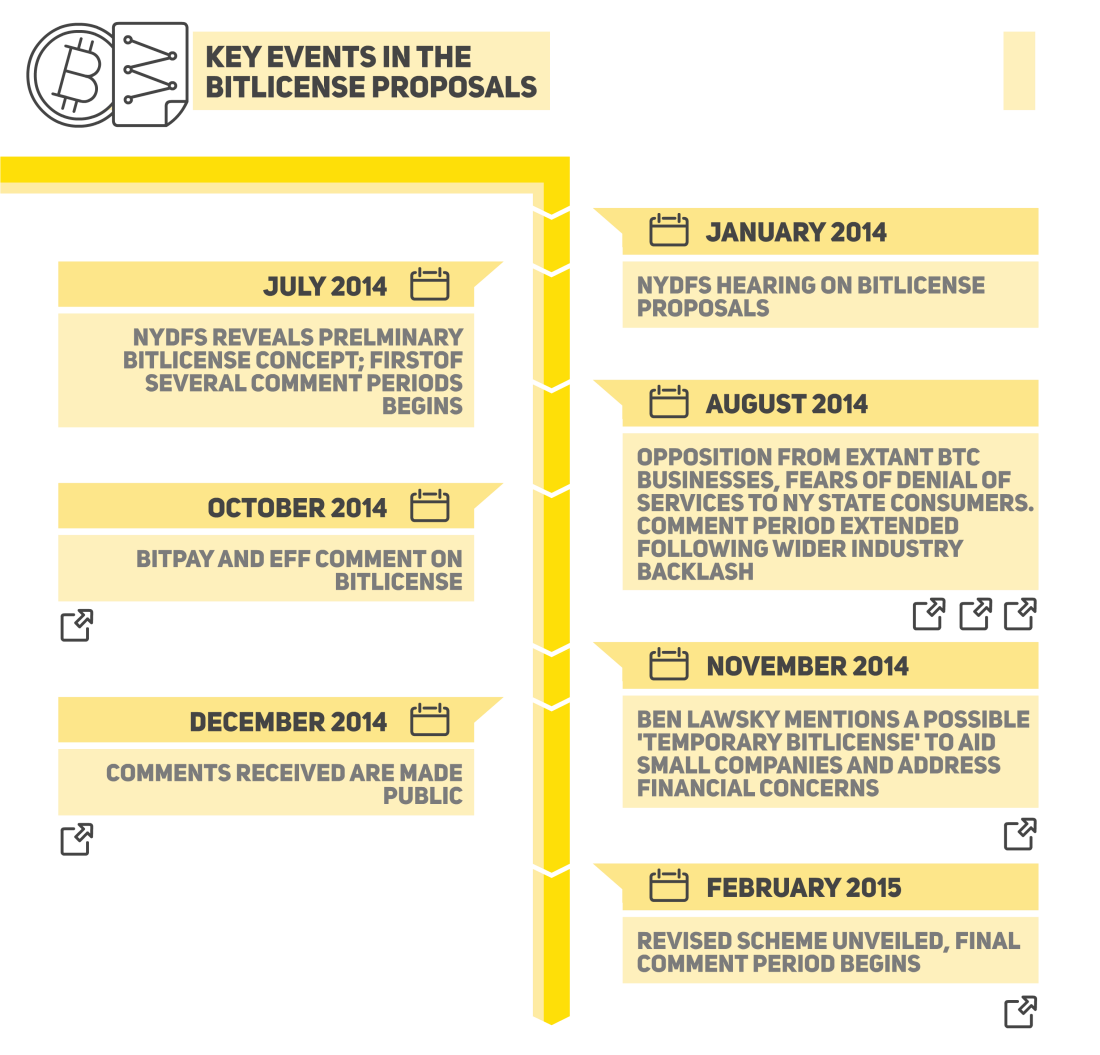

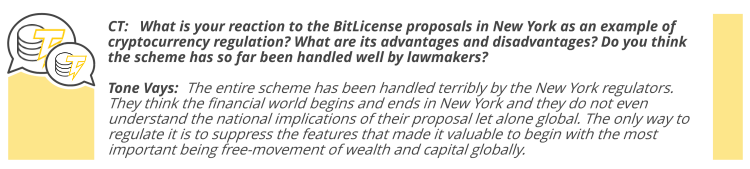

BitLicense is notable in being an advanced ‘test case’ for how regulation of cryptocurrency could progress globally. While having a set of rules focused on one small jurisdiction is disadvantageous, the highs and lows of the development period have provided useful insights to be taken on board by other authorities looking to deal with the issues surrounding lawful business use of cryptocurrency.

BitLicense was created by the New York State Department of Financial Services (NYDFS) and was a major effort of its Chief Superintendent, Benjamin Lawsky. From its inception in late 2013, Lawsky has been the main proponent of the scheme, and accompanied many of its major milestones. Public reaction, particularly from within the cryptocurrency industry, has been notorious, and Lawsky has had to adapt the proposals considerably since the first draft was made available in August 2014.

Below is a timeline of the main events surrounding BitLicense.

6. Cryptocurrency and consumer protection

When considering the issue of consumer protection, what is immediately conspicuous is that the nascent state of the cryptocurrency industry means that it still differs considerably from traditional finance in this respect. Whereas strict rules have governed businesses in the latter sector for decades, cryptocurrency remains an area where there is a major impetus to engage in consumer protection compliance, but little enforcement of it. This results in an uneven environment full of risk to consumers. However, as technology improves and best practice procedures gain popularity, the landscape is quickly changing.

A current standard (as of March 2015) for cryptocurrency businesses is the use of multisignature technology as a way to secure funds and user information. This has been shown to greatly decrease the ease with which assets can be compromised by third parties (and, indeed, internally), but more recently it has been proven not to be entirely effective.

By contrast, other industry operators are proponents of alternative methods such as cold storage, but this comes with its own risks and necessitates placing additional trust on those in charge of assets.

What is the regulator’s role in consumer protection?

As with any area of cryptocurrency, the current climate dictates that regulators attempt to strike a workable balance between suitable protection, which is in line with accepted standards, while allowing room for innovation and experimentation on the part of the cryptocurrency industry.

Similarly, in this area as in others, governments are taking various stances, with some seemingly open to the above approach, and others either presenting extensive, possibly premature guidelines (e.g. New York State) or banning development altogether.

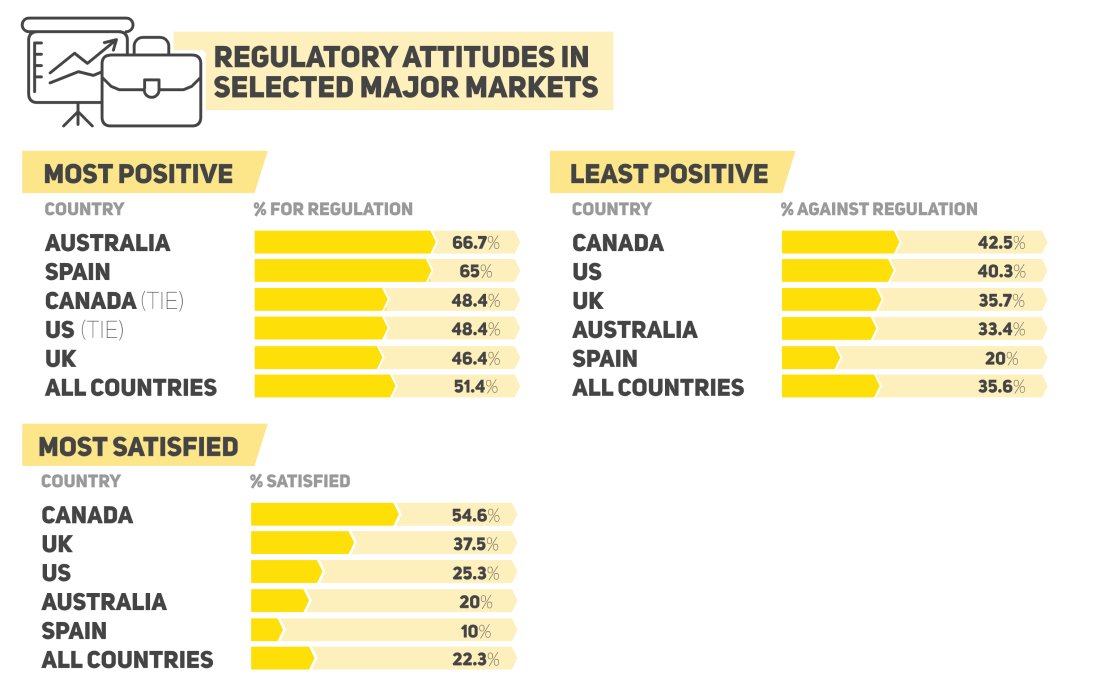

In addition to the attitudes of regulators themselves, it is interesting to consider the consumers’ perspective when gauging an overall impression of public opinion in a certain jurisdiction.

The above infographics display the results of a survey by CoinDesk of consumer attitudes towards regulation in selected major markets.

7. Conclusion: a note on regulation and the future

While the international community is currently in a state of flux regarding cryptocurrency regulation, it is a widely held belief – even a foregone conclusion in 2015 – that regulation is a certainty in the future. It is this belief which has resulted in the many calls for a balanced solution from senior figures within the cryptocurrency sphere.

As has been seen with the BitLicense proposals as a test case for the regulatory process, the need for transparency and ample public consultation is particularly conspicuous. While such an approach can lead to protracted drafting periods and a raft of differing perspectives, as well as feedback which is not always constructive, it is the principal method by which cryptocurrency can make legitimate inroads into mainstream consumer society.

For the moment, however, the rate at which this could occur, as well as the regulators’ role in assisting this, remains inconsistent across the globe. While cryptocurrency is making progress in many countries, it is notable that in those with no formal legislation its practical application is being quickly realized, examples of this being Kenya and Botswana. It is thus notable that cryptocurrency development is currently occurring in two spheres: one with regulation, the other without it. In each case, different sections of society are benefitting from the effects of this new technology.

Sources: Cointelegraph, Blockchain.info, CoinDesk, European Digital Currency and Blockchain Forum, CoinOutlet, Coinmap.org, CoinATMRadar, Bitcoinpulse. All pages accessed 9 – 25 March 2015.

Did you enjoy this article? You may also be interested in reading these ones: