Cointelegraph has assembled a research report on the regulatory environment for cryptocurrency across the globe. Already in 2015, we have seen many attempts at regulating new forms of digital currencies by various governments and jurisdictions, and we’d like to highlight the general trends and outlook for the readers.

The report will be published in two parts, with the first available below relating to the history and the current regulatory status around the world for 2015.

- Summary

- A visual history of cryptocurrency regulation

- The status of cryptocurrency regulation around the world

- Regulatory compliance for business

- BitLicense: a test case for cryptocurrency regulation

- Cryptocurrency and consumer protection

- Conclusion: a note on regulation and the future

1. Summary

Bitcoin and cryptocurrency have experienced a rapid evolution of public image over the past three years. From occupying an obscure niche in technology-oriented circles to becoming a major feature of global financial debate, their rise has in many ways been unprecedented.

This rapid transformation has resulted in, and in turn been precipitated by, an explosion in associated socioeconomic activity. Businesses with countless focuses have appeared in order to profit from and innovative on the potential held by Bitcoin and its associated blockchain technology. In fact, an entire ecosystem has taken root, which can be found in the majority of the world’s jurisdictions that has collectively come to be known as the cryptocurrency community.

The practical implementation of cryptocurrency to the point where a certain number of members of this community, as well as lay consumers are using it to transact, has placed it firmly on the radar of international lawmakers. While this in itself is hardly a surprising development, the methods in which jurisdictions are treating cryptocurrency, as well as their overall perspective and degree of permissiveness, vary considerably. In many countries, there are still no clear rules dealing with cryptocurrency at all.

This variability is not simply a reflection of the political situation in respective states; rather, it is seen as a consequence of the challenging nature of cryptocurrency itself. Blockchain technology and the many ways in which it manifests itself in practice create a complex new area for legislators, and the difficulty of regulating cryptocurrency is conspicuous in the fact that, for example, no jurisdiction has so far managed to produce an entirely effective solution.

The challenges presented by cryptocurrency have furthermore been linked by skeptics, sometimes arguably excessively, to illicit activity. A popular belief in March 2015 is that cryptocurrency more easily facilitates achieving of illicit goals by criminals and other bad actors, and even that cryptocurrency by its very nature is somehow bound to heighten criminal activity. While it cannot be said that this is a definitive factor in deciding how policy makers legislate, it is certainly a common argument put forward in government literature on cryptocurrency, as any scan of news resources will confirm.

It is safe to suggest that in considering the concept of effective regulation of cryptocurrency, lawmakers must take into consideration a wealth of factors concerning both consumers and businesses.

The report below considers a number of these factors and provides some background information for perspective on the issue, as well as more in-depth opinion from a range of experts in the field. Long-time Cointelegraph collaborator Tone Vays also offers his contribution on several important topics, which can be found in the respective sections.

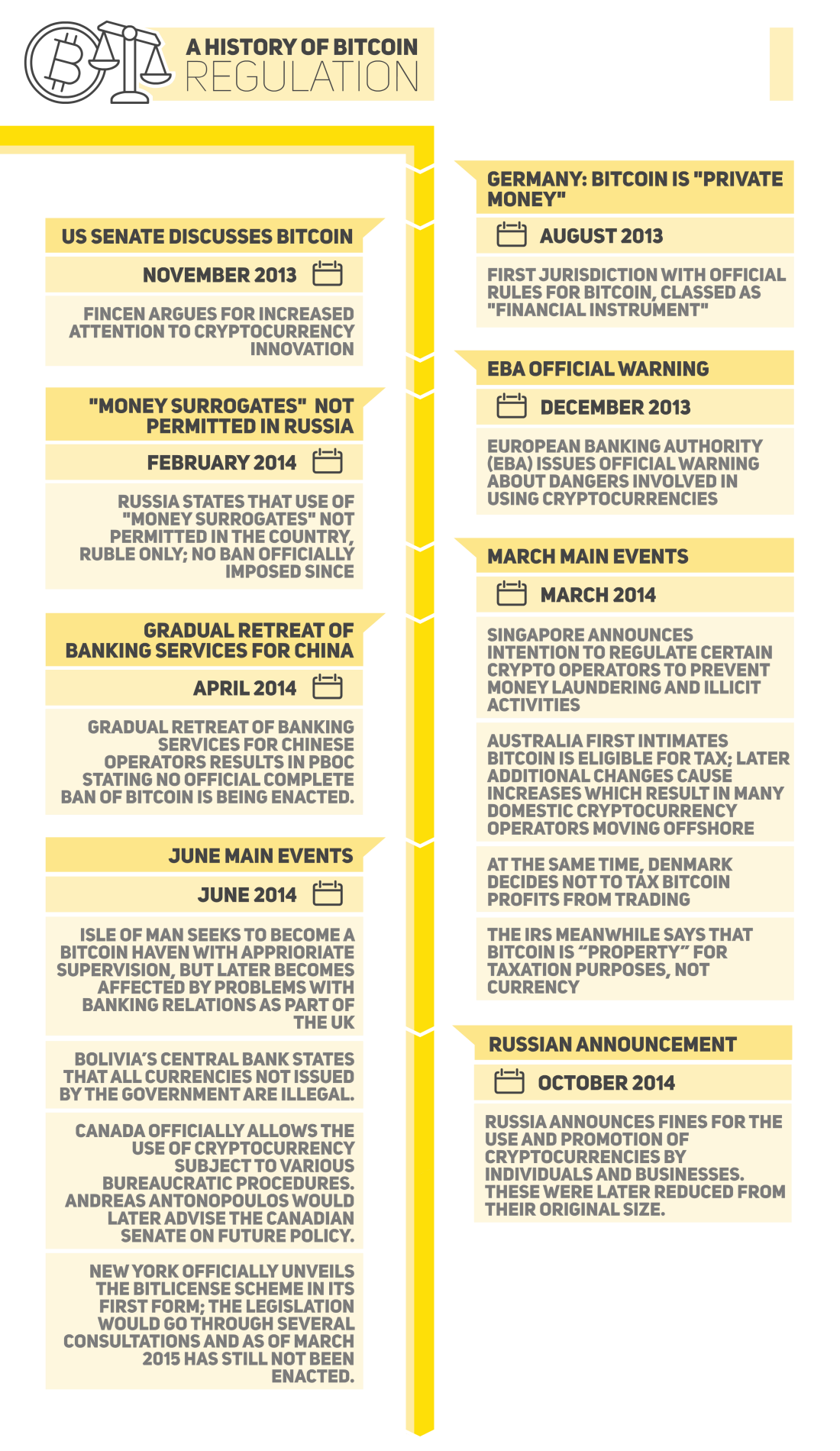

2. A visual history of cryptocurrency regulation

The infographic below gives a brief outline of the major events to have occurred within the sphere of cryptocurrency regulation internationally, from the first noteworthy incident in Germany in August 2013 to Russia’s announcement of penalties for the use of ‘money surrogates’ in October 2014.

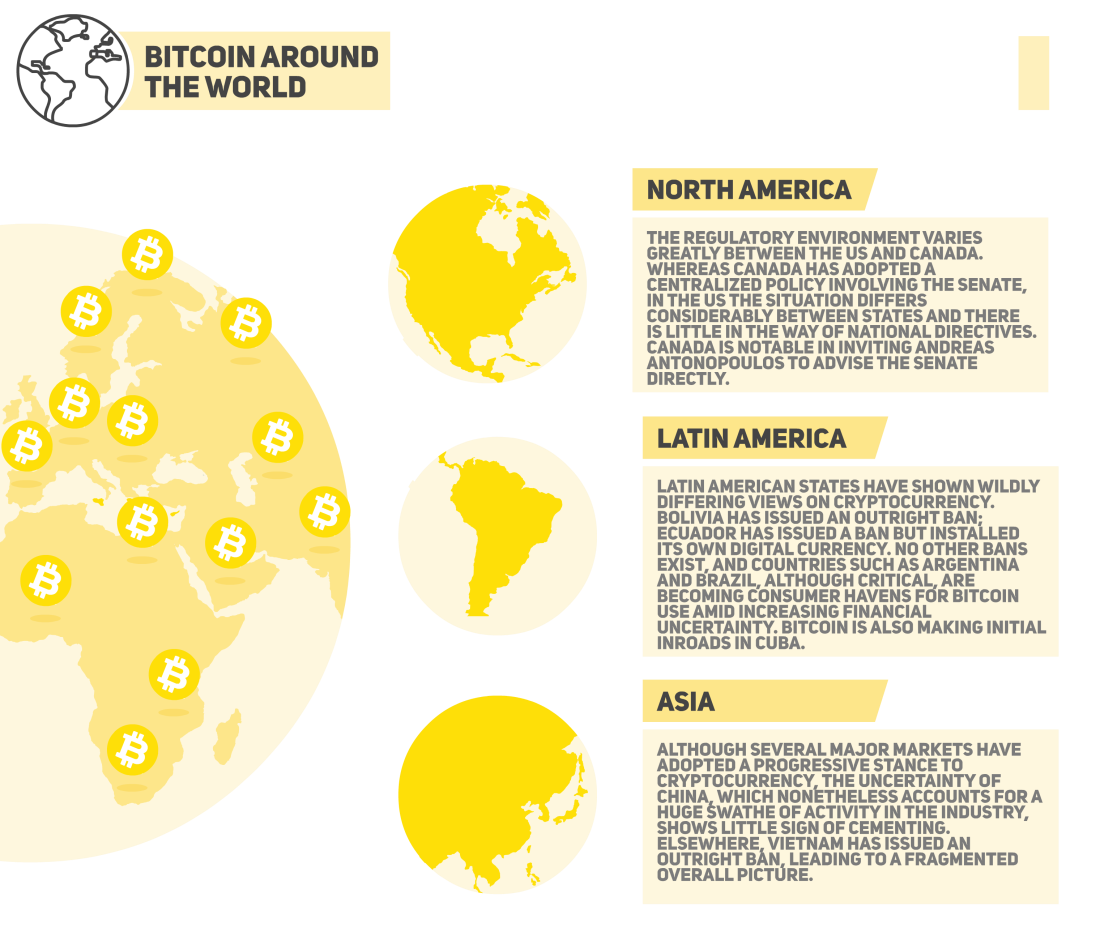

3. The status of cryptocurrency regulation around the world

The main objective seemingly desired by both regulators and the cryptocurrency community with regard to regulation is to strike an effective balance. This ‘balance’ more specifically consists of allowing for essential mechanisms related to areas such as tax and consumer protection to be applied to cryptocurrencies, while at the same time allowing for innovation within the community to continue unimpeded.

As of March 2015, it is immediately apparent from consulting any relevant analytical material that this balance has not been achieved in any major jurisdiction, and far less so internationally. The infographic below gives an outline of current regulatory practices across the world.

For more detailed information on specific areas, refer to the expert comments included following the infographic. Included are statements relating to positive, negative and contested jurisdictions to give an overall impression of the challenges facing cryptocurrency in each scenario.

Sources: Cointelegraph, Blockchain.info, CoinDesk, European Digital Currency and Blockchain Forum, CoinOutlet, Coinmap.org, CoinATMRadar, Bitcoinpulse. All pages accessed 9 – 25 March 2015.

Did you enjoy this article? You may also be interested in reading these ones: