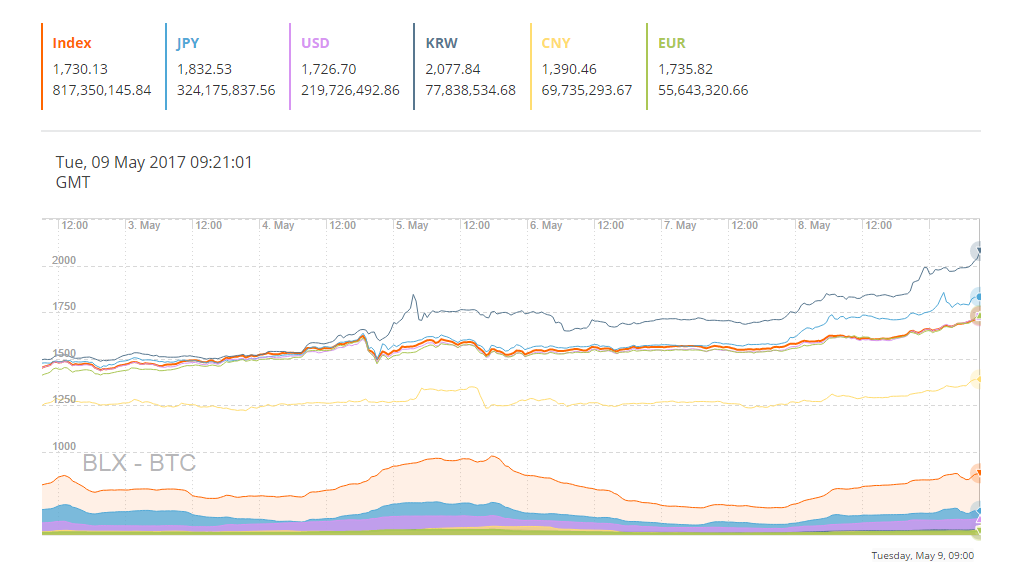

Bitcoin price has established its new all-time high at $1,733, after demonstrating a five percent increase in value in 24 hours. As it did throughout the past month, the Japanese exchange market led the recent price surge, processing trades at an average Bitcoin price of $1,800.

Japan, Korea growing importance

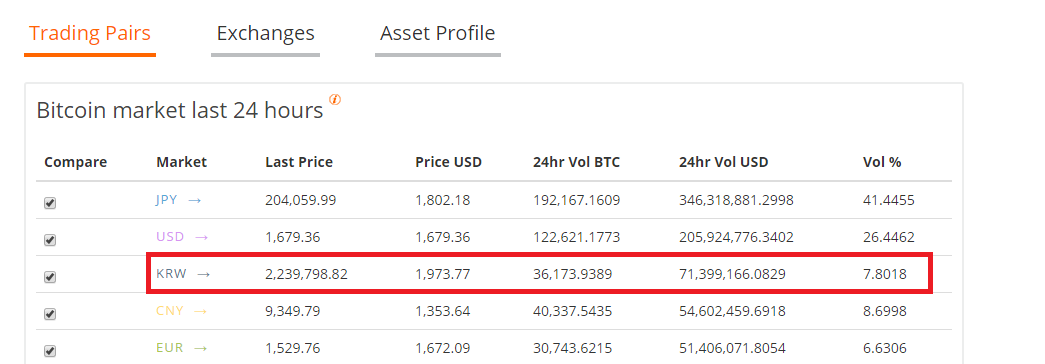

The Japanese Bitcoin exchange market currently accounts for 41.8 percent of the global Bitcoin exchange market share, as the largest Bitcoin exchange market in the world.

The South Korean market falls behind the US, with around eight percent of the global Bitcoin exchange market share. The two markets, Japan and South Korea, demonstrate 50 percent of the global Bitcoin exchange market.

The recent surge in Bitcoin price can be attributed to the explosive growth of the two above mentioned markets. Coincidentally, the two markets have always demonstrated higher demand from investors and traders toward Bitcoin, often listing Bitcoin price that is significantly higher than that of other markets such as the US and China in particular.

Currently, Bitcoin is being traded in Japan at around $1,800. Considering that the Japanese Bitcoin exchange market accounts for nearly half of all Bitcoin trades, it can be said that the high Bitcoin price of the Japanese market is being reflected in the global average Bitcoin price.

The South Korean exchange is also facilitating Bitcoin trades at an incredibly high premium of $1,970, demonstrating a staggering 15 percent premium over the US market, the second largest Bitcoin exchange market in the world, and around nine percent over the Japanese market.

Bitcoin undervalued?

A strong case can be made in regard to the under-valuation of Bitcoin price. The demand for Bitcoin in the regulated Chinese Bitcoin exchange market has substantially decreased over the past few months due to the government and the People’s Bank of China’s implementation of strict and impractical Know Your Customer (KYC) and Anti-Money Laundering (AML) policies.

Local news sources including cnLedger revealed that to utilize Chinese Bitcoin exchanges such as Huobi and OKCoin, users need to submit bank documents, conduct a face-to-face interview and other necessary documents for proof of identity.

Rather than going through such difficult processes to trade Bitcoin, the Chinese market has moved on to over-the-counter (OTC) markets such as LocalBitcoins, which the Chinese government tried to avoid all along. Currently, Bitcoin is being traded in the Chinese market for as little as $1,350 on regulated exchanges, a price that is nearly 30 percent lower than that of the Japanese market.

Will Bitcoin price reach $4,000 soon?

High-profile and institutional investors including Daniel Masters, director at Global Advisors Bitcoin Investment Fund (GABI), believe that Bitcoin price can enter the $4,000 region relatively soon, within 8 to 14 months. In an interview with CNBC, Masters stated:

"That example of a successful soft fork in litecoin has made people start to think that we could get a successful SegWit implementation in bitcoin and that could increase capacity and move us to the next level. In the 8- to 14-month horizon, my forecast would be around $4,000.”

The explosive growth of the Japanese and South Korean Bitcoin exchange markets have acted as the two major driving factors of Bitcoin price as of late. However, it is undeniable that the optimism around Segregated Witness (SegWit) is contributing to the upward trend of Bitcoin. Investors like Masters believe that once a scaling solution such as SegWit is activated on Bitcoin, the price will surge.