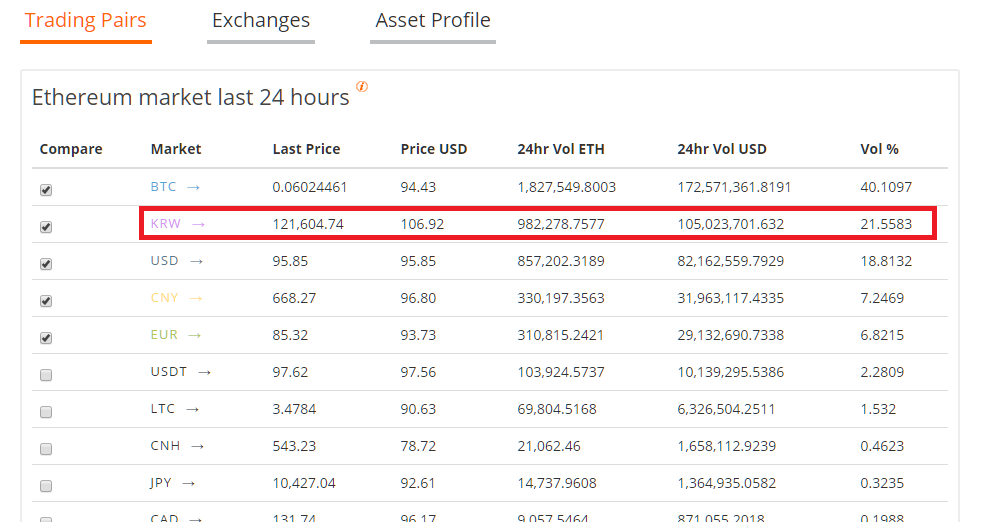

In an Ethereum price analysis published on May 2, Cointelegraph revealed that South Korea officially became the largest Ethereum exchange market in the world, taking over China and the US for the first time.

The South Korean market’s $105 mln daily trading volume triggered the interests of both institutional investors and casual traders worldwide.

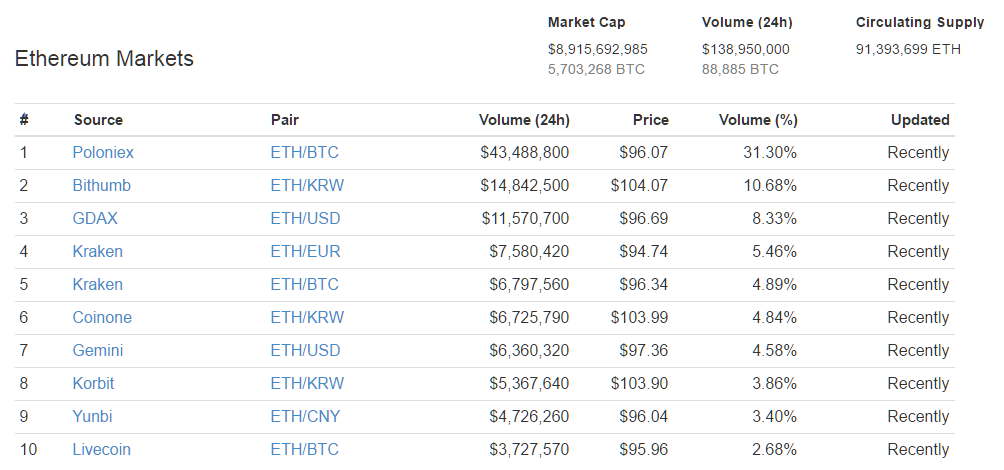

Five days later, South Korea’s largest digital currency exchange Bithumb maintains its position as the largest Ethereum-to-fiat exchange within the global market, with a $14 mln daily trading volume and 10.7 percent market share. Bithumb’s trading volume is even larger than that of Coinbase’s digital currency exchange GDAX, which falls short at $11.57 mln.

Why demand towards Ethereum is on the rise in South Korea

At this current stage of Ethereum development and the ecosystem of Ethereum within South Korea, the move from Bitcoin to Ethereum and other altcoins seems to be a strategy of local investors to profit from the explosive growth of altcoins in general.

Other alternative cryptocurrencies such as Litecoin and Ripple have also gained a significant amount of support from South Korea’s local communities.

The majority of support is being allocated to the Ethereum market due to the exponential increase in Ethereum price in the past few months and the interest of major corporations such as Sony in the Ethereum network.

Since January of this year, Ethereum’s market cap increased from around $700 mln to $9 bln. That is nearly a 13x growth in a five-month period. Because investors were already looking for alternative cryptocurrencies to invest in other than Bitcoin and Ethereum price was on the rise, most of the attention shifted to Ethereum.

During that phase, the announcement of multi-billion dollar conglomerates such as Sony in regard to Ethereum development further triggered the interest of local investors in Ethereum.

A member of an online Ethereum community wrote:

“I've just attended a panel discussing fraud and in the game industry. When asked about future developments, Sony's fraud specialist specifically mentioned Ethereum. Speaking to her afterwards, she was quite knowledgeable about smart contracts and it appears ethereum is very much on their radar. It came up in a discussion regarding fraud so will be part of their research.”

But he added:

“It's likely much too early for a project. Platform holders are very resistant to this kind of change.”

While Sony’s statement on Ethereum wasn’t considered to be a major driver of price in the global market, within the South Korean market, it was a big factor.

Enterprise Ethereum Alliance

It further convinced investors and justified the value of Ethereum. More to that, as more conglomerates including Microsoft and JPMorgan joined the Enterprise Ethereum Alliance, the demand toward Ethereum increased significantly in the South Korean market.

As a result, Ethereum meetups and conferences have become increasingly popular in South Korea. Communities have started to discuss the potential of decentralized applications and Blockchain-based innovation.