Note from the Author: Next week’s Analysis might be late or missing as I will be a speaker at the Anarchapulco event. Follow me (@Tone_LLT) for more timely updates throughout the week on price developments, latest charts and overall Bitcoin news commentary.

Last Week’s Review

Last Week we concluded with the following:

The move out of the Symmetric triangle was pretty strong, and the panic selling there after might have been due to the bad news of a few exchanges having major issues. The expectation going forward is still pretty bullish and once we can spend a significant amount of time above US$240 there is a very good chance we will see new highs for the month and give the yearly high of US$315 a run for the money.

Two additional scenarios in order of higher probabilities:

Bearish: Since the primary case is pretty bullish, here is what to watch out for. Our first real support is the dreaded US$223 Fibonacci line which we do not want to see breached (hourly charts). Under it is the monthly low at US$210. If we were to drop below that all that’s left is US$200 as a psychological round number and that’s it. Panic can set in and it’s clear sailing down to US$100, which no one wants to see. Not even those of us that might profit from shorting bitcoins cause in the end you just end up with more bitcoins, which may or may not be worth anything if the price keeps going down.

Bullish: The continuation of the bullish case looks like this. First hurdle is getting back above US$240 and staying there, then taking another shot at US$260 and US$315, which we are expecting to happen within the next few weeks at the moment. After that look for resistance at US$340 and US$400.

This has been the hardest week up to this point to highlight anything mentioned in last week’s conclusion. The reason for that is obvious, as Bitcoin has done absolutely nothing. Every time we moved above US$240 and it looked like it was ready to blast off into new yearly highs, the price pulled back down. The good news is that every time it pulled back, including the most recent one 24hrs ago, it managed to make a slightly higher low. Of course, we would rather not see these scares where an exchange like Bitfinex gets hit with a 10,000 bitcoin sell order in one hour, but as traders there is not much we can do if we choose to trade the freest market left in the world. There are always bigger fish trading, and one of these days those that have been profiting from market dips will get crushed.

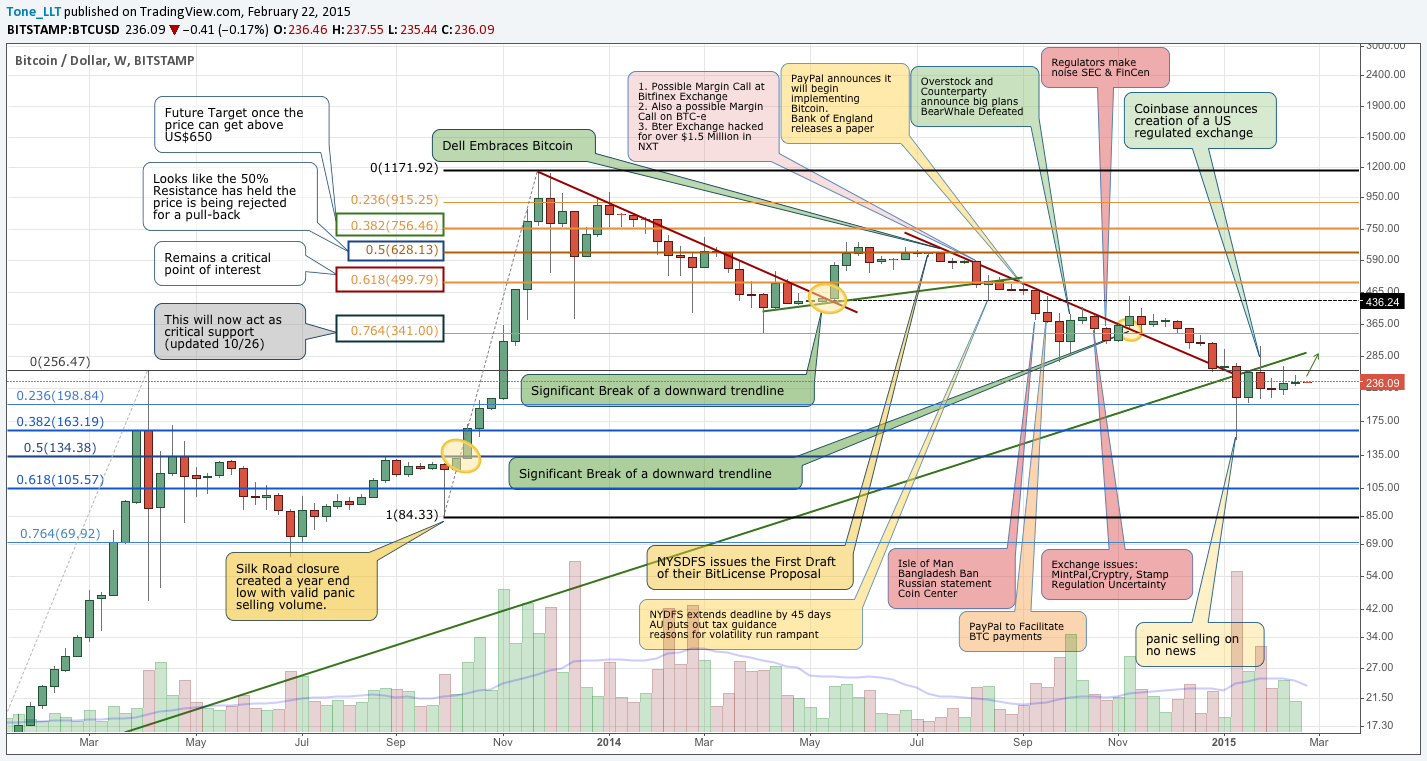

For now we start as usual by looking at the big weekly picture.

The long-term view has not changed at all. The best bullish sign that we can draw is that in the last 5 weeks the intraweek low has been higher each time. We are still sitting lower than the US$266 high from April 2013 so for those that happened to buy at the top of that bubble are now in the red almost two years later. That is actually quite unbelievable given how much the Bitcoin ecosystem has evolved over the past two years. Looking at this chart, we are not in danger of any significant support breaches as long as we stay above the US$200 mark.

Fundamentals & News

As usual we present 3 good roundups for those too busy to keep up with it all:

Cointelegraph Weekly Roundup by Armand Tanzarian

Bitcoin News Roundup by Bitsmith on TheCoinsman

Weekly News Roundup by Brave New Coin

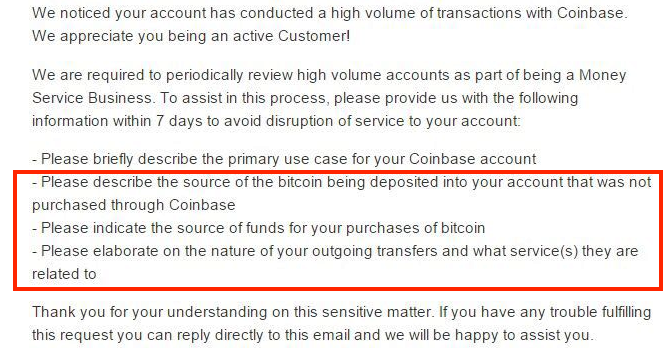

There is a lot of news to cover, though none of it was all that critical. As what is about to become a weekly theme (though it can certainly be done daily), we have to start with the immoral and unethical practices of Coinbase when it comes to human privacy. Since this analyst would never actually use Coinbase and is proud of convincing many people by now to using wallets like Airbitz and Mycelium, the following screenshot was provided by an acquaintance:

The first question can be justified as reasonable, while the rest however can only be argued as such by those who believe the IRS, NSA, CIA, FBI, and others have nothing but your best interest at heart. It is very unfortunate that the majority of the people do not see the dangers of an ever-increasing surveillance state whose primary focus is knowing all financial information to maximize tax collection. With a full understanding that Coinbase would not exist if not for full compliance, the following message is still suggested to users: please look for a more private way to store your bitcoins, especially if you are not dependent on a payment processor and simply treat bitcoin as a payment system.

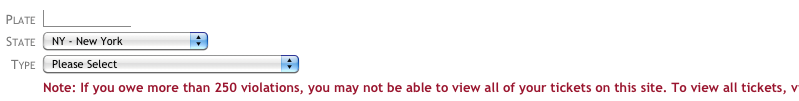

Since we are staying with the intrusive government theme, the latest news out of my hometown of NYC is that a proposal is being made to allow people to pay their fines and traffic tickets with bitcoin, which could save the city millions in Credit Card fees. A better option, of course, to save millions is to not write so many tickets, but since NYC is broke like virtually every government organization that only grows in size, that option of curse is off the table. Under full disclosure, this analyst did get two tickets in one day this month, one being for camera catching running a light one second too late and the other for forgetting to come back out to pay a meter at 10pm in this insanely cold temperature. (When is that Global Warming coming again?) Before anyone challenges the fact that NYC cops write too many tickets, please look at this “Note” on the NYC Finance Department website:

So what does that mean for bitcoin? Well, when one part of the government treats it like Heroine, and the other wants to accept it for services rendered, only users crazy enough to use a Coinbase wallet should really be thinking about using bitcoin for government services. Unless, of course, that payment can come with the disclaimer that using bitcoins will never lead to an investigation of your personal finances, and these records will never be shared with any other agency.

“Letting any part of the government know you have bitcoins that have not been fully probed, tracked or approved by Coinbase may lead to significant problems in the future when unconstitutional retroactive global laws hit the books.”

- Tone Vays

Speaking of the US Government’s fascination with Heroin and other narcotics, it is now clear that way too many bitcoins have been confiscated in the take down of Silk Road. Other than a 30-year-old web admin spending the rest of his life in prison, the most disappointing part is the enriching of the US Drug Enforcement agencies that took them down. Here is yet another report talking about the safety provided to those that were going to buy and sell drugs no matter what the government says. People (even the majority of Bitcoin proponents) have to understand that bitcoin is more than just a neat payment system. It gives people the power to have full control of their own wealth and with it comes the freedom of spending it in any way they see fit, which will sometimes include drugs. Trying to solve this problem by focusing on controlling the Blockchain instead of re-evaluating or even speaking out about the drug laws is actually a huge negative for Bitcoin and a positive for Darkcoin.

On a final note, the big news this week was that Stipe has finally integrated bitcoin as a payment option. A merchant using bitcoin is of course a no-brainer (other than dealing with government tax compliance), so it’s only a matter of time before every merchant with an Internet connection is accepting it. The devil, of course, is in the details and it comes down to one thing, what is the view of these companies about bitcoin. For a further look at what Stipe really thinks, here is a blog post I wrote about them 9 months ago: “Bitcoin: The Stripe perspective” is a view that will render Bitcoin Useless.

“The unsustainable mount of debts by western governments is on the verge to bringing the financial system to its knees, Bitcoin needs to be the savior, and not an integrated part going down with the ship.”

- Tone Vays

Daily Overview

Here is the usual one-year look back using daily candles.

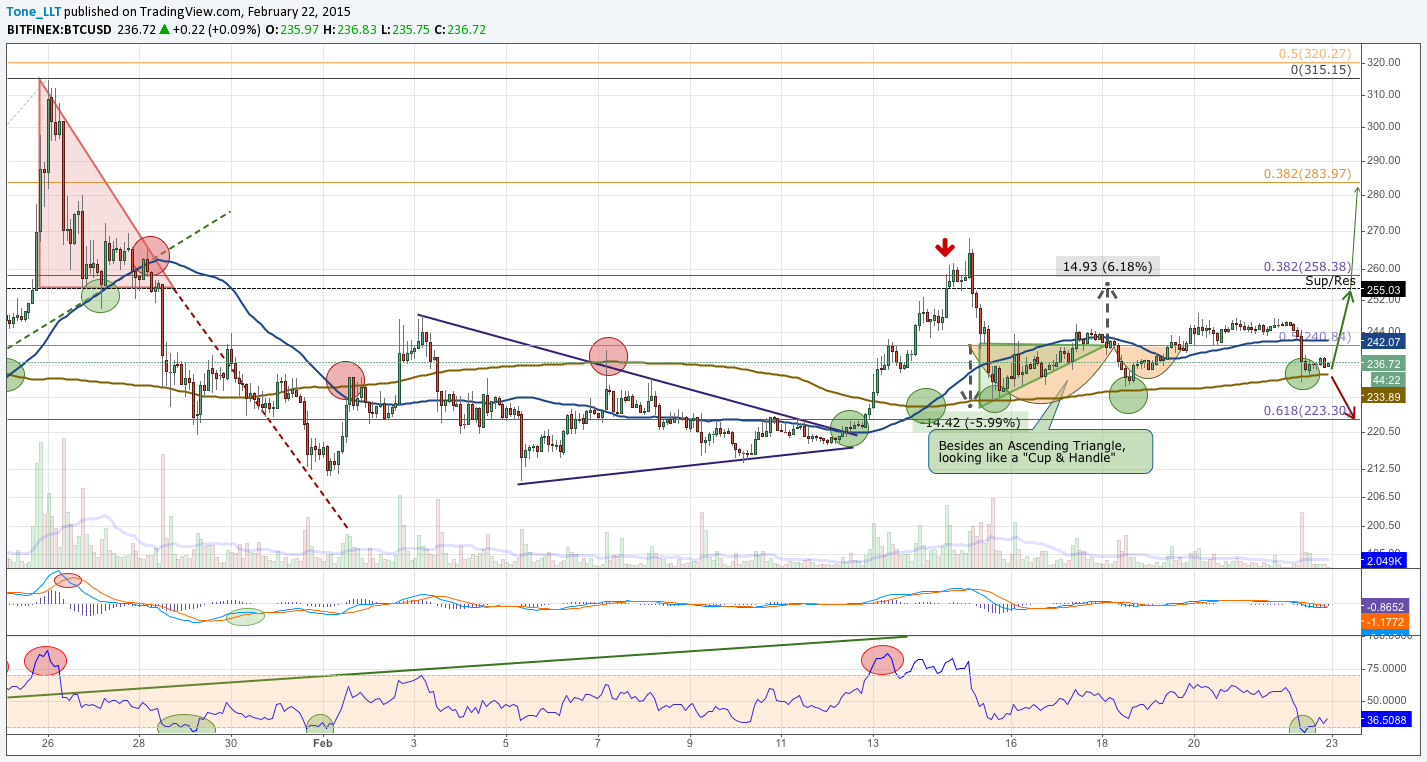

We are once again at the very bottom of a bullish channel and are starting to break below it. For illustrative purposes only we have added the target of what can happen if the bullish wedge breaks down like it did before, and it is ugly. However, this is not yet the expectation for two reasons. One is that we have barely broken under the channel, which should always be drawn with very thick lines. Second is that no two people will draw a channel the same way, and this is just one person’s interpretation. Many will say that intraday prices are not as relevant for daily charts and we should really be following the daily close price, which in this case will make the channel a lot less steep. Also, keep in mind that using logarithmic charts to draw straight non-horizontal lines does not make much mathematical sense, but if enough technical traders are doing the same, it can create a self-fulfilling prophesy.

The zoomed-in version of that chart is really struggling with that 50-Day SMA. It has really become the biggest hurdle over the last 7 months as it was only able to close above it a mere 6 times, and only once with any strength behind the move. No pattern shapes are starting to form yet so as long as we stay above the weekly lows we have to believe in the bullish case.

For a quick comment on the hourly chart that gets highlighted on Twitter (@Tone_LLT), it looks like the 200 period moving average has served as good support, but all the other patterns like the Ascending Triangle and the Cup and Handle have not been able to take us back to the 255 initial target. The chart is showing us one additional support point at US$223 and considering the amount of effort it took to break above it a few weeks back, it should hold us up for traders with ‘Long’ position to exit if the Moving Average fails to support the price this time.

Conclusion:

We remain stubbornly bullish and will continue to do so until all our support points break down. The volume for the Chinese exchanges has been down in light of the holidays so there might be one more week of back and forth. Those that have no positions at the moment might want to do nothing and just wait for a close above the 50-Day SMA plus a higher high the following day. That would provide some real signs that there is enough momentum to take us back to US$300.

Two additional scenarios in order of higher probabilities

Bearish: The bearish case is actually pretty compelling at the moment. Using daily charts we have very limited support around US$220, $210 and $200, which in the bitcoin world could all be broken in a single night. Once under US$200 the situation becomes scary with open air till the resent low of US$166 and if that goes, then we can see US$100 in a hurry.

Bullish: There really is not much of a bullish case beyond the primary view. Once we are safely above the 50-Day SMA, there is not much stopping it till the 200-Day SMA currently around US$350.

Reference Point: Monday Feb 23 1:00 am ET, Bitfinex Price US$235

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences world wide. He also runs his own personal blog called LibertyLifeTrail.

Disclaimer: Articles regarding the potential movement in crypto-currency prices are not to be treated as trading advice. Neither Cointelegraph nor the Author assumes responsibility for any trade losses as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money.

Did you enjoy this article? You may also be interested in reading these ones:

- Bitcoin Price Analysis: Week of Feb 16 (Exchange Scare)

- Bitcoin Price Analysis: Week of Feb 9 (Tough Decisions)

-

Bitcoin Price Analysis: Week of Feb 2 (Trend Change Part II)