The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

The cryptocurrency market capitalization has dipped following the criticism from the legendary investors Warren Buffett and Charlie Munger.

This time, even the founder of Microsoft, Bill Gates opined that he would short Bitcoin if he could. Contrary to his opinion, Microsoft continues to be supportive towards blockchain and cryptocurrency.

While these statements might scare away a few investors planning to invest into digital currencies and result in a short-term dip, it is not going to have any material difference in the long-term trend. A few months down the line, these dips will be hardly even noticed on the charts.

The New York Stock Exchange owner Intercontinental Exchange is considering the possibility to allow their clients to buy and hold Bitcoin. This shows that the traditional investors from Wall Street are warming up to the idea of investing in cryptocurrencies and it is only a matter of time before volumes increase.

Gary Cohn, former chief economic advisor to US President Donald Trump believes that there will be a global cryptocurrency in the future, but it won’t be Bitcoin.

BTC/USD

On May 09, Bitcoin momentarily dipped below both the 20-day EMA and the small trendline support but it did not hit our stops at $8,900.

Currently, the BTC/USD pair has again pulled back above the $9,000 levels, which is a positive development. This shows that the buyers are still keen to support prices at lower levels. Now, the bulls might attempt a rally back to $10,000 levels, which is a critical resistance. The digital currency will gain strength only above $10,000.

On the downside, a confirmed break below the $9,000 levels will result in a drop to the 50-day SMA. The RSI has formed a negative divergence which is a bearish sign.

We suggest maintaining the stops at $8,900 for now, we shall trail it higher in a couple of days.

ETH/USD

Ethereum has slowly clawed back to our purchase price. It should break out and sustain above the $745 levels to signal strength. A failure to do so will result in another retest of the 20-day EMA, which is currently at $693.

A breakout above $745 can carry the ETH/USD pair to $838, which is the May 05 highs. Above this level, a rally close to $900 is possible. Though our target objective is $1,130, we shall take it one level at a time.

On the downside, a slide below the May 07 lows of $685.18 will signal weakness. Therefore, we recommend raising the stops higher from $640 to $680. Let’s reduce our risk.

BCH/USD

Bitcoin Cash broke below the support line of the ascending channel and triggered our proposed stop loss on half of the position at $1,500. The stops on the remaining half kept at $1,400 is still intact.

Currently, the BCH/USD pair has climbed back into the channel and has broken out of $1,600, which is a positive move. If it sustains above $1,600, a rally back to the May 06 highs of $1,849 should be on the cards. Above this, the rally should extend to the resistance line of the ascending channel at $2,000.

On the downside, a breakdown of the 20-day EMA will signal weakness. Therefore, we recommend holding the remaining position with the stops at $1,400.

XRP/USD

Ripple continues to trade inside the range of $0.76-$0.93777. Currently, prices are bouncing off the lower end of the range. If the support holds, we should see a move back towards the upper end of the range.

However, we already have a few open positions, which are close to our buy levels. Hence, we need to wait for a couple of days before recommending a long position in it.

A breakdown of the range gives the XRP/USD pair a pattern target of $0.58223 on the downside.

Inside the range, trading will continue to be volatile.

XLM/USD

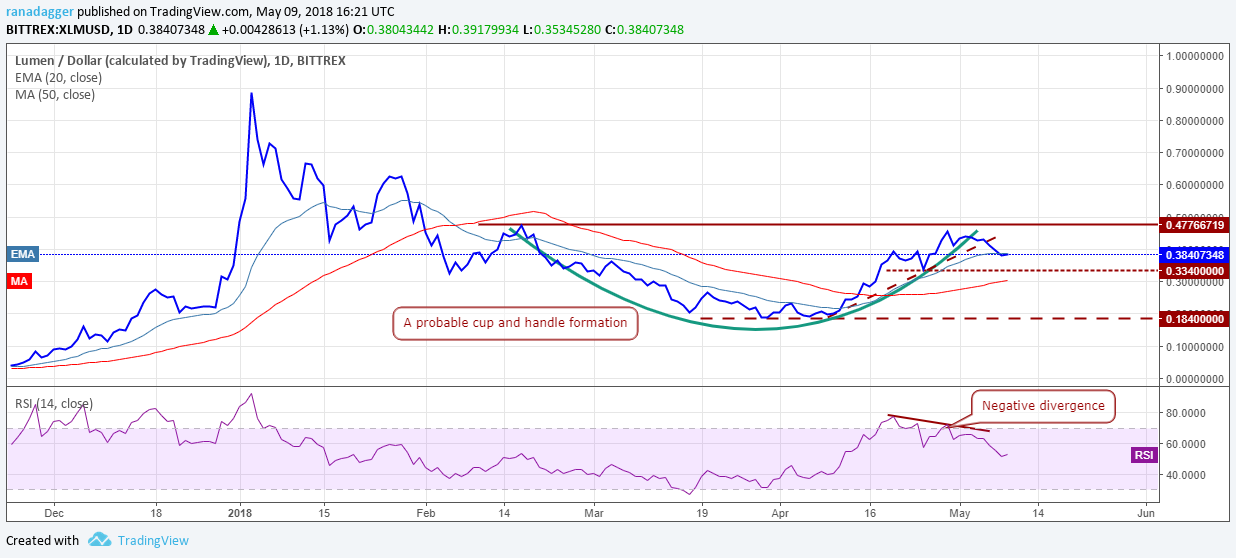

Stellar is trying to hold the 20-day EMA. If successful, it can rally back towards the $0.47766719 levels, which will form a cup and handle formation. A break below the 20-day EMA can extend the decline to the next support level of $0.334.

Though the XLM/USD pair is showing signs of bottoming out, we suggest waiting for the pattern to complete with a breakout above the overhead resistance at $0.48. Such a breakout has a pattern target of about $0.8.

If the bulls fail to push prices above the overhead resistance, the cryptocurrency can enter into a range bound action for a few days.

LTC/USD

Litecoin broke below the support line of the ascending channel and the 20-day EMA today, but the bulls purchased the dip close to $150 levels and pushed prices back into the channel. Now, a rally above $168 levels will indicate strength and a move to the May 06 highs of $184.794 is possible.

If the LTC/USD pair fails to scale the overhead resistance, it can decline to the next support level of $141.026.

Presently, we don’t find a high probability trade setup, therefore, we are not recommending any fresh long positions.

ADA/BTC

Cardano broke below the support levels and declined to 0.00003301 levels where buying emerged. Our suggested stop loss is placed at 0.000029 levels, just below the lows of the handle, in the cup and handle formation.

If the ADA/BTC pair fails to break out of the 0.00003445 levels quickly, it will continue to slide lower. It has already broken below the trendline and is just about hanging on to the horizontal support.

Due to the weakness, we propose raising the stops on half position to 0.000032 and retaining the rest at 0.000029.

IOTA/USD

IOTA held the support line of the ascending channel and the 20-day EMA on May 07. However, the resulting rally faced a stiff resistance at $2.55 levels. Currently, prices have again declined to the horizontal support at $2.2117. If this level holds, it will signal strength and we can expect a rally to the resistance line of the channel at $2.9. Traders can wait for a rally above $2.5 to sustain before entering long positions.

If the IOTA/USD pair breaks down of the channel and the 20-day EMA, it will indicate weakness and the fall can extend to the next major support at $1.63.

Right now, there are no reliable buy setups, hence, we have not suggested any specific buy and stop loss levels.

EOS/USD

EOS has largely been consolidating between $16 and $19.67 levels for the past few days. We like the way it has held above the 38.2 percent Fibonacci retracement levels of the rally from $5.9610 to $23.0290. This shows that the bulls are in no hurry to close their positions and are not waiting for a larger dip to buy.

If the EOS/USD pair breaks out of $20 levels, the bulls will attempt to push it to new highs once again.

On the other hand, a break below the $16 levels can sink the digital currency to $14.495 levels.

We shall wait for the consolidation to end before suggesting any long positions.

The market data is provided by the HitBTC exchange. The charts for the analysis are provided by TradingView.