Last Week’s Review

In last week’s post we concluded with the following statement:

We are now changing our view point to Long-Term (tentatively) Bullish, Intermediate -Term Bearish, and Short-Term Bearish. Unless we see some positive signs we are now focused on the possible Double Bottom target of US$440-450 zone. If that can hold, there might be some signs of a healthy recovery. If not, the next step down will be all the way to the US$360-380 zone but we will analyze that possibility in due time.

As always we provide potential less-likely outcomes so that the reader can consider all options. Price can obviously reverse at any moment with or without a news event so in case it does, watch the US$500 resistance level which has already proven its relevance on Sep 3rd. If that mark can be broken in quick fashion there is plenty of technical resistance right above it, starting with US$530 (Fibonacci), US$560-580 (Descending Triangle), US$630-650 (Fibonacci)

With our Bearish stance we were expecting to see lows in the vicinity of the U$440-450 zone. Price did fall immediately after the publication but made what can be considered a higher low at US$456 and then another one at US$459 the next day. The big question now is: Are these lows in the Mid US$450’s here to stay for a while or is more downside on the way? So on that note, let’s take a look at the long term picture.

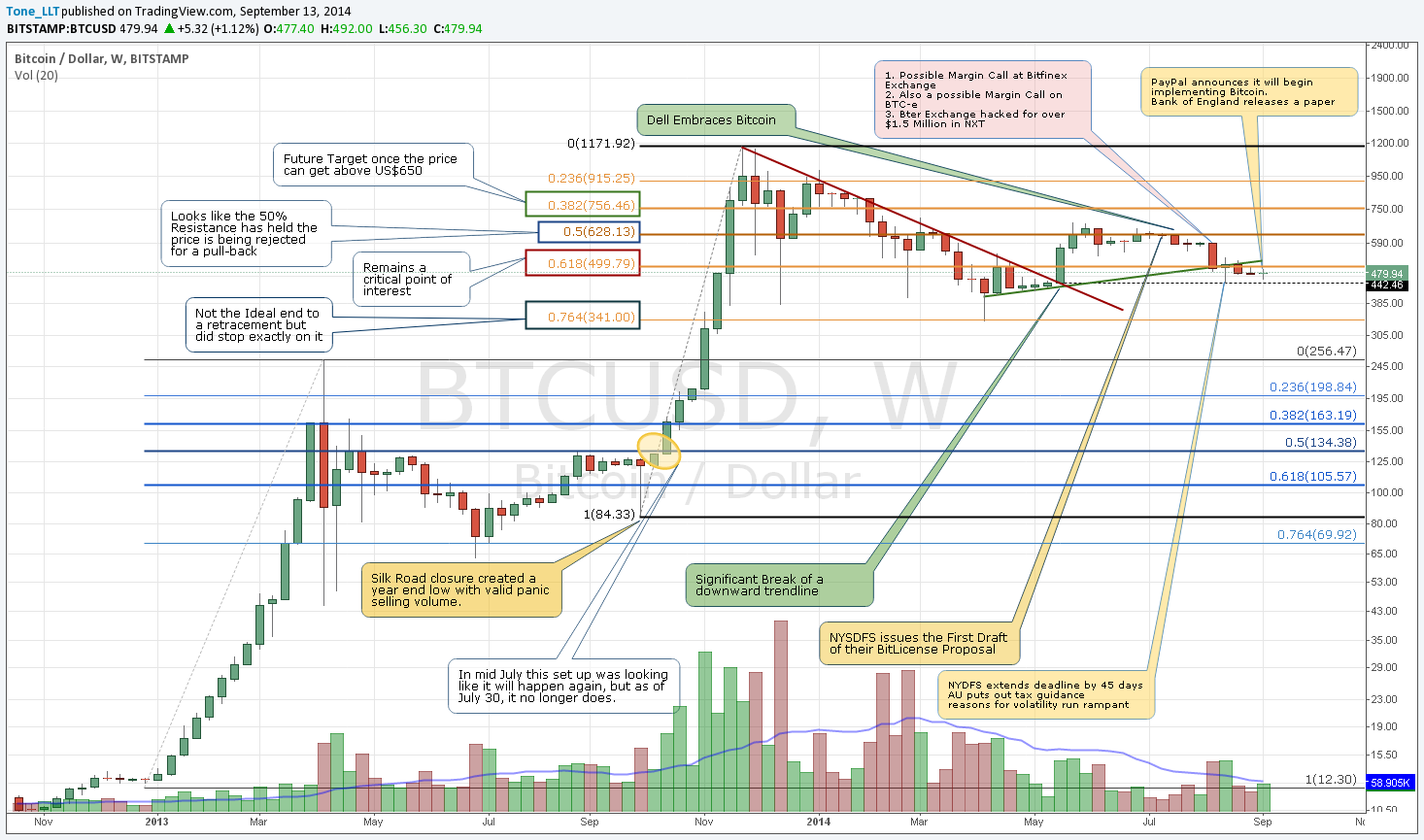

The chart remains ‘tentatively’ bullish, this will continue to be the case as long as the price remains above the US$440 August low. We are still noticeably under an upward sloping trend line, but today’s candle is looking like a Doji, which is something to keep an eye on for a possible reversal in this 3 month downward trend.

Education (Intro to Moving Averages)

Moving Averages are a common tool for traders as it provides a way to look at prices in a smooth way showing the overall trend. There are plenty of references that will go over this in detail including the differences between different types of Moving Averages. As usual with all these tools, the parameters are really up to the Analyst and often one has to make a decision based on whether the moving average is indicating a self fulfilling prophecy because many other traders are looking at the same thing or do you go and try to custom make one specifically for the security being traded. The latter tends to provide good signals historically but if no one else know it, a herd mentality will not be created as the signal is used going forward. The more popular parameters traders use on daily candles are Simple Moving Average (SMA) using 20, 50 and 200 daily pricing observations. Exponential Moving Averages (EMA) are also quite popular and in fact that is what we have added to one of our charts below. The number of observation are generally up to the analyst and while most will stick to round historically proven values like those listed above, this trader has seen periods of 137, 274 and 411 be used quite effectively.

Fundamentals (aka News)

Unlike the last few weeks there was plenty in the News to talk about this time around. The Bank of England put out a paper where they do not see Bitcoin as a threat and all throughout clearly showed their misunderstanding of this revolutionary technology and future implications. The big news however, was PayPal, or mare specifically one of its subsidiaries Braintree intending to implement Bitcoin as a payment option to those companies using their tools. A debate can certainly be made as to whether this will be good or bad for the Bitcoin Ecosystem, but for the purposes of this series there is only one question that needs to be analyzed: What would it do to the price?

All interpretations of the news is of course opinion, but thinking about it logically, the news should definitely bring in some positive PR. Even though PayPal already has a reputation for doing Government’s police work as they freeze accounts even in situations of them having 0 understand of the laws, this move could imply that they have gotten the ok from those up on the Hill. In this case this is a positive sign as it means the old financial guard is more open to Bitcoin even if those that are more privacy conscious will see this as another way to remove Bitcoin’s valuable anonymity aspect. In the intermediate and perhaps longer term views this might mean significant downward pressure on prices. If PayPal is to all of a sudden connect a few million global Bitcoin users, with hundreds of millions places for them to spend these bitcoins, the results could be Mass-Spending and not necessarily Mass-Adoption. Just because your driver or hotel is now accepting it as a payment method does not mean they are embracing it nor believe it is revolutionary. So if all these transactions are immediately converted into Fiat Currencies there would need to be plenty of people willing to buy them from exchanges and that number at the moment is still extremely small.

Another negative aspect of all these Merchants all of a sudden coming on line at once is that it has a chance to stress the system. Bitcoin is very efficient in its small circles, but at the moment is still limited to less than 10 transactions a second. Adoption and Acceptance need to grow gradually and having it show up all at once has potential to for some havoc. So to those screaming for Mass-Adoption tomorrow: “Be careful what you wish for, you just might get it and won’t be happy with the results”.

Daily Overview

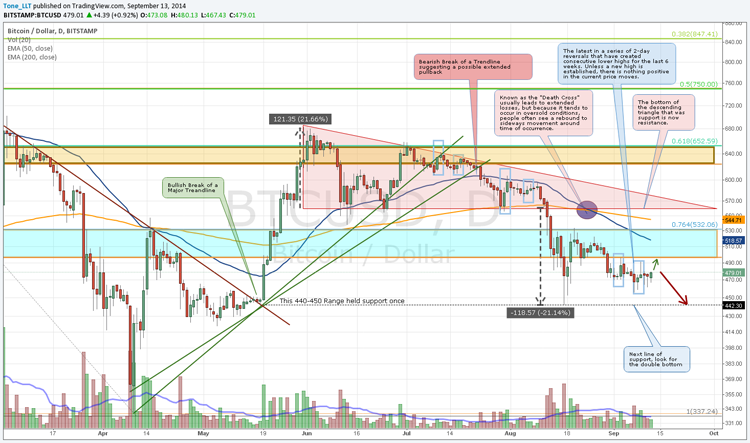

Here is our 1-year Daily chart referred to as the ‘Intermediate’ time frame still referencing Fibonacci Retracements and a few Trend Lines broken back in July

Ever since the Descending Triangle was identified, we have considered this time frame to be bearish. It is still hard to find anything positive in this chart and it will stay that way unless we can recover the US$500 mark in a sustainable fashion.

Here is the more detailed short term chart also looked at on a Daily scale. We continue to make 2-day rebounds that have notoriously been creating lower highs virtually every time. The first thing that would need to happen for any thoughts of higher prices in the intermediate term is for this cycle to end. In light of our educational section this week we have added two Exponential Moving Averages (EMA), which have recently experienced a “Death Cross”. EMA tend to be the better options when it comes to volatile securities which Bitcoin certainly is as it gives more relevance to prices closer to the current day so the lines react faster.

Conclusion:

Our overall stance remains the same as last week: Long-Term (tentatively) Bullish, Intermediate -Term Bearish, and Short-Term Bearish. We are still keeping our eye on that possible Double Bottom target in the US$440-450 zone. Last Week’s fall into the Mid US$450’s was close to our target, but the action needs to prove to us that this slightly ‘higher’ low is here to stay. Unless that happens we will continue to treat the constant formation of ‘lower’ highs as an indication that prices have some more room to correct as guessing the bottom is not a strategy.

We will also remain diligent of the following situations:

Bearish: If our current support line of US$440 cannot hold the price up, the next logical line of support is all the way down in the US$360-380 zone.

Bullish: US$500 is now the first line of major resistance and if we can break it to the upside it will also break the cycle of lower highs we’ve been seeing on a weekly basis making the move even more relevant to the possibility of a trend change. However, there is plenty of technical resistance right above it, starting with US$530 (Fibonacci), US$560-580 (Descending Triangle), US$630-650 (Fibonacci) and so on.

Reference Point: Saturday Sep 13 5:45pm ET, Bitstamp Price US$480

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences world wide. He also runs his own personal blog called LibertyLifeTrail.

Disclaimer: Articles regarding the potential movement in crypto-currency prices are not to be treated as trading advice. Neither Cointelegraph nor the Author assumes responsibility for any trade losses as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money.

Did you enjoy this article? You may also be interested in reading these ones:

- Bitcoin Analysis: Week of Sep 7 (Intro to Time pt. II)

- Bitcoin Analysis: Week of Aug 31 (Intro to Time)

- Bitcoin Analysis: Week of Aug 24 (Intro to Trend)

Coin HR - the best way to find a perfect bitcoin job or an applicant for your vacancy. We connect talent with opportunity!