Note from the Author: Coming to you from the Bitcoin South Conference in Queenstown New Zealand that featured speakers like Andreas Antonopoulos and Jeffery Tucker. Please see (@Tone_LLT) for additional updates.

Last Week’s Review

Last week, we concluded with the following:

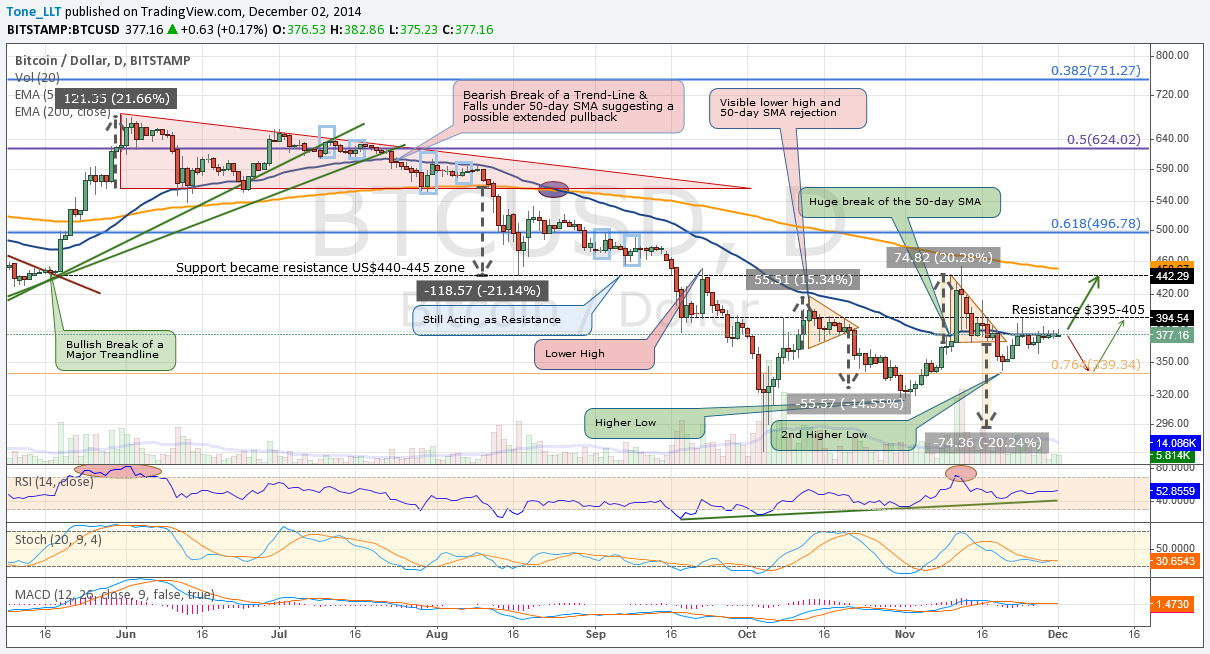

Now that the pullback from the US$450 top has played its course, we can consider the low from a few days ago at US$340 as a temporary low; if it holds and we can get back over the 50-day SMA, which is now beginning to turn down once again, it would be a great sign.

For the moment we remain tentatively Bullish Long-Term, Bullish Intermediate Term, but Neutral Short-Term. We have fallen lower than ideal so resistance we thought was cleared is now back in play. This includes US$375 and US$400. Don’t expect miracles and most likely there will not be a year end rally to the moon and the most likely outcome for the near future is some consolidation while a larger trend is established.

Two scenarios in order of higher probabilities:

Bullish: One more time we will attempt to say that the pullback low is in place, but this time at US$340, so if we can break the US$375 in the next few days, US$400 is now nearby. If the ultimate target of this rally is US$500, it would be nice to see this target reached by Christmas so don’t expect miracles this week.

Bearish: The Descending Triangle that has formed is not to be ignored - it might be the only real Bearish thing we have on the charts, but it is there and they are right about 70% of the time. If the price reverses at any moment and starts to get near that US$340 level, US$300 might come in the blink of an eye.

This has been one of the less volatile weeks for Bitcoins’s price in a while. We have been consolidating around the 50-day SMA that currently sits around US$380. It is actually positive sign that we are consolidating and are mostly staying above the base of the Descending Triangle shown on the graph of the daily chart.

We will be diving right into the charting today, mostly due to time constrains and the unreasonable hotel internet charges in these parts of New Zealand.

We remain Bullish on the Long-Term chart. This is now the 4th week since we have cleared the downward sloping trend line and the next important mark for us to break will be the US$450 zone.

Fundamentals & News

It sounds like Black Friday was not as popular this year as in years past, which fit the current global economic slowdown theme. In the case of Bitcoin, it should also be expected that people will be less eager to spend their bitcoins this year vs. last year due the big drop in year over year price. This should fly right in the face of all the inflation pushing economists. As Bitcoin goes up in price everything around you becomes cheaper and hence, your spending increases. The opposite is also true and it’s happening now in the Bitcoin space as the currency begins to drop in price.

The news from eBay CEO Devin Wenig is on par with PayPal, but once again, unless there is an intention to actually hold on to the bitcoins there is not much good that will be accomplished for the BTC price or mass adoption. What would be nice to see is an interface where sellers on eBay would be able to get bitcoin directly or even have the ability to list items in BTC only, if they prefer to get paid in Bitcoin.

It is very disappointing to see companies doing the government’s dirty work for them in identifying users. One of Bitcoin’s prime advantages is privacy so if this is compromised, more development is needed in places like Mixing Services, which DarkWallet is already implementing. Or a situation might come up that a more anonymous coin like Darkcoin will begin to take a significant market share out of Bitcoin.

Daily Overview

Here is our standard 1-year Daily look back. The lows are holding nicely and the bullish channel over the last month or so is still going strong.

The channel in the chart is implying that we could see prices reach US$500 in the near futures, and the recent low of US$345 fits perfectly.

The Short-Term view still remains pretty neutral as it hangs around the 50-day SMA, but it’s starting to turn bullish once again. A consistent closing above this average and the base of the triangle should lead to a rally up to the 200-day SMA, which currently sits around US$450.

Conclusion

It is nice to see Bitcoin stable for a short stretch of time, even if it is at this low year over year level. We are tentatively bullish across all time frames and hope to see US$400 broken in the near futures as it rallies to US$450 and perhaps even US$500 into year end.

Two scenarios in order of higher probabilities:

Bullish: Since the overall case is bullish, it might be more fitting for the first alternate scenario to be simple consolidation into Christmas. There is a very likely chance that price will remain between US$375 and US$425 for a decent amount of time.

Bearish: The descending triangle is still not something you want to see on a daily chart. It is suggesting a price drop to just under US$300. We would need to rise above US$400 in order to remove this possible target from our charts.

Reference Point: Tuesday Dec 2, 3:30 pm ET (Wed 9:30 am New Zealand), Bitstamp Price US$380

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences world wide. He also runs his own personal blog called LibertyLifeTrail.

Disclaimer: Articles regarding the potential movement in crypto-currency prices are not to be treated as trading advice. Neither Cointelegraph nor the Author assumes responsibility for any trade losses as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money.

Did you enjoy this article? You may also be interested in reading these ones: