The views and opinions expressed here are solely those of authors/contributors and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

In August, the altcoin market managed to set a historic record, after a slowdown and the price drop at the end of the previous month. The mark of the total altcoin market capitalization reached the $94,205,900,000 point.

In July, despite the uncertainty about the Bitcoin future, in a matter of days the total capitalization of the market fell to $45,499,800,000.

After the SegWit news, it started to recover, and thanks to the Bitcoin Cash appearance, the total capitalization of altcoin markets increased an additional $9,716,420,145.

Over the last month of summer, the infrastructure of the market has changed drastically for a reason.

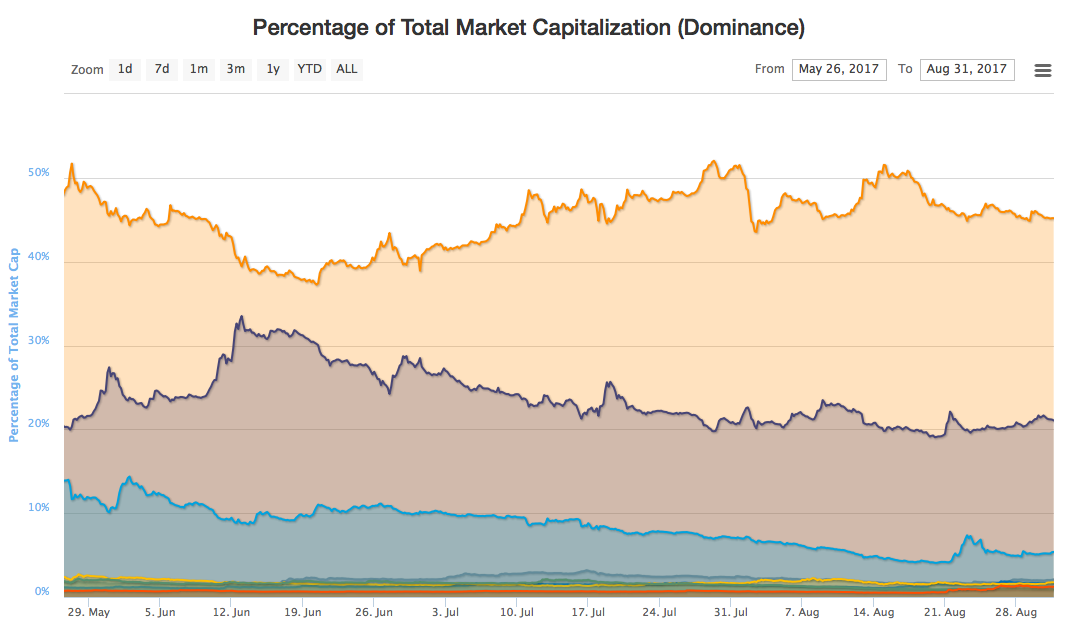

The appearance of Bitcoin Cash (5.7%) moved Ripple (5,2%) to the fourth place among all cryptocurrencies.

The second place holder is still Ethereum, with 21% of total capitalization.

Bitcoin is still keeping no more than 45%, even after gaining new all time high price levels.

The main growth of the market is due to the inflow of capital into the market of altcoins. The total Bitcoin capitalization fell again. This month it felt by $11 mln, from $89.2 mln to $77.8 mln, while the the total market capitalization of the leading cryptocurrency increased from 42.7 percent to 50.97 percent.

At the same time, the leaders, ETH, BCC, XRP, LTC, NEM, DASH, account for slightly more than 75 percent of the total capitalization of all altcoins, having the greatest impact on changes in the total value of the market.

Update:

However, on the night from Sunday to Monday, there was one more event that brought the market down almost 15%. The People's Bank of China issued an order banning initial coins offers (ICOs) in the country. The prohibition extends not only to new primary distributions of coins. Organizations and individuals who have already carried out ICOs will have to return funds to investors.

The market managed to recover in three to four days.

Ethereum

Ethereum is constantly doing new ico projects, making partnerships with various companies.

The Metropolis hard fork in the Ethereum network is scheduled at the end of September 2017. The new version of the software will expand the capabilities of the Ethereum network and will be an important intermediate step for the transition from the proof-of-work algorithm to proof-of-stake. In particular, Metropolis will serve as the basis for the introduction of the so-called zk-SNARKs - cryptographic tools underlying Zcash, which will make completely anonymous transactions on the Ethereum network possible.

Litecoin

Over several months the asset has been in the 0.0099-0.0218 BTC range. LTC seems to be in a good position, considering the technical analysis and market approach. It is clear that LTC/ BTC is in the channel, it broke its MA200 day on volume and is currently testing it. Technically, the volume is concentrated on purchases, it can be called a sign of strength if in the near future this asset will hold the 0.01368 BTC level, MA200 - wholesale price zone.

Also, in the channel and in an uptrend, there is a trend relative to the MA200 and MA20, and the relative to the USD looks stronger than the one to the BTC.

Another factor associated with the recent rise of Litecoin, may be the impending LTC/ BTC inter-network transaction exchange. Now that Bitcoin has activated SegWit, Lightning's network technology should facilitate the creation of seamless cross-site swaps between the two cryptocurrencies. This will help ensure that Litecoin remains relevant in the long term, and will further promote innovation around the LTC network. Also Litecoin got a boost after BitGo, the leading company in the multi-signature technology, working with major Bitcoin exchanges and trading platforms, began supporting LTC

Ripple

The charts do not look attractive, but the growth over the last weeks was accompanied by very high trading volumes.

The fact that Ben Bernanke leads the first Ripple conference is of greater fundamental importance. The Ripple course is not heavily dependent on any specific events, but recently the cryptocurrency trading volume has increased significantly on the South Korean exchanges. And the fact that Ripple is expanding in China is certainly important.

Currently, more than 60 organizations in the world use Ripple XRP, including Santander, RBC, UBS and UniCredit.

On August 28, Ripple announced that the company hosted a delegation, which included academic and industry leaders, official representatives of the NBK. The meeting was held in the start-up San Francisco headquarters and was dedicated to "the latest trends in the field of blockbuster."

OmiseGO

OMG has a beautiful classic technical situation. Narrowing the volatility to the level of resistance, there’s a sign of strength and exit into the next zone on volumes. Judging from the history, the price should now test the previous level for purchase orders; in case there are, the price will go up.

At the beginning of the last quarter there should be updates.

In light of the recent events, OmiseGO has reassured that the Chinese ICO ban will not impact the network.

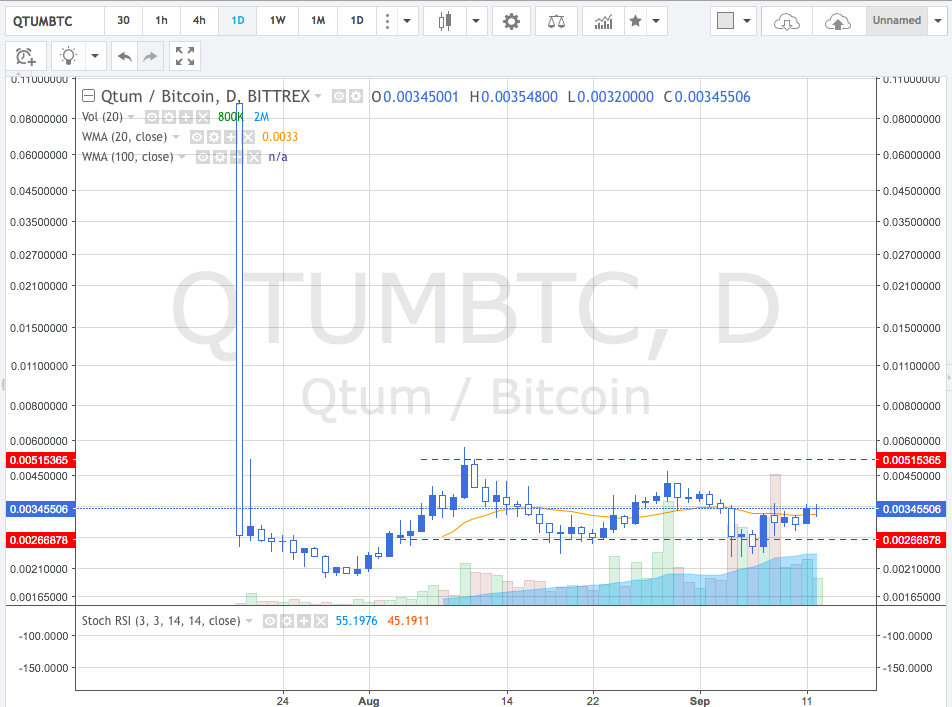

Qtum

Right now, there’s no visible technical input. The schedule does not give much information. It seems to be a good idea to buy large quantities around the 0.0035BTC; as there is no entrance.

According to the roadmap, in September the mainnet will be released; important releases are also expected in November.

Monero

The currency was in the consolidation for quite a long period of time. By the end of August, it made a spring, collection of stops, and a shakeout with a breakdown of the resistance level. A breakdown of several candles on large volumes is a sign of strength. Monero has settled at the 0.025 BTC level absorption, after which you can either re-enter the transaction, or expand the position.

The crypto asset was added to the largest South Korean exchange Bithumb. Soon, the Monero support also announced being listed to other crypto currency platforms, including Polish exchange BitBay.

After the release of the Kovri beta version, which will be implemented by default, each user will receive an additional level of I2P anonymity. This will greatly improve the decentralization and confidentiality of Monero and will increase the XMR distribution and value.

A team of Monero enthusiasts based in Hong Kong have launched an alternative version of LocalBitcoins.com. The website will connect buyers and sellers of the cryptocurrency based on the country of residence.

Monaro hard fork has been rescheduled for September 16. Also, the Ledger Hardware Wallet Monero integration has started.

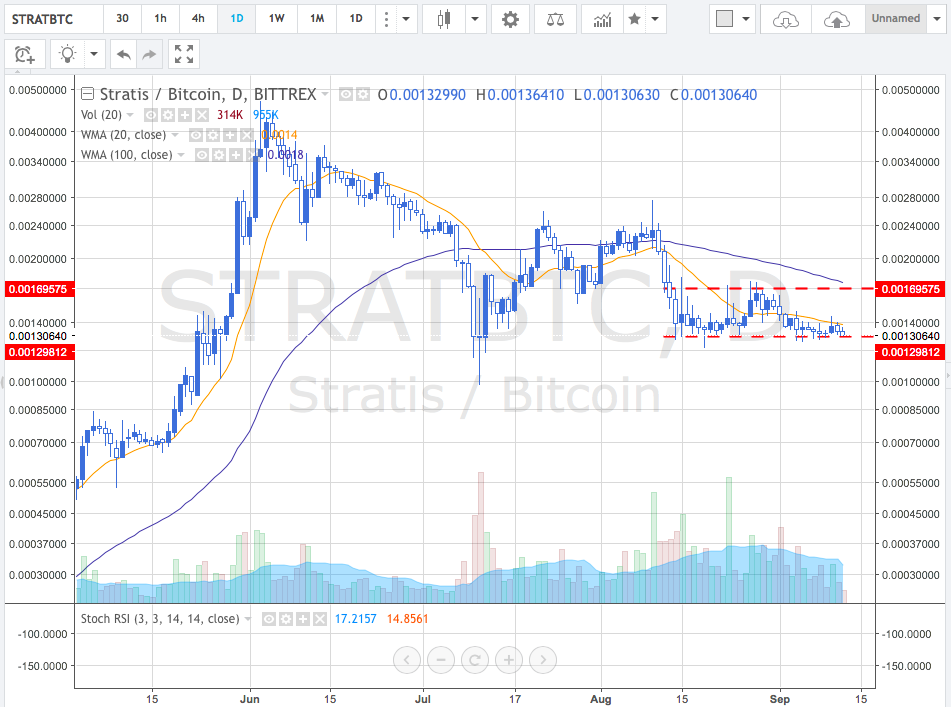

Stratis

The asset is in a downward trend with a channel formed. There was a stop movement to the bottom of 0.0013BTC, and at the moment this is the main support zone. Currently, the currency is traded below its average price, which is not a very positive factor. There is a certain consolidation at the top of the channel, but there is no sign of demand / strength in the asset.

In the alternative development of events, after breaking through the upper part of the channel, absorbing sales in the consolidation zone, the potential for movement to the level of 0.005 BTC is possible.

Stratis is a pretty new project, but looks like it has much to offer to both developers and cryptocurrencies fans. The platform proposes a solution for a quick formation of individual chains, based on its own blockbuster. A consulting agency based in London that helps you create networks and use Sisters that best suits their needs.

The ability to create applications in C # and .NET is quite attractive for companies. In addition, those who use cryptocurrencies can benefit from the secrecy of transactions in both STRAT and Bitcoins.

They plan entering the market in the 4th quarter of 2017, according to the roadmap. But they have postponed the release of the wallet which was planned at the beginning of September.

Ark

Ark is in a good position now; there is an active demand at the highest border. With sufficient activity the price will go higher.

Since September 5, sales of the long-awaited update of the wallet, Branded Ledger Nano S Hardware Wallets, have started.

If there are good reviews, the price will go up.

Komodo

KMD, the asset on the chart, is limited to about 0.00075BTC price.

The way out can be either the mainstream activity, or trigger news.

Major announcement is anticipated, there is a countdown on its official website and Twitter account.

#Countdown has begun - Major #Komodo announcement. #cryptocurrency #fintech #blockchain $kmdhttps://t.co/RDW3SOW9Vl

— Komodo Platform (@KomodoPlatform) September 2, 2017