Capitalization and infrastructure

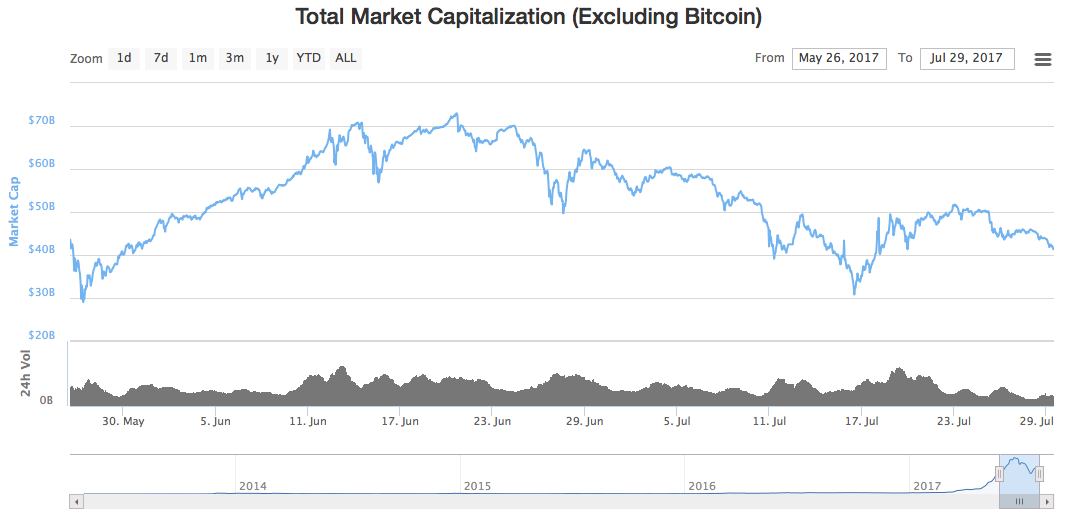

In June, the altcoin market managed to set a historic record, after a long race, which began back in April. The mark of the total market capitalization reached $72,830,700,000.

In July, the same trend reversed and, despite the uncertainty about the Bitcoin future, in a matter of days the total capitalization of the market fell to $30.79 mln.

After the news about SegWit deployment, the price started to recover, but it could not overcome the $50 mln point.

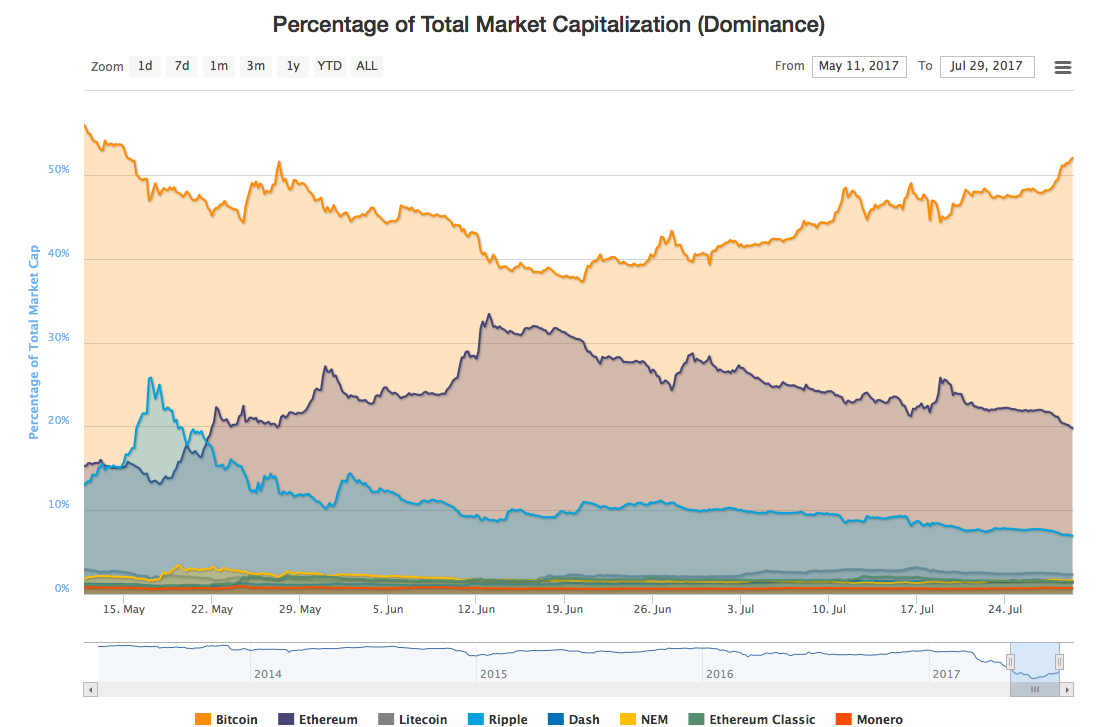

Over the two summer months, the infrastructure of the market has changed drastically for several times.

In mid-June, Bitcoin and Ethereum reached almost the same share - 39.5 percent and 33.4 percent, respectively.

However, at the end of June, with the majority of network participants started to signal about the SegWit adoption, the infrastructure again shifted towards Bitcoin, whose share become slightly over 52 percent.

Ripple, Dash, Litecoin, NEM, with the specific gravity of 6.9 percent, 1.7 percent, 2.37 percent and 1.66 percent respectively, remain the most popular currencies, after Ethereum, whose share in total capitalization decreased to 19.7 percent.

The total Bitcoin capitalization fell by $6.5 mln, from $95.7 mln to $89.2 mln, while the share of the first cryptocurrency, in the total market capitalization increased from 42.7 percent to 50.97 percent.

The total drop on the crypto market was due to a significant capital outflow from the altcoin market. In total, the market lost about $15.7 mln.

At the same time, the leaders, ETH, LTC, XRP, DASH, NEM, account for slightly more than 70 percent of the total capitalization of all altcoins, having the greatest impact on changes in the total value of the market.

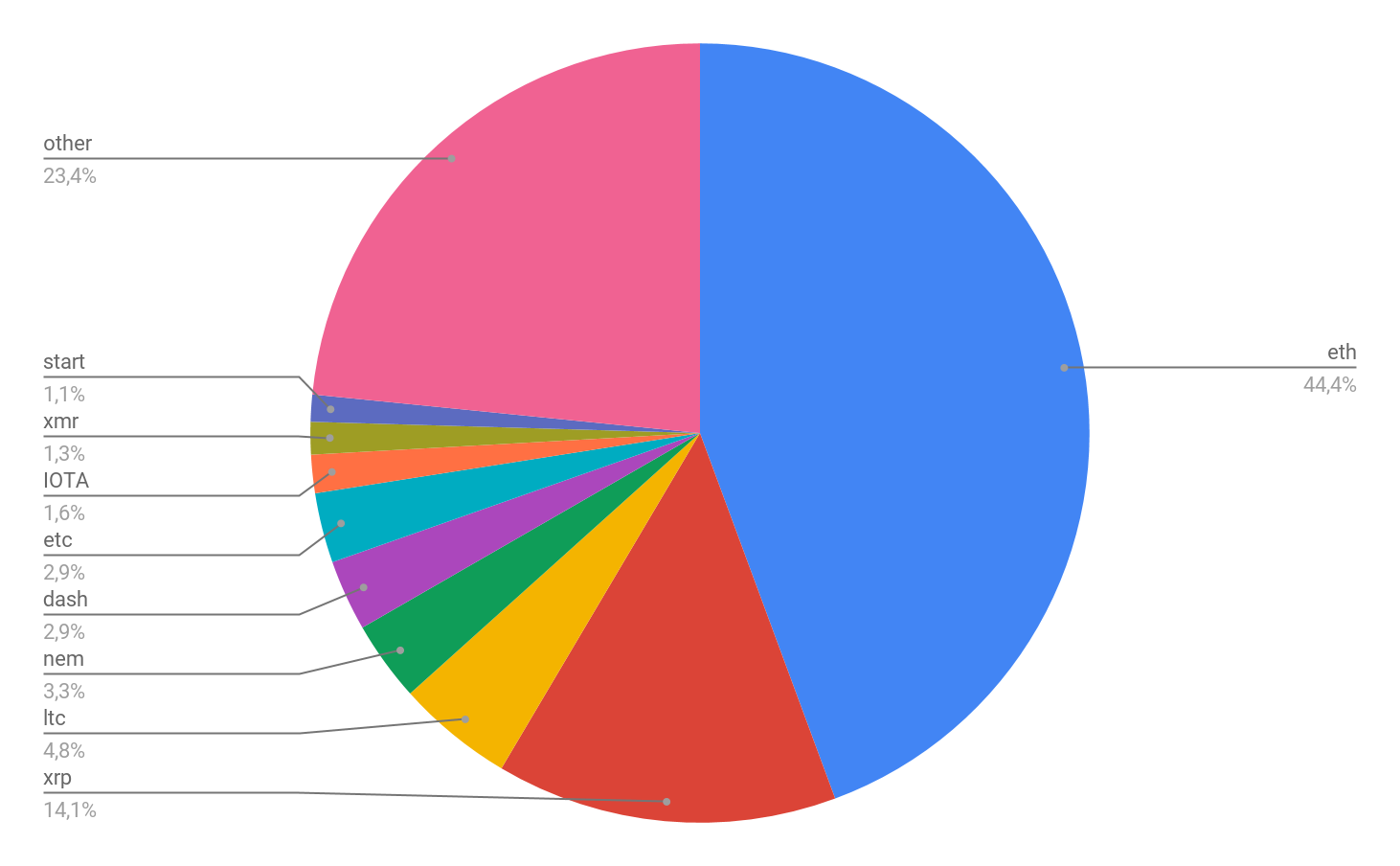

Top five altcoins

Ethereum

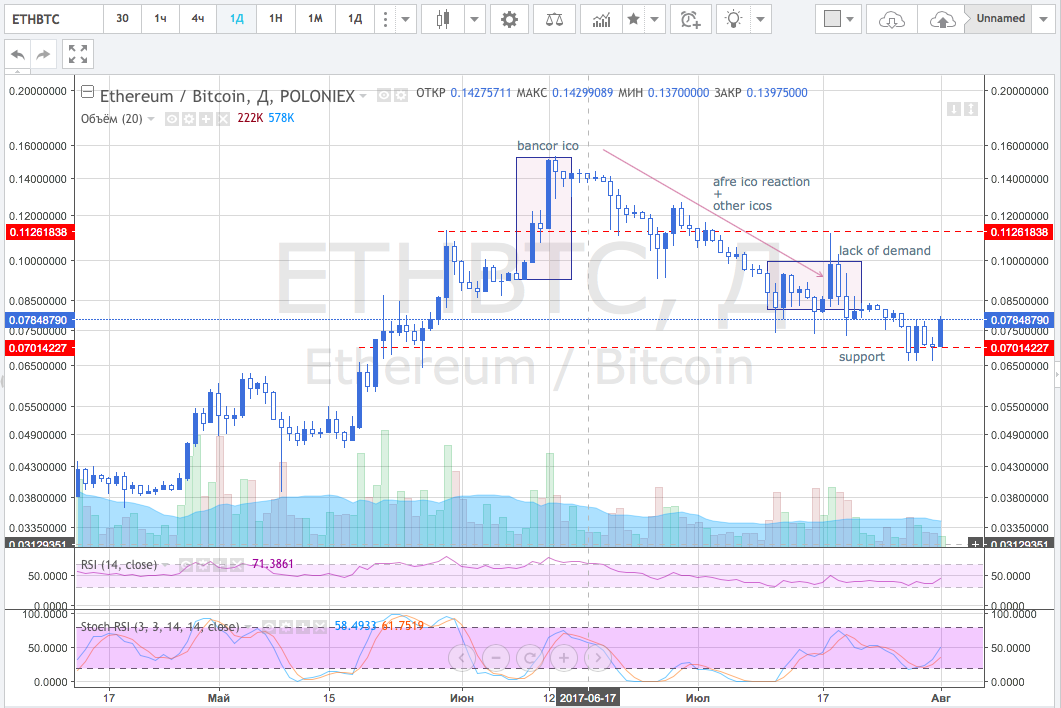

The most popular crypto asset was Ethereum, accounting for 44 percent of the market value of altcoin, and is its main engine. During the summer, there were a lot of ICOs held, accepting investments in ETH. Such popularity influenced the rate: active growth to the historical maximum just before the start of the ICOs and the price drop right after.

Despite the fact that graphically the market looks weak, there is some positive news, like Winklevoss Stock Exchange of digital assets launching daily closing auctions for Ethereum, or S7 Airlines implementing a Blockchain-based ticket program.

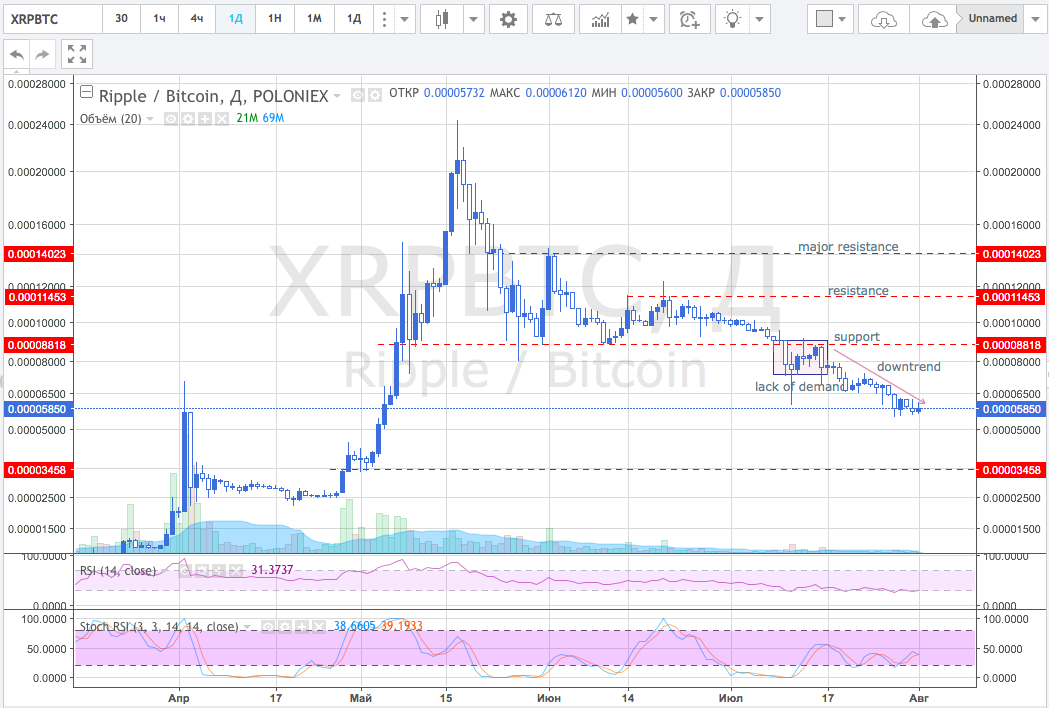

Ripple

Ripple is the second altcoin in capitalization, i.e has 14 percent of the market value.

Since the middle of May, it’s had downtrend and does not have any upcoming events, that might influence purchases. By mid-July, the Bank of England tested the possibility of cross-border payments, using Ripple technology. After that an attempt was made to recover in price. But due to the lack of sufficient demand level, the price went down.

In addition to the British monetary regulator, this technology is actively explored by other banks, including Santander, Royal Bank of Canada and Mitsubishi UFJ Financial Group, who are striving to make cross-border payments faster and cheaper.

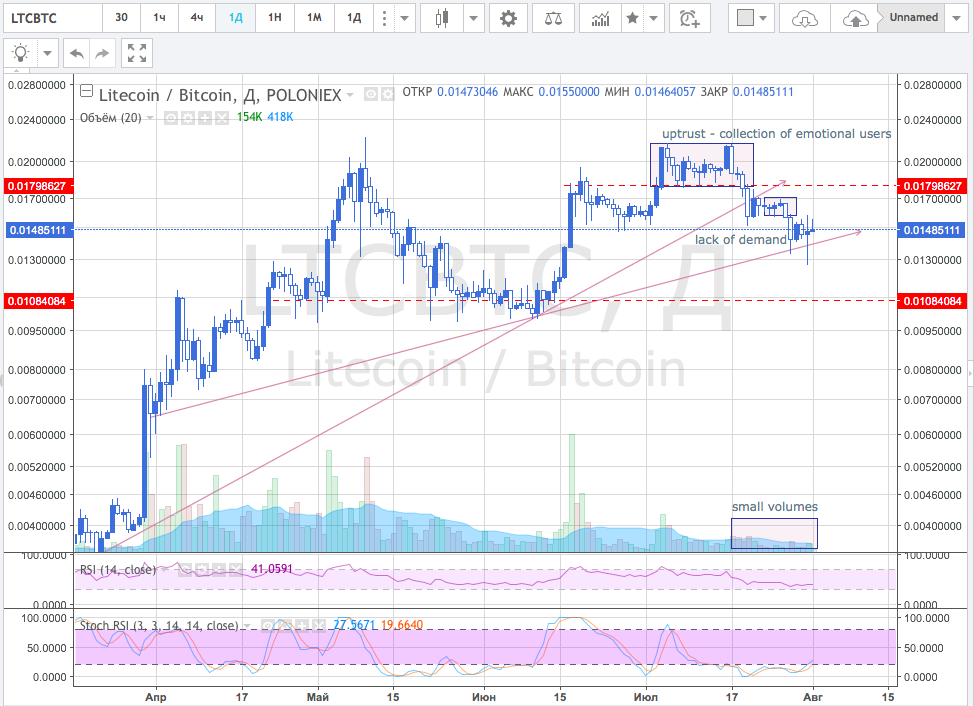

Litecoin

The total Litecoin capitalization share is five percent.

Graphically, XRP looked strong from May and has been in a growing trend. The change of mood on the whole market is related to Bitcoin news. The decrease in volumes and the update of monthly lows indicate that the asset is not ready to buy at the current price.

Promising news

One of the largest mining pools in the Bitcoin ecosystem of BTCC launches the production of Litecoin.

New York City kindergartens started accepting Litecoin.

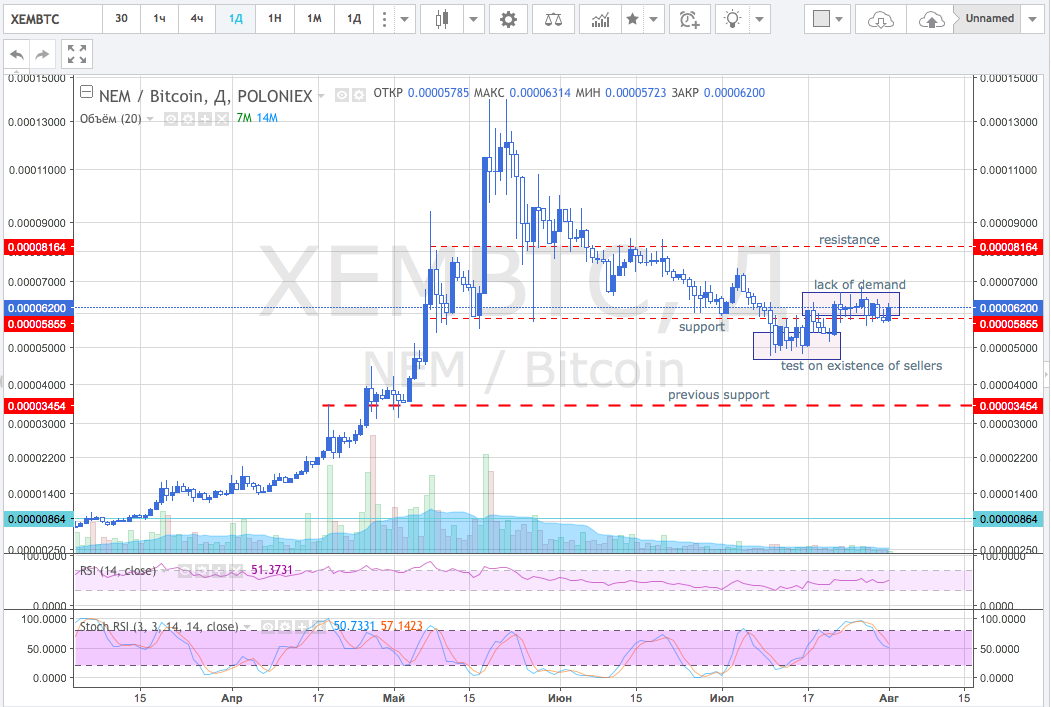

NEM

NEM is the fourth largest capitalization of crypto currency with 3.33 percent.

After fixing a new price high in May this year, the price began a two-month pullback, which seems like an ordinary distribution after a sharp take-off.

Today, the price is at the support level, where the balance between demand and supply has been established. Replenishment of forces of any of the parties will determine the further movement of the asset. It’s better to buy after leaving the "lack of demand" zone or wait for a refusal to the previous support zone.

Dash

The fifth most popular cryptocurrency forms three percent of the market value.

Since April, the price is in a fairly narrow price range, that indicates unwillingness of sellers to lower the price and, at the same time, that there is not enough demand in the market to exit this ranges.

In July, attempts were made to get the price up, but despite the SegWit news, the movement stopped and the price fell under resistance again. If the price does not go lower, there will be an entrance for purchase.

Pay attention

By the end of July, in spite of the Bitcoin network update, most altcoins price stopped their movement. The further price direction depends on the fork aftermath.

In order to minimize risks and preserve own capital, it is not recommended to conduct Blockchain transactions until the conversion is complete.