Investing in cryptocurrencies has been very rewarding and risky at the same time depending on how and when you started. Just a year ago, one bitcoin was worth $1,000. Currently, it is worth more than $7,000 after falling from its all-time high of $19,000 in December, 2017. You could have made tons of money if you had invested in bitcoin earlier but you would’ve lost a lot of money if you had started investing in last few months.

Cryptocurrencies and blockchain technologies are very promising, but they are still in experimental stage. Bitcoin has been around for only 9 years, and Ethereum is just 2 years old. Moreover there are many problems and hurdles to be overcome. Scalability, energy consumption, criminal activities, price manipulations, tax and legislations are just some of them. In other words, it’s just beginning which can be compared to the early stages of the internet. There is risk and there is reward.

So what is the best strategy to invest in cryptocurrencies?

Since the market is very new and volatile, the best way to invest in it is perhaps minimizing your risk by diversifying your portfolio. All of us would like to think that we can buy low and sell high. Unfortunately, most people end up doing the opposite. So let’s change the question to “What is the safest way to invest in cryptocurrencies?”

For example, stock market has rich and mature history. It has seen many bubbles, market crashes and economic recoveries. The wisdom and data generated in the field cannot be underestimated. From Tulip mania of the 17th century to the financial crisis of 2008 which actually gave birth to Bitcoin all have lessons to learn from. However, among them, one strategy looks more suitable in this situation. Risk management and diversification. It’s the practice of spreading your investments around, so that your exposure to any one type of asset is limited. This is designed to help reducing the volatility of your portfolio over time and reaching long-term financial goals while minimizing risk. Of course, there is no strategy that ensures profit and guarantees no loss but it is probably the safest strategy in our case because:

- Blockchain technologies are still in a very early stage

- No one knows which cryptocurrency will become dominant in a few years

- Mass-adoption hasn’t started yet

- The market is very volatile and can be easily manipulated

- Regulations and legal statuses of cryptocurrencies are uncertain

- Most governments are hostile to cryptocurrencies

Considering the situations, a safer approach is to make multiple small investments in diverse cryptocurrency portfolios over time. It will reduce your risk and you’ll feel less psychological pressure to sell low and buy high. Also it will be much easier to see the market trends since you are investing over time. For example, if you had invested daily $1 in a cryptocurrency portfolio of Bitcoin-50% and Ethereum-50% for the entire year (Apr 2, 2017 - Apr 2, 2018) even during the all-time highs, you would’ve still made $320 (+88%) today. You could have made much more than this if you had noticed the bearish trend and stopped investing in February.

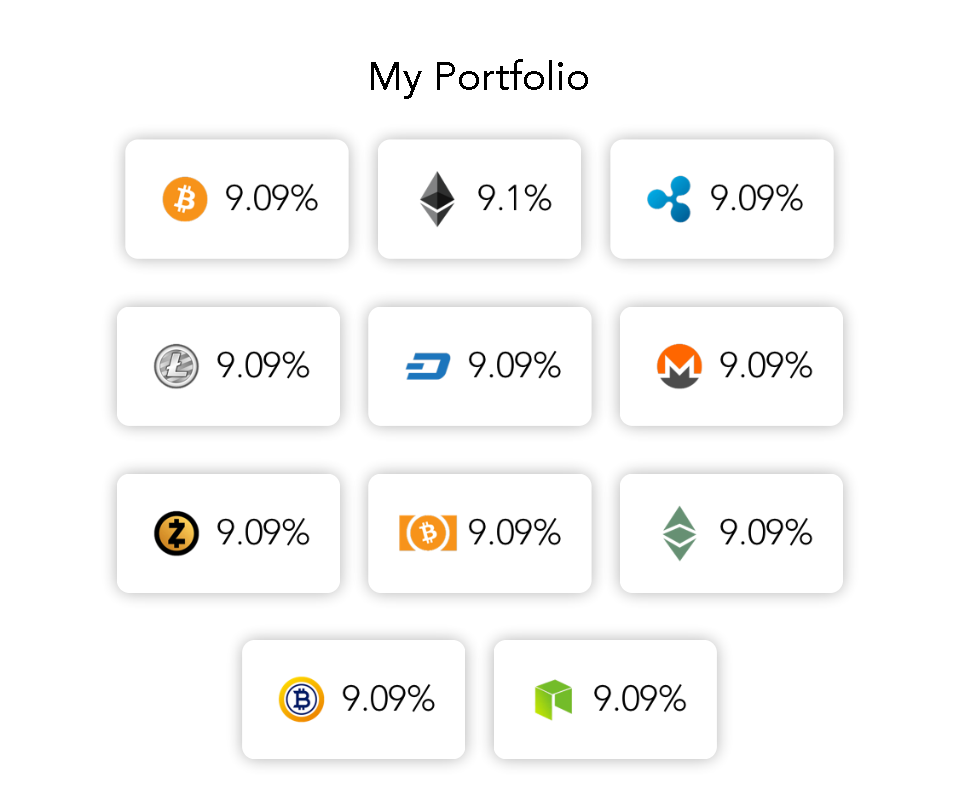

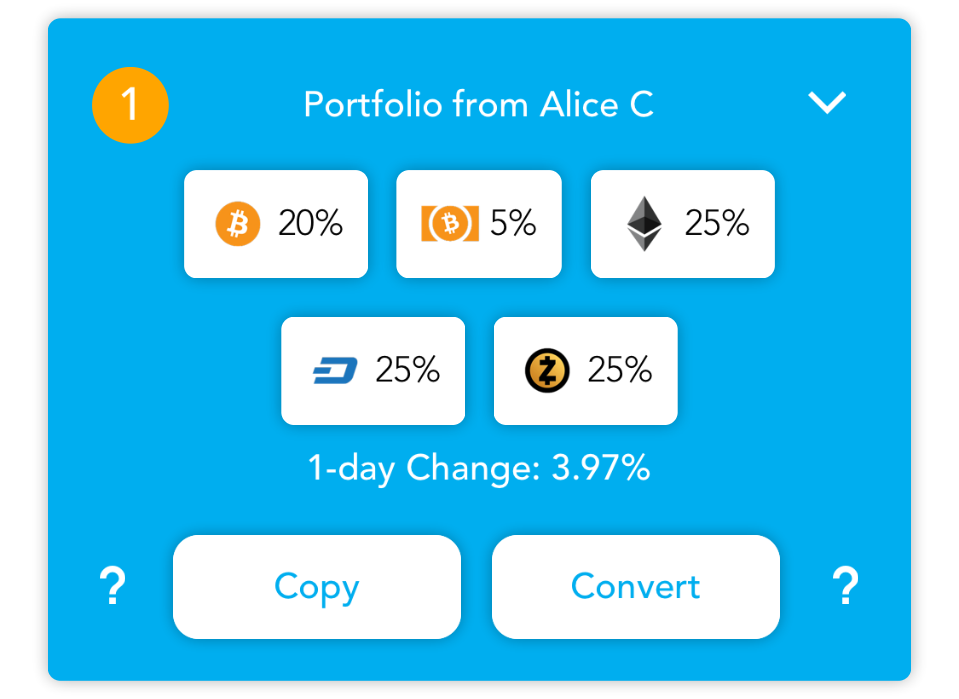

It’s the main principle behind Coinseed, a micro-investment and portfolio management app. You can create a portfolio from dozens of cryptocurrencies and make investments as small as $5 into your portfolio. You can even invest just your spare change by linking your credit cards to the app. Coinseed also ranks user-generated cryptocurrency portfolios by their returns and you can easily copy them as your portfolio or convert your cryptocurrencies to the portfolio.

Coinseed app is currently available world-wide on both iOS and Android platforms and it has more than 20000 active users.

Coinseed’s ICO is live at the moment with 10% bonus at the moment. In fact, only 2% of ICOs out there has a live product and real users before their ICOs. This puts Coinseed into that rare 2% of all ICOs.

Company name: Coinseed, Inc.

Company site: www.coinseed.co

Company email: [email protected]