Blockchain Asset Fund (BAF; baftoken.org) is the world's first hedge fund which allows anyone to participate in all aspects of Cryptocurrencies including Digital Assets, in-house Blockchain based companies, and Cryptocurrency mining. They have just added to their website information about the commencement of Pre-Sale. The speed at which the project is going shows great promise. Let us take a look at what exactly the project entails and offers to the public.

The following are the four key aspects of their product:

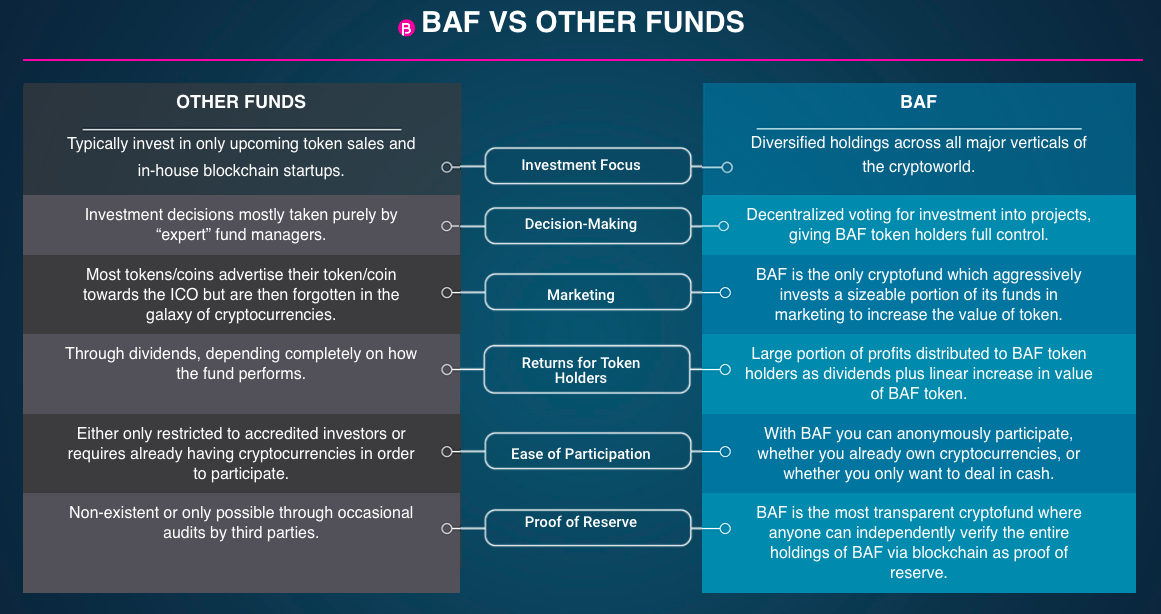

- Fund Management: BAF is the first hedge fund of its kind which allows for a truly decentralized voting on new investments by BAF token holders and gives their choice 50% of the overall weight towards the investment decision.

- Fund Diversification: BAF invests into a diversified portfolio of cryptocurrencies, digital assets, blockchain start-ups, and optimized mining operations which allows BAF token holders to automagically diversify their holdings across all aspects of the cryptoworld.

- Informed ICO Investments: Before commencing voting for a potential investment into a new ICO, the pros and cons of the token are shared internally within BAF token holders. This leads to a healthy discussion that allows BAF token holders to make an informed choice during the voting phase.

- Safety of Funds: BAF will never hold any of its funds on an exchange, and instead store all crypto-assets into an escrow smart contract holding private key of their cold storage wallets. The escrow smart contract would use oracle to access non-ethereum coins/tokens.

The BAF Investment Process

As described below, BAF has put into place a sound process for its decision making regarding any new investment opportunity. The process is truly decentralized and conducted in the most transparent manner seen in the industry:

- Investment Proposal: A fund manager or any BAF token holder may propose a potential investment to BAF.

- Investment Fact-Check: Complete due-diligence is performed that includes fact-checks such as trade volume, the crypto-community sentiment regarding the asset, social status, team strength, team history etc.

- Investment Evaluation: The potential investment is put on evaluation internally by the BAF token holders, who evaluate the opportunity based on a comprehensive set of factors.

- Investment Voting: For a potential investment, 50% of the voting weight is given to the Fund Managers, and remaining 50% is given to the BAF token holders. This approach by BAF is the display of decentralization in its pure form which is something most blockchain based technologies should ideally strive to achieve.

- Investment Decision: The potential investment proposal is accepted or rejected based on the outcome of the decentralized voting.

The Pre-Sale is open now, and the current rate at which they offer BAF tokens is set at 1500 BAF/ETH. This is a 25% bonus as compared to the next tier in the pre-Sale (there are 4 tiers in total). Based on their website, they accept payments in Bitcoin, Ethereum as well as FIAT, for their pre-sale. For queries or more information, they can be reached at [email protected].

In summary, BAF is set to democratize participation into all aspects of cryptocurrencies through a single token and on top of this, provide its token holders control over investment avenues through true decentralization. This has resulted in great demand for the BAF token and already through early investor commitments and the ongoing pre-sale, they have raised around USD 5 Million through early investor commitments and the ongoing pre-sale. They aim to complete their public fundraiser by February, 2018 and are looking forward to be listed on major exchanges in the coming quarter next year. They also intend to provide dividends to BAF token holders at the end of Q1 2018.

Company name: Blockchain Asset Fund

Company site: www.baftoken.org

Company contacts: Abhishek Bhattacharya

Email: [email protected]