When Xapo began accepting pre-orders for its debit card - charging a one-time handing and shipping fee of US$15 and offering users one card per wallet - the company was thrilled by the high demand.

International payments using debit cards have always been expensive. As a result, Bitcoin users were excited to start using debit cards, since many people live abroad and want to send money without having to deal with ridiculous exchange fees.

Private companies are searching for ways to corner the market and provide debit cards which can be loaded with digital currency, and then used like any other debit card issued by a bank. Apart from offering security against illegal use, these cards attract low fees, at least in theory.

But apparently, debit card supplier Xapo put themselves in a quandary by first promising low transaction fees when they claimed users will be charged a $15 one-time flat fee for the debit card to cover shipping and other expenses. But cryptocurrencies users showed their frustration by commenting on reddit after the details about the fee structure was revealed.

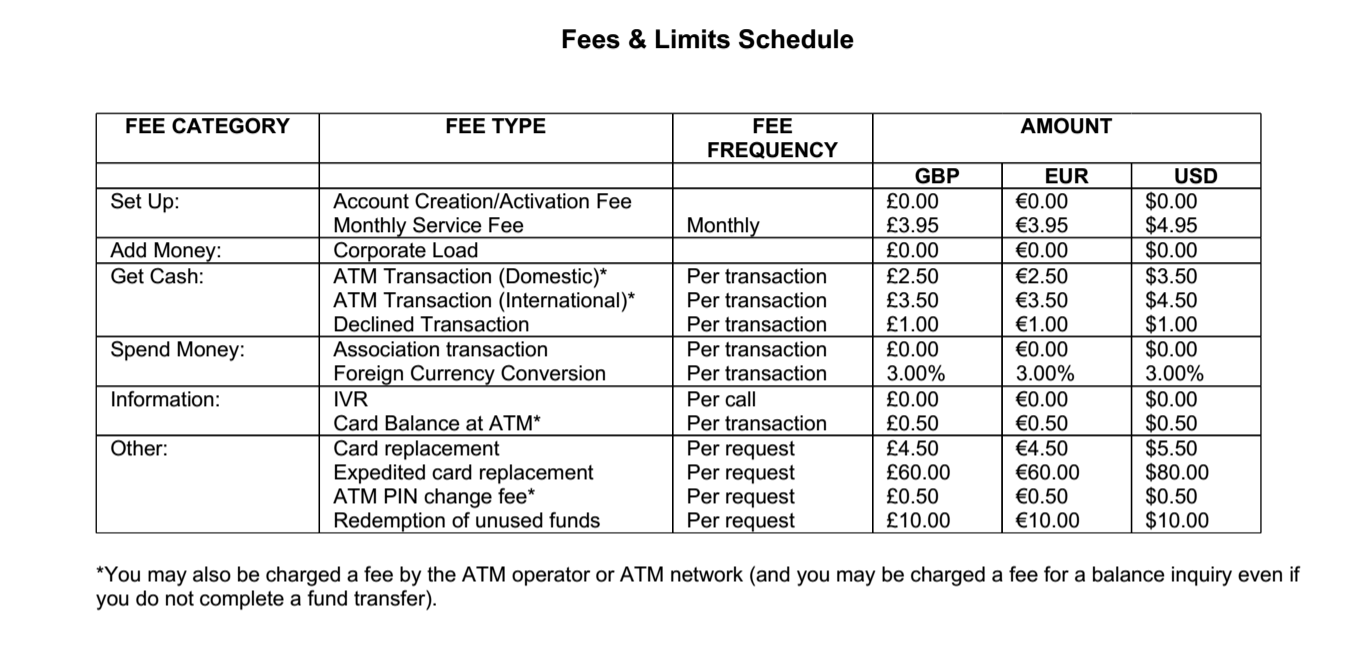

Many users became unhappy with Xapo's limit schedule and new fees as users naturally don't want to spend US$5/month for service fees, pay up to US$3.50 per withdrawal and have to deal with a 3% commission each time they convert foreign currency.

Xapo - Debit card fees & shipping update

Xapo wanted to clarify things, and thus decided to update their information regarding the fees charged for their Xapo credit card. They also apologized for having creating confusion.

Initially, the debit card was not meant to be used in ATMs; they added the functionality later on, and now they mention that "there will be charges associated with ATM usage.”

"When we announced the card, we indicated that the card would not work at ATMs, so we didn’t address ATM fees. We have worked hard to make this functionality available for the Xapo Debit Card, but there are charges associated with ATM usage, similar to ATM fees currently associated with your bank-issued debit card."

"We have no intention to mislead users into joining the program. But we realize that we did create confusion - and for that we are sorry. If you’d like to cancel your Xapo Debit Card for any reason, simply follow these steps..."

Unfortunately, Xapo's ambiguous wording led many customers to believe that there will be no extra fees added to the card (except the US$15). A potential driver of the consumer backlash was the release of some additional pricing information that came after a lot of people had already pre-ordered their Xapo debit card. Xapo explained in an August 4th press release:

“The Fees & Limits Schedule we posted is from the existing third party program under which we are currently able to have the cards issued. Under that fee schedule, there is no activation fee, but there is a monthly service fee and other fees, including card replacement and foreign currency conversion.”

On Reddit, people started complaining that owning a Xapo card is just like owning an ordinary card issued by a bank. Interestingly enough, the company mentioned a"third party provider” that we can speculate to be possibly Visa, which recently stated it is interested in “facilitating the growing use of Bitcoin and cryptocurrencies.”

Another headache for Xapo is that it now can't ship their debit cards to India and the US. Initially, they said the two countries were approved markets; however, they were notified later on that they had been reassessed. They did promise to keep users updated and notified of future developments.

Xapo finally cleared things up and argued that users will be charged a one-time payment of US$15 in order to deal with fees imposed by their partnership with a third party card issuer. Xapo explains that the parter has demanded a monthly service, currency conversion, and card replacement fee, among some other extra charges.

They never intended to deviate from their original announcement, and they added that users won't be charged monthly fees. But in case users are charged a monthly service fee by a third party issuer, Xapo stated that they will immediately cover the fee by directly sending the reimbursement to the users' wallets. Xapo’s official blogpost explained:

“When we announced the Xapo Debit Card a few months ago, we noted that there would be a one-time fee of US$15 in connection with ordering the card. That is still the case. Users who order the debit card will be charged US$15. This amount will be debited from your Xapo Wallet in bitcoins.

We do not, however, intend to charge monthly fees or fees for everyday spending. If our users are charged a monthly service fee, Xapo will reimburse that amount in bitcoins. So, if you use the Xapo Debit Card and are charged a monthly service fee by our third party provider, we will directly reimburse your Xapo Wallet.”

Anonymous redditor reviews Xapo debit card

A reddit user under the screen name “amonimus” shared his experience with the acclaimed Xapo debit card:

“TL;DR: Used Xapo Debit. Worked perfectly.

"I received the card in the mail yesterday. Completely unbranded. Looks like a regular pre-paid debit card. I went online to activate it. Apparently, My Choice / Visa Debit has a program called ‘Xapo Prepaid Visa USD Card.’”

The user went online to activate the card, but noticed the website said he had a balance of US$0.00, whereas his Xapo wallet had about US$100. A quick message to Xapo cleared everything up, however. The user was told everything would be ok.

The following day, the holder of the Xapo debit card wanted to purchase a notebook. He tried the card at a local paper store, and paid. The transaction was quickly approved. The money was successfully withdrawn from the user's Xapo account. After checking the "Xapo Treasury,” he noticed that 16.50 EUR was converted to 22.75 USD, which was the standard exchange rate.

The whole process was extremely easy according to the redditor. This could be a major milestone as anyone using Bitcoin can now spend it instantly by using the Xapo debit card. Meanwhile, nobody will even know you're using Bitcoin to pay for purchases as the card has no Bitcoin insignia on the from and instead is branded with your typical Visa logo.

In spite of the numerous advantages of Xapo's debit card, the user experienced some issues. He couldn't buy things online with his Visa card. Also, many European online retailers don't allow people to buy things online with Visa Debit. The user noted the following issues:

- I was not able to make a purchase online using my Visa Debit. I tried once, and will try again to make sure. Hopefully this isn't a problem. Many online retailers in Europe don't allow purchases online with Visa Debit so I think the use case for this debit is, for now, mostly in a retail environment;

- My purchases are still capped by how much money I have at Xapo, and am willing to trust them with;

- The forex issue could become a problem.

Nonetheless, these may just be some minor hiccups and hopefully Xapo will fix these issues in the near future so users can use Bitcoin to pay for almost anything just as they would with a regular debit card.

Did you enjoy this article? You may also be interested in reading these ones:

Looking for the best applicant for your vacancy? Or trying to find your perfect job? Send your job offers and CVs to [email protected]! We will find the best for the best.