The Gemini bitcoin exchange, which seems to have been caught up in red tape forever, has finally won regulatory approval from the New York State Department of Financial Services, according to the company’s blog this morning.

A Long Time Coming

Bitcoin investors and enthusiasts Tyler and Cameron Winklevoss have been working on the Gemini project for over a year and aimed to become the first U.S. based Bitcoin exchange to gain full regulatory approval. Instead, Coinbase announced that their new Bitcoin exchange was the first to gain domestic regulatory approval in January, as Gemini remained buried in a paperwork purgatory.

Yet, states like New York and California later said Coinbase has not met their states regulatory approval and did not receive proper licensing. So Gemini maintains a status as the first U.S. exchange to launch in full compliance with all Bitcoin regulations and consumer protection laws in its entire area of operation, which will include 26 states.

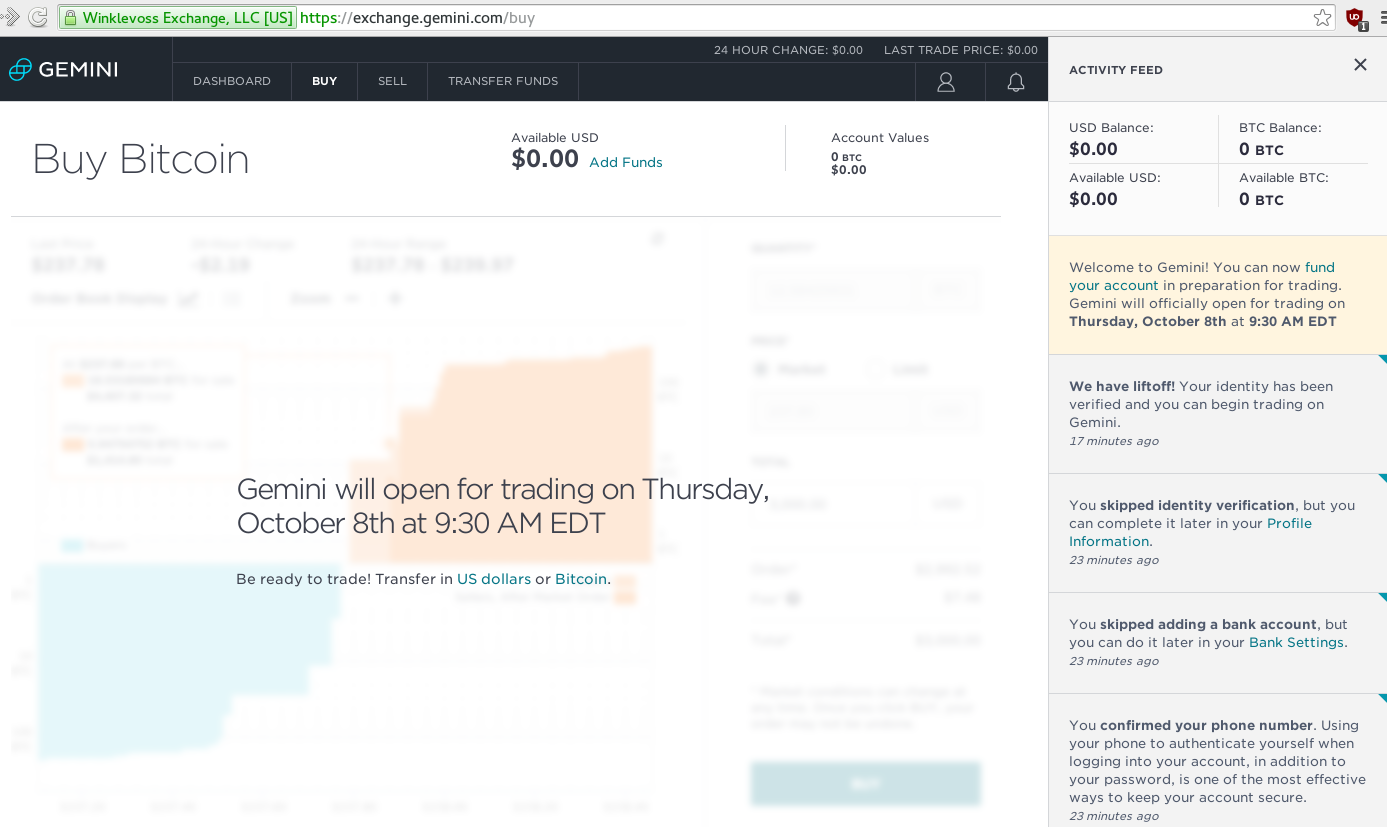

“We are excited to announce that Gemini has opened its doors to both individual and institutional customers,” Cameron Winklevoss gleefully reports on the company’s blog this morning. “We have begun sending out invite codes so you can create and fund your account in preparation for trading, which officially begins on Thursday, October 8th at 9:30 AM EDT.”

Part of the problem has also been the regulatory path the Winklevoss twins have chosen to take, seeking a larger market potential penetration where the novice investor can gain Bitcoin access through Gemini as easily as a professional investor.

Tyler Winklevoss explains to TechCrunch why they didn’t go down the BitLicense route in New York:

“We didn’t apply for a BitLicense because we wanted to build an exchange that both Main Street and Wall Street could use and trust, so we decided to obtain a limited liability trust company charter in order to do so. (Gemini will be like) NASDAQ, E-Trade, and DTC built into one.”

The team at Gemini has spent this year preparing for launch by building their consumer security program, building strong capital reserves, and crafting a robust and compliant AML (anti-money laundering) program. The end result is Gemini Trust Company, LLC, a New York state limited liability trust company.

This structure makes Gemini a fiduciary and allows them to accept both individual and institutional customers under New York Banking Law. BitLicense sanctioned Bitcoin companies do not receive such fiduciary powers. Each transaction will have a 0.25% fee.

Gemini will be available for trading in the following states and jurisdictions nationwide this Thursday: New York, Washington D.C., California, Colorado, Delaware, Florida, Idaho, Indiana, Kansas, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Montana, New Hampshire, New Mexico, North Carolina, Ohio, Rhode Island, South Carolina, Tennessee, Utah, Vermont and Wyoming.