Global investment management firm BlackRock Inc. chief executive Larry Fink claimed in early October 2017 that the significant increase in the popularity of Bitcoin and other digital currencies such as Zcash, Monero, among others, reflects the extent of money laundering activities occurring around the world. It is believed that digital assets like Bitcoin are being used for tax evasion, money laundering, and online gambling.

In a Bloomberg interview at the BlackRock Fixed Income ETF conference held in New York, Fink claimed that he believes in the potential of Bitcoin and other virtual currencies, despite the current speculative atmosphere regarding their use.

“I am a big believer in the potential in what cryptocurrencies can do.”

Meanwhile, J.P. Morgan Chase & Co. CEO Jamie Dimon has called Bitcoin a “fraud”, and said it’s worse than the seventeenth century asset bubble involving tulip bulbs, further adding that the leading cryptocurrency will “eventually blow up.”

“It’s worse than tulip bulbs and won’t end well.”

Bitcoin and the other virtual currencies currently have a combined market value of around $144 bln based on data from Coinmarketcap.com. Bitcoin accounts for about 50 percent of the total value.

More flow-through of information

Fink expressed his optimistic view on the open-source, distributed ledger called Blockchain, which is the driver behind the digital currencies. He claimed that the Blockchain technology has the capability to expedite the “more flow-through of information.”

Meanwhile, the leading virtual cryptocurrency Bitcoin posted a 2.6 percent decline to $4,288 in the latest trading.

Bitcoin, however, already increased by around 350 percent in 2017. In comparison, the S&P 500 index (SPX) has risen by 13 percent during the year, while the Dow Jones Industrial Average (DJIA) has surged by 14.5 percent.

What are the motives for using Bitcoin and cryptocurrencies?

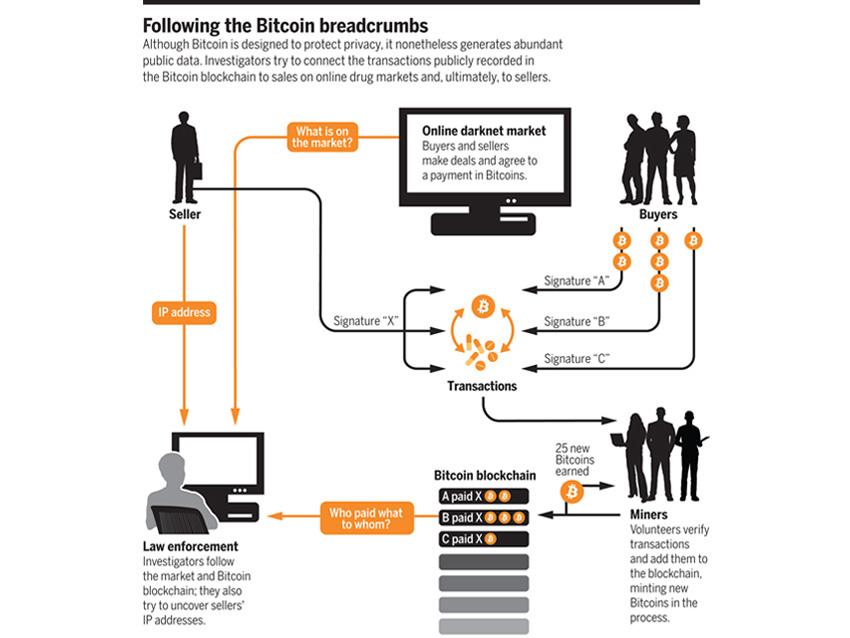

Image: Science Mag

- Pseudonymous nature

- Easy to use

- Allows multiple accounts and IP mixing to better cover their tracks, making it much more labor intensive for the authorities to easily track or “follow the money”

- Ransomware is becoming a billion-dollar industry, according to NYU and Google study

While Bitcoin transactions are not entirely anonymous - one’s cookies gathered through various web activities may still be tracked - cryptocurrencies allow for faster and global transactions, which is probably far more important for those who choose to conduct transactions over the dark web. The European Union, however, considers such move to be stupid, since tracking activities is not entirely impossible once the authorities are involved.