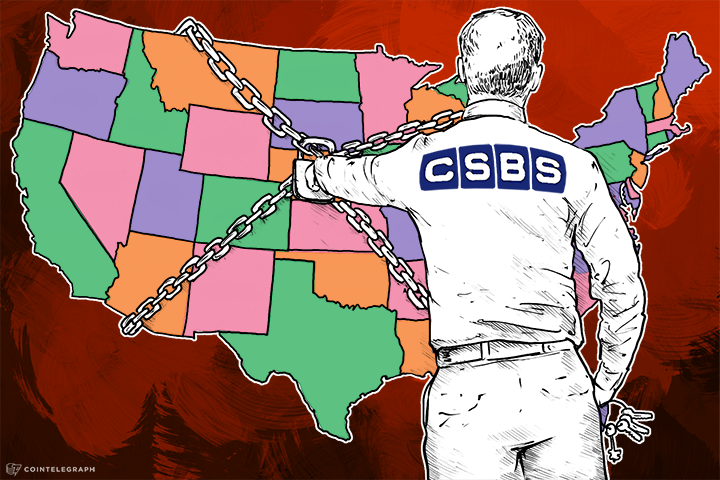

The Conference of State Banking Supervisors (CSBS) recently released their “Draft Policy on State Virtual Currency Regulation.” The CSBS is a nationwide organization of banking regulators from all fifty US states, the District of Columbia, Puerto Rico, and the US Virgin Islands who supervise 5,400 state-chartered financial institutions with a combined US$4.2 trillion in assets.

The CSBS is not a government agency. It is a confederation of regulators that work for various state agencies but is not itself under legislative control. Instead it is defined as a non-profit organization founded in 1902 and headquartered in Washington, D.C. Two of its stated objectives are indicative of the organizations goals:

- Represent the interests of the system of state financial supervision to federal and state legislative bodies and regulatory agencies; and

- Ensure that all banks continue to have the choice and flexibility of the state charter in the new era of financial modernization.

One of the functions of this organization is to suggest regulations that will help protect both the public and the economy as a whole. But another function is to protect the banks and financial institutions which they oversee. The best way to protect these institutions is to ensure that any competing economic paradigms are controlled by the very regulations that they propose.

The recently released draft policy suggestions are an excellent example of this problem. The draft does not, perhaps intentionally, make specific suggestions. Instead it seems to be an attempt to place virtual currencies under the same regulations that currently “control” the behavior of banks and the financial industry.

This might seem to be a good suggestion except for one fact: The current regulations do absolutely nothing to reign in the financial industry. Economist Fabian Brian Crain believes that applying current rules to new technology is not the way to proceed. He told Cointelegraph:

“The approach does not surprise me at all as it is common for the existing financial institutions try to apply existing rules and procedures to new and different technology. Unfortunately, there are many problems with this. It's extremely expensive, cumbersome and invasive.

Personally, I understand that these rules will be applied to companies touching fiat. But if they try to regulate pure crypto companies in the same way, this will simply accelerate and encourage the development of open-source software that is truly peer-to-peer and cannot be controlled. The more they insist on this approach, the faster technology will be developed that cannot be controlled anymore.”

One of the main concerns is the use of cryptocurrency for money laundering and other criminal activities, which the current regulations were designed to prevent. But well-intended regulations did nothing to prevent HSBS from building extra-large deposit windows for the drug cartels to deposit duffle bags of cash. Well-meaning regulations did nothing to prevent investment bankers from crashing the global economy in 2008.

Regulators understand that the regulations they create do little to either hamper criminal activity or protect consumers. They also understand that cryptocurrencies are, or can be, an existential threat to the current financial industry that they are pledged to protect. The suggested policies were clearly not designed for the stated reasons but instead were being suggested as a means to bring cryptocurrencies under their control.

The Bitcoin community received a good lesson as to what form this control will take when the State of New York proposed regulations under the Bitlicence, which seem to favor legacy banks and credit card companies. Under a centralized system of regulations, said regulations always favor those in power and rarely consider the interests of either the masses or the individual. This new proposal is not much different, although it is less detailed. The general theme was that centralized control of virtual currencies is the only way to both prevent financial crime and protect consumers.

As already stated, centralized control accomplished neither of those goals. Instead, the decentralized nature of the blockchain could enable Bitcoin to restore control of private assets back to individuals. We can discuss regulations all we want, but without a math-backed, decentralized solution, the only question on everyone’s mind is: who will regulate the regulators?

Did you enjoy this article? You may also be interested in reading these ones: