The transparency of Bitcoin goes a long way in determining the price of the digital currency, as much of the market movement can be put down to where the money is moving. However, it is a lot harder to figure out to whom the money is moving.

Financial markets are determined by supply and demand factors, as well as information on who owns an asset and who wants to buy that asset. This of course relies on market transparency, as traders and insiders watch what hedge funds and pension funds are doing with their equity holdings.

Bitcoin is obviously slightly different as the digital currency is transparent - but anonymous.

Bitcoin ownership is not transparent

While transactions and the movement of Bitcoin is open and available on the ledger, the name behind those transactions is anonymous, just a string of usually untraceable letters and numbers.

This of course makes it a bit more difficult to determine who owns Bitcoin, and where money is moving or staying, but this is seen as a positive for the digital currency.

In this digital world where cybercrime and hacking is always around the corner, those with sizeable investments in Bitcoin would prefer to remain anonymous so as to not set a target on their backs - additionally, they can spread the wealth across a number of wallets.

Bamboozling the IRS

Of course, not being able to tie mass fortunes down to certain individuals makes it frustrating for financial regulators trying to keep tabs on money for legal and illegal uses.

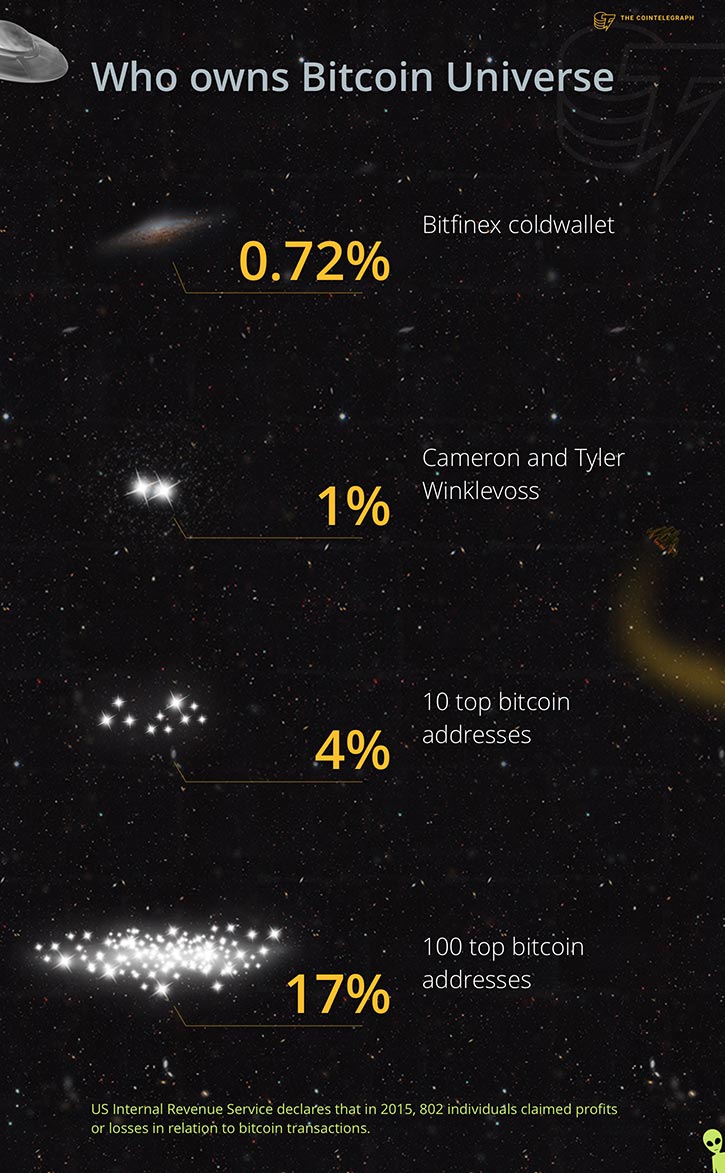

The IRS has had to rely on the trust of Bitcoin users in declaring taxable gains, but when in 2015 only 802 individuals claimed profits or losses in relation to Bitcoin transactions, it was clear that anonymity was being abused.

However, there are motions in play to help governmental institutions to track users and their Bitcoin, but it’s being met with resistance.

The Bitcoin rich list

The website BitcoinRichList, suggests that the top 100 Bitcoin addresses own around 17 percent of all Bitcoins.

This figure stood closer to 20 percent in August 2016, so one can assume that the ensuing 800 percent rally in prices since then has seen some larger holders taking profits amid increased and broadening participation.

Breaking the anonymity

Of course, while it’s easy to hide behind the anonymity afforded by Bitcoin, many come out and show off proudly their investments in the digital currency.

The biggest names in the business that are loud and proud are Cameron and Tyler Winklevoss, who once said they owned one percent of all Bitcoins. That would be around 1.65 mln at the current level that has been mined.

It is also believed that the mysterious creator of Bitcoin, Satoshi Nakamoto, who is rumored to have over one million coins, has spread his coins across wallets.

The other big players in Bitcoin include those involved in its creation, mining, or exchanges of the digital currency.

Names like Tony Gallippi, the Chairman of virtual currency processor Bitpay, who is said to have $20 mln invested in Bitcoin, or Dave Carlson, a software engineer who set up Bitcoin mining company MegaBigPower.