This article does not contain investment advice or recommendations. Every investment and trading move involves risk, you should conduct your own research when making a decision.

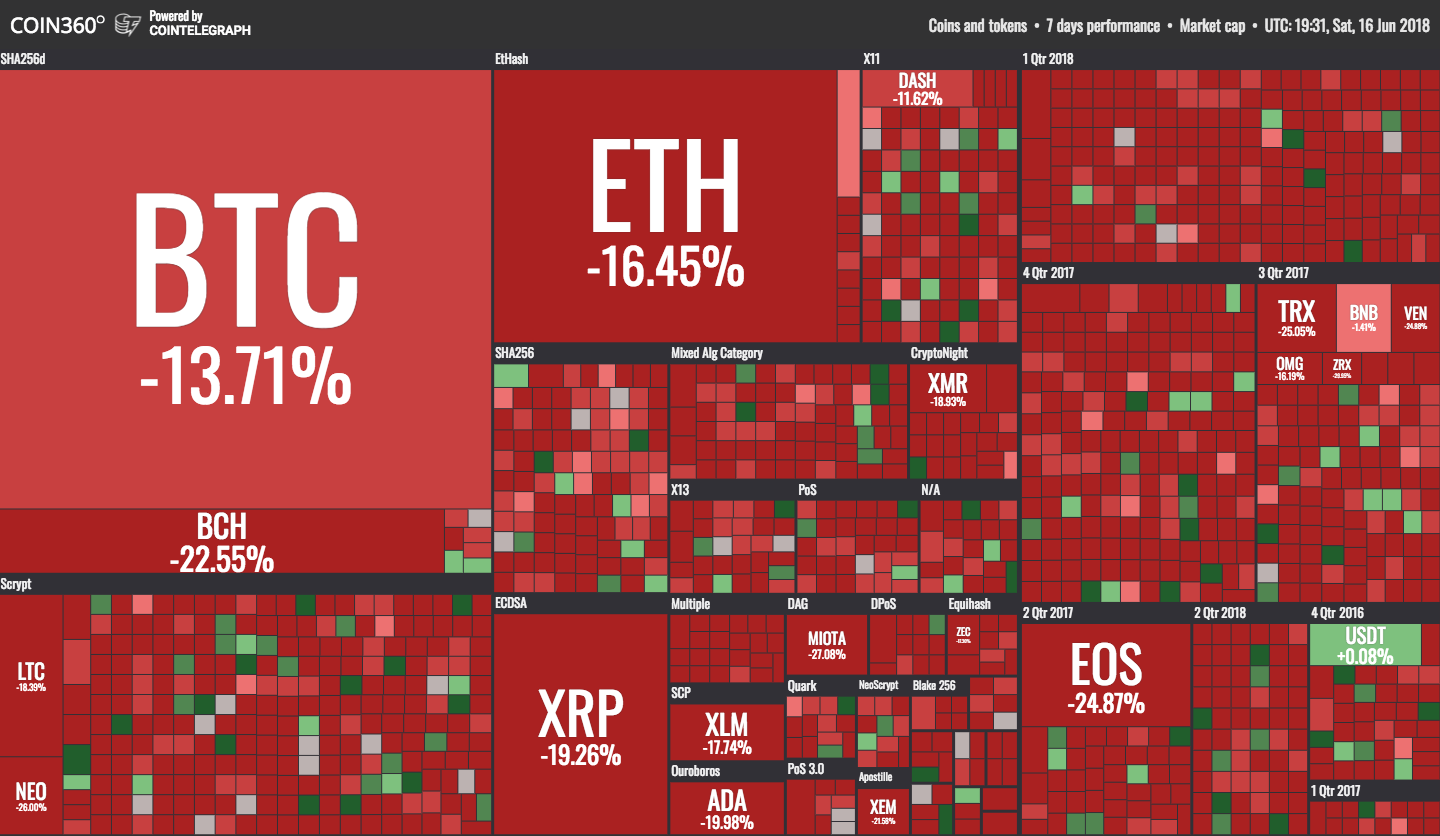

This week has not been too bright for the price of Bitcoin and other major cryptocurrencies, as the markets turned red. The price of Bitcoin started falling from around $7,600 to a low of just over $6,500 at press time.

Although this fall is not as dramatic as some others in the history of the volatile cryptocurrency, the general sentiment around the market has been negative for most of 2018. Still, Bitcoin is a volatile asset with its ups and downs still coming.

From the most recent slump that began on June 10, to a reprieve at the announcement that the SEC won’t consider Ethereum a security, the markets continue to go down, as well as up.

Source: Coin360.io

It has led many investors and interested parties to question what is going on in the market, especially in comparison to the highs of December last year.

A few experts in the field of cryptocurrency, investing, and markets spoke to Cointelegraph to give their insight into the current market situation, and why it is dropping.

Naeem Aslam, Emin Gün Sirer, Tom Lee, Miguel Palencia, and Alistair Milne, all discuss their thoughts as to the market is falling.

Naeem Aslam’s concerns with security and regulation

On June 11, it was reported that a small cryptocurrency exchange in South Korea was hacked and many mainstream media outlets tied this catalyst as a reason for the sudden downturn in the market.

However, many commentators have refuted this cause-and-effect link and have sought other reasons for why the price is down. However, regardless of how much effect the hack directly had on the price in Bitcoin, Naeem Aslam, Chief Market Analyst at ThinkMarkets, discusses how this latest hack is another instance of negative press for the cryptocurrency space.

“Exchanges are not utilising the top-notch technology to protect consumers and hackers are taking full advantage of this issue. The question is, is there any limit to these hacks? After every few months, we are seeing the same pattern emerging. This is the result of loose regulatory control and regulators must step in to protect the consumers. Anyone who wants to do with anything with exchanges should be forced to adopt high-grade security and regular security upgrades.”

The effect of these hacks adds a far bigger element of risk to investing in cryptocurrencies, and for the new market of traditional investors, and this is a big turn off.

“Traditional investors would look for riskier assets when the bull market is in full throttle and investors run for the hills when bears are in town. However, smart investors use a slightly different approach. They move their funds from riskier assets to those where they can seek safety.”

“For instance, in a bull market, sectors such as financial, tech and energy are the most favorite sectors. When the market starts to fall off the cliff, portfolio managers and hedge funds start to favour sectors such as consumer staples. They seek stocks with better dividend yield because, even though the general trend in the market could be to the downside, they still get a better yield relative to the overall market.”

Emin Gün Sirer looks at a crackdown on manipulation

One of the bigger news stories to come out this week, that has also been tied to the downturn of the market is that research indicates Tether and Bitfinex were at the center of price manipulation, which led to December’s high of nearly $20,000.

Emin Gün Sirer, associate professor at Cornell University, looks not only at this news, but also at the fact that there is a law enforcement crackdown coming on price manipulators as a reason as to why the market is down. He also explains how the cryptocurrency market has not decoupled yet, which only adds to a bigger sentiment of negativity.

“The cryptocurrency markets are in their early stages. We know this from the fact that the coins still have not decoupled — they all move in unison, regardless of the merits of one project over another. This indicates that systemic risks to the area dominate all other concerns,” he told Cointelegraph.

“The current downturn is motivated by one such perceived risk: the law enforcement action on exchanges and their effort to put a stop to price manipulation. This was a long time in the making, and cannot happen soon enough. I suspect that the law enforcement action will be modest in scope and will bring much needed clarity and positivity to markets.”

While this investigation into price manipulation may be having a negative effect on Bitcoin’s current price, it can only be viewed as positive. And for Gün Sirer, it cannot happen soon enough.

“The fact is that these technologies are poised to transform the way we do business. They should not need market manipulation to sustain their value. I'm looking forward to a decoupled world where markets are able to evaluate each coin on its own merits.”

Three reasons from Tom Lee, plus futures effects

Tom Lee, the co-founder and head of research at Fundstrat Global Advisors, who is renowned for his bullish predictions on the Bitcoin price, has given Cointelegraph three reasons why the Bitcoin market is diving, and also mentioned his feeling on futures markets.

“I think there are several factors why cryptos are falling. One, we had a parabolic move at the end of last year, so there is a period of consolidation and price adjustment that is taking place.”

“I also think bigger factors this year have been a lot of government actions that have been taken this year that have scared crypto investors, probably the most notable is the actions taken by the US regulators, like the SEC taking action against ICOs.”

“Lastly, the pace of institutional investor participation in this space has been taking longer than expected, and I think part of that has to do with the slowness of getting some of the onramps established.”

Lee also told Bloomberg that he feels that the expiration of Bitcoin futures contracts has a part to play in the most recent decline in Bitcoin price. He explains this further to Cointelegraph by saying that these volatile movements from futures will not persist indefinitely.

“Futures markets, in normal liquid markets where there is broad participation, don't have an effect on the underlie, the futures itself is adding liquidity, or attracting liquidity, because institutions can use it,” Lee explained.

“In crypto right now, the market has a supply/demand problem, because mining rewards, coupled with tax selling, and other factors have caused more supply versus demand for crypto. The futures markets have been subject to some potential manipulation. I don’t think it will be the case in a few years from now, but even though the futures markets at the moment are only a hundred-million or so contracts, it is enough to affect Bitcoin price.”

Miguel Palencia’s position on ‘whales’

For Miguel Palencia, chief information officer at Qtum, which currently ranked 20th in terms of market cap, this current low has a lot to do with the faux-decentralised nature of cryptocurrencies which are still expanding and distributing.

He talked to Cointelegraph of the effect that ‘whales’ are having on moving the price around, but also makes mention of how these types of players in a relatively small and new market are also helping the ecosystem stay alive.

“Bitcoin, like other assets and technologies, goes through cycles that affect its use, which is often correlated with the asset price. What we see here, is that the cycle was accelerated by situations which can be solved by fully decentralized operations. Eventually, when the blockchain ecosystem becomes fully decentralized and not controlled by big stakeholders and "whales," it will be bringing back trust into the markets and we can see the markets climbing again, on the other hand, these market movers and shakers, supported by true Bitcoin believers, will not let Bitcoin reach zero.”

It is a double-edged sword then, according to Palencia. Whales must surely have a part to play in the supposed market manipulation, but they are also a driving force in keeping the market afloat with their own investment.

Alistair Milne’s view on the rapid slowdown

Alistair Milne, CIO of Altana Digital Currency Fund and founder of Cointrader, is examining the entire year’s performance and putting that December rally into perspective. The markets may well be down compared to the highs of $20,000, but $6,000 or $7,000 per BTC is still pretty good.

“It is a combination of a rapid slowdown in adoption, user-growth and profit-taking, as well as hedging,” Milne told Cointelegraph, explaining why he believes the market is where it is currently.

“Altcoins particularly became very over-valued and were overdue a correction. We are now searching for equilibrium again, where demand meets supply. From a macro point of view, it has never been better, so I feel comparisons to 2014/15 are misplaced.”

While many are hoping the bottom has been reached and the downturn is ending, Milne still thinks it is coming, but that it will provide a much more stable base to rebuild upon.

“I think after we eventually bottom, it will be a far more gradual comeback for the price likely accelerating in 2019.”

No need to panic

The sentiment around the markets may be negative and one for concern when it comes to everyday investors, but overall, the experts spoken to do not seem to be raising any cause for alarm.

Gün Sirer is calling for more regulation and policing to try and stamp out the perceived market manipulation, and Palencia raises a good point about the need for whales at the moment, but in the future, true decentralization will be reached and Bitcoin will be stronger for it.

Milne is also looking ahead, not worried about a bottom still-to-be reached, as it would allow for Bitcoin to gradually come back stronger. Aslam also brings up an important aspect that needs to be sorted out, that of hacks and poor security which are affecting market confidence.

There is a lot that needs to be patched up in the cryptocurrency market, and when these things are sorted out, the price should follow in repairing itself to a more pleasant level.