Note: the following article was submitted as part of Cointelegraph’s Super Writers Contest.

Bitcoin may be a fine example of decentralized engineering, an amazing technical tour de force, and even a possible solution to the world's money problems. But what good is all of that if people don't hear about bitcoin, embrace it, and learn to use it?

A story of alternative currencies

During America’s Revolutionary War the new alternative currency was the Continental Dollar, and when it failed, the people's confidence in paper money was deeply affected. As a result the US Constitution specifically prohibited any state from making anything but gold or silver legal tender in payment of debts. The US government didn't again issue paper money until 74 years after the signing of the Constitution, around the beginning of the Civil War.

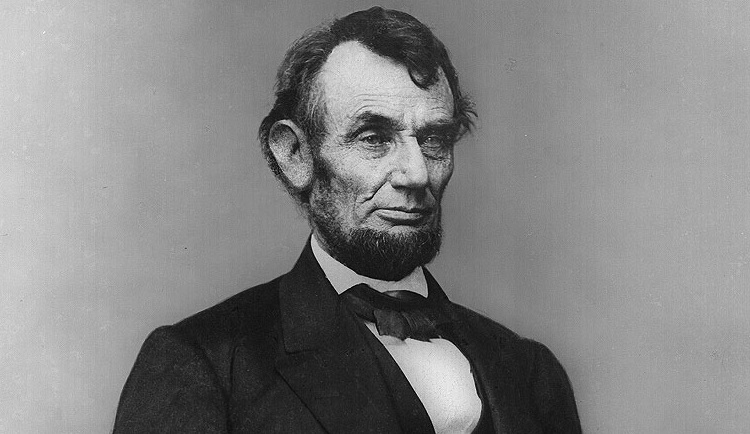

Sometimes a new currency can meet its political demise. President Abraham Lincoln's unbacked Greenbacks, despite being debt free currency, or perhaps because of it, didn't get much of a chance to endure. It carried no interest payments to use it, and the president considered this his greatest gift to America. Lincoln declared:

"I have two great enemies, the Southern army in front of me and the bankers in the rear. And of the two, the bankers are my greatest foe."

The bankers published an ominous declaration of their own in the London Times:

"If this mischievous financial policy, which has its origin in North America, shall become endurated down to a fixture, then that Government will furnish its own money without cost. It will pay off debts and be without debt. It will have all the money necessary to carry on its commerce. It will become prosperous without precedent in the history of the world. The brains and wealth of all countries will go to North America. That country must be destroyed or it will destroy every monarchy on the globe."

After successfully issuing over US$450 million in America's newest paper money, Lincoln was assassinated. The war was over, and the money was immediately recalled.

Fast forward to the late 1990s, during which there were two major experiments in establishing an alternative currency. One was called Beenz, which reflected some of the creators' insight in choosing a catchy name. But Beenz was described as a vaguely worded point system that few could understand. And its sketchy method of bypassing currency laws did not inspire confidence. It was soon forgotten as the new millennium approached after a failed attempt to go public.

Also during this decade was the innovative money scheme called Flooz, which entirely by coincidence rhymed with "lose." So from the start it had that subliminal effect going against it. But everyone knew S&H Green Stamps and Flooz were based on a similar idea that rewarded customer loyalty. After two years and US$50 million in venture capital money, it also failed. Not that it wasn't popular. Its biggest user was reportedly the Russian mob, who preferred Flooz over other money laundering methods. Not even Whoopie Goldberg's sponsorship would save this one.

At least bitcoin doesn't end with a "z." That would have probably led to its early demise. A choice of a name can carry a lot of weight. Imagine being offered to trade your hard earned dollars for some bitcoinz, or maybe some roonz. No thank you.

Since the 1990s, Japan has suffered a series of economic problems. As a result, this country is today estimated to have over 600 active alternative currencies in circulation. The Japanese government seems to have fewer issues with alternative currencies than the Feds.

The NORFED Liberty Dollar was removed from circulation after a long fight with the US authorities, who declared that issuing any coinage that was meant to compete with official US coinage while looking similar was a criminal act. Prosecutors at the Justice Department had determined these gold and silver coins were in violation of US Code. The FBI and Secret Service promptly confiscated the entire hoard of silver, gold and platinum in November 2007, including two tons of Ron Paul Dollars. Liberty Services owner Bernard von NotHaus is still in court attempting to recover his assets worth roughly US$7 million.

Who's heard of Bitcoin?

Any of these currencies might have had a better track record had they enjoyed enthusiastic public support and wide circulation. Widespread acceptance of a new currency can mean the difference between it becoming a household word or a forgotten footnote.

So how can one support bitcoin? Besides the obvious activities of purchasing it, transacting with it, mining it and accepting it for services, how can we support awareness of this new cryptocurrency?

Whenever I'm standing at a checkout counter, once I see the cashier isn't counting change or otherwise occupied, I'll ask a simple question. Actually, it's two questions. First, "Do you mind if I ask you something I ask a lot of people?" The next question is the money maker. "Have you heard of Bitcoin?"

I've found around 10 % of those surveyed can remember hearing something about it. But there is a problem. Most of these people report a negative or doubtful opinion, predominantly due to the strong association with the Mt. Gox failure widely reported in the news. The general impression among the public seems to be that Bitcoin went down the tubes with Mt. Gox, its first trading platform.

First impressions, especially negative ones, are hard to shake.

Why isn't bitcoin's value headed to the moon? One website provides an impressive list of the companies accepting bitcoin. These everyday names include Overstock, Tesla, WordPress, Amazon, Dell, Target, Microsoft, and Dish Network. It's a long list. The corporate sector appears to be well aware of the potential. But what about the everyday user, the man or woman on the street? Why would they remain more confident in a currency that is backed by nothing but faith, and has lost 96 % of its value since 1913?

The story that must be told

If Bitcoin is to be vastly successful, it may require more than an offer of a ride in a spaceship to help it break through. If we really care about the success of this ingenious innovation, we need to put our collective marketing efforts behind it. Bitcoin has a thousand stories to tell.

One of my favorites is how I purchased US$100 of my Christmas gifts for just US$6 worth of bitcoins acquired months earlier. That one usually perks up some interest. We have to tell our stories to drown out the negative ones about Mt. Gox, volatility, computer virus ransoms and Silk Road. We have to turn the tide of fear, uncertainty and doubt back to our favor. There is a lot of work to do, and we need every evangelist of cryptocurrency to speak in favor of it.

What's your story?

About the author

Kevin Tambling is a digital currency professional, online marketer and web developer living in Central Florida.