Japan's Rakuten has started to accept Bitcoin as a payment method, UK government announces an additional £10 million funding to research further into digital currencies, US$12 million worth of bitcoins disappear in Dark Net marketplace scam, and more top stories that happened this week.

UK Government Pledges £10M to Digital Currency Research, Alongside Regulation

The UK government announced a £10 million, or US$14.6 million, research fund to look into opportunities in digital currencies.

Publishing the results of the five-month consultation on the future of digital currencies, the government outlined a series of recommendations and the next few steps on their approach to the emerging sector:

"The government is launching a new research initiative which will bring together the Research Councils, Alan Turing Institute and Digital Catapult with industry in order to address the research opportunities and challenges for digital currency technology, and will increase research funding in this area by £10 million to support this."

Japan’s Rakuten Becomes Largest E-Commerce Business to Accept Bitcoin

Japan's largest Internet company Rakuten Inc., announced it has started to accept bitcoin as a payment option on its American portal Rakuten.com, becoming the largest e-commerce company to embrace the digital currency.

The company said this first integration should be followed closely by other global marketplaces integrations, including its German and Austrian e-commerce portals.

Facebook Launches P2P Payments, Denies 'Building Payments Business'

Facebook, unveiled Tuesday a new payments feature that allows users to send money through its messaging app, Facebook Messenger. The feature, which is expected to roll out in the US over the coming months following by the UK in late-January 2015, is defined as "a more convenient and secure way to send money between friends."

US$12 Million BTC Disappear in Dark Market Scam

Evolution, one of the largest like other online drug markets, used bitcoin as a medium of exchange. Leaders Verto and Kimble ran off with an estimated US$12 million in bitcoin. The shuttering of its doors could be a major reason the price of bitcoin took a nosedive from around the US$290 mark to around US$255.

Some lost a huge chunk of money in the swindle. “I have lost everything I had worked for over the past year. That was my retirement fund,” one user said.

Ukraine to Shut Down Separatists’ Bitcoin 'Accounts'

Ukraine will block the Bitcoin accounts of "separatists" in the country’s east. Such was the statement of the head of the Security Service of Ukraine (SBU), Valentyn Nalyvaychenko.

According to Nayvaychenko, the SBU and the State Financial Monitoring Service will put special focus on cards and bank accounts. He also listed Bitcoin among the payment instruments subject to control.

He stated:

"Another aspect of the joint work of the SBU and SCFM, as well as the Ministry of Internal Affairs, where necessary, is the blocking of accounts, cards, various 'bitcoins' and so on, where the separatists are trying to funnel money."

Elsewhere

Privacy-centric messaging app Wiper has been pulled from Apple's App Store in China after the start-up introduced a feature allowing users to send and receive bitcoins within messages, reported TechCrunch.

BitGo announced that individual users can now avail themselves of Bitcoin security features at zero cost. Businesses looking to secure their Bitcoin holdings can also try BitGo’s services for free, reported NewsBTC.

MGT Capital Investments Inc. announced on March 17 it had suspended discussions with Tera Group, Inc., owner and operator of TeraExchange, LLC, a Bitcoin derivatives exchange regulated by the US Commodity Futures Trading Commission. The said agreement was intended to found Tera Group going public on the New York Stock Exchange.

Reddit user Kinitex has been crunching the numbers on the scale of Bitcoin thefts over the last four years. Tallying over 900,000 BTC being stolen in this period, the inquisitive user works out that an average of over 18,500 BTC being stolen per month since 2011.

Cryptocurrency and Bitcoin related software products and services provider Newnote Financial has acquired Canadian based Bitcoin exchange Cointrader.net, the CoinZero Point-of-Sale System and ATM machines in London and Tokyo among other assets for US$1.2 million in cash and stock. The deal makes Newnote the world's first and only publicly traded Bitcoin exchange listed on three stock exchanges.

New Bitcoin ATMs

In light of Cointelegraph's partnership with Coin ATM Radar, we have compiled a list of the Bitcoin ATMs that went live this week.

On February 15, a new one-way Genesis Coin Bitcoin ATM was installed in Hong Kong at the World House, Reilsons (HK) Limited Shop 215, 2/F, 19 Des Voeux Road, Central. Operated by BitFX, the device resulted from a collaboration with Filipino bitcoin exchange Coins.ph, and is available everyday from 9am to 6pm.

Congratulation to @BitFXnow and Coins.ph for the launching of Bitcoinnect Jr. in Central HK~@bitcoinpoet @RedditBTC pic.twitter.com/AKuS2dW10W

— Bitcoinnect (@Bitcoinnect) March 11, 2015

In Toronto, Canada, a two-way BitAccess machine was installed at Pearl King, 291 King St W. Operated by BitSent, the device is available everyday from 11:30am to 10:30pm.

On March 16, Romania welcomed its third Bitcoin ATM, a two-way BitXatm located at The Pub - Pilsner Unique Bar, Bd. Regina Elisabeta, No.9, Bucharest. Operated by BitcoinBank Romania, the device is limited to 6,000 RON and charges a 2% fee per transaction.

The machine should support Litecoin, NXT and Dogecoin as well, in the near future.

Market Activity

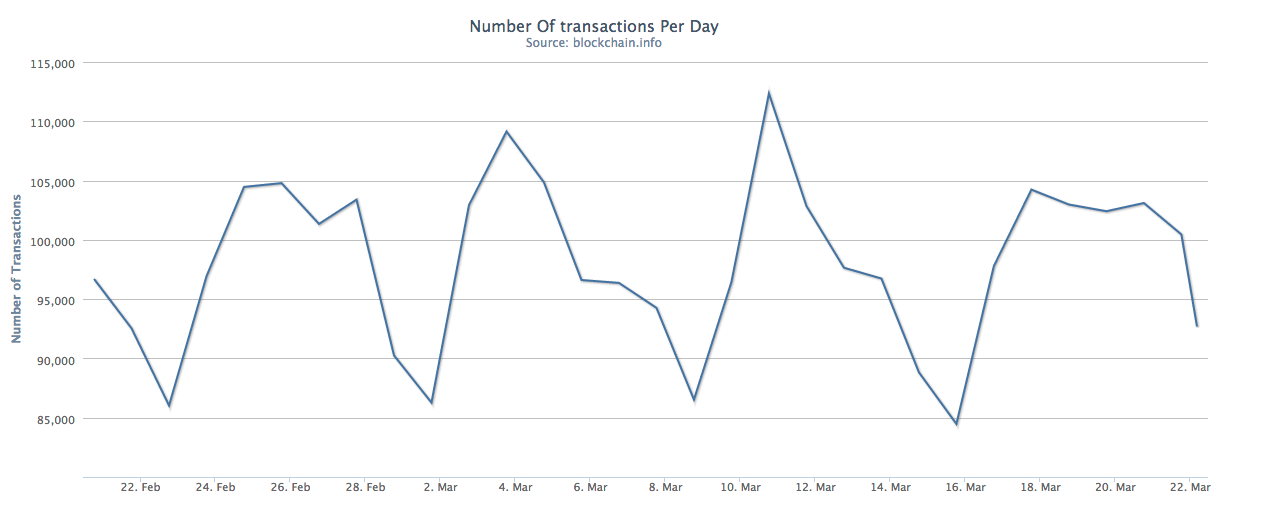

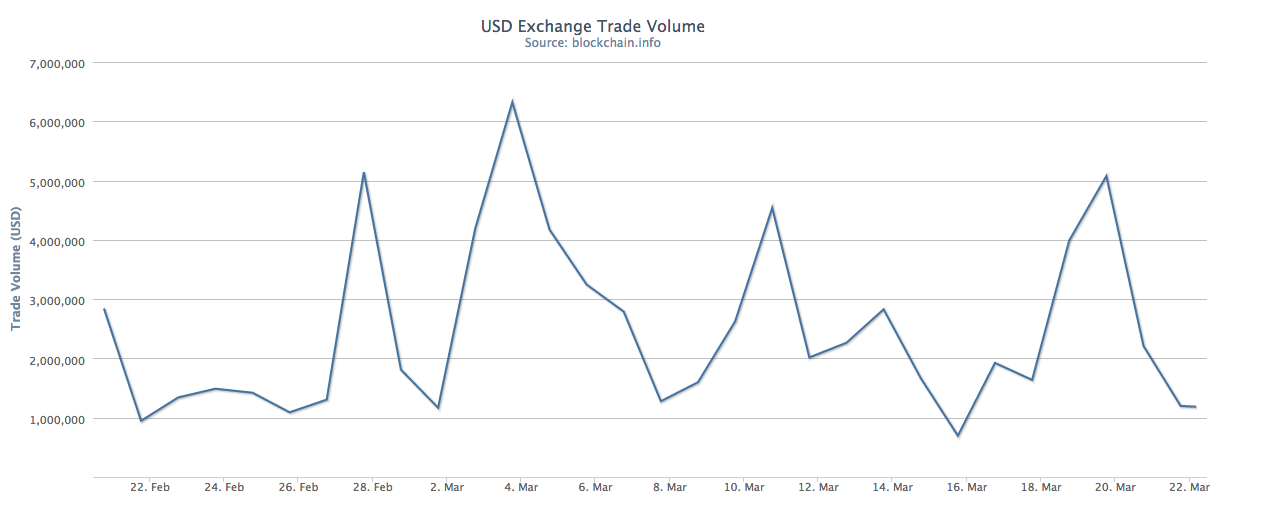

Last week, many bitcoin enthusiasts were watching and waiting for the digital currency to cross the US$300 mark. As of today, the BTC/USD price is down to 260 BTC/USD, according to Blockchain.info data.

Most importantly, we didn't see a meaningful rebound. Bitcoin stayed above 250 BTC/USD but the slump was not erased, which might suggest that the short-term trend changed. The rally might have run out of steam and we might have just seen the first signs of the continuation of the long-term decline.

Did you enjoy this article? You may also be interested in reading these ones: