A new report says that U.S. banks and corporations have outpaced every other country in global investments in FinTech over the past few years. Investments in the country have nearly tripled, supporting startups through the launch of competitions, accelerators and incubators, helping new businesses to seek potential partners and investments.

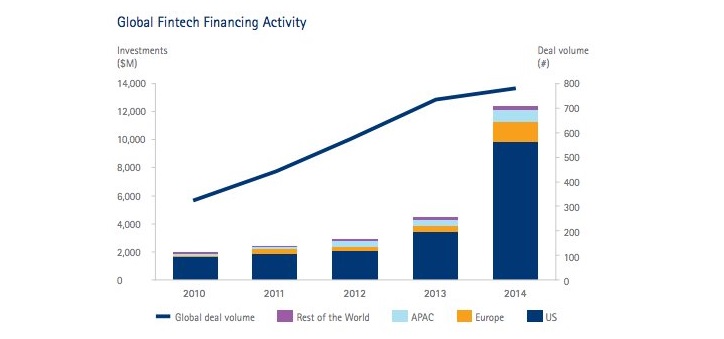

According to the report released by Accenture and entitled “The Future of Fintech and Banking,” global investments in FinTech tripled to US$12.21 billion in 2014, as investments in financial technologies like Bitcoin and online lending platforms grew by more than double at 200%.

A recent report published by CB insights also found that most investments were made by U.S. corporations and venture capital firms, totaling up to US$1.1 billion in Q1 and Q2 of 2015.

Robert Gach, managing director of Accenture Strategy Capital Markets, said:

"An increasing number of [U.S.] banks and insurers are investing in connecting into the FinTech ecosystem, whether through accelerator or incubator labs, venture investments or in other ways. We believe this explosive growth in FinTech will help drive innovation within some of the world’s largest financial institutions.”

U.S. Dominance

The graph of global FinTech financing activity shown above was provided to Business Insider by Accenture and the Partnership Fund for New York. It shows that U.S. corporations are responsible for around US$10 billion of the total global investments in FinTech for 2014.

Bitcoin, payment transactions and loan-focused companies, among all the startups, are attracting more global interest, accounting for 71% of the FinTech investment deals in 2014 and 2015. Accenture foresees that the next major areas for FinTech disruption in 2015 could be the insurance sector and cloud computing.

The dominance of U.S. corporations in the FinTech industry has been made possible through connections between FinTech startups and well-established financial institutions and banks. Such connections are, in part, set up by accelerators and incubators, such as Accenture’s FinTech Innovation Lab, targeted to support FinTech companies.

Wall Street ‘Powwow’

In continuation of their search for possible investments in the FinTech industry this week, Wall Street companies and banks held a ‘powwow,’ presenting seven new FinTech startups at Bank of America’s New York city offices. They were joined by a group of investors and bankers from Goldman Sachs, JP Morgan Chase and American Express. Maria Gotsch, CEO of the Partnership Fund for NYC said:

"The focus is on companies where a large financial institution is either a customer for that tech company or a partner.These are tech companies that are bringing innovation into the system.”