Morning Consult conducted a national survey of 1,999 registered voters in the U.S. from Oct. 13 -15, 2016, and came up with data that shows that more than six in ten consumers want a repeal of the merchant markup, known commonly as the Durbin Amendment of the Dodd-Frank Act.

As a part of the 2010 Dodd-Frank Act, the Durbin Amendment lowered debit card interchange fees — charges that stores pay banks every time a customer swipes a debit card to make a purchase — costing consumers an estimated $4 bln annually.

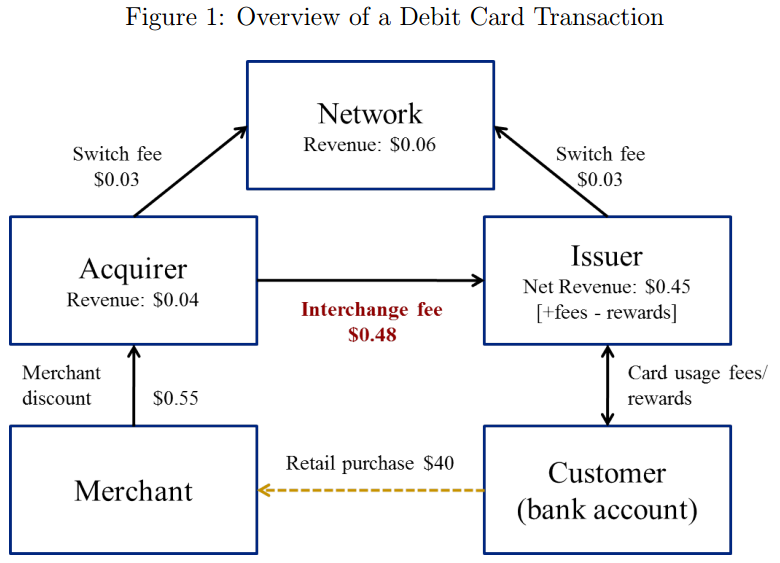

According to the Federal Reserve, a transaction involves five main parties: the consumer, the consumer’s bank (the issuer), the merchant, the merchant’s bank (the acquirer), and the card network.The issuing bank offers a deposit account and a debit card to the consumer, and the acquiring bank offers card reader technology and processing activities to the merchant.

The network establishes rules for card transactions and coordinates the transmission of information and funds between the two banks.

In a debit transaction, the interchange fee is paid by the acquirer to the issuer, and is generally deducted from the amount transferred from the issuer to the acquirer when settled. Interchange fee schedules are set by the network that carries a transaction such as Visa, MasterCard, or one of the PIN debit networks.

Prior to the Federal Reserve Board issued Reg II in June 2011 to implement the Durbin Amendment, the interchange fees were set at $0.48. Afterwards, the Board notes:

“Under the regulation, on Oct. 1, 2011, interchange fees for issuers with assets greater than $10 bln were capped at 21 cents plus 0.05 percent of the transaction value. Reflecting a provision in the statute, Reg II further permits covered issuers to receive a 1 cent adjustment for fraud prevention costs. Together, the interchange fee cap and fraud-prevention adjustment imply a maximum interchange fee of 24 cents for a $38 debit card transaction, a decline of 45 percent from the average value of 44 cents for the same transaction in 2009 prior to the Durbin Amendment (Federal Reserve Board 2011b).”

Merchants are pocketing the savings

Since the rules took effect in 2011, and with consumers saying enough is enough, retailers have pocketed $36 bln from the Durbin Amendment, according to a Reuters report. This has turned it into nothing more than a merchant markup that pads retailers’ bottom lines.

Also, fees on deposit accounts increased by an average of three to five percent, leaving consumers to face monthly account maintenance charges (with higher minimum balance requirements to avoid those monthly charges), insufficient-funds fees and inactivity fees.

Banks also cut back on debit card rewards programmes to add more rewards to credit cards which weren’t covered by the Durbin Amendment.

Now, according to the results from the survey, which has a margin of error of plus or minus two percent points, consumers think the amendment should be repealed if merchants are not passing the savings onto consumers.

This is based on a study by the Federal Reserve which confirms that merchants are not handing over the savings they receive from the Durbin Amendment. Instead they are pocketing six to eight bln dollars every year since the regulation was implemented — all of which should have been passed along to customers in the form of lower prices.

Molly Wilkinson, executive director of the Electronic Payments Coalition, told Reuters:

“It is clearly time to repeal the Durbin Amendment, which is nothing more than a merchant markup that has served the special interests of big box retailers for far too long. Customers are not benefitting from the price controls on debit interchange transactions and this new data shows consumers support ending this failed policy.”

Chairman Jeb Hensarling of the House Financial Services Committee and Representative Randy Neugebauer have introduced legislation to repeal the Durbin Amendment.