Following a long-term bearish trend on altcoins this autumn, the cryptocurrency market was surging at the end of the last year. Altcoins as Ripple (XRP), Stellar (XLM), Verge (XVG), Cardano (ADA) skyrocketed in the course of two to three week. Many others grew in price by five to ten times with the record-setters, such as Tron (TRX) and Verge - by 20 to 30 times respectively.

Many altcoins proved to be stabilizing. Major players such as Ethereum (ETH) increased immensely with a huge capitalization. It should be noted that the increase in prices has been growing alongside a relatively stable BTC price, which means that all the generated profits were nominated not only in US dollars but also in BTC.

By investing a minimum of one BTC in XVG at the price of 50 Satoshi in early December, an investor could sell it at the price of 1,500 Satoshis with a 30-time return on investment within just two weeks. To make a good investment in these coins, one simply needed to register at three major cryptocurrency exchanges, such as Bitfinex, Bittrex, Binance. There you can also monitor listings of new coins that could generate substantial profit as demand for them grows in the long run.

Unknown heroes

Another area on the market that is less known, but no less potentially profitable, is emerging crypto assets that are not yet listed on major exchanges. And this is not surprising, as being listed on a major exchange is rather time and effort-consuming for any startup project. Hundreds of applications are received by markets every day, but cannot be accepted immediately, as new coin undergoes a check of its technical specs of a new coin and its real demand on the market.

Each new coin that is to be listed would either draw back the liquidity from other traded pairs or become a dead-weight and delude the traders damaging the exchange’s reputation at the same time. Several instances of this can be observed at the hitBTC listed pairs overview.

That is why a great number of really valuable up-and-coming crypto assets with good chances for growth are starting at minor exchanges, where the conditions to be listed are less strict. Here these coins are making the first sparkles and then increase in price several times more once they get to a big exchange, like Bittrex. These are assets that if managed correctly from the start could make an investor very rich.

Little five

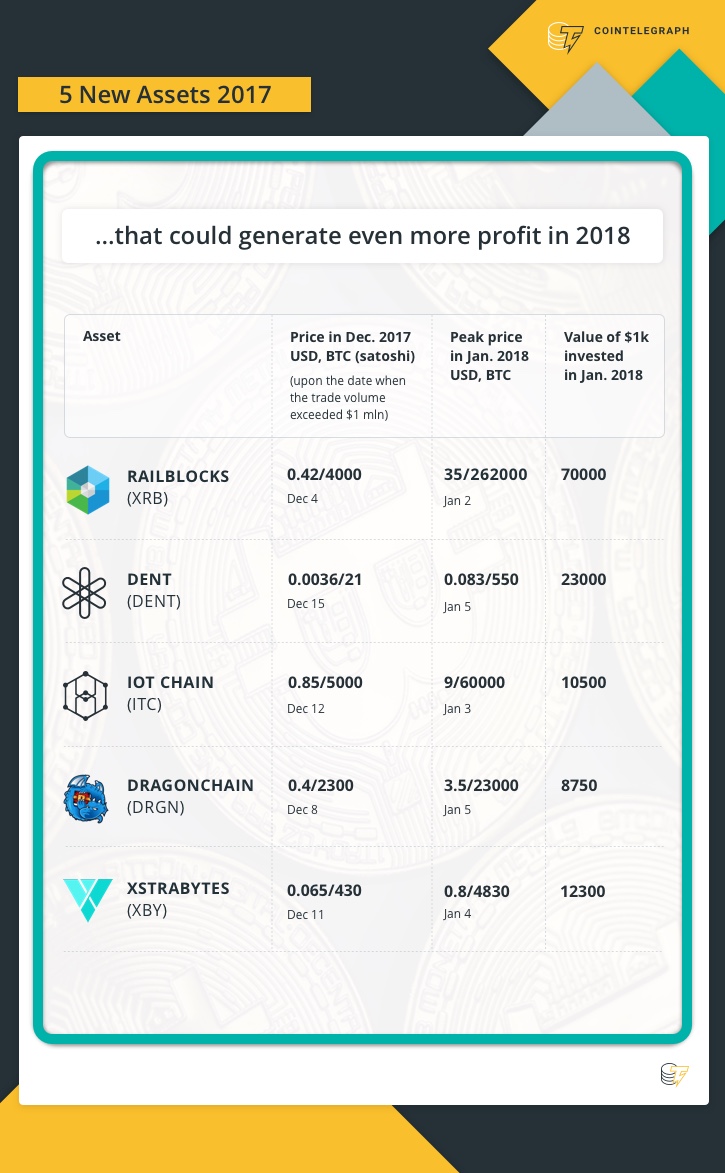

Let’s look into five new assets that, if invested in December 2017, would have generated an amazing profit for the investor and could maybe generate even more in the near future.

Only assets with the trade volumes no less than $1 mln were taken into consideration. All the “shit coins” that are growing at pump and dump schemes were filtered. Assets that are traded at major exchanges such as Bitfinex, Bittrex, Poloniex, Binance were not taken into consideration either.

All mentioned crypto assets (or “coins”) have been selected by the following criteria:

- Technology and demand from crypto or other industry (=likelihood of high future demand)

- Trading on a small exchange (=low price may result in few people having access to trading these assets. Thus, demand is low at the moment, but could significantly increase after releasing partnership and listing at major exchange)

- Low initial price (=probable undervaluation, taking into account previous criteria)

RaiBlocks (XRB) is a coin, built on DAG-technology along with well-known IOTA, focusing on fast microtransactions. One of the important points why this coin was picked is demand for DAG technology in industry and a broad market for future implementation.

Dent (DENT) is used for sharing prepaid packages of mobile data. According to Cisco review, 15 percent of mobile data is unused and this is the market of 4.8 bln dollars. User cases are as follows: sharing unused data packages, avoid roaming, automated buying mobile data for IoT devices at best price. This concept is good for future demand on Dent token, so it was selected.

IoT Chain (ITC) is a coin from a Chinese-based startup, providing high-scalable transactions for IoT industry. The project is based on a high-scalable DAG version. IoT in general is a trend in the industry and a new high-qualified project, which could present an interesting opportunity in an investment portfolio.

Dragonchain (DRGN) is a new Blockchain platform, designed by Disney. The platform is high-scalable, has huge functionality and can serve many fields of operation - smart contracts, identity, intellectual property, p2p financial instruments and many others. Also, the platform is building its own ecosystem with startup incubator. At the moment Look Lateral - an Italian project selling art with Blockchain rights fixation as well as LifeID (Blockchain-based identity) are making a product using Dragonchain. According to the top-tier company behind this project and technological functionality, this asset is surely a “little coin, going big.”

XTRABYTES (XBY) is a platform for dApps, offering high-scalability and decentralization opportunities over current Blockchain technologies. The team created a new consensus method, Proof-of-Signature and algorithm Zolt. This project seems good and new-tech oriented, so possible high-demand for XBY coin may arise if XTRABYTES solution becomes used widely.

Capital growth

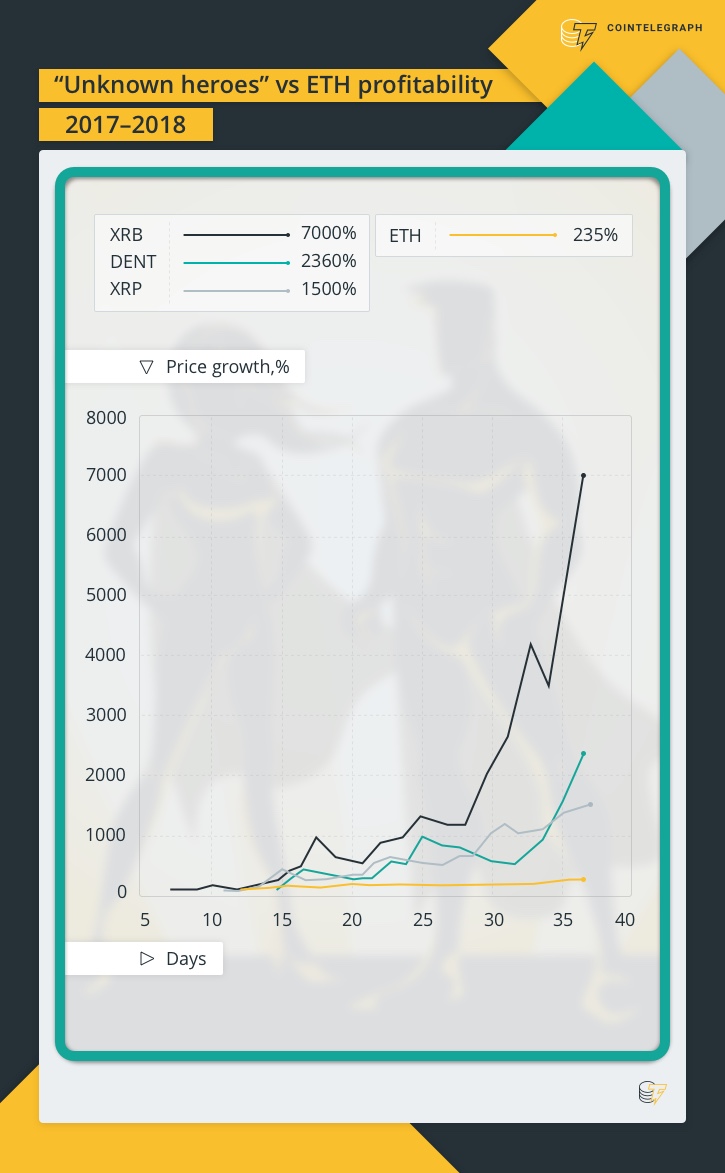

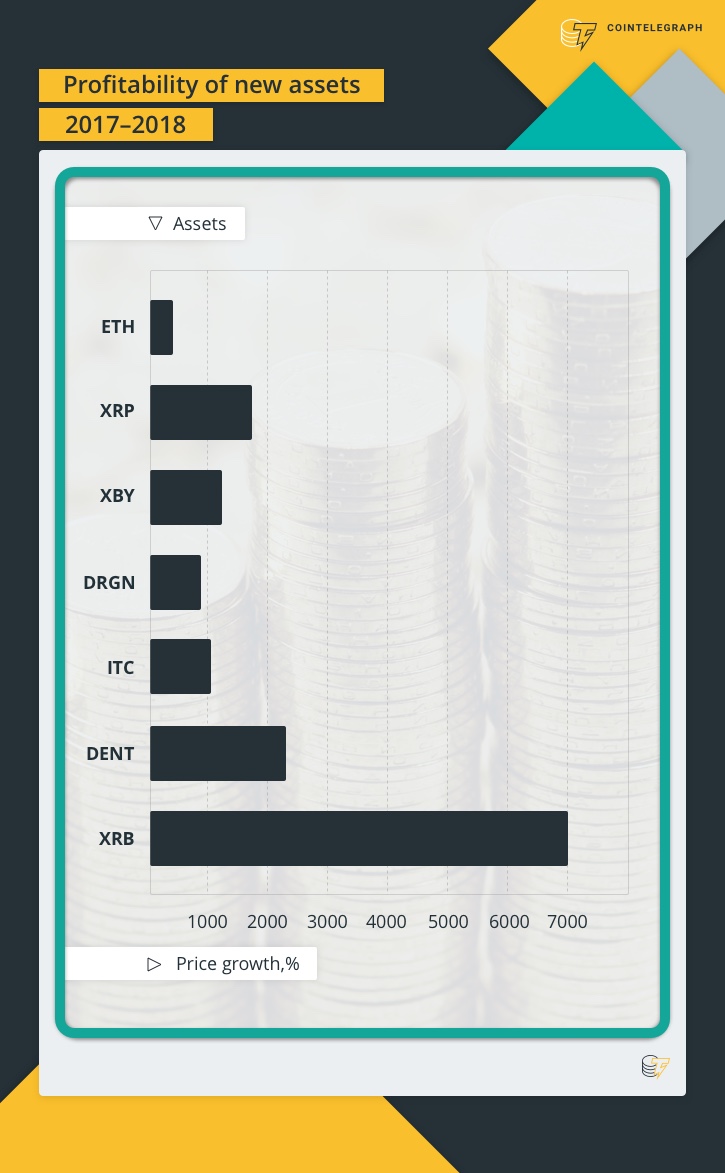

Profitability from holding these “little coins” was compared to buying and holding major crypto assets like ETH and XRP at the same time as demonstrated below. RaiBlocks demonstrated an enormous price growth rate, giving a 70 times increase on the investment; Dent provided 23 times capital growth. Otherwise little, but promising coins that were selected are comparable to XRP and significantly higher profit of investment in comparison to ETH.

It seems that these coins with good fundament and technology were unknown in a major part of the community whose price greatly increased once discovered by investors. Besides fundamental reasons of investment, many of them probably keep in mind that after listing on major exchanges price will be rising even more, when a very large community and big money will have direct access to trade these coins.

Smart investments

Assets in the crypto industry grow rapidly if there is a large influx of funds coming in from new investors with simultaneous holding by earlier investors. The price increase, in this case, is due to the constantly increasing demand together with the shrinking amount in circulation. After listing on a bigger exchange, like Bittrex or Binance, the demand grows massively, which increases the price even further.

For this reason, investors would monitor new coins introduced to smaller exchanges, because these assets are seriously underestimated due to the lack of audience and low trade volume. But constant monitoring can be rather tedious and requires having multiple accounts, which is time-consuming. On the other hand, potentially attractive coins don’t get a decent audience, because investors would rather prefer to purchase a new asset once it is listed on some bigger exchange. That results in a huge price increase and high volatility: massive funds are injected to the coin instantly at its purchase.

How to facilitate access to new assets

One of the current issues of the market should be facilitating the access to new assets for investors. On one hand, it will be easier for new users to start investing into crypto assets, and on the other hand, it would bring audience and liquidity to new coins. This is possible only by means of integrating all exchanges into one technical and visual interface that would allow trading multiple cryptocurrency pairs in one terminal at single-click ease. Once deployed, this would bring about another perk for both traders and new coins: traders would be able to start buying the coin from the date it was listed at any of the exchanges that are part of this integrated network, while the coin gets a more extended and organic timeline of growth.

Solutions

The problem has already been tackled by several teams. One of them is B2BX that ran a successful ICO in late 2017. They plan to make the first official B2B cryptocurrency exchange aggregator or marketplace to connect institutional clients, forex/DMA and stockbrokers with cryptocurrency exchanges. So, when the B2BX product is delivered on the market, cryptocurrency exchanges could receive more liquidity. The project is targeting brokerage houses, liquidity providers and institutional investors, the majority of the traders will have access to the market via their forex or stockbrokers.

Another startup that proved to be pretty successful is Arbidex – the platform that integrates crypto exchanges into one single interface with a built-in mechanism for automated arbitrage. The Arbidex team claims that integration of cryptocurrency exchanges together with the additional functionality as an automated arbitrage system will provide more liquidity to trading pairs and eliminate borders between exchanges. Using only one Arbidex account, a customer can buy and sell crypto assets and coins at all connected exchanges.

So, new trading pairs on major exchanges like Binance or small like Livecoin automatically are in availability to trade for all Arbidex users. They even offer a breakthrough high-end trading terminal for traders, integrating orderbooks and trading pairs from multiple exchanges with an opportunity to make extra profit.

The third solution can seen in the Japanese project Liquid, which is operating under Quinone Corporation, which has the exchange license from the Japanese authority. One of the project goals is to provide liquidity for the cryptocurrency exchange market and to create a worldwide order book.

What to expect?

This year seems to be bringing more maturity to cryptocurrency exchange markets. Hopefully we will see the introduction of market brokerage platforms and services with trading tools such as professional trading terminals, analytics, and the possibility to buy and sell the majority of crypto assets in one window. What if 2018 is the year of little coins becoming big?

Disclaimer: The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.