In the short space of nine years, Bitcoin has thrust cryptocurrencies into mainstream consciousness by shaking up the financial world.

Since its inception in 2009, the preeminent cryptocurrency has thrown a spanner in the works of traditional banking and financial institutions and has paved the way for the creation of a plethora of industry-shaping virtual currencies and blockchain-based innovations.

With that being said, it’s been far from smooth sailing for Bitcoin or any other cryptocurrency. Dramatic highs and soul-shattering lows have been part and parcel of the past nine years.

The volatility of cryptocurrencies has created more than a few detractors and we’ve seen a number of headlines exclaiming the ‘death’ of Bitcoin and cryptocurrencies in general.

These obituaries have come from a wide variety of industry experts and commentators. While they’re almost always subjective, they portray a negative, fear-mongering mentality that detracts from the technological breakthroughs that have been sparked by blockchain technology.

Let’s take a look at some of the instances that have led to mainstream media outlets signalling the death of Bitcoin and examine where the industry is at midway through 2018.

A brief history of Bitcoin deaths

It’s not difficult to find articles slamming Bitcoin and cryptocurrencies — just look at 99bitcoins.com, which has a compendium of Bitcoin obituaries that has now surpassed the 300 mark.

The earliest headline heralding the end of Bitcoin, according to the website, is an article entitled ‘Why Bitcoin can’t be a currency’ published in a blog entitled The Underground Economist in 2010. In essence, the writer pointed to Bitcoin’s constantly fluctuating value as the main reason why it shouldn’t be considered a currency.

“While Bitcoin has managed to bootstrap itself on a limited scale, it lacks any mechanism for dealing with fluctuations in demand. Increasing demand for Bitcoin will cause prices in terms of Bitcoin to drop (deflation), while decreasing demand will cause them to rise (inflation).”

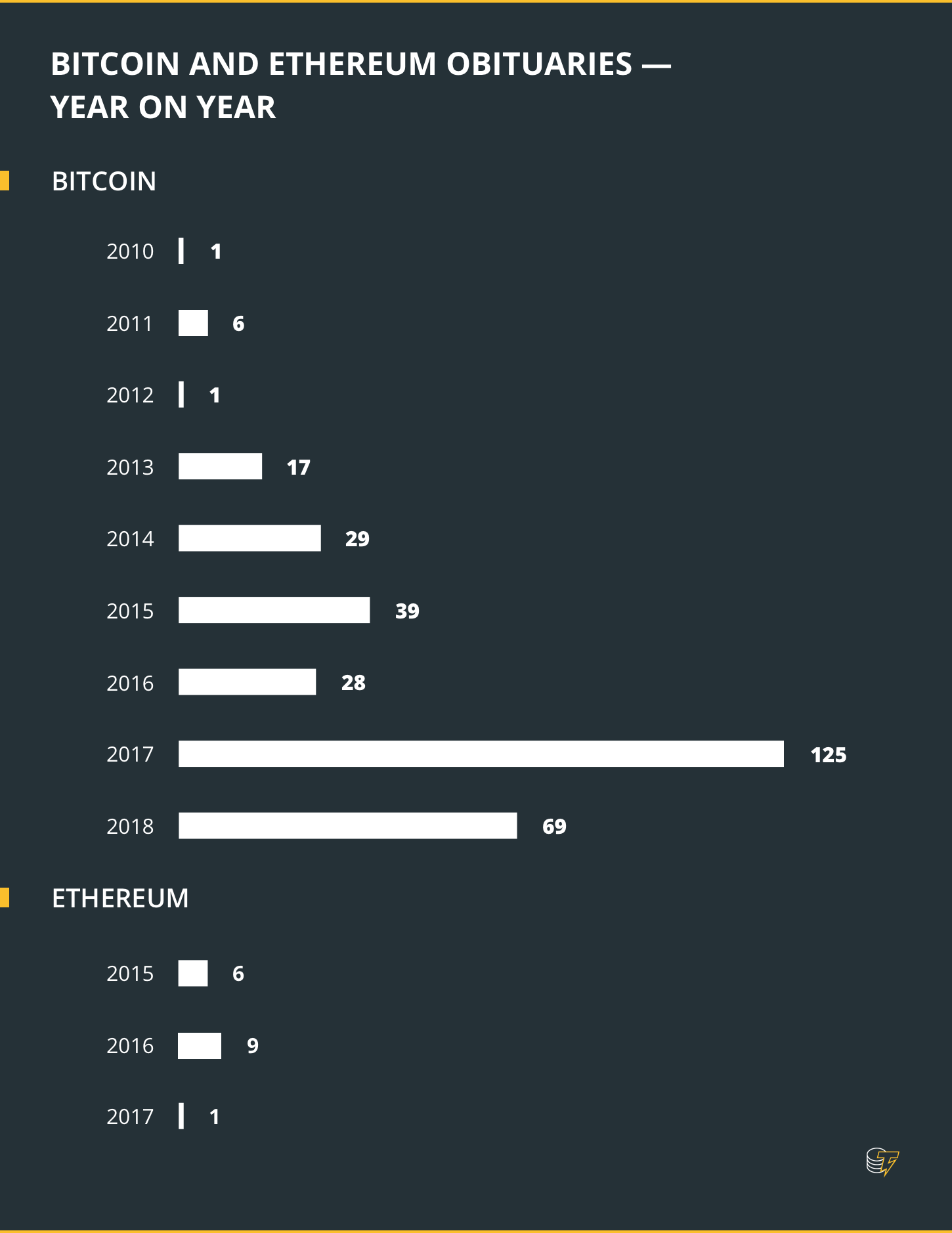

Since then, the number of headlines suggesting that Bitcoin was doomed to fail has increased year on year. In 2017, there were a total of 118 Bitcoin obituaries articles.

These obituaries are any articles that predict the demise of Bitcoin, based on assumptions or quotes from a wide range of commentators. This includes mentions of fraud, ponzi schemes and money laundering and frankly anything that is negative enough to cast aspersions on the future of Bitcoin.

While the sheer number of articles that have predicted the death of Bitcoin may be humorous, a glance down the list of headlines from various publications tells a different story altogether.

Small scale blogs like the one that is credited for the first Bitcoin death article have a limited reach and aren’t likely to have a profound effect on the sentiment of a large group of people.

However, as the number of these articles increases, so too has the caliber and profile of the publications producing this content.

Mainstream mania

CNBC has covered cryptocurrencies extensively over the last few years, with content that is fairly objective in terms widespread coverage of both positive and negative sentiments towards the industry,

With that being said, CNBC has been the source of numerous interviews quoting various sources that have labelled Bitcoin a bubble and ponzi scheme, while speculating on how it would crash.

The most telling example of this was JPMorgan CEO Jamie Dimon comparing Bitcoin to the Dutch Tulip Mania before predicting it would blow up on CNBC. Perhaps more telling was the effect Dimon’s statements had on Bitcoin’s value, which fell after the American executive’s comments:

"It's worse than tulip bulbs. It won't end well. Someone is going to get killed. Currencies have legal support. It will blow up."

In November 2017, Bloomberg published an article that speculated on a number of different factors that could potentially derail Bitcoin as it headed to that $20,000 high in December.

The article quoted several sources that point to the number of altcoins, regulations, cyber attacks and the launch of derivatives as pitfalls to Bitcoin’s rise in price and popularity.

Bubble talk

The Guardian published an editorial in November 2017 that labelled Bitcoin’s price as a bubble, and pointed to the costs of mining, slammed the endorsements by celebrities and made strong statements about Bitcoin’s primary use as means to buy drugs and pay ransoms online.

Forbes contributor Jay Adkisson wrote an op-ed which went on to describe the way Bitcoin is currently sold as a scam. The writer boiled down Bitcoin to a core existence as a number, without an intrinsic value.

He went on to suggest that cryptocurrencies lack ‘uniqueness,’ pointing to the sheer number of cryptocurrencies in existence.

The Telegraph also published a number of articles last year, drumming up ‘bubble’ rhetoric as the 2017 wound to a close. Abhishek Parajuli took a mighty swipe in his own op-ed on the platform, citing wild volatility, poor utility as a medium exchange as well as slow transaction speeds:

“So, hype aside, Bitcoins are lottery tickets. They have no underlying utility. When the music stops, those left holding them will be burned.”

Wall Street Journal contributor James Mackintosh weighed in on the value of Bitcoin in mid-September 2017. In essence, the writer delved into the notion of Bitcoin having become digital gold as a store of value.

Going on to assumptions of an economist — as well as a comparison to the price of actual gold — the Wall Street Journal contributor suggested a very poor chance of Bitcoin replacing gold as a store of value.

While these articles can be well-researched and compelling in their presentation, it’s hard to find a single one that provided compelling evidence that Bitcoin would fail altogether. Some accurately predicted price corrections, but those touting the death of cryptocurrencies are still to be proven right.

ETH and the rest

While Bitcoin has undoubtedly received a far greater amount of negative press in the last nine years, it is not alone.

Ethereum, the second biggest cryptocurrency by market capitalization, has also been in the crosshairs of doomsayers since its launch in 2015. Digiconomist has also compiled a list of Ethereum obituaries, which is up to 16 since 2015.

The first of these articles was published on a blog called WallStreetTechnologist run by self-described former Wall Street technologist Jerry David. Written in December 2015, David was of the opinion that Ethereum would fail to launch its platform due a number of factors:

“Too ambitious of goal[s], too complex a system to get it done, and too much money squandered on someone who has little business experience.”

Fast-forward three years and Ethereum has quashed all of those concerns emphatically. However, the journey has been fraught with some hairy moments.

In June 2016, following the launch of DAO, cyber-criminals figured out an exploit that allowed the theft of 3.6 million ETH tokens, worth around $60 million at the time. As ArsTechnica reported, the attack truly threatened Ethereum’s continual existence.

Close to a year later, a hacker exploited a flaw in Ethereum-based platform Parity which resulted in $34 million worth of ETH being stolen. The platform was somewhat saved by ‘white hat hackers,’ that drained other Parity account funds to safeguard against the initial hacker stealing more ETH.

This then led website Nulltx laying part of the blame for the Parity multisignature bug on Ethereum itself.

“Smart contracts, which are often seen as the cornerstone of everything Ethereum has to offer, are simply not secure. They weren’t on day one and they still aren’t today. While everything may seem in order most of the time, the Parity multisignature bug shows how easy it is sometimes to manipulate these contracts for financial gain or just to annoy others.”

While these events were sure to draw negative criticism, Ethereum has had to deal with a far smaller amount of obituary-style reviews.

The third largest cryptocurrency by market value, Ripple, has also faced some harsh criticism. Bloomberg slated the company for trying to get XRP listed on various exchanges by paying financial incentives for doing so.

In January, MIT’s Technology Review said investors jumped on the Ripple bandwagon, in the hopes that it would become the ‘next’ Bitcoin. The article suggests that the surge of investment into the blockchain-based cross-border payment system was hyped up and that the project could still fail in the long term.

EOS, the fifth biggest cryptocurrency by market cap, has received its fair share of disparaging coverage in the lead up to its launch in June.

As Cointelegraph reported in it’s review, the blockchain-based operating system faced criticism for the token-swap that was required after a year-long ICO, as well as it’s delegated Proof-of-Stake system.

Ethereum founder Vitalik Buterin and EOS CTO Dan Larimer had extensive online debates arguing for their respective consensus protocols, which put a spotlight on both blockchain platforms.

Other cryptocurrencies also face plenty of pessimistic forecasts. For instance, Altcoinobituaries is a website that tracks the market value of a number of cryptocurrencies, with foreboding messages of their looming demise.

2018 – Crypto still fighting

Following a dramatic high in December 2017, Bitcoin has faced a tough six months of volatility amid the uncertainty of regulations and mitigating factors around the world.

As of June 2018, 69 of these doomsday Bitcoin posts have been published, as per 99bitcoins’ list. A number of headlines have continued to label the cryptocurrency as a bubble, citing various sources predicting its demise.

Nobel Prize-winning economist Robert Shiller followed in Dimon’s footsteps, comparing Bitcoin to ‘tulip mania’ in an interview with CNBC in January:

"It has no value at all unless there is some common consensus that it has value. Other things like gold would at least have some value if people didn't see it as an investment. It reminds me of the Tulip Mania in Holland in the 1640s, and so the question is did that collapse? We still pay for tulips even now and sometimes they get expensive. [Bitcoin] might totally collapse and be forgotten and I think that's a good likely outcome but it could linger on for a good long time, it could be here in 100 years."

The MIT Technology Review published an article in April which explored three different ways that the cryptocurrency could ultimately be brought to its knees — namely a government takeover, Facebook takeover or the creation of millions of tokens that eventually make Bitcoin irrelevant.

Reuters quoted Bank of England governor Mark Carney in a review which suggested that Bitcoin ‘failed’ as a currency. Carney told London Regent University students in February that the cryptocurrencies shortcomings were plain to see:

“It has pretty much failed thus far on the traditional aspects of money. It is not a store of value because it is all over the map. Nobody uses it as a medium of exchange,”

Around the same time, a Forbes headline reading ‘Is Bitcoin Heading to Zero’ explored a number of reasons why Bitcoin had seen such a dramatic drop in value. The article was centred around the shortcomings of Bitcoin in relation to Ethereum — mainly transaction fees and governance issues.

The writer cited PHD economist Eli Dourado’s work on Ethereum, which highlighted the far cheaper transaction costs on the Ethereum blockchain. Furthermore, the governance of Bitcoin and its ongoing development was also cited as a point of concern:

“Bitcoin has been unable to seriously address its on-chain scaling problems. Its community has alienated, marginalized, and purged dissenting voices, notably Mike Hearn, Gavin Andresen, and Jeff Garzik. Its core development team has been captured by an ideological faction committed to only off-chain scaling in the name of decentralization. This faction has undermined consensus scaling agreements and trashed the reputation of anyone who points out any of the above.”

More recently, famed investor Warren Buffett went as far as calling Bitcoin ‘rat poison’ in an interview with CNBC:

"In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending.If I could buy a five-year put on every one of the cryptocurrencies, I'd be glad to do it but I would never short a dime's worth."

These headlines have certainly not been kind to Bitcoin and cryptocurrencies in general. Taking advantage of the profile of some commentators, markets have been continually bombarded by doomsday prophecies and speculative remarks.

Dealing with it

The reality of life is that many things are completely out of our control. This is particularly true when it comes to the type of information and news we are subjected to on a daily basis.

As Cointelegraph reported in March, cryptocurrency has forced its way into the minds of the masses. This has even led to some of the biggest TV show hosts, from Ellen Degeneres to John Oliver, giving satirical, bizarre and possibly damaging accounts of what Bitcoin and cryptocurrencies actually are.

What these TV superstars prove is that the industry is too big not to notice, but is still misunderstood and met with plenty of apathy.

It may well be difficult for this tendency to mock and denigrate the cryptocurrency space to stop, but time will tell.

Nevertheless, mainstream media outlets — be it news or entertainment — will continue to mold the perception of millions of people when it comes to cryptocurrencies.

The spin, positive or negative, will be dependent on how the sector grows and addresses its own shortcomings in order to build trust and understanding in the global community.