I recently gave a talk to a clutch of enthusiastic crypto-investors in Indore, in central India. One gentleman, who was particularly knowledgeable got up to make some comments. “See, I feel that most of the other cryptos out there have no value. Ultimately it will all come down to Bitcoin and maybe Ethereum. In many ways what is happening now is just like the Dot Com rush. Valuations are everywhere. So what I look for is what can you actually do with the token -- does it fulfill any real-world value like Fliecoin and StorJ.”

This gentleman covered a lot of ground quickly, so we must parse his comments carefully. To begin with, he sounds like he’s talking about tokens in terms similar to fiat money -- most national currencies are useless for international exchange, only a few are reliable stores of value: the US Dollar, the Euro and maybe the Pound or the Singapore Dollar. But then he immediately pivots and talks about tokens as a form of equity, albeit the frothy and insubstantial kind, which crashed in the wake of the Dot Com bubble. Finally, he talks about two examples of utility tokens which are paid out when users share their computational power or their storage space with a network. The tokens in effect are a unit of transaction particular to a given platform, product or service and may be considered as a proxy for them. This is a lot of metaphors to mix in a brief exchange!

There has been a lot of focus on crypto assets this year, as some 900+ alternative coins or tokens have launched and accumulated some $75 bln in capitalization. Vitalik Buterin now says he did not imagine so many people would attempt to build new coins using the ERC 20 protocol that became part of the Ethereum platform that he designed. But because it became so simple and straightforward for so many people to design and launch a new token that would immediately work on the Ethereum Blockchain, a kind of Cambrian explosion of alternative coins has resulted. There is a lot of confusion and uncertainty on how to think about crypto-tokens, what their regulatory status is and what if anything they are good for.

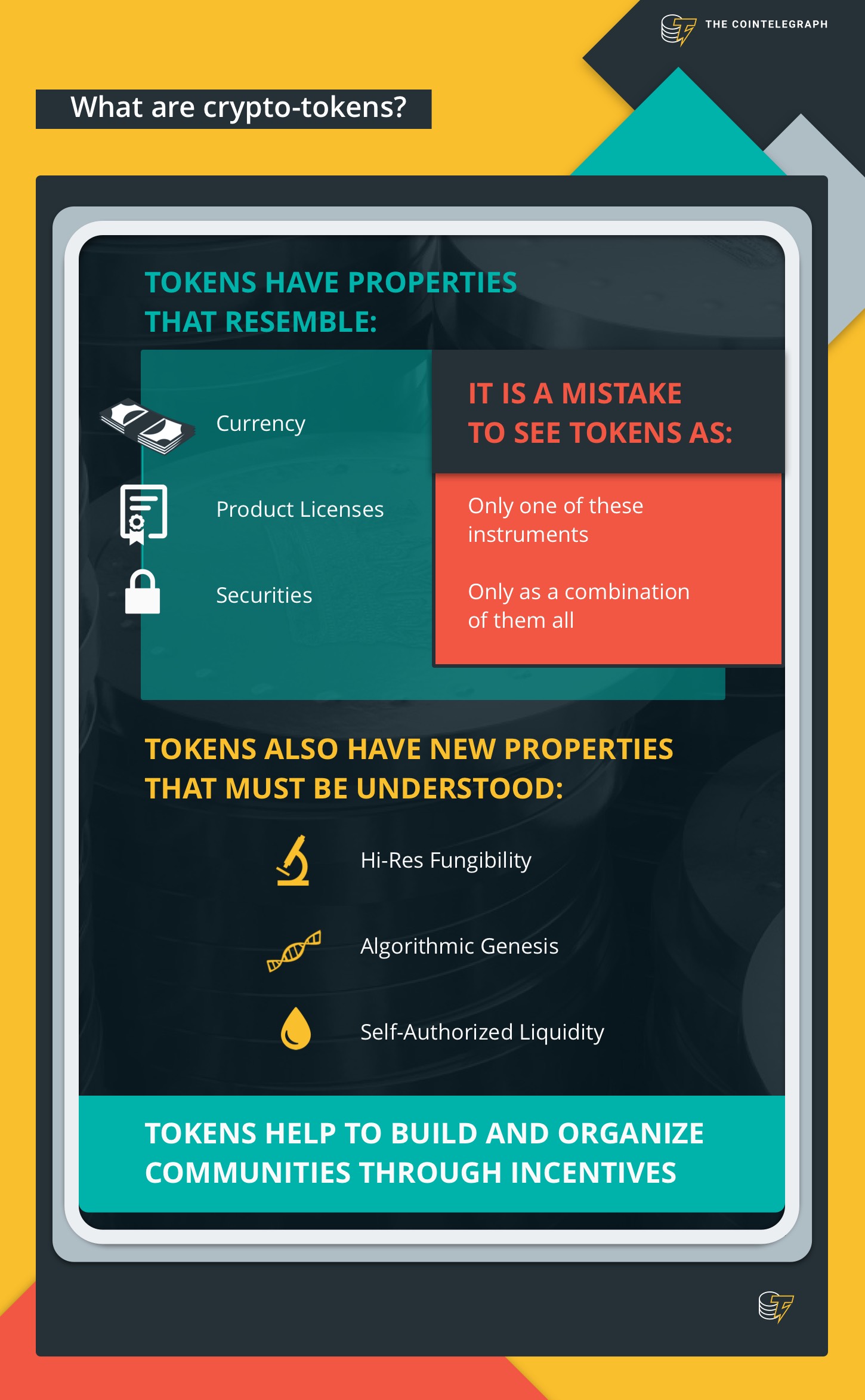

As we see from the comments made by the gentleman in Indore, tokens have properties or dimensions related to currency, equity and products. Let’s look at these distinct aspects in order.

1. As currency

Of course, Bitcoin is the very paradigm here and has always called itself a coin. And even though Ethereum describes itself as a ‘world computer’ with much more sophistication and utilities in relation to Bitcoin, it is also widely held, widely traded and has enjoyed a continuously escalating value in relation to fiat money. In the past several years there has been a profusion of alternative tokens asserting that they are in fact currencies: Monero, Zcash, Dash, Litecoin. And there would be many more in future.

What’s worth noting here is that whether new tokens assert their intent to behave like currencies or not, the fact that they are widely held, widely exchanged and easily valuated renders them cash-like. There can, therefore, be no formal distinction between cryptocurrencies and some other class of tokens which do not behave in this way.

But in what way are crypto-tokens not like fiat currencies that we have already known? There is one odd matter: despite the widespread adoption of Bitcoin and Ethereum, neither is yet a preferred unit of account. That remains in fiat, specifically in the US dollar. This is one sense in which so-called cryptocurrencies may rather be behaving like a financial instrument whose value may vary over time or a secondary national currency valued against the dollar. We should note that while Bitcoin and Ethereum have both done very well over the past year, from an Ether-centric perspective Bitcoin has become very much cheaper than before. Once we begin seeing things this way we will be better placed to believe that at least some tokens are indeed currencies.

2. As the promise of a new product-business

If Bitcoin and its early peers offered themselves primarily as a form of digital currency, new decentralized apps and the organizations that built them began creating so-called utility tokens and selling them in advance of their product and system being built. The ERC 20 protocols on Ethereum templatized this process and made it quick cheap and easy for anyone to go out and mint a new token set and then raise money against it.

Once a utility token issues its ICO, moreover, the token can come to be widely held and exchanged for other tokens. In this way, a token is similar to a Kickstarter campaign, which may raise money from early adopters before the unique new wallet, electric cycle or multitool has actually been manufactured.

Or you might even compare it with the thousand dollar deposit that so many enthusiasts put down on the Tesla Model 3 several quarters ago: Elon took your money early and is now using it to build your new car. As discussed above, however, you have the right to go out and sell that deposit receipt to someone else quickly and easily on account of the token’s greater fungibility.

Adam Ludwin has recently argued that tokens should be seen as a new asset class that enables decentralized applications and in turn that decentralized apps have their central utility in censorship resistance. While Ludwin is essentially correct to point out that tokens have so far served to fund decentralized applications and that this might be classic and original use, they can also now be used in many more innovative and derived applications. We must, therefore, soften Ludwin’s views on two fronts -- decentralization as an absolute and the kind of value unlocked by decentralization. A cursory view of the existing token horizon reveals to us highly centralized tokens like Ripple, which are run by private corporations. Centralization and decentralization are therefore not absolute binary states but rather ideal-types at polar extremes while most existing applications on Blockchain fall somewhere in the middle. Secondly, there are many reasons for decentralized apps to come into existence which may not have to do with censorship resistance but with the redistribution of trust within existing networks. For example of energy, content and agricultural supply chains, all of which stand to be readily tokenized.

Richard Kastelein recently mentioned to me the successful ICO of EMovieVenture a movie futures club. This is a semi-decentralized crowd-feedback oriented movie ticket futures project without a real decentralized app or many software developers to incentivize. Whatever one may think of this particular case, its success suggests that there isn’t a business model or sector vertical immune to tokenization. Tokenization has now jumped the shark -- it is a form of social and financial behavior that is enabled by Blockchain originally applied to crypto-technological applications, but it is now abroad as a means of futures trading for new enterprises.

Even if, from the point of view of investing rationally in viable, credible token ecosystems such as StorJ and Filecoin should be the most attractive to investors. There are of course going to be many more and diverse types of product business ideas including those attached to celebrity, entertainment and lifestyle. If a Beyoncé token comes about in the near future, I would not suggest you hold back from her ICO just because she is not building a truly decentralized app.

3. As securities or securitized assets

According to a recent ruling by the US Securities and Exchanges Commission, the purchase of crypto-tokens may be deemed to be securities if they conform to the Howey test:

- There is an investment of money

- There is an expectation of profits from the investment

- The investment of money is in a common enterprise

- Any profit comes from the efforts of a promoter or third party

This has led to a round of global hand-wringing, as promoters of crypto-tokens have bent over backwards to solemnly aver that their tokens in no way represent securities according to this definition. Despite such anathema to the very concept of a security, we must confess that all tokens have a security-like dimension, whether or not they actually conform to the above Howey test. Think of a platform like Ethereum: it is a vehicle for investment into hundreds of ERC 20 tokens which are all the effort of third parties. Many buyers have a clear expectation of gain. It is a common, albeit distributed enterprise.

More and more complex forms of tokens are now being designed and issued, including for example, asset-backed tokens as are now being issued by Smartlands. New, more complex token designs might come to resemble fixed income plans, debentures, funds of funds and even quasi-debt instruments. Notwithstanding the current ruling people are going to want to do things with tokens that will repeatedly bump up against existing regulation, which will likely have to be updated to follow contemporary and emerging practice.

A different way of looking at tokens as equity is from the perspective of the individuals issuing the token: organizations or groups of individuals may choose to issue tokens and collect fiat money, much as they might with equity. Token issuance has capitalization effects similar to equity for those who issue it. And in case there is no company associated with the token then there will only be the token to tie together the interests of the different people associated with the given project. Here, the token resembles a form of equity, in terms of giving proportionality and joint interest to people otherwise unconnected with one another. Tokens that are expressly linked to the valuation and performance of other tokens are clearly securities and will have no other go than to submit to existing securities regulation.

The metaphor is the thing

Benjamin Lee Whorf famously described the use of ‘spun limestone’ to insulate wood fired distillation plants. Factory managers were stunned to see the material catch fire after some weeks of use through a complex chemical process which produced flammable fumes of acetone and which caused multiple factory fires. Whorf’s diagnosis was that factory planners could not compute that this material was flammable because of its name and feel, which was like a stone -- which common sense informed by linguistic ideologies dictated will not normally burn. The terms you use therefore have consequences for the thoughts that occur to you.

If you see crypto-tokens primarily as currencies, you will be interested in their capitalization, circulation and adoption. You might also come to believe that there will be a single winner who will take all and emerge as the standard of reference for all other currencies. This view might easily lead to Bitcoin maximalism or Ether chauvinism, and it may well also be wrong.

If you see tokens as successors to the equity model of the corporation you might well imagine that many flowers will bloom. However power laws will make some tokens far more successful than the mean and that many tokens will eventually be worth nothing in any denomination, crypto or fiat.

If you’re looking at tokens as a kind of product license or as a means to advance pay for future goods or services, you might wonder what all the fuss is about. Because advance sales and loyalty points are neither novel nor deeply disruptive of existing modalities of venture funding.

From each vantage point, you will see primarily one aspect of the token at the expense of others. The more difficult truth is that a crypto-token is all of these to varying extents depending on the specific design and application of each particular token. We must resist our reflex to think and talk using the categories of the past but rather appreciate the ways these three dimensionalities blend together to create the irruptive power of this new thing.

Tokens of a type

So if tokens aren’t exactly currencies or deposit receipts or equity, what are their positive attributes? What exactly do they enable for us and why are they useful, if not always valuable?

1. Hi-res fungibility

Once listed on an exchange, a token can be exchanged for another token at a publicly available exchange rate with little transactional friction. One cannot do this with ESOPs, with advisory equity or with any other kind of corporate paper, promissory notes or other existing instruments associated with building a new business. This has many benefits for founders, advisors and early adopters alike, but may also have large drawbacks which will become obvious as newly raised ICOs like Tezos come to face the light of public scrutiny early and without the benefit of backroom smoothening from Venture Capital firms.

All this means that unlike equity, tokens are fungible and that too at minute fractions or degrees of resolution. This high resolution is actually a beneficial attribute in its own right. Consider the fact that many early-stage advisors won’t work with a startup business at less than two percent equity. It’s just not worth their trouble because the time and effort involved in keeping track of their many investments won’t allow them to consider, for example, 0.5 percent of even what seems to be on track to become a $10 mln business.

But consider the fictional case of a five mln dollar ICO raise of ‘Coineum’ where the million coins minted will be worth $10 mln. Imagine you were offered 50,000 Coineums with a face value of $150,000. Whether it is Behavioral Economics or the current froth or old-fashioned greed, you might have a harder time saying no. By rendering value in terms as fine and fungible as fiat money; tokens seem to be more attractive to investors.

2. Algorithmic genesis

One of the more interesting aspects of Bitcoin, which has not been emulated by any of the ERC 20 tokens launched off Ethereum is its continuous mining and slow progressive entry into circulation. There might be any number of innovative ways to approximate this aspect of Bitcoin monetary policy based on the operational parameters of the microeconomy being designed. One interesting model is that of Steem, whose tokens are generated at a fixed rate of one block every three seconds, and which are then distributed to various parties in the system based on an algorithm designed to strengthen the entire ecosystem.

Simon de la Rouviere has recently come on the record saying ICOs may themselves be an anachronism or a metaphor smuggled in from an older way of doing things, and that the self-generation of a community may better be envisioned as a continuous and open process. What this means is that unlike say equity holdings, which may be of a fixed proportion, distribution of token holdings can be elastic over time, responding dynamically to the size, volume, frequency and other operational parameters of the microeconomy.

3. Self-authorized liquidity

James Kilroe has recently explained that new coins keep getting created by founders because they can be better compensated through a new platform rather than by incrementally improving an existing one. While this may not seem very different from existing corporations where the incentives to turn around an existing division are often far lower than to build a new company up from scratch, how this may be achieved in tokens differs slightly from equity.

It has long been established practice to allocate equity to founders and early employees of a technology enterprise that remains to be built on the back of its core team. Some advisors and angels may also get to earn or buy equity on favorable terms. But it is unheard of for early users and participants in a future community or microeconomy to be similarly compensated. Beginning with the metaphor of mining in Bitcoin, crypto-tokens now level the distinction between equity allocations and early-bird discounts or cash-back for early customers on a platform. While the incentivization of early members of the company seems perfectly legitimate to all, some investors often balk at their money being used to ‘buy’ customers and to underwrite the discounted dumping of product. There appears to be a different set of cognitive heuristics for how to spend your own fictional assets (equity) versus other people’s money (capital raised).

Consider another fictional case, of the development of a decentralized provenance engine for the art community. To build it you might mint and distribute coin to all stakeholders including artists, collectors, dealers and galleries. You might give them more coin to update their transactions and to collectively establish provenance for all the works in your Dapp. Eventually, these costs are covered by owners and purchasers of artworks who pay into the system to gain access to the provenance data collectively created. It is hard work for Christie's or Sotheby’s to do this work in a centralized manner, but far easier for decentralized communities to do it, so long as all are appropriately incentivized. This microeconomy could never come into existence if it did not self-authorize the creation of its coin alongside the rules for its use through its Dapp.

The ability of founders to compensate key members of the emerging decentralized community in tokens has been described as ‘better-than-free’ business models by Balaji Srinivasan and Naval Ravikant. ‘Better than free’ has a ring of ‘perpetual motion machine’ about it. It seems somehow wrong and ultimately counterintuitive that such a thing could ever work other than as a Ponzi scheme. We might better speak of it as a self-authorizing mechanism for incentivizing the creation of a microeconomy, which is really what all tokens ultimately enable or set into motion. What equity is to a business, token is to a microeconomy.

While the gentleman from Indore was not wrong to look for applications areas that were meaningful and valuable for end users, that is again not the full story. Equally important at the early stages of a token project is the means through which the token will be distributed widely and equitably among the key stakeholders necessary to make the project viable. These are no longer only the founders and core employees of the ecosystem, but increasingly other influencers, content creators, data updaters, freelancers drawing work from the platform and other ad hoc participants in the ecosystem that either put coin in or draw it out.

A Sufi Qawwali celebrates all existence as the result of Allah looking in a mirror and then drawing himself out of himself. This is as good a metaphor for the genesis of a microeconomy as any other, and it can best begin with the self-authorized self-dealing of a founder network with itself, its close partners and its wider ecosystem. This is the process that tokens now enable, in some cases alongside traditional equity structures and in other cases without them.

Train your mind to this new openness and permeability between the boundaries of your company and its wider ecosystem. Now think of this new fusion as a microeconomy. Use your token to incentivize and so coordinate the interests of its stakeholders together.