Should you let an AI algorithm make a $100 mln call on your behalf? That’s a concept that several hedge funds have been tackling for a few years. As artificial intelligence continues to prove its efficiency in an increasing number of fields, many investment firms, nascent and old, are starting to engage in its use to make trade decisions—and they’re willing to bet huge amounts of their customers’ money on it.

For years, quantitative hedge funds have been using computer algorithms to make trade decisions. However, those algorithms were driven by static models developed and managed by data scientists and weren’t adept at dealing with the volatilities of financial markets. Decisions made by these algorithms yielded results that were often inferior to those made by human discretion.

In recent years with the emergence of machine learning and deep learning, the branches of AI have caused a breakthrough in the creation of software and are driving new innovations in computational trading.

In contrast to traditional software which rely on predefined rules given by programmers, machine learning algorithms work by analyzing huge amounts of data and defining their own rules based on the patterns and connections they find between different data points. Machine learning software autonomously update themselves as they ingest new data.

This is the approach that has helped create systems which are efficient at parsing the content of images and video, understanding and translating the context of spoken and written language, saving power, diagnosing cancer and more. Many believe that the same technology can transform financial markets.

Employing machine learning

Several Wall Street hedge funds have become drawn to the opportunities that these self-altering algorithms can provide when applied to financial trading. An example is Man Group, one of the world’s largest hedge funds with $96 bln under management. Since 2014, Man has been using machine learning algorithms to make autonomous trade decisions in its AHL Dimension fund with very positive results.

Man’s engineers set boundary parameters for their ML algorithms including exposure caps, asset classes and trading costs. They then provide the algorithms with data and let them discover patterns and correlations that would go unnoticed to human analysts. The ML algorithms constantly compare new data with historical patterns and try to guess how changes will unfold in the future. Man is applying the model to fast trade decisions as well as educated predictions for several weeks into the future.

The availability of data and computing resources, the two main requirements of machine learning algorithms, are the primary factors that enable Man Group and other hedge funds to employ AI in their trading. Today the costs of processing power have dropped considerably. Man manages its own huge data center in London. Other firms are setting up virtual data centers through cloud providers such as Amazon, Microsoft and Google.

More important is the explosion in the generation of data and online services that has happened in recent years. According to Deutsche Bank, there are one billion websites on the Internet, with 100 million more being added every year. There exists more than 500 exabytes of data, with more than 90 percent of it created in the past two years. Embedded in this digital ocean are reams of publicly available information, also called alternative data, that can complement financial data and help make to better trade decisions.

This can include a wide range of data types including job posts, social media discussions, satellite imagery, credit card transactions, and data obtained from mobile devices. This information enables analysts to better predict how stocks will perform.

However, collecting and perusing through all this unstructured information is beyond the capacity of human analysts. Alternative data has given rise to its own market, with vendors scraping, cleaning and selling this data to the investment community. Some hedge funds are spending millions of dollars to obtain valuable data. According to consultancy firm Tabb Group, spending on alternative data in the US alone will reach $400 mln in the next five years.

Machine learning algorithms provide the power to bring all this unstructured data to order. At investment firm Point72, computer vision algorithms analyze satellite images of parking lots and combine it with mobile phone geolocation to report on how many people are visiting various stores. Meanwhile, natural language processing algorithms perform sentiment analysis on social media posts and forum discussions to see which brands customers are complaining about.

The challenges of AI-based trade

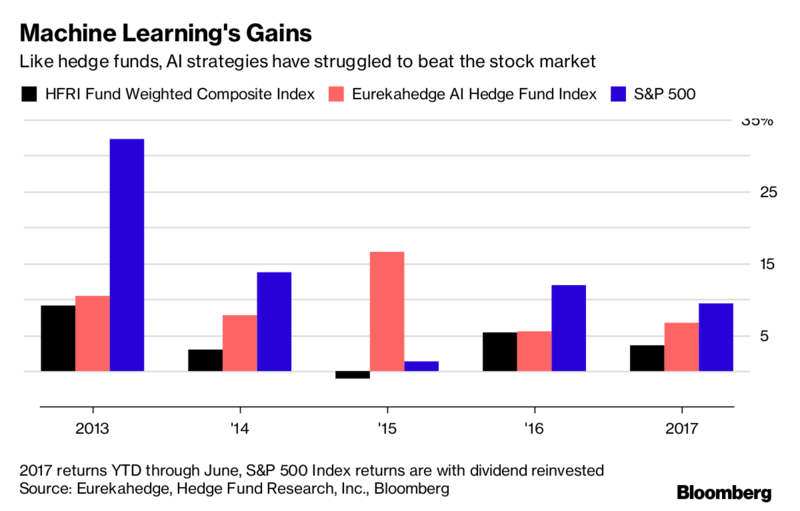

While machine learning does show a lot of promise in finance and trade, it still has to overcome several obstacles in the coming years. Skeptics doubt that anything short of human-level AI will be able to handle all the mysterious parameters that influence financial markets, such as news events, politics, economics, and other events such as natural disasters. At Man Group, the AHL fund has gained 15 percent in three years since engaging in artificial intelligence, nearly double the industry average. But it’s still lagging behind the S&P 500.

Image: Bloomberg

Hedge funds employing artificial intelligence will also have to overcome challenges that are inherent to the technology. This includes a lack of transparency. As AI algorithms ingest more data and grow more sophisticated, the engineers that build them find it harder and harder to explain the mechanics behind their functionality. This can become a problem when you have to explain to your customers why your algorithm made a wrong decision to their detriment. Man makes sure human analysts examine unusual trades before they’re executed, and it’s building autopsy tools that help engineers investigate decisions made by the algorithms.

Firms will also have to be wary of the data they acquire, as they can involve information obtained from consumers. Machine learning algorithms often correlate information in ways that can cause privacy concerns.

Aggressive use of big data also threatens to push hedge funds into legally gray areas. While the use of publicly available data is not considered insider trading, the definition of what data is deemed public and legally safe to use in algorithms isn’t very clear.

Nonetheless, proponents of machine learning and artificial intelligence have no doubts that algorithms are the future of trade. As Eric Schmidt, former CEO of Google and current executive chairman of Alphabet believes, in 50 years no trading will be done without computers dissecting data and market signals.