*Expert Blog is Cointelegraph new series of articles by the crypto industry leaders. It covers everything from Blockchain technology and cryptocurrencies to ICO regulation and investment analysis. If you want to become our guest author and get published on Cointelegraph, please send us an email at [email protected].

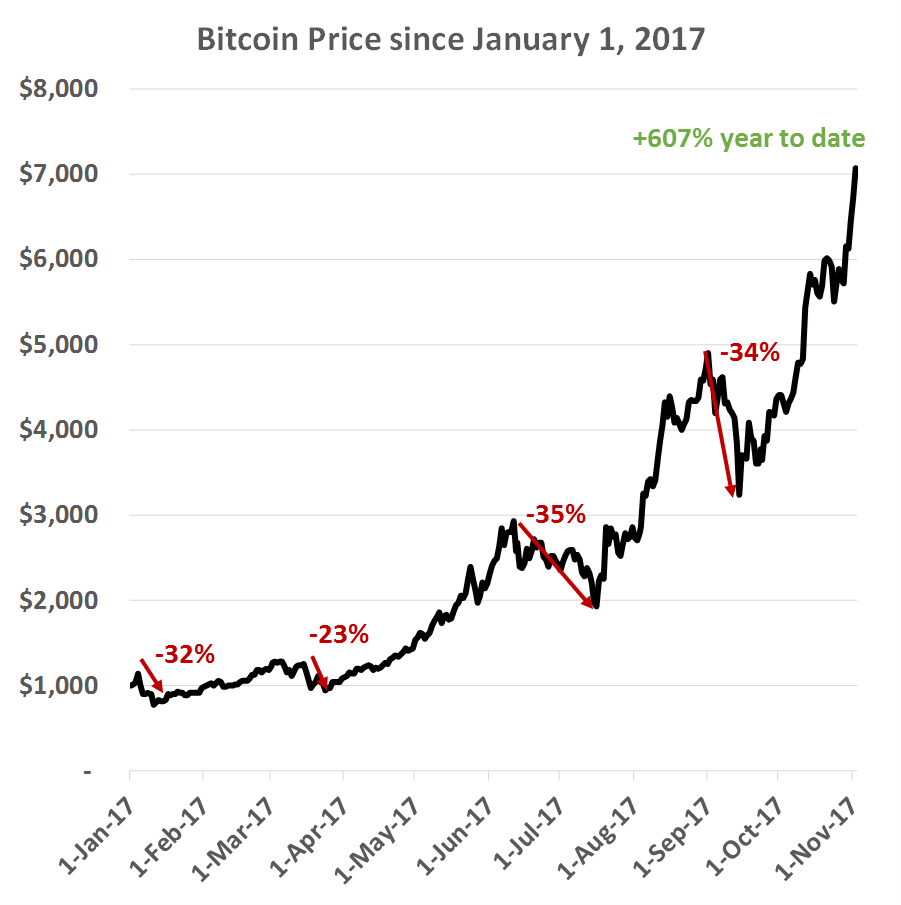

Despite being attacked from all sides, Bitcoin is up 607% this year, and 2017 isn’t even over yet! Just look at some of the main attacks that Bitcoin had to fend off this year:

- Cryptocurrency exchanges banned in China. This market used to account for more than 90% of global trading volume just a year ago.

- CEO of JP Morgan calling Bitcoin a fraud multiple times, going as far as calling his own daughter dumb for owning some Bitcoins.

- Bitcoin Cash hard fork on August 1.

- Upcoming SegWit2x hard fork.

Bitcoin bubble has burst multiple times

Yes Bitcoin crashed multiple times this year, by more than 30% in January, July and September. But the currency came back stronger every single time. It is currently roaring at $7,000. You would think that more mainstream journalists would take a step back and wonder why this cryptocurrency keeps coming back stronger and stronger every time it is under attack. But you’d be wrong--most mainstream journalists suffer from a serious case of confirmation bias. That means they dismiss any information or data that does not support what they already believe, namely, that Bitcoin is a bubble, end of discussion.

Each time the Bitcoin bubble burst, Bitcoin showed how resilient it was. Bitcoin has been demonstrating its antifragility - term coined by Nassim Nicholas Taleb in his book Antifragile - every time it has been threatened. It is not only robust, but it actually gains strength from disorder and instability. This has led a number of people to refer to the currency as “antifragile.”

The more the status quo establishment fights Bitcoin, the stronger it will get, as people realize that no one has the power to stop Bitcoin. You do not go after Bitcoin this hard if you do not believe that it has the power to disrupt entire sectors of the economy.

There are thousands of Bitcoin Core nodes located around the world, all it takes is one node to survive for Bitcoin to stay alive. This is how powerful a decentralized system is.

Stars are aligning for Bitcoin

The world’s largest option exchange - CME Group – announced this week it is going to start listing Bitcoin futures contracts before the end of the year. This first step will pave the way for financial products such as ETFs that will open the market to retail investors.

The “Bitcoinization” of a few economies has also already begun. One of the only ways to send money to Venezuela these days is through Bitcoin, while in Zimbabwe, Bitcoin trades above $10,000 as the country is going through a severe currency crisis. Bitcoin is quickly becoming the safe haven of the 21st century. You can take money in and out of any country in seconds. No other asset allows you to do that.

Of course, Bitcoin will go through many other ups and downs, the road is going to be bumpy and the outcome is uncertain, but one thing is for sure: it is going to be one hell of a journey!

Bio: Vincent Launay is a finance specialist at the World Bank in Washington DC. He holds an MSc in Finance from HEC Paris and a CFA charter. The views and interpretations in this article are his own and do not necessarily represent the views of the World Bank or Cointelegraph.