In our Expert Takes, opinion leaders from inside and outside the crypto industry express their views, share their experience and give professional advice. Expert Takes cover everything from Blockchain technology and ICO funding to taxation, regulation and cryptocurrency adoption by different sectors of the economy.

If you would like to contribute an Expert Take, please email your ideas and CV to [email protected]

It is hard to pinpoint precisely when banks stopped innovating, but it has been a while since they brought any valuable innovation to their customers. Banks almost blew up the world economy a decade ago, yet most of them got bailed out. Why were they rescued with hundreds of billions of dollars of taxpayers’ money? Because they were too big to fail and posed a systemic risk if they hit the dust. At the time, there was no alternative to banks and fiat currencies. But then, on January 3, 2009, right in the middle of the financial crisis, a new, revolutionary currency was discreetly launched: Bitcoin. The first ever cryptocurrency was born.

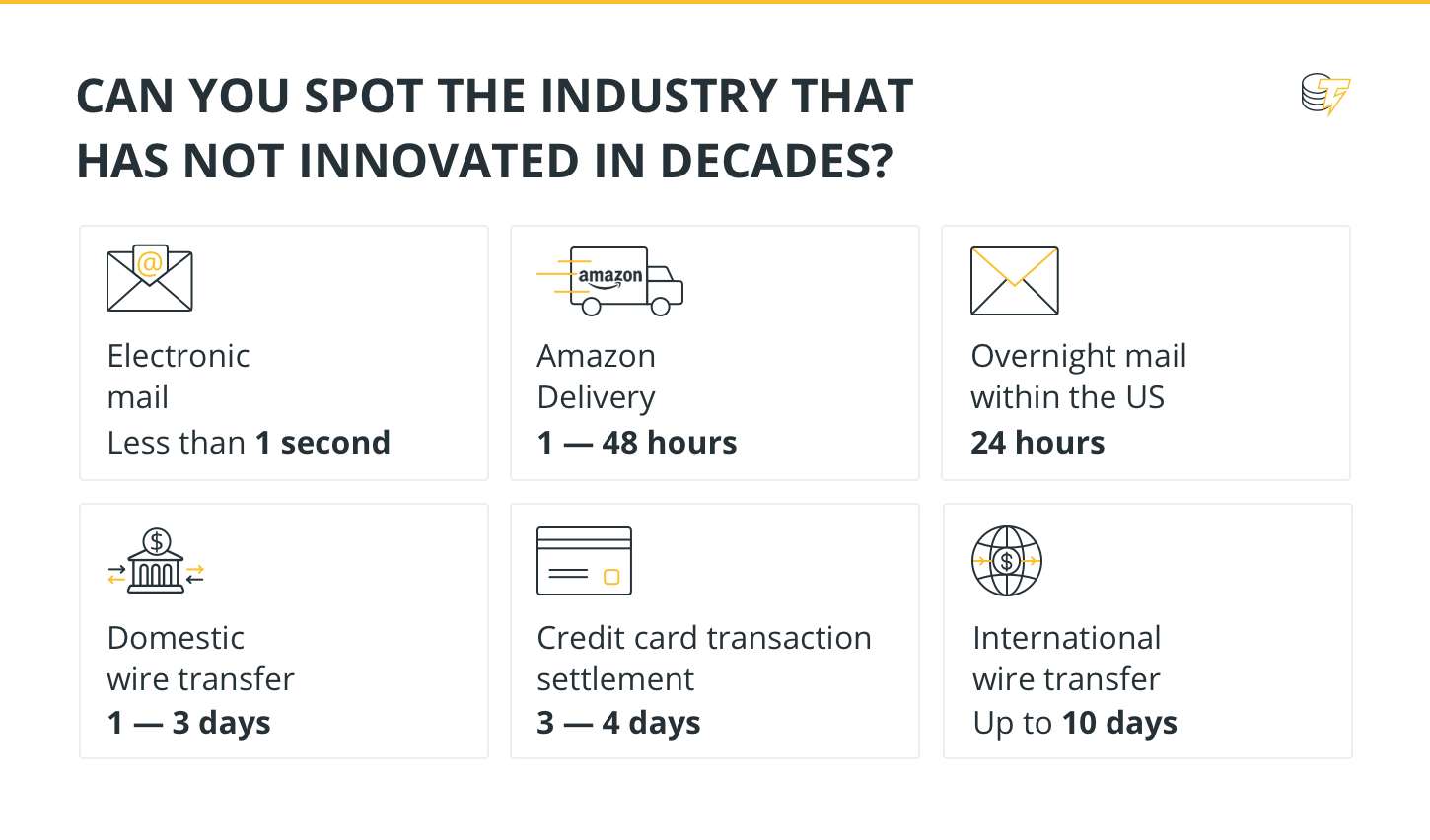

Isn’t it crazy that in 2018 it is faster to send a physical letter anywhere in the US or get groceries delivered to your doorstep than to send money electronically?! Even more absurd, you cannot send wire transfers on the weekend because … banks are closed! Why would you need banks to be open for a process that obviously does not involve any human action? This industry has been sleeping at the wheel for decades, and it is now ripe for disruption.

The current system keeps 2.5 bln people out

Until very recently, banks were dismissing the very idea of cryptocurrencies. “How could it work? Surely, it’s just a fad - cryptocurrencies are not backed by any central bank!”. It is precisely because they are not backed by any central bank that they have a shot at being successful. The track record of central banks around the world in the past century is abysmal, most fiat currencies fail within a generation or two and end up losing most, if not all, of their value. Even the US dollar has lost more than 80 percent of its purchasing power in the past 40 years.

The paradigm shift is so profound that it was, and still is unfathomable for banks to realize how disruptive Blockchain technology was going to be for them. Think of what Netflix did to video rental companies such as Blockbuster, or digital cameras to Kodak. The main problem with the banking system right now is that it keeps 2.5 bln people out. These people are too poor to be interesting for banks, so the financial system is not interested in providing them any service. They are effectively forced to rely exclusively on cash and as a result their savings are destroyed by inflation over time as they have no way to hedge themselves nor to have access to any financial services.

What banks do not realize yet is that these people are lost for them. They will never have a bank account and will leapfrog straight to cryptocurrencies. In developing countries around the world more and more people have smartphones, which is all you need to own cryptocurrencies. As banks realize that cryptos are a threat to their very existence, they are legally required to disclose this in their annual reports.

“Financial institutions and their non-banking competitors face the risk that payment processing and other services could be disrupted by technologies, such as cryptocurrencies, that require no intermediation”

JP Morgan 2017 Annual Report

Until recently, Bitcoin did not have a very strong value proposition for people in developing countries. Making a payment using Bitcoin these days is like making a wire transfer, it is relatively slow (one block every 10 minutes and your transaction may not be included in the next block) and still expensive (about $1 now, down from $20+ back in January).

If you earn $5 per day, you cannot afford to spend even a $1 fee on every single transaction to buy or sell goods or services. In developed countries, merchants have gotten used to paying 5 to 7 percent in processing fees to credit card companies just because so far there has not been any alternative available to accept electronic payments.

Enter the Lightning Network

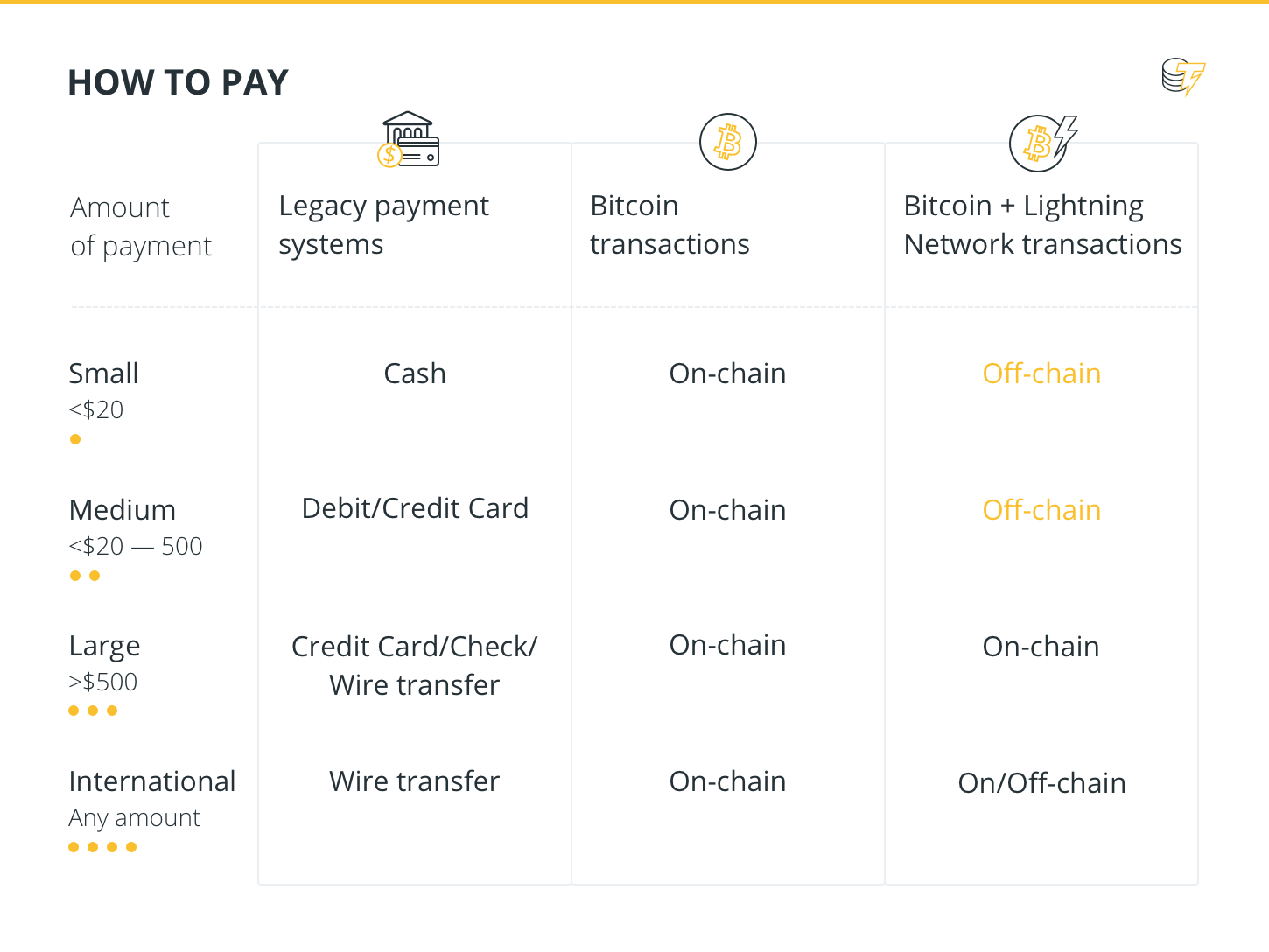

While Ethereum is gunning for many of the services offered by Wall Street and basically any service that relies on a trusted third party in the middle to execute a contract, Bitcoin is gearing up to take on legacy payment systems. The upcoming launch of the the Lightning Network (LN) has just been announced. It will be the first ever Layer 2 solution that is built on top of the current Bitcoin Blockchain. The basic principle of the LN is that not every single transaction needs to be broadcast to the whole network, especially small ones.

In a way, it is replicating what is already happening with the current banking system. When you use a credit card, you settle dozens of transactions at once when pay your bill. Same thing when you use cash to make several small purchases, all the banking system sees is a withdrawal from an ATM. You would never even think of paying your coffee with a wire transfer, right? So why would you do it with Bitcoin?

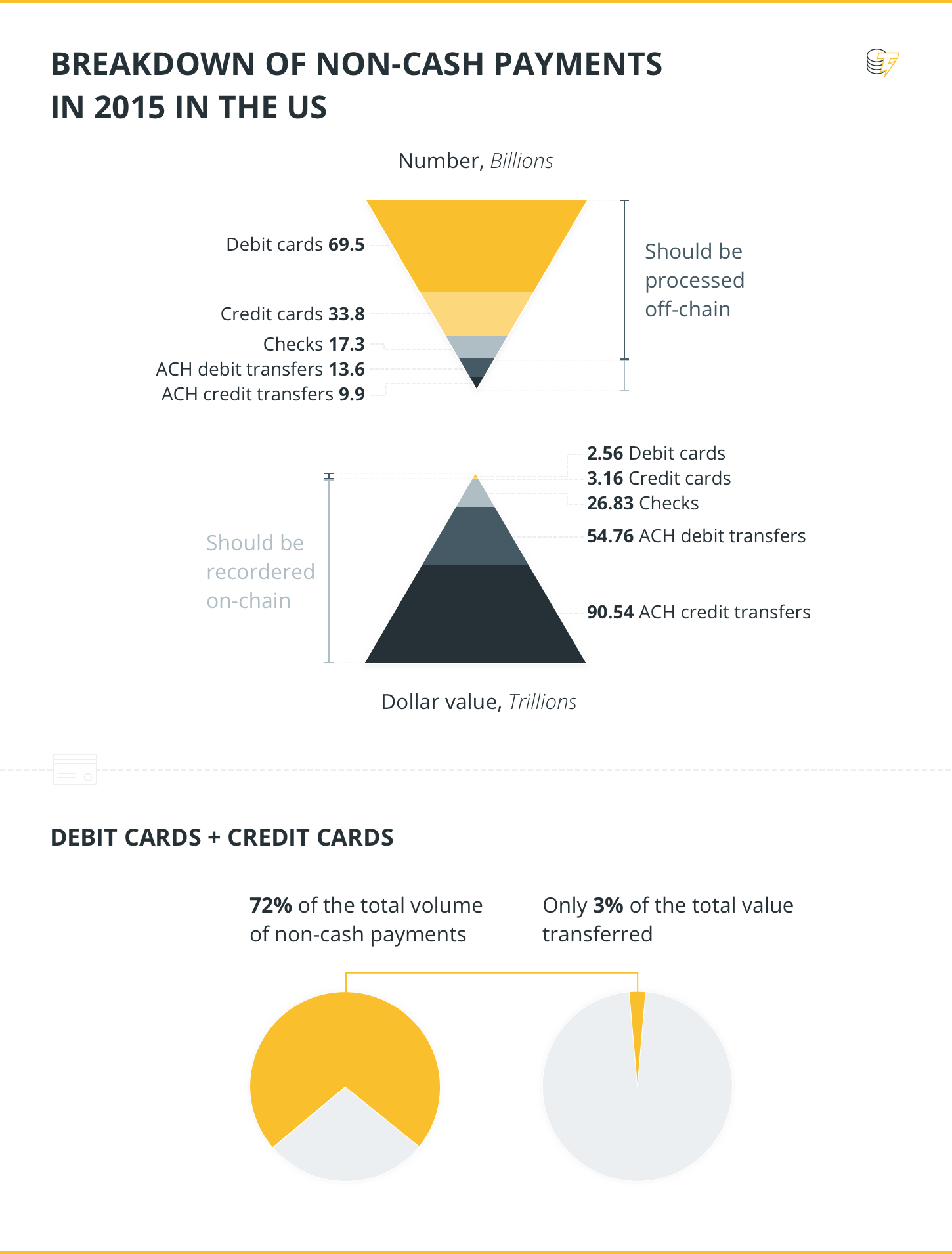

Increasing linearly the capacity of the network - by eightfold in the case of Bitcoin Cash - does not solve anything for a network that needs to grow exponentially. It makes no sense to burden the distributed Bitcoin ledger with every single small transaction. It will never be able to record millions of transactions per week and remain light, efficient and decentralized. It only makes sense to record large transactions on the Blockchain, while the majority of small transactions can simply be processed off-chain.

Having a wallet on the LN that you will periodically reload with some Bitcoin will enable you to send payments to LN wallets through bilateral payment channels opened between users. You will send signed transactions to other parties, but these transactions will be kept in MultiSig wallets on the LN and will not be broadcast to the Bitcoin network. At any point in time, any party will have the ability to close a payment channel and settle hundreds or thousands of transactions that happened on the LN with just one transaction on the Bitcoin Blockchain (all transactions are netted out at this point). This is the proper way of scaling up, because with such a solution the capacity of the network increases exponentially, not linearly.

Transactions on the LN will be confirmed instantly and fees should be close to nonexistent. With the rollout of this technology it will become harder and harder to justify charging 5+ percent credit card transaction fees to merchants when the alternative with the leading cryptocurrency will cost them close to nothing to process. There is one major problem that this solution does not solve though, people may not want to spend their Bitcoins but rather hodl them, but this is a topic for another article.

The views and interpretations in this article are those of the author and do not necessarily represent the views of Cointelegraph.com and the World Bank.