The global macroeconomic picture is sending out a message and that is one of deflationary forces starting to take hold.

In past articles it was discussed what this means and its likelihood. With each passing day the probability seems to grow and global central banks are beginning to take action (Bank of Japan and the People’s Bank of China) or looking more likely to take aggressive action (European Central Bank).

It is safe to say at this juncture that the Federal Reserve is watching this all unfold and will probably be forced to wait to raise interest rates. This article will examine some of the asset classes that are being affected by deflation as well as those causing the deflation themselves.

The Big Gorillas in the room: USD and Oil

Unless you live under a rock, you will have noticed the price of oil has collapsed in epic fashion (see chart below). I have included a chart which goes back to 1982, to show the historic nature of this collapse and where possible support lies (around the US$40 area) now that we have broken through several key support levels.

To put it simply this decline in the price of oil as well as the velocity of the decline matter and matter greatly from a deflationary standpoint. Generally speaking, this decline was so swift and fast that the damage, which has been wrought, won’t be known for a while. Falling commodity prices can be dealt with by companies and nations when they are orderly, but when they fall at such speed it leaves widespread damage.

It goes without saying that energy companies, which produce oil (think U.S. shale) as well as the economies of country’s (e.g. Russia and Canada) that are dependent on oil exports will be greatly affected. This is highly deflationary and is pulling global yields lower.

The currencies of these energy exporters have weakened as a result, which has caused the US Dollar to reach levels it hasn’t been in over a decade (see previous article on the USD). This is causing a vicious cycle whereby commodities are being pushed even lower due to USD strength as commodities are priced in USD.

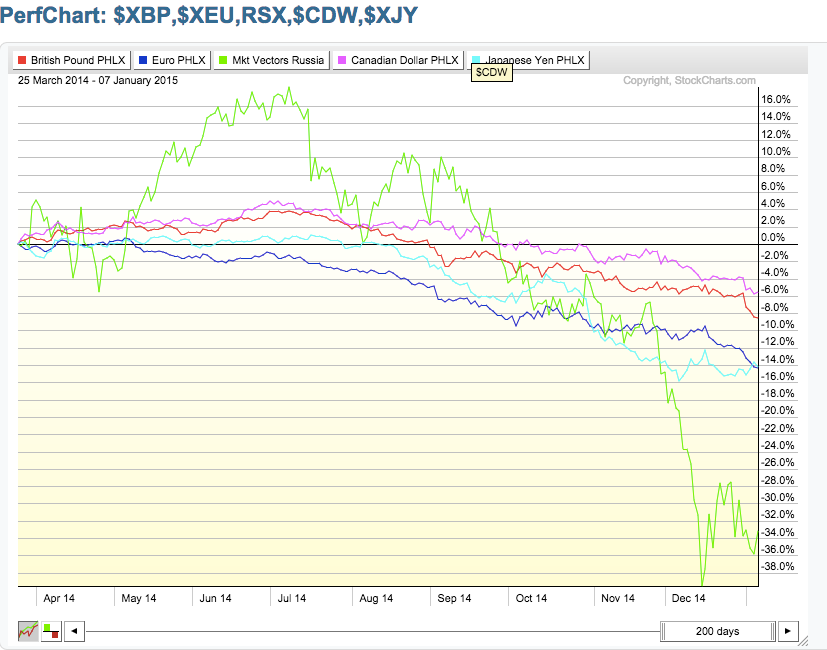

All major currencies are falling and causing the USD to rise in the case of the Canadian Dollar (CDW), the British Pound (XBP) and the Russian ruble (RSX), as falling energy prices are putting downward pressure on these currencies.

In the case of the Euro (XEU) and the Japanese Yen (XJY), their lax monetary policies are about to get even looser due to stagnating economies. In other words, falling foreign currencies are the result of weaker economic conditions than those in the United States. The USD also becomes a safe haven as all other currencies fall, which is also adding to its rise. See the chart below:

In general, when global economic conditions are improving bond yields are expected to rise. We are not seeing that even in strong economies like the United States. In fact, the price of bonds is rising to new highs and their associated yields are falling to new lows. This does not depict a healthy global picture.

All over the developed world, deflationary forces are pulling bond yields lower as European and Japanese bond yields are already at all time lows.

The 30 year Treasury Bond has also reached a 10 year high:

Bond yields are falling and bond prices are rising because global investors are looking for safe havens (US treasuries of all duration, the US Dollar, and even gold.) This is being caused by tensions in Greece and the Eurozone as well as the deflationary forces mentioned above. For all intents and purposes, Europe is back in recession and deflation is starting to kick in. Eurozone consumer prices fell to negative -0.2% for the first time in 5 years.

The price of gold is starting to improve and Taariq Lewis, CEO of Digital Tangible attributes this “to fears of a Greek exit (Grexit) and a stalling global economy as well as lingering doubts on the resilience of US growth from Q3.”

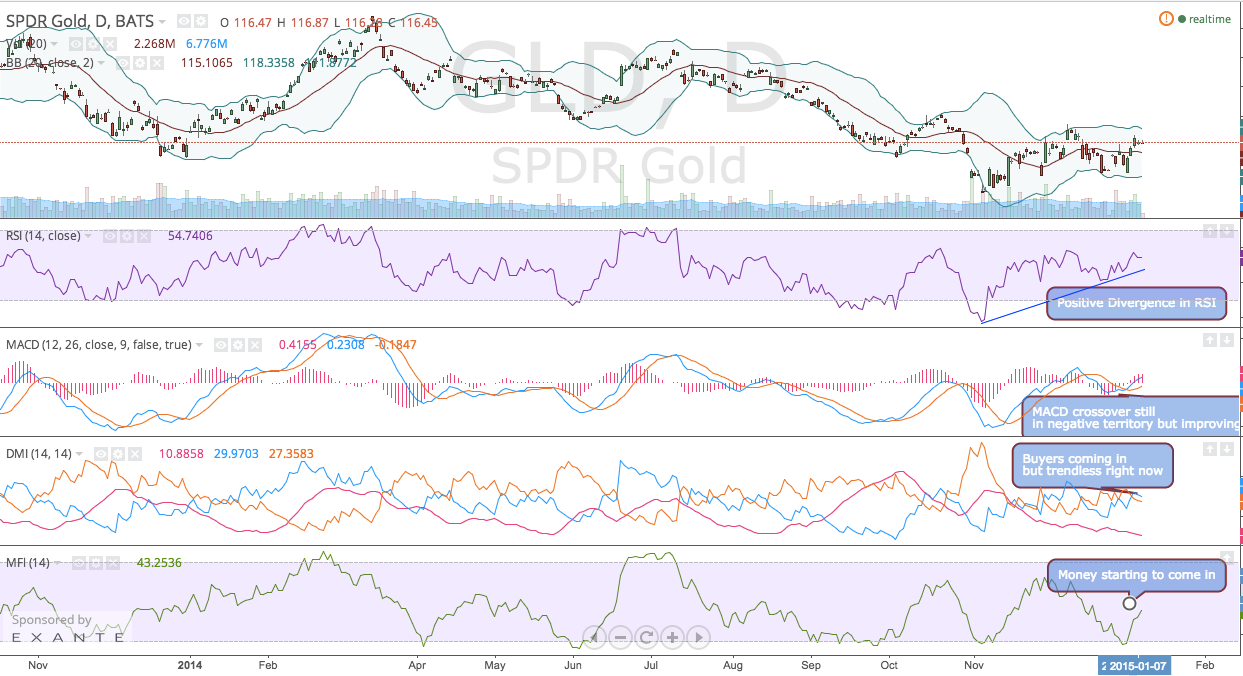

While the chart below shows the price and the accompanying technical indicators (see comments below on chart) are improving, USD strength will be a major headwind for gold as well as all other precious metals and commodities.

Bitcoin

The chart below speaks for itself. Bitcoin continues to struggle mightily and the price action and direction have been commented on many times. Despite trouble in Europe, the bitcoin price has decoupled and continues its march lower. The dollar’s strength is hurting bitcoin like all other commodities as well as the flight to safety, which was mentioned above. So is the rise of the Shanghai Index and China’s attempts to stimulate its domestic economy. The Bitstamp issues are certainly not helping either.

A general comment on price is that without panic selling and capitulation it will be difficult for bitcoin to find a real bottom. Unfortunately, this is yet to show up in the charts and the long decline continues as shown below:

Nothing happens in a vacuum and it is important to take note in a global economy that the relationships between all asset classes in different countries matter greatly. These factors control capital flows, which all look for profits. The deflationary backdrop of the world is distorting global capital flows as well as the ever evolving economic landscape.

The central banks are hell bent on stopping deflationary forces from winning, and aiding growth. We are only beginning to see what happens with a strong USD and we are yet to see what the collapse in oil will bring for the global economy.

Certainly, the coming months will reveal how this will unfold. By paying attention to how different asset classes react to these economic events we can make more informed decisions on when and how to invest.

[Author note: Please see @sammantic for timely updates on all things bitcoin, including price analysis and the latest charts.]