Earlier this week, China’s largest mainstream media company People’s Daily defined Bitcoin as digital gold, further validating its legitimacy. Suddenly, investors and mainstream media outlets across the world have started to endorse and adopt Bitcoin.

Bitcoin to replace reserve currencies

In the past month, Bitcoin has received more extensive mainstream media coverage than it did in 2013 when interest in Bitcoin peaked.

Media companies and investment firms in South Korea, India, Australia and Japan have started to discuss the possibility of Bitcoin surpassing the value of certain reserve currencies in the far future as an alternative monetary and financial system.

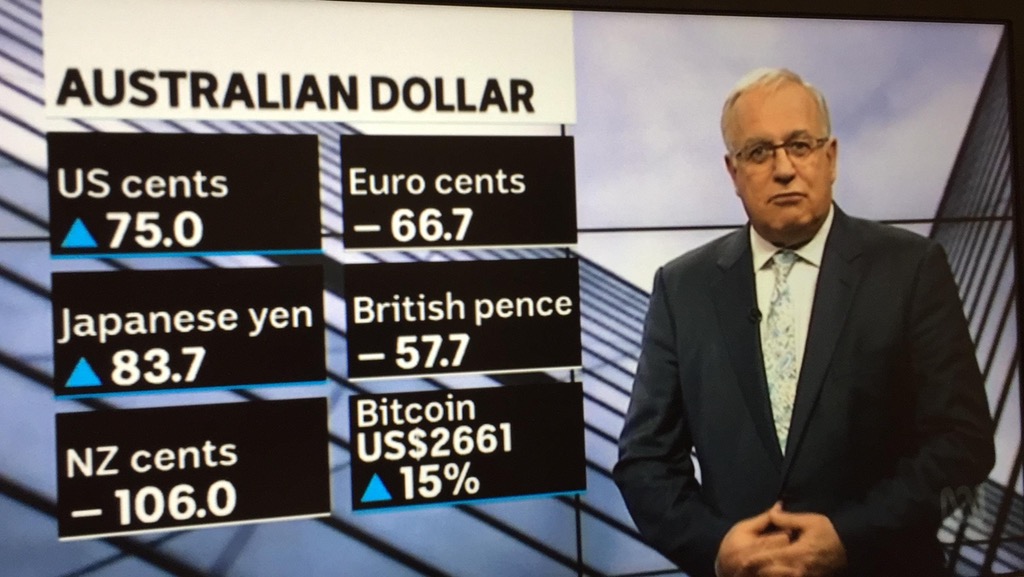

Most recently, ABC News, a national news service in Australia produced by the Australian Broadcasting Corporation, reported that it is possible for Bitcoin to replace reserve currencies such as the US dollar in the next 10 years if it sustains its current exponential growth.

Alternative financial network

Bitcoin experts including BitGo engineer Jameson Lopp also suggested that investors and traders should consider basing off the dominance index of Bitcoin on the global M1 supply against currencies such as the USD, instead of altcoins in the cryptocurrency market.

Lopp noted that as of now, Bitcoin accounts for around 0.14 percent of global M1 money supply and still has a long way to go before surpassing the value of reserve currencies. However, if the idea and the concept of Bitcoin overtaking existing government-backed currencies to become the alternative financial network are the focus of investors, supporters of Bitcoin should compare the dominance index of Bitcoin to the M1 money index.

Still, the fact that mainstream media companies such as ABC News and Bitcoin experts including Jameson Lopp are even bringing up the M1 money index into discussions about Bitcoin is a positive sign that Bitcoin is on its way towards mainstream adoption.

Rapid adoption in Japan

In Japan, mainstream adoption of Bitcoin is imminent, with leading airlines, electronics retailers and some of the country's most well-known and influential companies accepting Bitcoin as digital currency rather than as digital gold and investment.

If deals with Japanese companies are pursued as planned, more than 300,000 Japanese merchants could soon accept Bitcoin in the country and tens of thousands of convenience stores could start offering Bitcoin as an official method of payment.

Genki Oda, the president of BITPoint, the company that led the deal with Peach - Japan’s largest budget airline - to accept Bitcoin, said in an interview:

“We’re holding discussions with a retail-related company. By going through a company providing payment terminal services to shops, we have the possibility of increasing its use at one stroke. It’s easier than talking to lots of individual retailers. We’re also talking to a big convenience store operator about using it.”

The demand and optimism toward Bitcoin as both a long-term safe haven asset and digital currency are rapidly rising across the world. The only technical issue left to solve is scaling to lessen fees in order to facilitate the mainstream adoption of Bitcoin.