“Nobody in their right mind would ever come to Helsinki in November” - says the banner at the front entrance to the Helsinki Exhibition Centre, Finland’s biggest convention and exhibition center. We at Cointelegraph are badasses, just like the other 15,000 guests, 1,700 startups, 800 investors and 630 journalists who attended one of the leading startup and technology conferences in the world - Slush 2016.

Building worldwide startup community

The history of Slush started in 2008 when a small group of Finnish entrepreneurs met over a pint of beer. A few months later it grew into a gathering of two hundred people, and look at it now! Having always been characterized by an incredible energy and enthusiasm, Slush aims to facilitate founder and investor meetings and build a worldwide startup community.

Just to give you guys an idea of how huge this event actually is, here are some quick numbers:

- 30,000 square meters of venue;

- Six stages, where founders, investors and the media share their stories in fireside chats and keynotes;

- 260 startups at demo booths;

- 8,000 investor-startup meetings; and

- Hundreds of side events, dinners and roundtable sessions.

This year Slush has been more international than ever - about 60 percent of the attendees arrived from outside of Finland - from a total of 124 countries.

Nordic FinTech stars on how to democratize capital markets

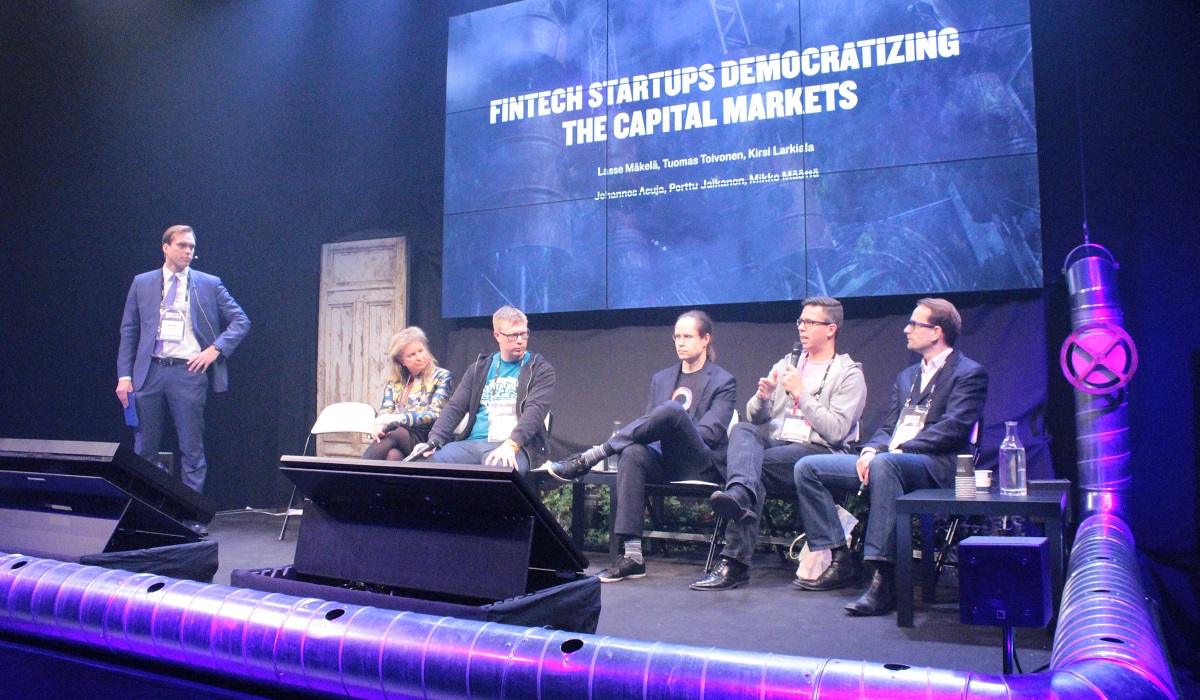

With this variety of themes and events, we felt like a kid in a candy shop, feeling a little indecisive of where to go. Panel session FinTech Startups Democratizing Capital Markets got into our personal list of highlights of the event.

At the panel, Nordic FinTech stars have been looking into how FinTech is transforming the world of financial services, facilitating businesses, funding models, marketplace models and financing platforms.

Johannes Asuja, managing director at Evli Investment Solutions and moderator of the panel session posed some very interesting questions to the speakers.

FinTech is developing rapidly, it is transforming global markets. Unsurprisingly interest in FinTech, its latest developments and potential to disrupt the financial services industry is growing. The very fact that experts and professionals have gathered at Slush to talk about it demonstrates that there is a lot to talk about in order to facilitate moving forward.

Indeed, it is important to take a look back once in awhile to see how things are developing, reconsider strategies to see the things that might have been overlooked and adjust the process to the most pressing needs.

The panelists, who included Perttu Jalkanen, co-founder and CCO at Arex, Lasse Mäkelä, CEO at Invesdor, Kirsi Larkiala, Global FinTech Top 100 Influencer, Mikko Määttä, director of business development at Zervant, Tuomas Toivonen, co-founder at Holvi and Sanyu Karani from Fundingbox, tried to find an answer to general questions. Such topics included a discussion of where FinTech is now and where it is moving, while also looking at more specific issues related to the funding of FinTech companies, the effects on customers and the potential of FinTech to facilitate development.

Let’s work together!

One of the key points that all speakers agreed on is that banks and FinTech companies need to collaborate. There was a time when investing in startups developing technology solutions for financial services seemed hindered, but the overcoming of the recent global banking crisis has opened up more space and possibilities for partnering.

Lasse Mäkelä says: “Banks certainly had difficulties when it came to funding companies, especially small companies. The underinvesting of technology was obvious - banks had to pick up their own systems to be able to operate normally. But now banking is growing, a lot of things are happening in this area in Europe. What is clear, however, is that banks remain underserved, which is why a lot of FinTech companies are coming there.”

FinTech came along and it becomes clearer that it is guiding innovation, as there are a lot of companies on meaningful missions, aimed to take care of some foundational business projects. “FinTech companies can do a lot of things,” says Kirsi Larkiala. The important thing here is to establish a good partnership with the bank.

Tuomas Toivonen from Holvi, a Helsinki-based banking startup that provides entrepreneurs and small to medium-sized businesses with a range of business services as well as traditional banking through its online platform, says: “BBVA has a long track record of working with FinTech startups and helping them introduce their solutions in the industry. BBVA understands the digital world, they are able to help us nurture projects by giving us the necessary room to grow. We found a way to combine the advantages of being a FinTech player as well as being on board with one of the largest banks.”

When developing technology solutions for a financial services sphere, it is important to remember why these solutions are being developed.

Customers are the key

With the progress driving forward, there are still many complex and difficult systems offering really complicated solutions, to the extent in which the client does not understand what they are paying for. FinTech startups are united by one aim - to bring more clarity, transparency and flexibility to these services. At the end of the day, it’s all about the customer.

Sanyu says: “Nowadays it is irrelevant how small or big the business is, the most important thing is how much liquidity and flexibility it brings to the market. Customers are starting to realize that it is not necessary to purchase all services from one single provider. That’s why FinTech companies are winning here - they are focusing on building one service, but with the aim to provide it really well.”

This is good for competition on the market and again for the customer. Smaller businesses form a growing segment of the European economy, they are not in the business of business management or administration and they are providing services to the customers. In addition, they offer them an integrated solution for invoicing, maintaining an online store and handling reporting services they need, so that they can focus on serving their customers in the best possible way. There are a lot of benefits that FinTech companies can provide, also there are a lot of benefits traditional companies can provide - but they should only join forces if it is possible to drive innovation.

In discussing the state of the FinTech industry within one year’s time, speakers were unanimous. “Fintech is making a huge impact in Europe helping businesses to handle their tasks, we will surely see a much bigger impact in the future,” said Tuomas Toivonen.

Mikko Määttä agrees: “What we want to accomplish, however, is bringing down some of the barriers that exist now. We also would like to see more collaboration on all levels.”