Singapore - home to some 400 fintech startups and 100+ financial institutions–is more ambitious than ever to take the global fintech hub crown. The government-led, corporation sponsored Fintech Festival is into its second year, this time bigger and better than last.

Totalling five days from Nov. 13-17, the festival event welcomes attendees with its warm tropical weather on the small island state. I was lucky enough to be invited as a media member to witness the biggest get-together of every player in the fintech ecosystem: startups, investors, financial institutions, corporations and government agencies.

It’s always summer in Singapore. Photo credit: Lucia Ziyuan

Covering everything trending and topical in fintech from distributed ledger technology to regulatory risk, we are seeing highly prestigious speakers and government officials making appearances at the event. While it would be impossible to report back every detail, I will try my best to highlight the noteworthy in this article.

The festival experience

The festival was an indoor event that took up three exposition halls at the Singapore Expo. Upon arrival, the event arena was already buzzing with delegates of all sorts of nationalities chattering in every accent imaginable. After registration, I was immediately greeted by huge showcase booths from festival sponsors: Deloitte, Prudential and KPMG among others.

Corporate sponsor booths like Deloitte’s take up the majority of exhibition real estate

Compared to other fintech events I’ve been to, the booths at this festival were way more creative and inviting with genuinely exciting new technologies on display. Deloitte, for example, showcased their voice and tone recognition technology for mitigating risk. PayNow-the biggest peer-to-peer payment network in Singapore–exhibited how money can be moved instantly with just the recipient’s phone number with an experiential showcase.

There is definitely no lack of happenings for the week celebration. The festival breaks down into three main types of events and many smaller segments running concurrently. There was so much going on every minute at every corner of the venue that one can easily be held back by FOMO. Just as I headed towards an intriguing conference talk about the open ledger, at the same time there is another exciting, inclusive fintech talk happening on a different stage.

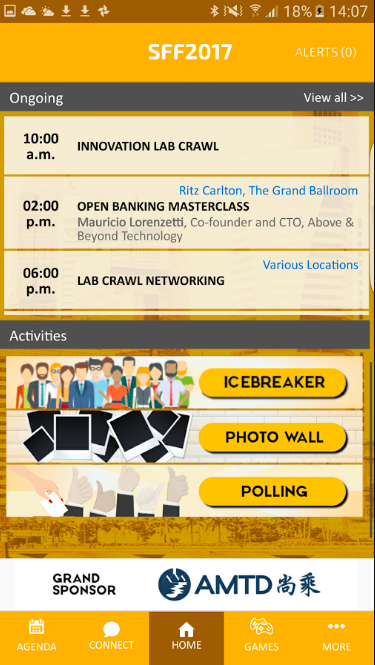

While the crowded floors are a little challenging to navigate and too many events happening concurrently, with the help of the official event app I was able to plan and bookmark events that interest me beforehand. Even conference talks I attended were a full house–people were standing around for these hour-long talks. The crowd enthusiasm was amazing.

SFF event app. Image source: Google Playstore

There were also several workstations and lounge areas to chill out and have a chat, along with abundant food options, thanks to the varieties the Southeast Asian food capital has to offer. I even bought a pre-packaged customizable salad from a vending machine using touchless payment and thought of Nick Szabo’s famous smart contract as vending machine analogy. What a fintech moment.

cashless payment at salad vending machine. Photo credit: Lucia Ziyuan

Fintech Sandbox–a top-down approach to innovation

As the official host, the presence of Monetary Authority of Singapore (MAS) looms large throughout the whole event. The government agency’s ambition to take a top-down approach to innovation was pronounced–there is even a dedicated fintech arm within the organization called “Fintech and Innovation” group.

Most notably, MAS is known for their bold experiments within the fintech regulatory sandbox. If you haven’t heard of it, the Fintech Sandbox is where MAS gives the green light to test out new products or solutions in a controlled environment in instances where these new ideas would not have passed regulators’ scrutiny to go ahead.

At the festival, MAS Sandbox came to life with a sandbox stage literally build with real sand. In a speech by Mr. Ong Ye Kung, minister for education and second minister for defense, we had a glimpse of what a structured liberal regulation framework would work for financial innovation.

Sandbox literally made out of sand as open stage. Photo credit: lucia ziyuan

Mr. Ong cited the example of PolicyPal, the first graduate of the MAS fintech sandbox and now a licensed insurance broker after testing its solution in the sandbox with a limited pool of users. He further mentioned that MAS will “further loosen the regulatory boundaries for sandbox cases where the risks do not outweigh the potential benefits of the solution to consumers.” That would mean even a bigger playground for cutting-edge fintech innovators.

Other MAS-led innovation initiatives include partnership with MIT Media Lab on key areas including Distributed Ledger Technology, the global Hackcelerator program and MAS Fintech Awards for which projects in and outside of Singapore were rewarded with generous cash prize.

Fintech is maturing

While there is still a lot of hype around emerging fintechs such as ICO and AI bots, we get the sense from conferences and speeches that fintech is maturing now with a more “grown-up” attitude.

For one, more innovations are happening in the traditional, seemingly “undisruptable” section such as RegTech and Insurtech. On the other, fintech makers’ attitudes towards regulation is loosening up. Fewer people are talking about disrupting, and the many mid-stage fintech ventures are seeking alignment of interest with regulators and financial institutions.

At a panel discussion titled “Alternative Payments: Beyond Hype,” Brad Garlinghouse from Ripple, Taavet Hinrikus from Transferwise and Tim Grant from DrumG sat down to talk about altcoins and more. When asked if society will be going cashless, all of them said fiat is not going away anytime soon. Talking about the role of financial institution in fintech innovation, all three expressed positive sentiments towards working with regulators. Taavet Hinrikus said that “tech entrepreneurs are getting better at dealing with entrepreneurs. Turns out regulators listen to you.” Brad Garlinghouse went a step further to say that it’s “important for the industry to be proactive and talk to regulators.”

Brad Garlinghouse, CEO of Ripple, breaking down altcoin hype for the audience. Photo credit: Lucia Ziyuan

And political leaders are watching fintech closely too. In a speech on financial inclusion by Queen Maxima of the Netherlands given at the festival, her majesty gave 9 pointers for successful inclusion of fintech: data privacy, cyber security, digital literacy, financial literacy, digital ID, connectivity, interoperability, fair competition and physical infrastructure. You have to agree that these are very on point insights.

And governments are going out of their way to compete for innovation solutions. At the closing talk by the Yuriko Koike, the governor of Tokyo, we saw the government’s efforts to position Tokyo as a desirable destination for financial innovation such as financial awards and advertisements much like a promotional outdoor ad for tourism.

Conclusion

30,000+ participants, 100+ nationalities–this year’s fintech festival has to be the biggest industry event in recent history. It’s promising to see such strong growth and shared enthusiasm in this industry. There is no doubt that fintech will continue to make big waves in 2018.

But we also walked away with more questions than answers. Despite the globally shared language in fintech, there is no commonly agreed approach to fintech innovation as the regulatory environment in each country is very different. What does it mean for financial inclusion to scale? What would true interoperability look like especially on the Blockchain? What does it mean for innovators to work with regulators on building infrastructures, and how?

Perhaps at the speed we are moving forward with technology, we will see the answers reveals themselves at the next fintech festival.