South Koreans get a first look at Samsung’s new mobile payment solution, P2P lending company BLender secures new funding, BitPay reports huge spikes in Bitcoin transactions in Latin America, and more top stories from this week in FinTech.

Korea Gets a First Look at Samsung Pay

On July 16, Samsung announced the launch of a trial service of its mobile payment solution Samsung Pay for select customers in Korea. The official rollout is expected later this year. PYMNTS reports:

“According to Samsung, the technology available in Samsung Pay works with both near field communication (NFC) as well as traditional magnetic stripe card readers. This compatibility puts Samsung Pay in a good position with merchants because they will not have to upgrade payment terminals in order to accept contactless payments, which may see Samsung Pay being used in even more stores.”

BLender Scores $5M to Expand the Boundaries of P2P Lending

BLender just secured US$5M in funding from Blumberg Capital. The P2P lending startup currently operates within Israel, but has plans expand into Western Europe and Latin America in the coming months. From Geektime:

“BLender’s hybrid model creates credit ratings based on financial, social, and demographic background to upend the banks’ foothold on peer-to-peer lending — and empower emerging markets. Since its birth in November 2014, BLender has appropriated over NIS 10 million in loans, or around $2.5 million, with the average loan between NIS 15,000 and 20,000, or approximately $3,750-5,000. Currently, lenders involved with BLender are either individuals or companies, putting up anywhere from NIS 5,000 to 1 million.”

Bitpay: Monthly Bitcoin Transactions Up 510% In Latin America

Bitpay has released figures showing a huge spike in transactions in Latin America, surging from 638 in February all the way up to 3,509 monthly in June 2015. From CT:

“Bitcoin is proving to be a stable protection towards inflation and lack of access to financial services in underbanked regions and where governments fail to address economic stability. This is likewise indicated by the spike of transactions in Latin American countries. Merchants in underbanked countries like Paraguay, Bolivia and Peru where debit card ownership percentage of population lies below 10% struggle to find payment solutions to use online.”

The Future of Finance Is in Real Time

Speed is essential if companies want to stay ahead of the curve, and financial firms need to keep up with the pace. The race toward real-time financial services is now. From TechCrunch:

“So far, much of the hype in FinTech is concentrated around the front-end through P2P-payments like Venmo, Facebook Pay and Snapcash, as well as mobile payments like Apple Pay/Wallet and Android Pay. These solutions change the dynamics of the customer interface, but are mainly built on existing infrastructures (either the banks or the card networks). However, in a world where physical goods can be delivered within the same day, expectations for real-time payments are rising.”

These 9 Trends Show the Future of Mobile Payments and Banking

MEF’s 2015 report, which studied 15,000 mobile users across 15 countries, has identified nine global mobile money drivers and trends leading the way. VentureBeat reports:

“Mobile money usage in mobile first countries has leapfrogged established economies and is fast becoming the norm. On top of that, the acceleration of smartphones in these countries has already created a host of additional mobile opportunities that are disrupting banking and retail. For example, mobile banking activity in Indonesia was cited by 80 percent of respondents, in Nigeria 85 percent, and in Kenya an incredible 93 percent of all respondents.”

Bitcoin Is the 'Napster' of Finance — And There'll Be an iTunes

Eric Van der Kleij, boss of Level39 — where 150 FinTech businesses are housed in London — has a good overview of what exactly the FinTech world is up to. One of the technologies that fascinated Kleji is the blockchain. Business Insider reports:

“Van der Kleij calls blockchain ‘the real frontier’ of finance and likens its evolution out of bitcoin to the rise of peer-to-peer technology out of illegal music-sharing website Napster.

“He says:‘In the world of music you had Napster as the unregulated challenger to the establishment. What they did is prove that technology can enable peer-to-peer file sharing to take place without the establishment controlling it. What that industry did is they wisely embraced that technology to reduce their costs and you now have the iTunes Store, Spotify. That transformed the model of music distribution.’”

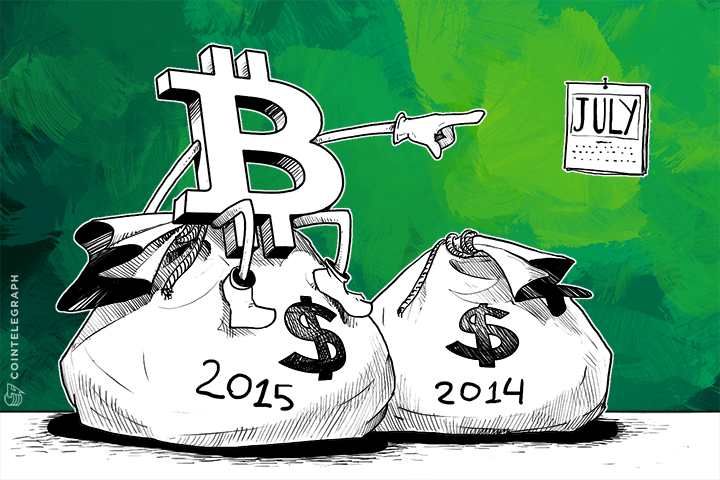

Bitcoin Capital Investment in 2015 Quickly Passes 2014 Totals

While large-scale national economies are slipping into default and long-term indebtedness, the Bitcoin economy couldn’t be more robust in 2015. Newly updated totals show that Bitcoin’s level of venture capital funding and investment has obliterated 2014 year-end totals after just over six months. From CT:

“In 2012, few had even heard of Bitcoin, much less thought it worthy of capital investment when it just cracked US$2 million for the year. The next year saw interest explode to just under US$100 million, and venture capital funding for companies like Blockchain.info more than tripled in 2014, to US$350 million. With [last week’s US$20M] BitFury deal, totals for 2015 have passed US$357 million for the year with almost half the year remaining.”

PayPoint Releases Card Payment Security Service for Online Merchants

PayPoint has announced CardLock, a secure payments plugin which helps e- commerce merchants reduce PCI Data Security Standard responsibilities in their existing websites by almost 60%. Finextra reports:

“CardLock is an invisible token-based solution which has been designed to work alongside PayPoint’s payments API, allowing merchant websites and applications to retain their seamless consumer experience without the need to handle or store sensitive card data. The token based solution has been developed with merchants in mind, enabling them to retain full control of their overall payments experience whilst significantly reducing the PCI burden.”

Investment Firm Wedbush Predicts $400 Bitcoin by 2016; Advises to Buy GBTC

Financial services and investment firm Wedbush Securities released a report in which it predicts that bitcoin will trade for US$400 by next year. The firm furthermore suspects that Bitcoin Investment Trust's NASDAQ-traded bitcoin derivative GBTC will keep pace. From CT:

“The Wedbush report, authored by Gil Luria and Aaron Turner, calculates the expected future value of bitcoin by comparing it to existing players in the payments industry. The report predicts that the Bitcoin payments network could end up powering 10% of online payments, and up to 20% of global remittances by 2025.”

Singapore's FinTech Startup Fastacash Raises US$15M in Series B

Fastacash has raised new money to help ramp up scaling, accelerate consumer usage and expand the company’s global reach. This latest round of funding was led by Rising Dragon Singapore and includes Life.SREDA, UVM 2 Venture Investments LP, as well as existing investors. E27 reports:

“Launched in 2012, fastacash is an online payment startup that allows users to make value transfers — i.e. money, airtime, and coupons — through social networks and messaging platforms. Fastacash partners with banks, mobile operators, remittance companies, payment service providers, mobile wallets and other financial institutions to enable these value transfers.”